-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

Receiving a rejection on a clients HOH efile. Dependent is her son who had no income and is disabled over 24 years old. I'm receiving this error: A Dependent SSN in the return must not be the same as the Primary or Spouse SSN on another eturn where the Primary Taxpayer or Spouse was claimed as an exemption. Is this suggesting the Dependent may have already filed his own return??? I'd appreciate any input.

-

Client received a 1099-R, Code J. I believe this is a fully taxable withdrawal from a Roth and the program recognizes it as such. I did some research and there is an exception if the funds were used for a home purchase. That is not the case in this clients situation. The only thing I'm questioning is the brokerage statement reflects it as a loan? Does that play any part in this or change anything?

-

Can someone post a link for it?

-

Deb...you definitely did the right thing. I wouldn't give it a second thought. Her intentions were very clear. Good for you for sticking to professional and ethical morals.

-

Lloyd...I'm curious. Did she issue the 1099 on her own or do you prepare the 1099's for her? She's a rule follower, for sure.

-

Where are you relative to years past? As of today, I am moderately behind on prep work as I have a number of returns waiting to be started (I have the information, just haven't begun them). I'm way behind on getting the completed packets to the clients. Once my client reviews the completed returns and delivers me the signed 8879's, I transmit the e-File. Once the e-File is accepted, I prepare a packet of information for the client including copies of the returns with my signature. Still have to prepare many of the packets.

-

Thank you all.

-

Possi...was just looking at the 8889. Thanks for clarifying that. Appreciate it.

-

Client had distribution from his HSA. I believe the proper way to account for this is to include it on line 21. Should it also be shown as a negative on line 21 if the medical expenses exceed the distribution? Client does itemize...so I will place the actual expenses on line 1 of Schedule A. Client does not have enough medical expenses to exceed the 10%. I assume, if an individual does not itemize (and maybe even if they do), as long as the medical expenses exceed the distribution, the amount should also be shown as a negative amount on Line 21? Am I right? A month left in the season.

-

I'm not looking to jinx anything here, but ATX has worked very well this season. I haven't run into any issues with the program and I'm happy with all that ATX offers.

-

Catherine...I read up on that and will suggest it. Thank you for posting.

-

Thank you.

-

Client pays real estate taxes for elderly parent. The parent's home is in their name, not my clients. Can my client deduct the real estate taxes she pays on the parent's home on her Schedule A?

-

Figured it out. Had to make a change in the Preparer Selection.

-

Preparing a New York return and I'm having trouble getting the exclusion number to populate the proper field. I did update my preparer information to include the proper code of 03-CPA but it doesn't seem to be transferring to the New York Form. When I "Check the Return" I receive the error message: NY IT-203 Error The New York Tax Preparer Registration Identification Number or exclusion code must be entered. Any advice? Does the exclusion information need to be added anywhere besides on the Preparer's Tab?

-

I'd be closer to Rich...around $700.

-

You probably have, but I'll ask anyway...do you have "Client letter to display will be e-filed" checked?

-

Client won $750 at a casino in Barbados. Do foreign countries report anything to the IRS? We've included it on the return, offsetting it with gambling losses, but just made me wonder if foreign gambling winnings are reported to the IRS? I'm thinking no?

-

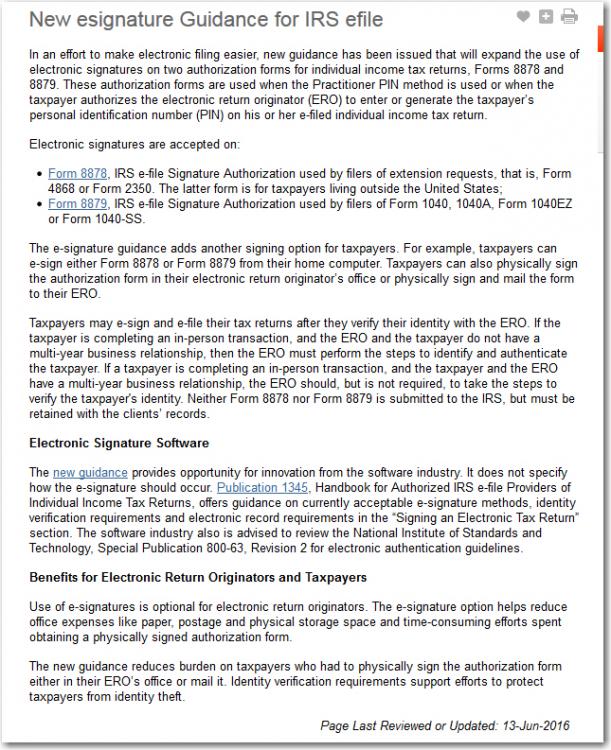

Here's some guidance from the IRS: https://www.irs.gov/uac/new-electronic-signature-guidance-for-the-irs-efile-signature-authorization

-

You can print a State cover sheet but I don't. I place the Federal cover sheet over the Federal return and then place the state return behind the Federal return in a presentation folder. Returns are on the right side pocket of the folder. Invoice and self addressed envelope is in front of the returns. Client letter along with the other ATX forms and the clients back up information is in the left folder pocket.

-

My mistake...what I meant to say is, "I send them a secure email with copies of the returns and the 8879's to sign." They absolutely have access to the returns before signing the 8879's.

-

Hey, Jack....check out mistake 5 in the attached article. It seems like he can make contributions each year, unless I am reading it wrong? http://news.morningstar.com/articlenet/article.aspx?id=687449

-

Yes...I use the ATX supplied summary, planner and comparison. Also use the ATX client letter. I'm sure there are other options that offer a nicer presentation and I am open to suggestions. These have always worked well for me.

-

I organize my packet as follows: Cover Letter - combined. Tax Summary Planner Comparison Copy of 1040 with cover sheet Copy of State return My invoice with a self-addressed stamped envelope to return payment to me All of my clients drop off their info. I prepare the return and then call them to discuss. Send them a secure email with copies of the 8879's to sign and return to me. Once I receive the signed 8879's, I eFile the return. When the IRS and State accept the eFile, I prepare the packet and mail it out to them. This has worked well for me.