-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

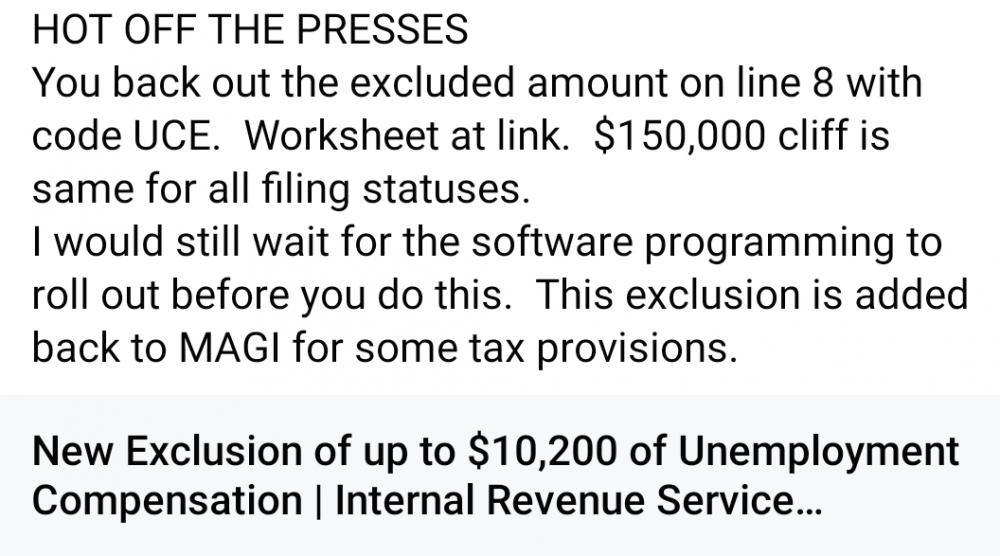

https://www.journalofaccountancy.com/news/2021/apr/automatic-irs-refund-tax-mistakenly-paid-on-unemployment-benefits.html?utm_source=mnl:cpald&utm_medium=email&utm_campaign=02Apr2021 IRS to automatically issue refunds on tax-free unemployment benefits By Sally P. Schreiber, J.D. April 1, 2021 In good news for many taxpayers, the IRS said that, beginning in May and continuing through the summer, it will automatically issue refunds to eligible people who already filed a tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan Act, P.L. 117-2 (IR-2021-71). Under this process, eligible taxpayers will not have to file amended returns to receive a refund. The American Rescue Plan Act, enacted on March 11, allows taxpayers with modified adjusted gross income of less than $150,000 on their tax return to exclude unemployment compensation up to $20,400 if married filing jointly and $10,200 for all others, but only for 2020 unemployment benefits. The IRS explained that, according to the Bureau of Labor Statistics, over 23 million U.S. workers nationwide filed for unemployment last year and some self-employed workers qualified for benefits for the first time. The IRS said it is trying to determine how many workers affected by the tax change already have filed their tax returns. Because the change occurred after some people filed their 2020 tax returns, the IRS says it will take steps in the spring and summer to correct those returns, which may result in a refund. In testimony before the Oversight Subcommittee of the House Ways and Means Committee on March 18, IRS Commissioner Charles Rettig had promised that the IRS would attempt to issue these refunds without requiring taxpayers to file amended income tax returns, which can be costly and time-consuming. The IRS explained that for those taxpayers who already have filed and figured their tax based on the full amount of unemployment compensation, it will determine the correct tax amount of unemployment compensation and tax generally. Any resulting overpayment of tax will be either refunded or applied to other outstanding taxes owed. The IRS will do these recalculations in two phases, starting with those taxpayers eligible for the $10,200 exclusion and then moving on to returns for those married filing jointly taxpayers who are eligible for the $20,400 exclusion and others with more complex returns. Taxpayers do not need to file amended returns unless the calculations make the taxpayers newly eligible for additional federal credits and deductions not already included on the original tax returns. As an example of a situation where a taxpayer may be entitled to an additional credit, the IRS explained it can adjust a return for a taxpayer who claimed the earned income tax credit (EITC). But because the exclusion for unemployment benefits changed the taxpayer’s income level, he or she may now be eligible for an increase in the EITC amount, which may result in a larger refund. In these cases, taxpayers would have to file an amended return if they did not originally claim the EITC or other credits but now are eligible because the exclusion changed their income. The IRS advised taxpayers to review their state tax returns, too. The IRS has also issued guidance for those taxpayers who have not yet filed their returns on how to treat the benefits, including a worksheet for figuring a taxpayer’s modified adjusted gross income for these purposes and the amount of unemployment compensation a taxpayer can exclude from income. — Sally P. Schreiber, J.D., ([email protected]) is a JofA senior editor.

