-

Posts

4,493 -

Joined

-

Last visited

-

Days Won

188

Everything posted by BulldogTom

-

Request for waiver of penalty for medical reasons denied

BulldogTom replied to Robbie's topic in General Chat

Correct me if I am wrong please. I thought for first time penalty abatement a simple call to practitioner priority was all you had to do since they could look up prior penalties while you were on the phone to see if they qualified. Is that not the case? I have not had to ask for penalty abatement in years, and I think the one time I called in for first time abatement it was granted. Is this no longer the way to do it? Tom Modesto, CA -

I hope someone answers cause I forgot how to do it as well. Tom Modesto, CA

-

CA LLC FORMS: CA 568, CA FTB3522, CA FTB 3536, CA FTB 3537

BulldogTom replied to KATHERINE's topic in General Chat

Katherine, Form 3522 is used to pay the $800 annual fee (notice they don't call it a tax?) that CA imposes on all LLC's regardless of income. It must be prepaid and the voucher you send in with the payment is the 3522. Most small LLCs only pay the $800 and so only use the 3522 for that one time per year payment. The 3536 is used to pay the gross revenue tax. Think of the 3536 as a 1040ES. Estimate the amount of revenue and send in the payment. Larger LLC's like yours will be in this situation. Form 3537 is the extension form. If you make an estimated payment of tax with the filing of the return, you don't use either of the above, just the 3537. Hope this helps. Tom Modesto, CA -

Thanks for all your input. I keep hearing about Venmo and I was about to sign up, but now I think I will pass. I don't want the headache of the social aspect. Tom Modesto, CA

-

IRS yesterday confirms that MFJ taxpayers in Community Property States are to split the UI equally between them and then apply the exclusion to each spouse, even if only one had UI. Big break for taxpayers in Community Property States. Tom Modesto, CA

-

Must be some house...that area is a little isolated and very desert, except with snow. Are you building a client list out there? Hanging on to your CA client base? Both? Not meaning to pry, but I am getting close to moving as well, and I wonder how you keep your clients happy. Tom Modesto, CA

-

Really, there are more than one? You learn something new every day. Tom Modesto, CA

-

Check the report for efiled forms. The 1040X should be included when you file. If it is not there, I don't know what you did incorrectly. I know it looks just like you are filing the original return, but the X should be included in the Efile, it just won't call it a 1040X in the e-file manager. Tom Modesto, CA

-

Bingo! This will be the issue. How many people are just going to treat this like the "free" money they got last year? Assume a client gets enhanced UI for 6 months, advanced CTC and works for 6 months. What are they going to say when you tell them they have no refund coming cause they got it during the year? This is going to be a bloody year for the chains (Block, Liberty, JH). They live off the quick turnaround, big refund checks and advancing loans off of the refunds. But then again, the President and Congress could decide that this is still unprecedented times and forgive the payback on the tax credits and allow UI to go untaxed for another year. We saw it before and we may see it again. Tom Modesto, CA

-

Are you in Verdi? If so I drive past you every time I go to see my son. Which is quite a bit. That area out there was nothing a decade ago, now everyone wants to live there. The view of the Sierras as you go past Boomtown is spectacular. Tom Modesto, CA

-

Texas is in the center of the country, so we could travel to a lot of Square Dances, and our kids could fly in to see us from where ever they are living. We have a few relatives there. Nevada, Reno specifically, because my son lives there and it is 45 minutes from his house to the lift chair at Mt. Rose. I would definitely get a season pass. Also, the Washoe Valley has some spectacular scenery looking at the eastern slope of the Sierra Nevada mountains. Idaho - well because half the state is now from California, and it is a very beautiful state. I have been to Boise several times and always loved it. Not too far from Yellowstone, the second greatest National park behind Yosemite. We also have some relatives in ID. I have been to Virginia, but only Richmond and south of DC, so that is what I think of when I think of VA. Probably unfair to judge the whole state by what I have seen. I would kill or die for a home like Rita has, it is one of the most memorable homes and properties I have ever visited. While we were there, I just drove around the country and every place I looked felt like I could make it my home. Been to Nashville a couple of times and loved it. Been to Memphis, it was so-so. But everywhere in the country that I went was green and beautiful. One advantage of the pandemic is we moved 75-80% of our clients to virtual. I expected to lose about 20% of my clients, but so far we have about 95% retention for the year, which is very close to our historical average. So I could move anywhere, and do my CPE in Reno and Southern CA every year (and sneak in a visit to my kids when I do) and keep a majority of my clients. Just need to make sure I have killer internet speeds where ever we move. Tom Modesto, CA

