-

Posts

4,493 -

Joined

-

Last visited

-

Days Won

188

Everything posted by BulldogTom

-

Any "reasonable" split between land and building will work. I don't think you can "ignore the whole thing". Why are you taking on new clients? I thought you were moving to retirement? Tom Longview, TX

-

I already have a portal associated with my website. Do I have to get their portal to use their e-sign? Tom Longview, TX

-

The Basis is the value of the Home on the Date of Death. If the client did not get an appraisal and the sale happened very close to the Date of Death (like within 90 days - my suggestion, not IRS rule) you probably can get away with the sale price as the DOD valuation. If the sale is further out than 90 days, you should have an appraisal done for DOD valuation. Tom Longview, TX

-

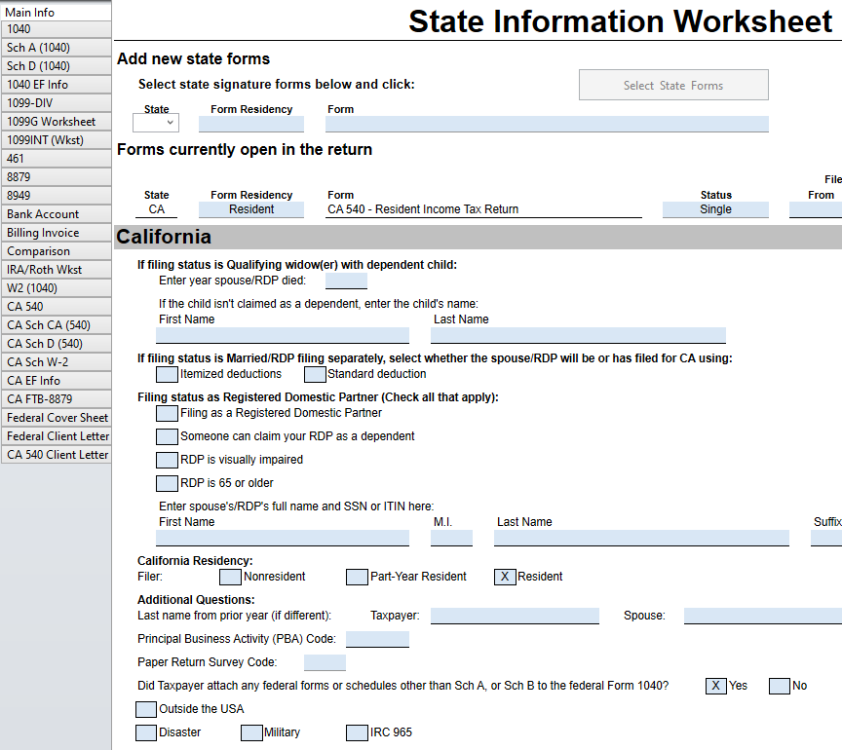

Sorry, I should have been more clear. In ATX it is on the State Information Worksheet at the very bottom. I am not sure of all the counties that are not included, but Orange county is one of them (just looked it up today for a client).

-

I am trying to "shame" my CA clients who ask me if they get the extension by asking them "Were you affected?". If they say yes then it is not an issue, if they say no I ask them why they need the extra time? But the quick answer to your question is YES, anyone who resides or owns a business in those counties will get an automatic extension of time to file and pay their 2022 taxes. There is a checkbox on the main form that you can click that says Disaster. Then you can fill in the words CA Winter Storms for the description. The IRS will check the county and you should be good to go. Tom Longview, TX

-

How is the verification process? Is it like ID.me? Where you have to upload your drivers license and other proof of identity? Has anyone used the Esignature feature in ATX? Seems like that would be the easiest for me, but does it work well? Tom Longview, TX

-

My clients have become dummies (or they have gotten rid of all their computers, printers and scanners - 'cuz like a phone can do everything now days!). It seems this year that the process of printing out, signing and sending back the 8879s has become too much for some of my clients who only have a phone for everything now. Some of them can't comprehend an email that says "print, sign and scan back to the portal your engagement letter and forms 8879". I am so frustrated with some of these clients...they seem to think I am the problem, even though they have been sending me their docs through the portal for a couple years now. Maybe I am and maybe I should think about getting out of the hand-holding business (aka tax prep). If I capitulate and add e-sign for forms, what is it going to cost me, who should I buy it from and how complicated is it for my clients to use. Tom Longview, TX

-

Double Check Please - NOL not limited to 80%

BulldogTom replied to BulldogTom's topic in General Chat

Just to follow up and clear my thinking, the Cares Act only changed the carryback rules (suspended them for 2 years) and did not change the 80% rule for 2018 and forward NOLs? Tom Longview, TX -

