-

Posts

4,491 -

Joined

-

Last visited

-

Days Won

187

Everything posted by BulldogTom

-

If you think the client is lying, then by all means you should decline. That is your call not mine. I don't think a behemoth of a truck is preposterous for a ranch. 2 tons of feed in a trailer going up hill....on the freeway....at 70 mph. It takes a truck. A man sized, full power, get through the mud truck. I just wish we could plug in an app like the insurance companies do and at the end of they year it would spit out a mileage log so we don't have to guess where it was parked and driven. Maybe the next Acting Commissioner (fifth, sixth...I lost count) can make a rule that they have to have that device to get a mileage deduction... how cool would that be? Pipe dreaming Tom Longview, TX

-

Don't need answers today - next week would be nice

BulldogTom replied to Catherine's topic in General Chat

I think she is saying they got the credit 10 years ago and stopped making the annual payment on their tax returns and now want to pay what they owe. @Catherine is asking if the 5405 is still a valid form for this and if there is a penalty or interest that needs to be calculated when they pay back the remaining balance due. The following commentary is about why the IRS did not follow up after all this time if they missed the repayment. At least that is how I read the OP. Tom Longview, TX -

Any body else having issues getting Ack's back from California?

BulldogTom replied to Tax Prep by Deb's topic in E-File

They started slowing down on Monday. Seems to be slow but all eventually ack'd. Tom Longview, TX -

Does anyone have time to check my work? Solo 401K spreadsheet

BulldogTom replied to BulldogTom's topic in General Chat

much easier. Thanks Tom Longview, TX -

Yeah, I know it is April 14th, don't hate me, just ignore if you are up to your eyeballs right now. I have this client who wants to maximize his retirement contributions. Successful business, just him, net income always in the 200K plus range. Says his retirement provider will not allow him to make contributions after the end of the year (I have no idea why). So I made him a SEP Calculator a couple years ago. Worked great. Now he is switching to a Solo 401K and wants another calculator. So I just made one. Only 2 entries needed - Income from Sch C and Employee Contributions (highlighted cells). Anyone want to try and break this thing and tell me why it doesn't work? Thanks in Advance. Tom Longview, TX Solo 401K limit calculator.xlsx

-

@Patti in Upstate NY exactly. Mom is insufferable. Owns the S-Corp. Love the kids who get the K-1s. 4 total returns. @Sara EA Slowly raising the Corp and Mom. She is starting to notice. Afraid if I raise her too much she will tell the kids. Tom Longview, TX

-

I don't see a way. It only pulls from the filer email. Tom Longview, TX

-

So, do you file the 1040X before the refund is paid on the original return? I have always waited for the refund before amending, but I am wondering if that is the correct course of action? I just don't want to gum up the works at IRS. Tom Longview, TX

-

Conspiracy theorists with the highest credentials who spoke on condition of anonomy claim the workers who were forced back to the office are sabotaging the end of tax season in their final days before exercising their buyouts. No one is available to confirm or deny these rumors. Film at 11. Tom Longview, TX

-

Good thing there is a handy supply of paper right there to document your business purpose... Tom Longview, TX

-

Is it "ordinary and necessary" to "do your business" during working hours? Asking for another friend. Tom Longview, TX

-

Without water, how does a client flush the toilet when they go to the restroom? Just asking for a friend. Tom Longview, TX

-

Brain Dead - Need help with NR state allocation

BulldogTom replied to jasdlm's topic in General Chat

I agree with @jklcpa. I am wondering how you are going to do that in ATX? My first thought is to use the State K-1 Worksheet and override. Is that how you would do the entry? I don't have anyone in this situation, just filling up my brain with some extra information that I can forget later and know that I knew it before. Tom Longview, TX -

Bookkeeping is a separate charge for me. I don't mix the two on my billing. 1 bill for the bookkeeping, 1 for the tax return. And I made a decision a couple years ago that Corps, Scorps and P/S start at $1000 before I open my software. I don't care how simple they are, they can get hairy in a heartbeat. I am thinking about doing the same thing with Estates and Trusts. The amount of handholding that you have to do when someone's mother passes away and the child who has no clue how to be a Trustee starts asking questions. They have built trust with us, and we try to walk them through the process, but man it takes a lot to get them to understand what they have to do, all the while grieving their loss. I just wrapped one up that I would rather never see the client again. And they are good friends of ours. But man it was rough. Tom Longview, TX