-

Most importantly, best to you and your husband Judy. I hope his recovery goes smoothly the rest of the way. As for clients like the one you described, they ultimately pay the price for the AGITA (Italian word for stomach acid) for the issues they cause. My fees tend to go up significantly for those type of people. If they leave next year, no problem at all. If they come back next year, well my fee doesn't go down any.

-

I have used MAX for several years now, after many years of using Total Tax Office. I always felt the advanced calculations should be part of the program regardless as to what version you have. With that said, they have the luxury of offering it for an additional fee and that's exactly what they've done. I purchased the $499 package for this year. I still have to intervene and and make selections within the advanced calc screens. It's not something you can simply allow to flow through the return without checking to make sure its correct (like you need to do with any other aspect of the program.) It's a nice option but I'm not sure it's worth the additional $499.

-

I've gone paperless with 75% of my clients. I upload everything to the portal and have them sign electronically. I then provide them with a completed copy of the approved eFiled return for their records. I hope to increase this number overtime but there will always be some clients who prefer paper copies.

-

Is information from a 1099-OID entered anywhere on the 1040? The only figures on the form are in Box 1Original Issue Discount 2020. I did read the IRS Pubs on this but it I could not find a clear answer on where it should be reported, if at all?

-

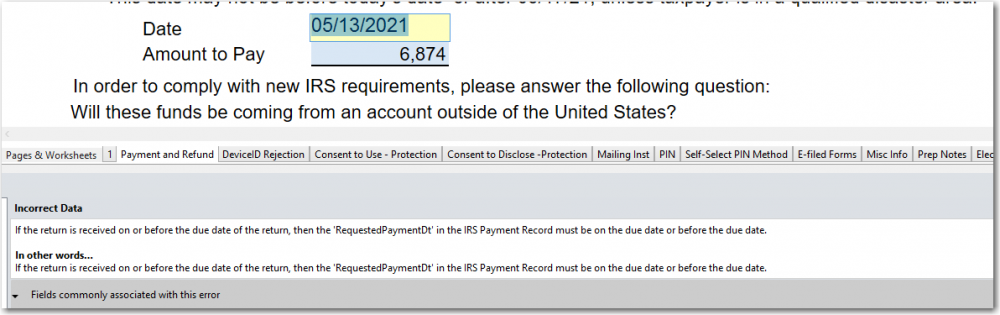

I'm talking about 1040 EF Payment Tab. I indicated for payment to be made on May 13, 2021 and the return was rejected. Your selection of April 15 should not be rejected...hopefully.

-

Has anyone successfully eFiled an ATX return with a due date listed in May 2021?? The ones I have eFiled continue to be rejected. I'm using a date of 5/13/21.

-

Spot on. For most people, they would need to have purchased a significant amount for it to potentially benefit them even a little. Not to mention, they would need to itemize to begin with.

-

It's been such a "fun" day. It got more fun once I received my acks today. Has anyone seen this error before? What am I doing wrong exactly??

-

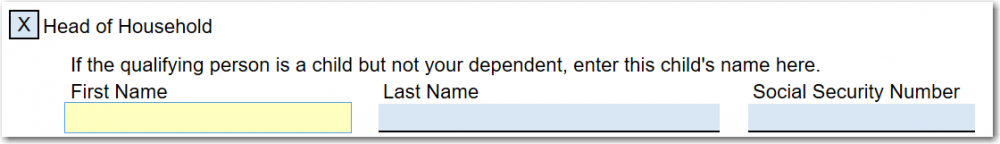

Child of Divorced Parents - Filing Status

Yardley CPA replied to Yardley CPA's topic in General Chat

In ATX, HOH Filing Status has the following: I assume by completing the fields with the name and SSN of the qualifying child, the system does not claim the dependent, but qualifies for HOH. -

Child of Divorced Parents - Filing Status

Yardley CPA replied to Yardley CPA's topic in General Chat

Thanks for the response, FDNY...I was under the impression since my client is the custodial parent claiming HOH she does not need to sign the 8332. -

Preparing return for new client who has been divorced for several years. 23 year old, unmarried, full time student lives with the client year round and has done that since the divorce was finalized. My client pays for more than half her support. Divorce decree stipulates parents can alternate taking the dependent status. Las year, 2019, my client claimed HOH, taking the child as her dependent. Clients ex filed as single. This year, clients ex will take child as his dependent. I did read through Pub 504 and believe my client can claim HOH this year and amend her 2018 return, which was originally filed as single, to claim HOH. Can anyone confirm my understanding of this? Form 8332 does not need to be filed, correct?

-

As I was reviewing this years completed tax return for a client, I noted that the pension information that was efiled last year was transmitted with the wrong payee information. All of the financial information was reported correctly but it was transmitted using a different payee. There must of been an old 1099-R input screen that I inadvertently input the information on with the incorrect Payee and TIN. Is there a way to rectify this?

