-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

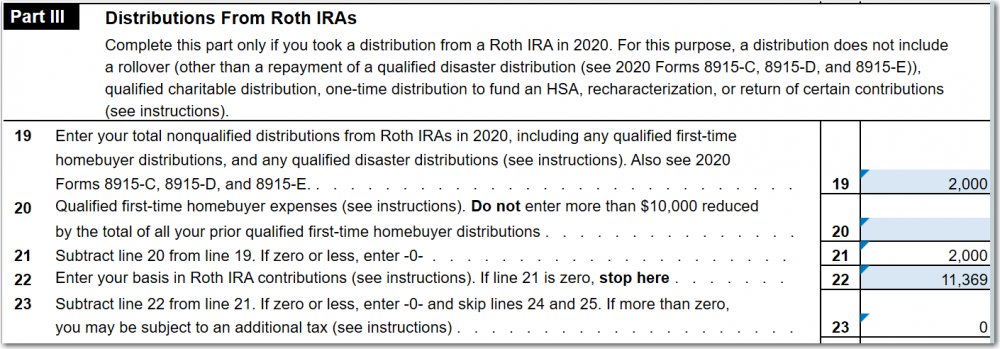

MFJ spouse withdrew funds from her Roth IRA in the amount of $2,000. She is 48 years old. 1099-R was coded as J: Early distribution from Roth IRA no known exception. There are no exceptions based on the client. They just needed the funds. Her basis in the account is $11.369. I completed Part III of the 8606 as follows: Is this a taxable event for her? The ATX program shows the $2,000 distribution on line 4a but treats it as a non-taxable event with line 4b showing zero. I appreciate your feedback.

-

Maryland just extended filing deadline to 7/15/21

Yardley CPA replied to Abby Normal's topic in General Chat

Wow...will President Joe Biden indicate that the Federal is extended in his speech tonight? His predecessor's extension worked well for most of us. -

Amazon reported $23.64 in Royalties to client on a 1099-Misc. It will not link to other income, only a Schedule C. Is that really the route I have to take for this?? The information I have is it pertains to Kindle Direct Publishing. Client does not have any type of business and while I will find out more, I'd like to just reflect it as other income.

-

Sincere condolences to Rita and her family. May her Mom rest in peace.

-

Based on my understanding and the information you present, you can, yes.

-

Sure seems that way. More information to track and include on returns. I guess there's an opportunity to increase rates?

-

If your invoice reflects what you feel is a fair and reasonable price for their return, let them walk. It's difficult to see clients leave but at this point in my tax "career" I'm not looking to give my services away. I think my rates are below market in some instances, but I'm okay with that. I'm not looking to decrease them more, if anything they will continue to go up in the future.

-

Did ATX remove the option of "Other" for box 8a? What is the new catch all that can be used? Can it be left blank with no issues?

-

Thanks for the post, Judy. And thanks also for attempting to scrub the information. Moderator Extraordinaire!!

-

Could it have something to do with the charitable contribution deduction?

-

It would be nice if they make a decision and announce it soon. If they are going to extend, why the wait to announce it? Let the nation know and it would certainly help the tax preparers with their plans for the next month and beyond.