-

Fresno State vs UCLA at the Rose Bowl. A bucket list item gets scratched off this year. NATP Tax Seminar (Live) in Las Vegas in September. Time to start using the Travel account again in my GL again. I don't think a suite is extravagant, since the buffet does not come included. Maybe there will be live stage shows again (saw Jersey Boys last time we went to Vegas for a tax seminar). Seriously considering leaving California. It is not the state I grew up in, nor the state I have called home all my life after this pandemic. I won't submit myself to these violations again. Looking at Texas, Idaho and Nevada. I can't convince my wife that Tennessee is as beautiful as she is. That would be my choice, but I don't get a full vote. Tom Modesto, CA

-

You should google "next winning lottery numbers" with the luck you have. It amazes me every time how good you are. Tom Modesto, CA

-

A gift tax return is not that hard to prepare. At some point you should take one on. Date of the gift, description of the gift, value of the gift and the donee. Pretty darn simple. As to the potential client in question, your choice, and I think you made a good one. But I would not be too concerned about the creditors. You prepare the returns based on the information provided. You are not an auditor the the IRS, nor the creditors. If a person completes a gift, whatever their motive, there is still a tax return to be prepared and filed. Tom Modesto, CA

-

Passed to the bene's on the K-1. Very common to see on a 1041. Tom Modesto, CA

-

In CA, community ends when the couple splits and has no intention of reconciliation. It is facts and circumstances, but if they split years ago, community ended years ago. No issue there for tax reasons. The real question - and I don't have an answer for it - is there any legal obligations from the Registration of the partnership that needs to be taken care of to let them go their separate ways? Like a divorce for RDP. With CA having same sex marriage for years, I never thought about the RDP and how that resolves itself in the state now. Tom Modesto, CA

-

I think they only get what they paid. In a "normal" year, the amount that they have to pay back from the PTC would be added to the amount paid in the tax year the PTC was related to. So my first thought is that they cannot take an amount that was not paid out of pocket or repaid on the reconciliation form. UNRESEACHED - so take it for what it is worth. In this crazy year, crazier things have happened. Tom Modesto, CA

-

Ok....the 571L is the report from which the Business Property Tax bill is generated. The assets of the company, less vehicles and real property (taxed under their own scheme) are listed by year at COST. On each section of type of property (machinery, equipment, Computers, etc.) is an amount for each year's purchases of that type of property. If you have the prior year report, it will save you a lot of headaches because the only thing you will need to do is put in the current year purchases and dispositions. If you have to recreate from scratch, hope that your numbers match the prior years when you get done, because if the prior year amounts don't match the previous reports, and there are no dispositions on the disposition schedule to tie them out, you risk an audit. And don't forget to put something (any amount) in for supplies. That is easy pickings for an auditor. As an aside, when I have gone through audits in the past on Business property, the first thing they ask for is the book and tax depreciation schedules, in detail. Then they will ask for the detail expense GL accounts for the common places to hide assets (Misc expense, Supplies, Office equipment, small tools, materials, Janitorial, computer software, etc.) If you get through that clean, you are home free, but if they find some ****creative**** accounting, they will continue to look. They will also do three years at a time. These audits are no fun, so making sure the 571L is tied out is the first step to avoiding the audit all together. ATX Max has the 571L. I have not looked for all counties, but I have never had one not there when I needed it. You are most likely going to have to do the submission online. They should have given you a letter from the county telling you what the account number and online login are. It is actually a pretty simple process if you have a filled out return in front of you. Let me know if you have other questions. Tom Modesto, CA

-

Are you talking about the 571L? Tom Modesto, CA

-

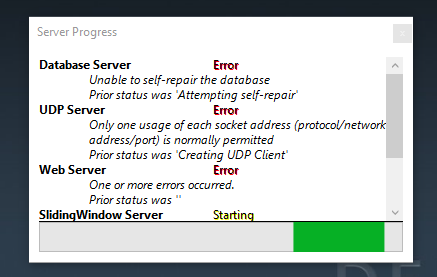

Is there a fix for this one? ATX won't start

BulldogTom replied to BulldogTom's topic in General Chat

Re-installed the Anti-Virus and ATX is still working. Thanks again. You guys are the best! Tom Modesto, CA -

Is there a fix for this one? ATX won't start

BulldogTom replied to BulldogTom's topic in General Chat

Thanks guys. Un-installed my virus software, restarted the services on all ATX software and the problem went away. Going to see what happens when I re-install my antivirus software. Did not use Abby's repair batch files, but I will keep this in mind. Appreciate you all. Tom Modesto, CA -

Went to start up ATX on my laptop. Have not used it for a week or so. This is what I get when I click on the icon. Is there a fix for this or do I need to call support? Thanks Tom Modesto, CA

-

Cool, good for you. These returns are not hard, and they can be a real nice source of revenue. Tom Modesto, CA

-

Hopefully there is enough in the bill to get an "adult beverage" of your choice. Tom Modesto, CA

-

Those of us who charge by the form are keeping it in the return....just saying. Seriously, I will be keeping it. Not just to get paid. I will probably need the form next year and I want it to roll over in the return. Tom Modesto, CA