-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

Disposition of Rental Property - 1099-S Received

Yardley CPA replied to Yardley CPA's topic in General Chat

Grandmabee...what would be the entry for each Section? Land is worth $30,000 (three beneficiaries share the rental). So I assume Section 1 would reflect the same dates...what would be the Gross Sales Price? I assume the cost is $10,000? -

Great F_ _ _ing post.

-

Disposition of Rental Property - 1099-S Received

Yardley CPA replied to Yardley CPA's topic in General Chat

As I completed the return and hit the "Check Return" tab in ATX, I was alerted to include the amount I received from any 1099-S on line 1 of the 4797. Kudos to ATX for alerting me to that. I think this is all I need to do and nothing needs to flow to Schedule D, but I'm not 100% on that. -

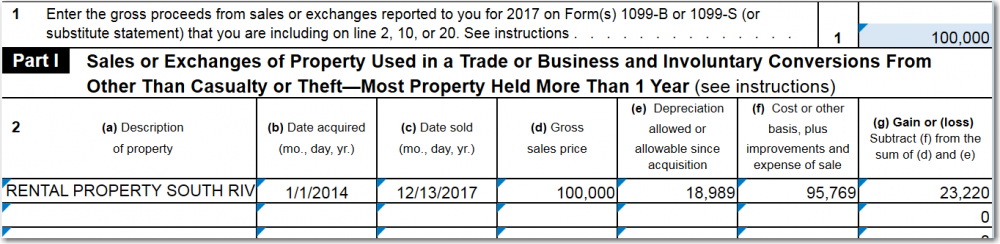

Client sold rental property in which she had a 33.34% ownership along with her two brothers for $300,000 selling price. Each of the three owners received a 1099-S in the amount of $100,000. I entered all the information: date of disposition, sale price and expense of disposition on the fixed asset screen and then chose to "force" the information to Form 4797 part 1, Long Term. The 4797 shows the $100,000 Gross Sales Price. Is this the only location on the 1040 that the 1099-S sales price needs to be reflected? I assume when the IRS sees it here, it sill be a "match" and there is no other location on the return that it needs to be reflected?

-

Thanks, Abby...Each beneficiary received their own 1099-S for 1/3 of the sale proceeds ($100,000 each). In 2016, the rental property was part of the Estate return and my client is indicating it never left the Estate? Any suggestions on how to handle this? Since each Beneficiary received the 1099-S? Can I not show any activity on the 1041 and let each beneficiary handle it on their personal return?

-

Allow me to clarify....the $1,475 Estate rental income was from 2016. The sale of the Estate rental property resulted in a 1099S being sent to each beneficiary with Bx 2, Gross Proceeds showing $100,000, so obviously the beneficiary's need to report this on their personal returns. I assume the Estate K-1's would include activity being reported to each beneficiary. Thank you again.

-

I normally do not prepare Estate Returns. Client asked me to this year. Her mother passed away in 2010. Estate has been open since that time. Estate has three equal beneficiaries... my client her brother #1 her brother #2's wife (Brother #2 passed way two years ago). The only activity within the Estate is a home that was rented. Last year the rental resulted in net rental income of $1,475. The 1041 showed: Line 17: $1,475 Line 21: $1,475 Line 22: Taxable Income of -300 The Federal K-1's were all zeros. During 2017 the rental resulted in a small loss of -$374. It was sold on December 13. Sale price was $300,000. FMV at DOD was $274,000. Improvements of about $7,000 were made. The prior accountant never depreciated the property. My questions: Is the sale of the rental handled on the 1041? If it is, can I simply show the sales price ($300,000) less the basis ($281,000) on 8949, allowing it to flow to Schedule D? Since the rental was not depreciated, there is no sale of fixed asset tab. If this is correct, Page 1 of the 1041 shows taxable income of $18,700 ($19,000 net proceeds less $300 exemption). I assume there would be no activity on the Federal K-1's since the estate would pay the tax due? This should close the Estate since there is no other activity. If it does, do I file the 1041 as final? Any advice / suggestions is greatly appreciated. Thank you.

-

-

I'm told the NC-40 form, Individual Estimated Income Tax, will be approved for eFile by end of today.

-

This options worked fine for me last year. I had several clients use the state direct debit feature for their estimates. Worked perfectly and the client didn't need to worry about mailing a check or a coupon. I have reached out to ATX and hope to get some feedback soon on when the form will be ready. I'll update when I know more.