-

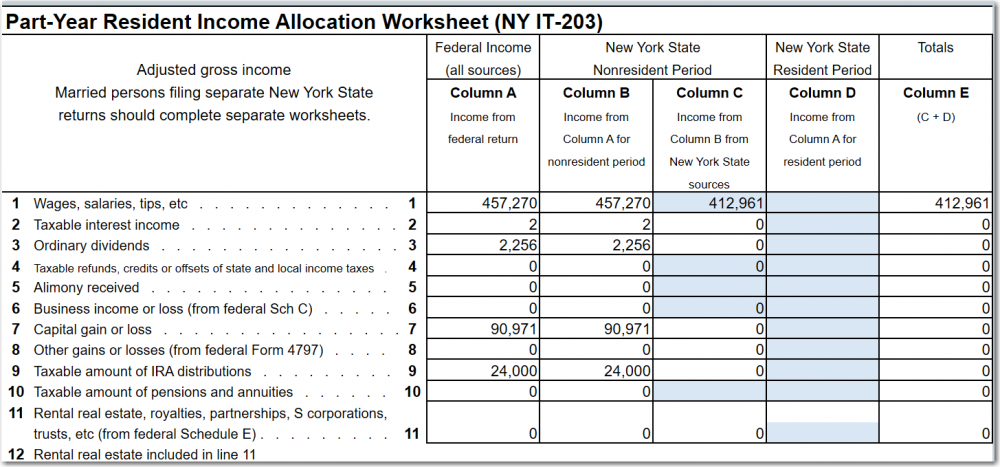

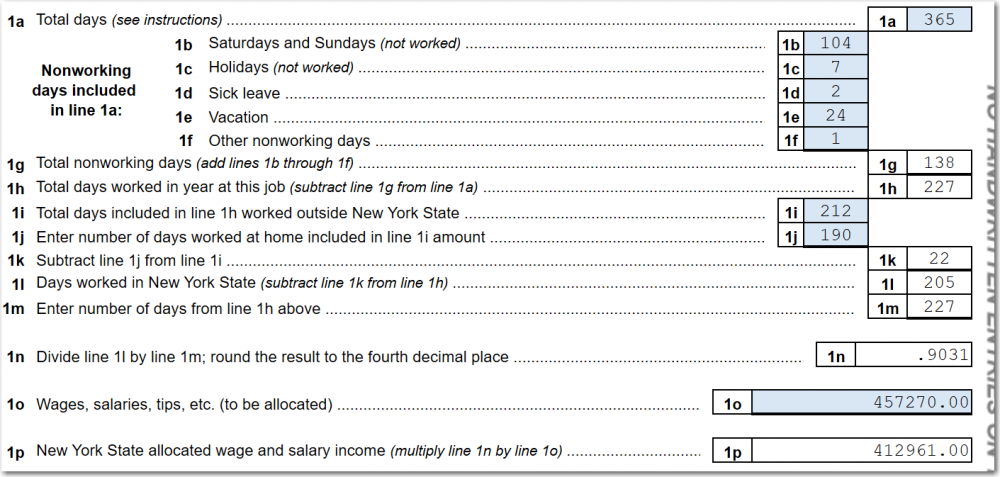

Thank you for the response. Wondering about line 1o the IT-203B. Should that always be the NY Wages from the W2 or is there some type of calculation used to populate 1o? ATX had populated that line with a figure that was less than NY Wages and I could not figure out how the number was arrived at.

-

Hoping someone with knowledge of New York returns can chime in. NJ Resident working in New York. Should IT203-B, Line 1o Wages, Salaries, Tips normally equal the W2 NY Wages? In my clients specific case, they also have Dependent Care Benefits added back because the wife did not work. So the amount on Line 1o of IT203B is the same as IT203 Allocation Worksheet Column B, Wages, Salaries, Tips Etc. $457,270. For some reason, ATX had populated $427,195 on Line 1o and for the life of me I could not tie back into that figure.

-

You would file a New Jersey Non-Resident Return. The client should receive their entire NJ withholdings back as a refund since the client did not reside nor did they work in NJ at any point. As for the NY, make sure to prorate using the IT-203B form. That will allocate for the amount of time spent physically working in NY.

-

NJ will give a credit for taxes paid to other jurisdictions.