-

I was going to get new computers before this tax season, but I held out waiting for the Win11 OS to mature a bit. 6 tax seasons on my current machine. I need to find someone to set up my system for me. I love Dell, but all the crap they pre-load takes forever to find and delete. Anyone here who knows about setup willing to clean up a Dell system for me? Not naming names, but his initials are @Abby Normal . Brisket on me, and when the humidity gets to you, you can hop in the pool. August in the South is wonderful if you love to wear the air. Tom Longview, TX

-

Since I charge by form, it is hard to compare. I just did some back of the napkin math and I come up with about $1200-$1400. For comparison, I have a client with a Sch C (Sep included), spouse is high income, Sch A, Sch B, K-1, 1 kid in college, multiple rentals in another state and the documentation they send me every year is pristine. This year the invoice was just under $900. I love this client. I have another client who left CA, retired early, SS, Investment income and Sch D activity, HSA, over the limit mortgage and 6 CA K-1s. Fed and CA NR plus all the basis sheets and Passive activity stuff. $490. I love this client too. He calls me every Nov and tells me what his income is and asks if he needs to harvest losses or take profits. No surprises when I get his docs. On the low side, Fed & CA with W2, Interest and simple Sch A goes about $150. Don't know if that helps or hurts. Tom Longview, TX

-

I think it does. I used to know how when we needed to scan and attach Sch B of the 1116 a couple years ago. I have not done it in a while. As I was eating dinner, I came up with a plan, I am going to reference the CCM in line 19 and SEE ATTACHMENT. Then I am going to complete a blank statement and then attach as a pdf. I am not concerned about the legal challenge to the deduction, my client fits the #2 scenario in the CCM to a T. I don't care if they audit, we are on firm ground. But I don't want to invite an audit because the facts are not presented in the originally filed return. And I don't know for sure how to make sure that the facts get into the IRS system. That is what has my knickers in a bunch. Tom Longview, TX

-

Thanks @jklcpa I guess my problem is that I can't find a place to give a detailed explanation that links to this form in ATX. I can put in a blank statement but that does not have a link to a form number so it will go together. The amount of space you get in Line 19 is very minimal (see below). If no one has a better idea, I will put in a blank statement with a header that indicates the form number and line number with the details as provided by the client. I just don't think it will end up in the efile so it will not get in front of the examiner when it gets kicked out for review. Tom Longview, TX

-

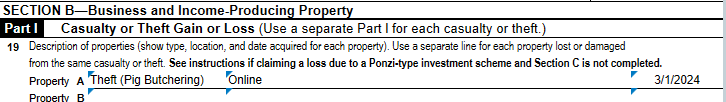

I am looking at form 4684 and I just think this is not going to go through. Looking for advice on how to present this in the return so that when a real set of eyes gets around to looking at it, there will be a chance they will be able to figure out what I am trying to tell them. This form is just not giving me the options to do so. Advice? Tom Longview, TX

-

If your computer is turned off, you can't be backing up. I think what he is saying is that ATX backup files will not backup properly onto another file location (like a flash drive or second hard drive) unless you go into the background tasks and "end service" on each "ATX Server" running in the background. He can answer for himself, but that is how a non-techy accountant reads it. Tom Longview, TX

-

Well, I think I have a similar situation. Of course they couldn't tell me in Jan or Feb, it has to be in April. Thanks so much for posting this info. May save my client some serious tax $. Tom Longview, TX

-

If I understand it correctly, the new Cir 230 guidance will require you to advise the client to file amended returns or you must decline the engagement. The new rules are going to be tricky in circumstances like this. I can't believe I am going to say this, but I am really going to need to look at a good Ethics course this summer if the new regs are finalized. Tom Longview, TX

-

On the top of the report there is a dropdown box. Click the arrow and pick Passive. Everything will be there. Tom Longview, TX

-

Don't hold back Pencil....tell us how you really feel. I would never buy an HP for the reasons you state. Tom Longview, TX