-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

Client is from New Jersey and it's a New Jersey Trust. The information input on the K1 shows it as a NJ Trust. The dividends and Capital Gains are not flowing from the Federal Return to the NJ Return. There are no other states on the return. The K1 is marked as a 1041, K1. Not sure how to get the information to flow.

-

Client has K1 from an Irrevocable Trust. I input the information on the Federal K-1 input screen and it flows just fine on the Federal return. It's just a few dividends and capital gains. It is not flowing to New Jersey. Is that due to the fact that they are not taxable in NJ or do I need to add a form to the NJ return? Appreciate any thoughts.

-

Edsel...I agree with your thoughts. If it looks like a Duck.... As long as that caveat is there though, "We are not auditors" it has to afford us some protection, I would think. I too would be curious to know if there were any court cases concerning this topic.

-

I spoke to the client and asked her to gather all her 2014 information and I can at least look through and determine what needs to be prepared. She responded by saying, "I had no income in 2014". She is disabled. With that said, I still asked her to pull whatever she had for 2014.

-

Would the financial institution who issued the 1099-Dive be able to provide information?

-

A new client has not filed in 8 years. Single, older female. I will concentrate on this after April 15, but was hoping for some input on where to start? I assume, for someone who has not filed for this long, you have to start at the earliest year not filed? Are there other guidelines to follow? If she does not have all the information she needs, what then? I'm not looking for anyone to spend a lot of time on this post, and certainly understand if answers flow in after 4/15, but wanted to throw it out there for your advice. Thanks!

-

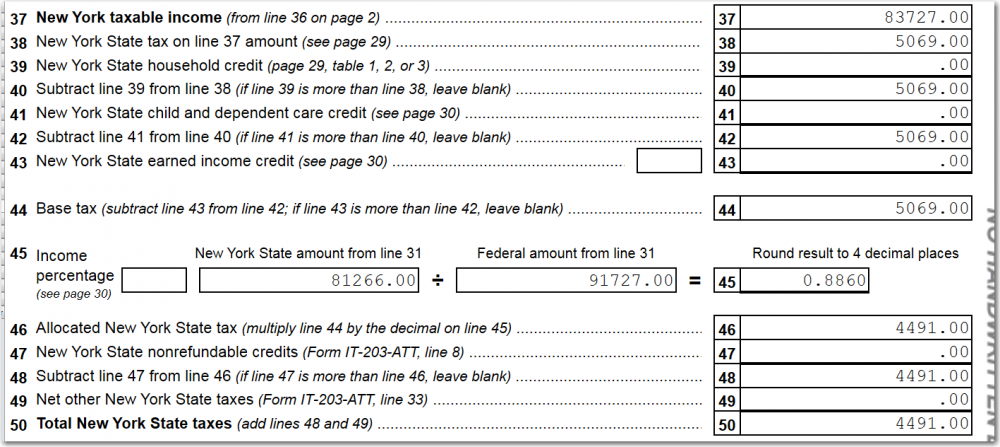

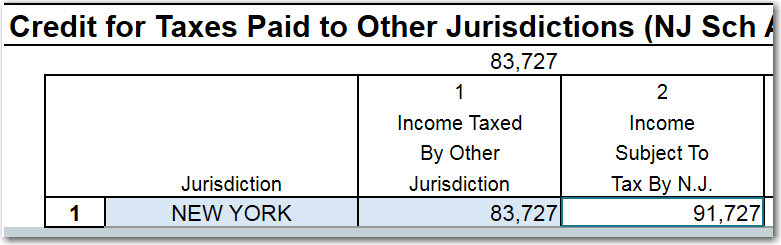

FDNY...thank you. the issue I'm having is the term "NY Taxable Income" on line 37 The NJ form asks for the Income Taxed by NY, so that's why I thought it would be the $83,727. With that said, NY wages on the W2 only amounted to the $81,266...so i guess that has to be the limit on the amount subject to tax. I appreciate your input.

-

I'd like to clarify my understanding of credit for New Jersey's Credit for Income Taxes Paid to Other Jurisdictions. NJ Full Year Resident working in NYC. NY Wages reflected on the W2 were $81,266. I 've attached a section of the NY-IT203 below along with the NJ Credit form. In the example below, i am using the income reflected on Line 37 of the NY IT-203, $83,727, New York Taxable Income,to calculate NJ's Credit. Is this correct or should I be using the $81,266?