-

https://www.journalofaccountancy.com/news/2021/feb/tax-provisions-american-rescue-plan-act.html?utm_source=mnl:cpald&utm_medium=email&utm_campaign=01Mar2021 Tax provisions in the American Rescue Plan Act By Alistair M. Nevius, J.D. February 27, 2021 The $1.9 trillion stimulus plan passed by the House of Representatives early Saturday contains many tax provisions, including a new round of economic impact payments, a tax credit for COBRA continuation coverage, and the expansion of several other tax credits. The House passed the bill, the American Rescue Plan Act of 2021, H.R. 1319, by a vote of 219–212, and it now goes to the Senate for consideration. Recovery rebates Subtitle G of the bill, titled "Promoting Economic Security," enacts a new Sec. 6428B that provides individuals with a $1,400 recovery rebate credit ($2,800 for married taxpayers filing jointly) plus $1,400 for each dependent for 2021. As with the two recovery rebates enacted in 2020, the IRS will make advance payments, which the Service has been calling economic impact payments. The recovery rebate credit phases out for taxpayers with adjusted gross income (AGI) over $75,000 ($150,000 for married filing jointly). The bill uses 2019 AGI to determine eligibility, unless the taxpayer has already filed a 2020 return. COBRA continuation coverage Subtitle F of the bill, titled "Preserving Health Benefits for Workers," provides COBRA continuation coverage premium assistance for individuals who are eligible for COBRA continuation coverage between the date of enactment and Sept. 21, 2021. The bill creates a new Sec. 6432, which allows a COBRA continuation coverage premium assistance credit to taxpayers. The credit is allowed against the Sec. 3111(b) Medicare tax. The credit is refundable, and the IRS may make advance payments to taxpayers of the credit amount. The credit applies to premiums and wages paid after April 1, 2021. Under new Sec. 6720C, a penalty is imposed for failure to notify a health plan of cessation of eligibility for the continuation coverage premium assistance. Taxpayers who receive the COBRA continuation coverage premium assistance credit are not also eligible for the Sec. 35 health coverage tax credit. Under new Sec. 139I, continuation coverage premium assistance is not includible in the recipient's gross income. Child tax credit The bill expands the Sec. 24 child tax credit in several ways. It makes the credit fully refundable for 2021 and makes 17-year-olds eligible as qualifying children. The bill increases the amount of the credit to $3,000 per child ($3,600 for children under 6). The increased credit amount phases out for taxpayers with incomes over $150,000 for married taxpayers filing jointly, $112,500 for heads of household, and $75,000 for others. The IRS is directed to estimate taxpayers' child tax credit amounts and pay monthly in advance one-twelfth of the annual estimated amount. Payments will run from July through December 2021. The IRS must set up an online portal to allow taxpayers to opt out of advance payments or provide information that would be relevant to modifying the amount. The taxpayer in general will have to reconcile the advance payment amount with the actual credit amount on next year's return and increase taxable income by the excess of the advance payment amount over the actual credit allowed. But taxpayers whose modified AGI for the tax year does not exceed 200% of the applicable income threshold ($60,000 for married taxpayers filing jointly) will have the increase for an excess advance payment reduced by a safe harbor amount of $2,000 per child. Earned income credit The bill also makes several changes to the Sec. 32 earned income credit. It introduces special rules for individuals with no children: For 2021, the applicable minimum age is decreased to 19, except for students (24) and qualified former foster youth or homeless youth (18). The maximum age is eliminated. The credit's phaseout percentage is increased to 15.3%, and the phaseout amounts are increased. The credit would be allowed for certain separated spouses. The threshold for disqualifying investment income would be raised from $2,200 to $10,000. Temporarily, taxpayers would be allowed to use their 2019 income instead of 2021 income in figuring the credit amount. Child and dependent care credit The bill makes changes to the Sec. 21 child and dependent care credit, including making it refundable for 2021. The bill also increases the exclusion for employer-provided dependent care assistance to $10,500 for 2021. Family and sick leave credits The credits for sick and family leave originally enacted by the Families First Coronavirus Response Act (FFCRA), P.L. 116-127, would be extended to Sept. 30, 2021. The bill increases the limit on the credit for paid family leave to $12,000. The number of days a self-employed individual can take into account in calculating the qualified family leave equivalent amount for self-employed individuals increases from 50 to 60. The paid leave credits will be allowed for leave that is due to a COVID-19 vaccination. The limitation on the overall number of days taken into account for paid sick leave will reset after March 31, 2021. The credits are expanded to allow 501(c)(1) governmental organizations to take them. Employee retention credit The bill extends the employee retention credit through the end of 2021. The employee retention credit was originally enacted in the Coronavirus Aid, Relief, and Economic Security (CARES) Act, P.L. 116-136, and it allows eligible employers to claim a credit for paying qualified wages to employees. Under the bill, the employee retention credit would be allowed against the Sec. 3111(b) Medicare tax. Premium tax credit The bill expands the Sec. 36B premium tax credit for 2021 and 2022 by changing the applicable percentage amounts in Sec. 36B(b)(3)(A). A special rule is added that treats a taxpayer who has received, or has been approved to receive, unemployment compensation for any week beginning during 2021 as an applicable taxpayer. Miscellaneous tax provisions The bill repeals Sec. 864(f), which allows affiliated groups to elect to allocate interest on a worldwide basis. The bill provides that targeted Economic Injury Disaster Loan (EIDL) grants received from the U.S. Small Business Administration (SBA) are not included in gross income and that this exclusion from gross income will not result in a denial of a deduction, reduction of tax attributes, or denial of basis increase. Similar treatment is afforded SBA restaurant revitalization grants. The bill temporarily delays the designation of multiemployer pension plans as in endangered, critical, or critical and declining status and makes other changes for multiemployer plans in critical or endangered status. For more on the nontax portions of the bill, see, "House Passes $1.9 Trillion Stimulus Bill with a Variety of Small Business Relief." — Alistair M. Nevius, J.D., ([email protected]) is the JofA's editor-in-chief, tax.

-

If I get yelled at for not attaching the pdf, I'm implicating you as well Abby. Just be forewarned!

-

Thank you both. I'm going to attach a pdf of the 1099-B to the return which shows each transaction. Appreciate the responses.

-

Client with 25 stock sale transactions listed. All have the necessary information to populate Schedule D and 8949. There are no adjustments to any of the transactions. Can I use the grand total figures and show one entry for the total amount of proceeds and one entry for the total cost on line 2B or must each be listed separately?

-

Is there an "Access Account" that allows you to view client information as the tax preparer?

-

In addition to the negative number on the "Other Income" line, can you attach an explanation to the return describing the situation and the reason for the negative number?

-

I believe there is a schedule on the form that allows you to input the extra $1,000.

-

What exactly does the secure access allow you to do?

-

I have used eSign for the first time this year through ATX. While it's a nice feature and has worked well the few times I've used it, it can be a heck of a lot better. As far as I know, there is no way to customize what is sent to the client. After you click the eSign tab and go through a couple quick questions, the process is taken over by ATX. ATX (or Docusign) sends the client a confirmation email that ensures the client authenticates themselves. Once authenticated, the client is provided with a copy of the return and signature forms. I receive a confirmation email that the documents were sent to the client. I also receive an email once the documents are signed and read for my review. I don't recall ever setting up any type of account to use eSign...I simply pressed the tab. Feedback from my clients have been positive. I wish there was a way to send engagement letters or additional documents as well. Maybe do a live chat with an ATX rep and see if they can assist you...or give support a call.

-

Should these legislations become law (sounds like it already is in Maryland) we would file an amended return for any filed before the official proclamation?