-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

Thank you, JKL

-

Taxpayer passed away in May, 2016. She owned a rental property that she willed to her daughter. The property was fully depreciated through the years. Daughter will continue to rent the property. Is she able to depreciate the Fair Market Value of the rental property now that it was willed to her?

-

Praying for you and your Mom, Terry.

-

State decoupling gains adjustment is automated now

Yardley CPA replied to Abby Normal's topic in General Chat

ATX has been smooth (please, don't crash now...I need you this weekend!!!!). I have had no issues all season. I do wish they offered the credit for other jurisdictions as part of their normal package. That would be a nice upgrade. -

Chowdahead...I just completed that form on a return. I included the 1099-C amount on the 982. I did not reflect it anywhere else on the return. It was my understanding that they will review the 982 and determine the next step. In my clients case, I had them complete the Insolvency Worksheet in anticipation of the IRS requesting that.

-

Given the amount of wins / losses, is she a professional gambler? I've never dealt with a professional gambler as a client but wouldn't they be able to deduct expenses?

-

Rita...I totally agree with you. My preference would be to have her contribute to an IRA. It just seems like she would be contributing a substantial sum to see the repayment go away. Ultimately, it's worth it...not sure she is able to at this time. But I'm going to float the idea and appreciate the suggestion.

-

Rita...yes, line four was $11,770. Just curious, why would you override for his copy? Grace and Deb...I included a IRA contribution of $1,500 to see if that would change anything...it doesn't. If I went up to $4,000 in increases the refund by $600. So not sure it makes sense for her to make an IRA contribution but I'll offer it to her anyway. I really appreciate everyone chiming in!

-

Would appreciate any assistance you can provide. Single taxpayer who enrolled through the marketplace for January through May. 1095-A Annual totals: Monthly enrollment: $2468.52 Monthly second lowest: $2,232.50 Monthly advance payment of PTC: $1,606.13 8962 Modified AGI: $51,910 Household Income: $51,910 Household income as percentage of federal poverty line: 401% I assume I need to include form 8962 with the return? Line 6 Box "yes" is automatically checked based on the 401% What is the next step? I've never dealt with this before. Appreciate your help.

-

Thank you, Rich.

-

Client received 1099-Q for funds distributed from her 529 to pay tuition expenses for her non-dependent daughter (daughter is taken on ex-husbands return). I recognize the client cannot deduct educational expenses for her non-dependent, but how do I account for this distribution from the 529? She provided me with a copy of the 1099-Q and the 1098-T. Is the distribution even reflected on Line 21 or on some other portion of the return?

-

Closed Estate Received 1099-B and 1099-Int

Yardley CPA replied to Yardley CPA's topic in General Chat

The 1099's came in the deceased / estate social security number. Appreciate everyone's input. -

Client included a 1099-B and 1099-Int for his father's estate which was supposedly closed many years ago. He, along with his sister were co-executors and split the estate evenly. The 1099-B includes sales price of stocks/bonds amounting to a little over $8,000. He has no idea what the basis of the stock was at the date of death. I could research that. The INT is for less than $40. These forms were received from the State's Unclaimed Property Department. Any idea what to do in this instance. I assume these funds need to flow to my client and his sisters 1040? How? Normally it would be through a K1, no? Since the estate was closed years ago, what can be done? Thank you.

-

Great info. Thanks for passing it along.

-

Client and his two siblings own a rental property. All income and expenses are split evenly, each owning 33.33%. Another preparer completed the Schedule E and I was provided a copy to work from. I normally enter the percentage of ownership on the Schedule E input page and that automatically allocates the income and expenses by that percentage. It does not allocate the depreciation amount though. Is there a way to apply the percentage of ownership to the depreciation amount? On this other preparer's Schedule E, I noted the calculation takes place on line 21. ATX does not handle it that way...unless I'm just not aware on how that is done? Schedule E Gross.pdf

-

Schedule E Depreciation - Calculating Correctly??

Yardley CPA replied to Yardley CPA's topic in General Chat

Thank you very much. -

Can someone please run this depreciation and let me know what your system indicates the current year depreciation amount is: Rental Residence - Family House Date acquired and placed in service 1/1/14 Cost Basis $200,000 (net of land) Prior Depreciation 14,242 Mid Month Thank you.

-

Sorry to hear about your issues Terry. That really stinks. Good luck sorting everything out. I hope it goes as smoothly as it can go for you.

-

Client and Mortgage Company agreed to a transfer of deed in Lieu of Foreclosure. This was a rental property for the client. There was no activity during 2016 and it was foreclosed on during the year. How do you account for this on the 1040? There are prior year unallowed losses amounting to $3,933 on the 8582. A portion of those losses, $962, are flowing to the Schedule E. That is the only activity on the E, along with Depreciation Expense that is disallowed. Should the E be filed with only a portion of the unallowed loss from the 8582? Not sure how to handle this one.

-

Schedule E Depreciation - Reduction in Basis

Yardley CPA replied to Yardley CPA's topic in General Chat

Last years return was professionally prepared. I just never saw a rental property's depreciation entered that way. That's why I asked. Appreciate everyone's input. -

Schedule E Depreciation - Reduction in Basis

Yardley CPA replied to Yardley CPA's topic in General Chat

Thank you. That's what I'm asking. May not have done it clearly. -

Schedule E Depreciation - Reduction in Basis

Yardley CPA replied to Yardley CPA's topic in General Chat

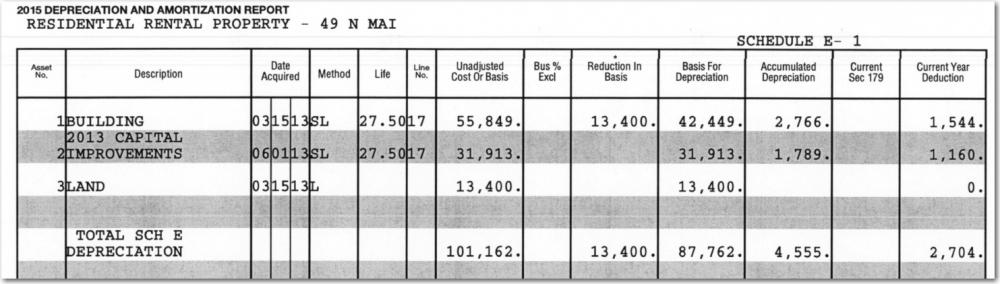

jasdlm and Lynn, I believe your method is what is being done in the depreciation schedule I attached. in the depreciation schedule, the building basis is 55,849 with a reduction in basis of 13,400 (basis of the land). Should the building's unadjusted cost or basis just be entered as 42,449 (55,849 less 55,849)? . Never saw it entered this way. -

New client with Schedule E - Rental Property. I'm attaching a copy of the Depreciation Schedule she provided. Building - Cost Basis = $55,849 Improvements - $31,913 Land - $13,400 Can someone explain, in ATX, on the Fixed Asset screen, how to reduce the Building basis by the amount of the Land? Thank you.

-

I think the larger question is the perception of having it mailed to your address. The reason is perfectly acceptable and there may not be a law that prevents it. Personally, I wouldn't do it simply because of how it looks. But as Pacun said, that's me.

-

My client's son filed his own return. Problem solved...but it would have been nice to know.