-

We all make mistakes. It happens. Wipe the egg off. What made you determine the LLC should have been taken over the Tuition & Fees?

-

There always seems to be that one missing piece of information that prevents you from completing the return and allowing you to feel some sense of accomplishment for the day!!!

-

Grrrr ATX is not approved for NC this year!

Yardley CPA replied to Margaret CPA in OH's topic in General Chat

I have also filed NC returns with you issues. -

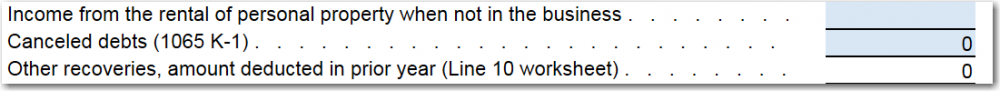

Hi, JKLcpa...Line 21 worksheet shows a "Cancelled Debt" option but it has (1065-K1) next to it. This 1099-C is not part of a partnership or K1. It was sent to the client by Sam's Club who discharged the clients debt. I do not see an option on the worksheet to enter Cancelled Debt not pertaining to a 1065-K1. So I'm wondering if it should just be typed in or should it be placed on the Cancelled Debt (1065 K1) line?

-

Client received 1099-C, credit card balance was discharged. It's a line 21 item, but do you write in or place it on the Cancelled Debt (1065 K1)?? I do not see a Cancelled Debt (1099 C) option.

-

Just over a week ago, I posted information pertaining to an individual who was in the military and stationed in California. Here is that information: New client. Married husband and wife who live in Philadelphia, PA. Husband, who is in the military, was stationed in California for the entire year of 2017. Husband's W2 reflects normal federal wages and withholdings but does not reflect any state wages or withholdings, no California wages, and no Pennsylvania wages. It does have an FL for Florida, but no wages listed. Obviously, Florida has no income tax. With that said, this is my first military return and I want to make sure I'm not missing anything. I assume his state wages should flow to his Pennsylvania income tax return along with his wife's wages?? Since he is military, he is not eligible for any special exclusions, is he? Thank you. New question pertains to the wife who lived in New Jersey (while the husband was stationed in California for the entire year). She lived at her mothers house from January 1 to November 30, while working in Philadelphia. The couple purchased a new home in Philadelphia and moved into that home December 1. Her W2 only reflects Pennsylvania wages and Pennsylvania withholdings for the entire year no New Jersey wages. The two states do have a reciprocity agreement. Based on that reciprocity agreement, the question is how to prepare the returns. I believe I should prepare a Married New Jersey Part Year Resident Return for the period 1/1 through 11/30. It would show the 11 months of New Jersey taxable wages but no withholdings. I would then prepare a MFJ Pennsylvania Part Year Resident Return for the period 12/1 through 12/31. It would only reflect one month of Pennsylvania taxable wages with a significant amount of Pennsylvania withholdings. New Jersey would obviously have a balance due and Pennsylvania's return would result in a significant refund. I would use the MFJ vs MFS calculation on ATX to determine the most advantageous approach from a Federal perspective. Hoping to get thoughts on this approach. Thanks!

-

Does anyone know the difference between checking the "complete box" on the eFile manager versus checking the complete box on the return manager? After both the federal and state eFile are accepted, I check the complete box on the eFile tab. That does not automatically check the box on the return manager for the corresponding return. What is the difference between the two?

-

If you are unsure of the country or possession the foreign tax is paid to, what do you enter from the drop down option? There used to be an "others" option, that no longer exists.

-

I'm referring to the picture that Abby Normal posted...nice ivy plant...but there's an adding machine on your desk?

-

Since when do Tax Stud Stars use adding machines????

-

Husband is in the Military - Stationed in California

Yardley CPA replied to Yardley CPA's topic in General Chat

Thanks very much! -

New client. Married husband and wife who live in Philadelphia, PA. Husband, who is in the military, was stationed in California for the entire year of 2017. Husband's W2 reflects normal federal wages and withholdings but does not reflect any state wages or withholdings, no California wages, and no Pennsylvania wages. It does have an FL for Florida, but no wages listed. Obviously, Florida has no income tax. With that said, this is my first military return and I want to make sure I'm not missing anything. I assume his state wages should flow to his Pennsylvania income tax return along with his wife's wages?? Since he is military, he is not eligible for any special exclusions, is he? Thank you.

