-

Posts

4,493 -

Joined

-

Last visited

-

Days Won

188

Everything posted by BulldogTom

-

Client gave a older Honda Accord to a bona fide charity. His basis is $3,300. FMV is $4,850 according to the charity receipt. The car will actually be used by the charity, not sold off for $. How do I show this on the 8283 in ATX. When I select Vehicles as the type of property donated, the software wants an entry in Gross Proceeds from Sale. If I put in a Zero, ATX makes the deduction zero. I can override the deduction amount, but I always hesitate to do that. Any help appreciated. Thanks Tom Longview, TX

-

Why would you be reporting it? Is it an asset used in a business? Is it a really valuable car? Is the recipient a beneficiary? A charity? If I gave a car to someone, I would not report it on my tax return - unless it was given to a charity or it was a business asset or over the value was over the gifting limit. Are you overthinking it? It is April. Tom Longview, TX

-

Talk to the IRS before you send in an amended return. I find that they do not want another return filed while they are looking at a return. If you get them on the phone, they will usually tell you what they want and make the changes from their end and send a letter letting you know what the change is and the amount due or refund coming. If the 90 day clock is actually running, do not ignore it, even if you are working with the IRS on the return. When the clock runs out it is too bad. Tom Longview, TX

-

Really? 1116 has to be added now as pdf?

BulldogTom replied to Margaret CPA in OH's topic in General Chat

Thank you all for this thread. I knew I read about this somewhere and reading it again helped me figure out what I needed to do. Tom Longview, TX -

Client's employer/financial advisor disagreement

BulldogTom replied to JackieCPA's topic in General Chat

How about using a substitute W2? Use the employer EIN. Now you have it in the wages section of the W2. Add an explanation (which will never be read but will CYA if an audit comes). Tom Longview, TX -

I have no idea but will be following this topic. I think I may need to move into e-signing at some point. Tom Longview, TX

-

The purpose of creating the LLC was not related to change of entity, it was for other business reasons. Client is looking to sell, and the broker he is working with told him that it is easier to sell an LLC than a sole proprietorship. So he created one. Don't know when he did the deed. I am still waiting for the LLC formation docs (requested 2 times) to find out what he really did. Not sure who told him to put himself on payroll. There is only one set of books (without any payroll expenses!). I have requested the 941s (requested 2X). Thanks for your responses. Tom Longview, TX

-

Sole proprietor formed LLC (disregarded entity) this year. Without my knowledge, put himself on PR. Got his papers yesterday with a W2 with him as employee and him as employer using his SS# as the EIN. Besides slapping his hand and stopping it from happening again, is there anything I can do to fix this for 2021? Or do I let it flow through this year as is since the net effect is the same? Thanks Tom Longview, TX

-

I use a Canon ImageClass 1620. Scanning is OK. Prints great. Copies great. I get the off brand toner on Amazon. Tom Longview, TX

-

Client from hell on St. Patty's day. Doesn't seem right.

BulldogTom replied to schirallicpa's topic in General Chat

We need a sympathy emoji.... Tom Longview, TX -

Never used for primary residence or rental? No depreciation taken? If so, then it is a capital transaction, long or short, reported on the 8949 (box checked for basis not reported to IRS) and carried to the Sch. D. Tom Longview, TX

-

Client from hell on St. Patty's day. Doesn't seem right.

BulldogTom replied to schirallicpa's topic in General Chat

Pour 2, pretend the second one is for one of us...and don't let a single drop go to waste. Tom Longview, TX -

VA EA Society is having a Tax Conference June 8-10th in Fredericksburg VA. If the party was on June 11th at Gail's the trip becomes mostly tax deducible. Just sayin..... Tom Longview, TX

-

I am now in North East Texas. I have a pool. Would love to host if Rita does not want to or cannot. Happy to fire up the grill and have you all over. Have to work out a date that the missus can work with. Tom Longview, TX

-

What cbslee said. I would guess it will be in the equity section, that is where I see the most issues. In QB, the one account I hate to see is "Opening Balance". Tom Longview, TX