-

Widow - Medical Expenses of Deceased Spouse

Yardley CPA replied to Yardley CPA's topic in General Chat

Thanks, Judy. I read the information in pub 559 which indicates: Medical expenses not paid by estate. f you paid medical expenses for your deceased spouse or dependent, claim the expenses on your tax return for the year in which you paid them, whether they are paid before or after the decedent's death. If the decedent was a child of divorced or separated parents, the medical expenses can usually be claimed by both the custodial and noncustodial parent to the extent paid by that parent during the year. Based on this information, my client can take the expenses he paid in early 2020 on his 2020 return as an itemized deduction subject to the 7.5%. He does not need to make an election or amend the 2019 return. Is that correct? -

New client's spouse passed away on 12/19/19. Spouse was in a long term medical care facility. Historically, client has always taken a large amount of medical expenses on Schedule A. The long term care facilities final invoice was received and paid in the first quarter of 2020. The amount was in excess of 20k. I believe this is deductible on his 2020 Schedule A, subject to the 7.5%. Want to make sure I'm not missing something?

-

MFJ couple. Husband is having difficulty obtaining a copy of his W2. He worked for a company from January through March, 2020. He never received his W2 and has been unsuccessful in contacting them after repeated attempts...and those attempts continue. Would the IRS or the State's Department of Labor be options for him to reach out to?

-

Here's some more guidance on the topic: https://www.irs.gov/newsroom/new-law-provides-additional-flexibility-for-health-fsas-and-dependent-care-assistance-programs#:~:text=As a result of COVID,end of 2020 and 2021.&text=Amounts spent by the employee,or dependent care assistance programs. It sounds like you can treat the unused portion as nontaxable assuming the employer did amend their plan.

-

Not sure if ATX provides the ability to have this emailed automatically. I don't think it does but maybe another ATX user can chime in?

-

I don't believe ATX offers an option that generates an email notification to clients once their returns have been efiled and accepted. Is there any such animal??? It would be nice if the system generated an email or text based on the status of the efile. Maybe someday?

-

Ugh! My daughter, who has a couple immune diseases, has Covid

Yardley CPA replied to schirallicpa's topic in COVID-19

Best wishes to her and to you! -

20 year old, full time student. Was taken as a dependent on the 2019 parents return. Parent's are phased out of any educational credits. Does it make sense to allow student to file on their own for 2020? They did have just under $5,000 in wages from a summer intern. Would filing on their own make them eligible for the stimulus? Would appreciate any thoughts on the matter. Thank you.

-

Why wait to announce this? If the plan is to extend to July 15, make the announcement and allow everyone to plan accordingly. We're less than a month away from the normal due date. It's not like this is a new concept. Put all politics and ulterior motives aside.

-

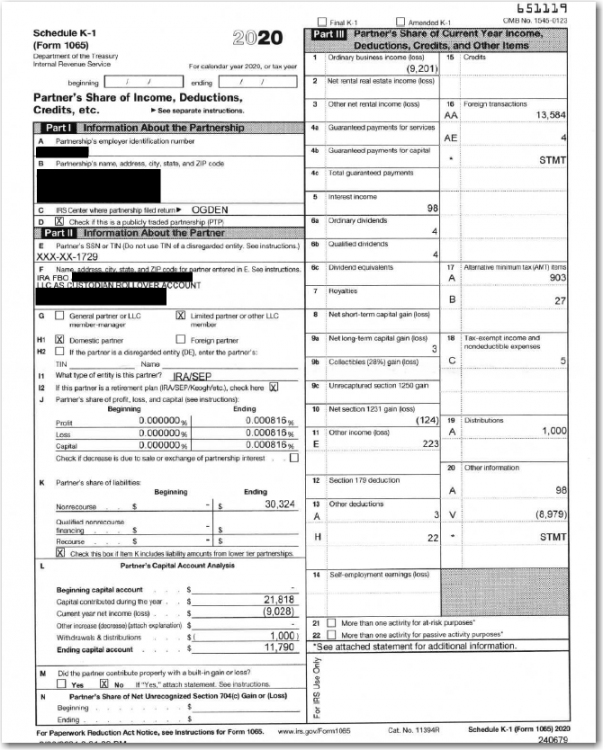

Client received K-1 for his share of a Custodian IR Rollover account. I don't have all that much experience with K1 entry. I have selected the K-1 form on the program and have attempted to input as much information as I can. For some reason, I can not find the section where I enter the address and EIN of the Partnership. Items to note: The Partner's SSN on the form (1729) is not my clients or his spouse. After entering all the information, it does not impact the return in any way. The calculated refund has remained the same as before the K-1 was added to the return. I assume this information should impact the the return but not sure why it is not. Any suggestions on what I may be doing incorrectly when inputting the information on the K-1?

-

Not sure of the validity of this. I saw it on the ATX Facebook page and figured I'd post here as an FYI:

-

Yes...account was opened in 2003. I wanted to confirm my understanding was correct, that since basis was more than the distribution it was non-taxable even though she is below 59 1/2. Thank you, Lynn.