-

Posts

4,279 -

Joined

-

Last visited

-

Days Won

226

Everything posted by JohnH

-

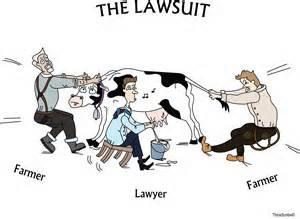

There's some excellent advice on this thread. Situations involving lawyers tend to be very lucrative for the lawyer and very costly for the tax preparer.

-

How about an audit reconsideration? We've discussed it before but I'm not sure whether or not it applies here - just throwing it into the mix.

-

Sounds like a rock-solid plan to me.

-

Thanks Max. Another valid point. If it came to that, I'd seriously rather pay the $72 out of my own pocket than to burn off a lot of time trying to chase down a misapplied $6,000 refund.

-

Thanks for the additional responses Judy & grandmabee. I'm still pondering how to handle this, given the amount involved. It's now clearly a matter of switching names IF we request that the overpayment be applied to 2018. But if I switch names and they STILL don't apply the $6,000 correctly, the client is going to be asking me every other day if I've corrected it yet. (Good client, but I know how they react when things don't go according to plan.) On the other hand, if we file as usual and claim a refund, it's just a matter of IRS processing the return normally, sending a refund, the client cashing the check, and then making the Jan 15, 2020 payment on time. This more-or-less takes it out of my hands and puts the responsibility back on the client (and IRS). If there's a delay, It isn't due to anything I did or did not do.

-

Sorry, I wasn't clear on the first post. We did submit current-year estimates (Apr, Jun, & Sep) in her name & under her SS# only. So she is covered there. The only issue is making sure the $6K refund on the 2018 return is credited to her SS#. Thanks for validating the idea to switch the names & SS#s on the 2018 return. That's what we are going to do, although there will still be some lingering uncertainty since it will be a paper-filed return.

-

Husband died in late 2018. We extended 2018 return to Oct 15, 2019. The 2018 MFJ return shows the husband as the primary taxpayer and the wife second, as has been the case for the last 30+ years. Wife is self-employed and routinely pays quarterly estimated tax in the $K - $6K range per quarter. The 2018 MFJ return shows a $6K refund which she wants to apply to her 2019 estimated tax in lieu of the Jan 2020 payment. However, since the 2019 return will be filed as Single under her SS# only, I'm thinking this may cause a problem. Solution would be to either claim a refund on the 2018 return (risking a partial estimated tax penalty for 2019), or to switch the names around to show the wife as the primary taxpayer on the 2018 return and still apply the refund to 2019 estimated tax. FIrst time I've run into this particular scenario. Has anyone encountered a similar situation or have any suggestions on best practice here?

-

Congratulations all around!

-

I'd write "Refused" in the space for her social security number and paper file. Hopefully here isn't a big refund hanging in the balance. Does the fact that he hasn't filed in 3 years and she refuses to provide the social security number cause you to feel uneasy in any manner? (For me, a couple of alarm bells are sounding.)

-

Catherine & Gail: Thank you both for your comments and excellent suggestions. I'm going to pass this along to the client.

-

A long-time client and close friend is moving to Australia with his wife to begin work in Oct of this year. They will initially be on a 2-year work visa in Australia. I have no experience in this area and am advising them to seek a tax pro in Australia who is knowledgeable about expat tax issues. He does already have some trusted leads on choosing someone once they arrive there. I do know that Australia taxes income on a FY ending Jun 30, they will also be taxed by the US on worldwide income, and there are some options they will have in utilizing credit for foreign taxes paid, partial income exclusion, etc. I also know that the handling of the part-year 2019 US return is different than the full-year in 2020. Have read a few other things but don't really know much else to tell them, aside from being careful to file the FBAR each year and to make a wise choice in selecting a tax advisor. I know this is a vague question, but does anyone have additional thoughts on things they should be aware of, such as potential tax traps, planning possibilities, etc? I would appreciate any suggestions that I can pass along to them as a courtesy.

-

I like having to do extra keystrokes. I need the exercise.

-

I'm interested in the answer to that question as well. Any reason not to use MS Edge? It looks like a drastic change from Chrome, but I like much of what I've seen thus far with Edge.

-

He knows I use a MacBook Pro for most of my heavy lifting, so I guess he thought this is all I would need for Word, Excel, and Quickbooks Desktop. Makes sense, because I doubt I'll be running anything that needs lots of RAM or processor speed. I was surprised at how heavy the Dell is, but then I'm probably spoiled by the MacBook. Thanks for the replies.

-

I decided to get a laptop so I can access QB Desktop when I'm out of the office. Here's what my computer guy sold me: DEL Latitude E5520, Intel Core i3 - 2330M CPU @2.20 Ghz 4GB Ram, 223 GB SSD Win 10, Microsoft Office 365, and ESET Security Price was $430 How did I do, and what did I miss (if anything) ?

-

I have a website - please let me know what you think

JohnH replied to BulldogTom's topic in General Chat

Looks very nice. -

Not sure is this is the best solution, but it would work. You could set up a simple macro to open and prefill the Form 8948. Since you know at the outset which clients wish to paper file, you'd just run that macro (along with any other standard macros you have set up), when you first open the return. Then it will already be there the first time you go to print the return.

-

Ron: It's the 8948. Drake still produces it. If the taxpayer chooses to paper file, there is certain documentation you are required to keep in your records to support checking that particular box.

-

And don't forget the vet bills & food for the "security cat" that guards the Salon. That's a deduction I was told one time by a multi-level marketer that is often overlooked.

-

Bart: If you'd gone to barber school you'd have become an instant tax expert without having to learn all those pesky details of actual return preparation.

-

Yes, I assumed you and NECPA both had good reasons. The clients don't have a good reason, but you're both kind and considerate enough to be concerned about them in spite of their inaction. That's admirable (and of course good business practice with profitable clients). In other situations, it sometimes takes a two-by-four to the head to get some clients to be more considerate. This business is all about making those distinctions, isn't it?

-

Usually the only way to get a significant discount in any negotiation is being willing to walk away (or at least convincing the other party you're prepared to do that). Maybe I'm naive, but if 2017 e-file isn't available for any reason, what's the problem with paper filing? It isn't as though the client is in a hurry to get it done... (But I do understand the overall concern extends beyond simply getting the return filed)

-

I think you nailed it with the research comment. What passes for research in the investment field is little more than "investment porn". The airwaves and internet are full of this nonsense, and it all comes at a heavy price. As John Bogle famously repeated, "Nobody knows nothing"" when predicting the future. Investment advisors exist to make weather forecasters and astrologers look like geniuses. Anyone who will take the time to read and understand his speech entitled "The Dream of a Perfect Plan" in March of 2000 will know virtually all they ever need to know about investing for the long haul. The fact is, smart investing & wealth accumulation is quite boring once one grasps the basics. http://johncbogle.com/speeches/JCB_AZ_Republic_3-00.pdf

-

scottmcfly: Steering them to Vanguard is one of the most important things you can do. Next best is getting them to read and understand John Bogle's philosophy on investing. He revolutionized the industry with the index mutual fund - I'm referring to the Total Stock Market Index, not some of the expensive knock-offs other companies are pushing. Understanding and properly applying Bogle's investing advice will increase ones wealth exponentially without the drag associated with the fees one typically encounters. But it takes a little work and many people just won't invest the time to educate themselves.