-

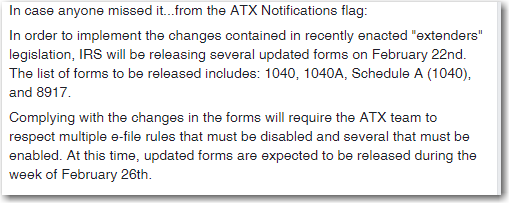

Is ATX saying anything about when extender changes will be ready?

Yardley CPA replied to BulldogTom's topic in General Chat

-

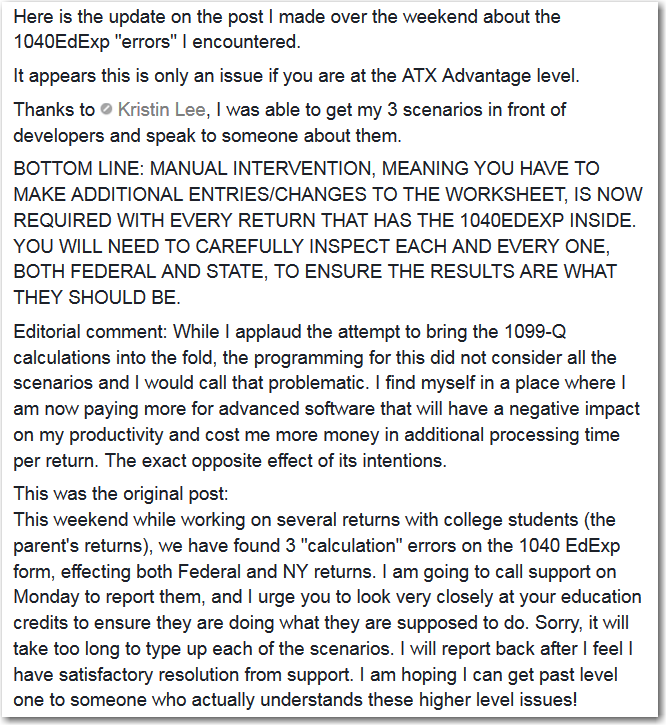

This was posted on the ATX Tax Software Support Group Facebook Page...has anyone experienced issues with the EdExp form? I haven't.

-

Jack...any idea why direct deposit of estimated payments is causing an issue? Hasn't the program been updated to accommodate the direct deposit? Apparently not.

-

Abby...how do you activate that? I'm not seeing the option.

-

Thank you, Bonanza. Hopefully, the form is approved soon.

-

Can the SSN's be suppressed in ATX?

-

Is anyone concealing the clients and dependents social security numbers on the printed copy of their forms? I have a couple of new clients who brought me their last year returns and the copy reflects all ********* for their SSN's. I understand the purpose of concealing the numbers, just wondering if anyone is concealing all the numbers. I have not concealed any of the number on the file copies I give my clients.

-

That's a good looking award Abby earned. Total Stud.

-

Is ATX saying anything about when extender changes will be ready?

Yardley CPA replied to BulldogTom's topic in General Chat

They did mention some information -- very general -- on their Facebook site that indicated they are waiting on IRS guidance. -

I do my best to provide my clients with top rate service. As a CPA (similar to other licenses, such as EA's), I follow a set of rules, obligations, and ethical standards. I'm comfortable knowing that I do my best to prepare client returns with the utmost integrity. I'm not suggesting I always get it right, but the client knows I'm not going to break any rules/laws. With that said, enforcement does not concern me because I have nothing to hide. Let's hope if they do implement new oversight, that's its reasonable. Time will tell.

-

Not only is Abby Normal a Tax Stud, he's also pretty savvy when it comes to computers and programming and writing scripts as evidenced by his "AutoHotkey" use.

-

In trying to create an eFile I receive an error indicating "Some forms in your return have not been approved for e-filing" and it points to the NC 40. Is anyone else receiving this message when attempting to efile the NC return?

-

I believe commute miles are the round trip distance between your home and your normal office each day. Once he gets to the office, any miles driven to conduct business can be considered for a deduction, depending on the purpose of the trip. If you're going from your home to some remote location, another option would be to back out the normal commute miles driven from your home to the office. The excess miles may be considered for business miles driven deduction, no?

-

I believe it is a commute as well. Considering his main office is further than the job site, I don't see how he would justify going to the job site as a deductible. Anything after the office stop would be considered for deduction, but going to the job site before the office is commute in my book and not deductible.