-

Depends on by how much. There is almost always a rounding difference. If it is a couple of dollars...no big deal. If it is way out, then you need to fix it. Tom Longview, TX

-

I got all my acks this morning. Tom Longview, TX

-

Still waiting on Federal Acks from yesterday. Got the State Acks. Weird. Please update if you start getting Fed acks. Will be monitoring this thread. Thanks Tom Longview, TX

-

Need confirmation on California Income Taxes

BulldogTom replied to NECPA in NEBRASKA's topic in General Chat

@NECPA in NEBRASKA Bonnie, I spoke to a friend (not a client) today who is an airline flight attendant domiciled in TX. She confirmed what I thought...the airline assigns her wages to her home base assignment. She was based out of CA for a portion of 2020 and 2021, and her W2 reflected earnings to CA for that period of time, even though her flight hours in CA were actually a small percentage of her total flight hours while she was based in CA. I have a feeling this is what you will see when your son gets his W2. Not sure if this helps... Tom Longview, TX -

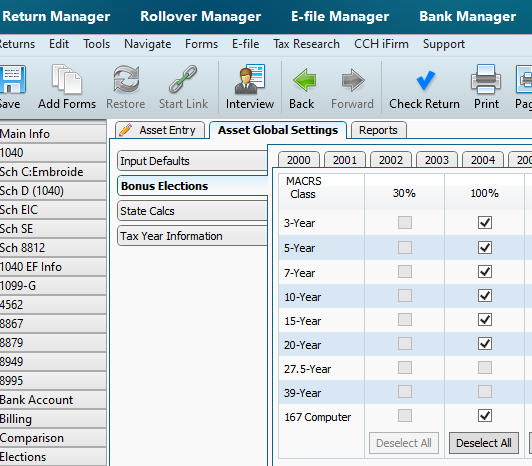

It is not on the elections page, it is in the fixed assets - Asset Global Settings - Bonus Elections. Took me a while to find them as well (don't do it very often). Kept going to the "Elections Tab" and trying to make it work from there. Tom Longview TX

-

Renewal fee every 3 years. Renewal cycle based on the last two digits of your social. Tom Longview, TX

-

NYS LLC filing question - different state jurisdiction: Nevada

BulldogTom replied to schirallicpa's topic in General Chat

I think you posted this to the wrong thread? Were you meaning to put this in the thread about Bonnie's son the airline pilot? Tom Longview, TX -

Need confirmation on California Income Taxes

BulldogTom replied to NECPA in NEBRASKA's topic in General Chat

Bonnie, I have never had a client who was a transportation worker, so I am not familiar with those rules. You son will still be domiciled in Colorado. Working in CA temporarily does not change that. He will file a 540NR next year for the time he was "based" in CA. What I have always done (right or wrong) is follow the W2 for state wages if the client is a non-resident CA taxpayer. It is a powerful third party document for either side if there is a dispute. Never had an issue using that method. If audited, the State would have to prove that the employer improperly completed the forms, and that the taxpayer knew or should have known that the employer document was incorrect. Pretty tough hurdle for the FTB to get over. Make sure he keeps track of all his unreimbursed expenses. CA never conformed to the 2017 Tax Act (something about never agreeing with anything a certain former POTUS advocated). Those 2106 expenses are deductible on the CA return. You will show them on the "state only" portion of the 2106 and they will be applied on the Schedule CA (California Adjustments). Reach out if you have any specific questions. Tom Longview TX (56 prior years in CA) -

Sorry, I guess I understood your question incorrectly ;o) I don't think there is a downside. If the IRS gets a 1099S for your client, I would hope they would look at the 1040 and the schedule D before they sent out a letter....but this is the IRS. At any rate, the response letter would be pretty easy "Taxpayer did not receive the 1099S, please see details of sale related to 1099S on the attached Sch D which was part of the e-filed return." Tom Longview, TX

-

Why would you? I assume you have the closing statement from the client? So long as you have the relevant data to accurately compute the gain and the §121 exclusion, why would you intentionally answer a question on the return incorrectly? Am I missing something where the software requires a 1099S to record the sale of a home? Tom Longview, TX