-

Neglected to check "Full Year Healthcare" box

Yardley CPA replied to Yardley CPA's topic in General Chat

Yes, she was. She was not a dependent on their return, but she was still covered under their insurance. Thanks, Jack. -

Neglected to check "Full Year Healthcare" box

Yardley CPA replied to Yardley CPA's topic in General Chat

Penalty was not calculated on the return. Jack...she was a dependent in the past, this year she was not a dependent and I filed her return as single. -

Dependent in previous years was not a dependent this year. I completed her return as single but neglected to check the healthcare box. The return was accepted with messages, informing the website to refer to if healthcare coverage is needed. The individual was still covered for the entire year under her parent's healthcare plan. What is the ramification of this? Is a 1040x warranted in this case or just wait to be notified?

-

Disposition of Rental Property - 1099-S Received

Yardley CPA replied to Yardley CPA's topic in General Chat

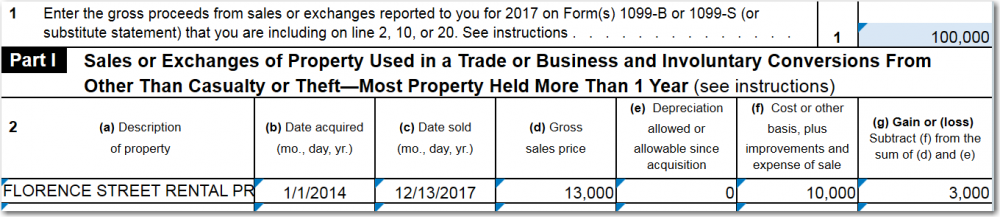

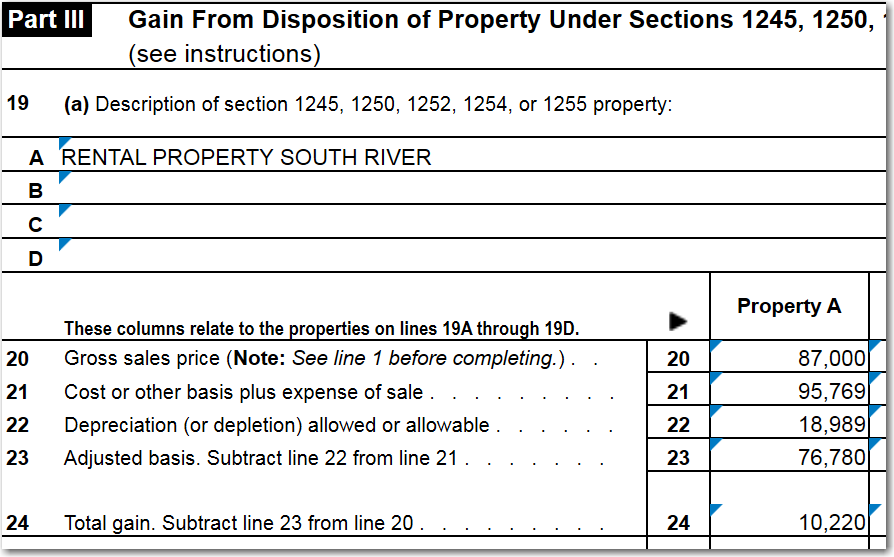

Thank you all who chimed in. Very much appreciate it. The total sales price was $300,000. Each of the three beneficiaries received a 1099-S for $100,000. Part 1 of the 4797 has a Gross Sales Price of $13,000 and Part 3 reflects a Gross Sales Price of $87,000. Combining them gives you the $100,000 and that is what the IRS is looking for, correct? So Part 1 of the 4797 should reflect the sale of the land based on a pro-rata calculation of the percentage of land versus building. In my case it looks like this: Part 3 should reflect the sale of the sale of the building: -

Disposition of Rental Property - 1099-S Received

Yardley CPA replied to Yardley CPA's topic in General Chat

Would it be unusual to have a gain on the land portion? I wouldn't think so, but want to make sure.