Only obliquely tax-related: 5 beers that should exist for accountants

BulldogTom replied to Catherine's topic in General Chat

Wine or Whine? Tom Longview, TX -

Double Check Please - NOL not limited to 80%

BulldogTom replied to BulldogTom's topic in General Chat

So the 2015, 2016 and 2017 NOLs are fully deductible until exhausted just like the old rules? The 2018, 2019 and 2021 NOLs have the new 80% of income limitations on them? And if the corp uses the 2017 and 2018 NOLs in the same year, the example above is how to allocate the NOLs to the income? In my current situation, the 2015 NOL will cover the entire profit for the year so I can take income to $0 for 2022. I think this is clear as mud. Please correct me if I am wrong. Thanks Tom Longview, TX -

Corp Taxpayer has NOL's from 2015-2019 that have not been used up as well as a 2021 NOL. The 80% rule does not apply to any of the earlier NOLs, correct? Only the 2021 NOL is limited to 80% of income. It has been a long Month. Seems like April 1 everyone decided it was time to get their taxes done. I have been going non-stop since then. Thanks Tom Longview, TX

-

I don't think so. As long as he is a resident of NYS and he files a CA NR return, the tax return product is delivered is his home state. At least that is how I read it now. CA could be lurking on this board trying to find new revenue sources. Tom Longview, TX

-

It appears the prior preparer and you have a different number for the parent's taxable income. I think the kid should be paying at 15% since his mom was in the 22% bracket (assuming she was HOH) and that would make the Cap Gains taxed at 15%. I am pretty sure that is how that works. Tom Longview, TX

-

Are you sure that a superseded return will not be manually entered? Tom Longview, TX

-

@Lion EAI don't have a definitive answer on this one. My guess is the way you hold yourself out to your CA clients (SP or LLC) would control. So if your Paid Preparer information on the bottom of the tax return says TAX PREP by LLC then you are doing business as an LLC and would have to register in CA as a foreign LLC in CA and pay the $800 annual LLC fee and file a 568 return. If your Paid Preparer section says TAX PREP by LION then you may be able to get away with filing a 540NR with your Sch C apportioned to CA. You will need to research this more. Tom Longview, CA

-

My understanding is no. Your customer is in CT so it is not CA source income. Tom Longview, TX

-

If your corp is preparing returns for CA residents you are doing business in CA and have to pay the annual min. tax. If you prepared the returns as an employee of your corp, you do not have CA source income. If your corp prepares CA NR returns for TPs in other states there is no CA source income. My wife is an employee of my SP. She does almost exclusively CA resident returns. She works out of my office in TX. She has no CA source income, but my SP does and I file a 540NR to report the income and expense for CA source income related to my Sch. C. Tom Longview, TX

-

The Fee would depend if you were a Corp or LLC, then there is a minimum tax of $800. If you are a SP, then no min. tax, just regular PIT from the tax rate schedules. Tom Longview, TX

-

Yes there was a thread, but different situation. The OP on this thread has a W2 for working in CA. Just a simple NR tax return to CA for the wages earned on the employees part in CA. The earlier thread would apply to the employer of the TP. Employer would have to register their business in CA (which they did if they are reporting wages to CA and producing W2s with CA earnings for their employees) and file a tax return on the income generated in CA. Tom Longview, TX

-

For CA, they want tax on the portion that was earned in CA. You will file a 540NR and attach a Form CA 540NR (Form CA stands for California Adjustments). Tom Longview, TX

-

Damn she is smart. Tom Longview, TX

-

I am confused a little bit on who your client is. Is it the Individual or the Trust? Or both? Is the Executrix your client for the Trust? Are there multiple trusts (like one for each sibling)? The Partnership seems to be reporting to your client their trust's share of income and expense and sourcing it to the state earned. Good so far. The trust (is the trust your client) should be producing tax return(s) based on the 1065 K-1 information and reporting appropriately to each state where there is a filing requirement and providing a 1041 K-1 to the beneficiary(s). The beneficiary(s) should be reporting the information from the trust K-1 on their individual returns to the IRS and the states where they have a filing requirement based off the source of the income. Tom Longview, TX

-

Just happened to me (but not tax docs). Got an empty envelope with the "Sorry your mail was damaged" message from the post office. Luckily for me it was from a realtor who wanted to make an offer on my rental home which is not for sale. I get a letter from the same realtor every six months or so. Tom Longview, TX

-

It is like a movie that you have never seen before and you don't know for sure how it will end. Never, ever thought of this as a possibility. Going to get some more popcorn and see how this plays out. Tom Longview, TX