-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

Would appreciate your insights on this situation: Domestic partners purchased a vacation home in May 2000, each owned 50%. They rented the home from 2000 through October 2012. Home purchase price (not including land) was $199,900, land valued at approximately $70,000. Rental income and expenses were split evenly on their individual returns. Each depreciated $99,950 and Accumulated Depreciation through October 2012 amounted to 45,880 for each of them. They married in November 2012 and moved into this home, utilizing it as their primary residence from that point on to the present date. They have now put the home up for sale, asking price of $489,900. Assuming they receive $450,000 as the selling price, what if any depreciation recapture needs to be dealt with and how? This is my first time dealing with recapture and I have been investigating it but would appreciate your thoughts. I believe recapture will be involved, how do I account for it? Thank you.

-

FDNY...I agree. Since I don't have much gift tax experience, I didn't know if there was a way to accomplish what he is asking. Since he is going to receive the 1099, I assume he's on the hook for the tax. Regardless, it sounds very messy to me as well, on many levels.

-

Would appreciate anyone who has experience with gift tax, as my experience with the topic is limited. I received the following email from a client: I wanted to ask your opinion on some investments I've been dabbling with. I have been investing in crypto assets for family and friends and recently cashed out a large amount for them. I understand and am aware that money is on the hook for short term cap gains tax since I was invested in it less than a year. Since the money was invested through my investment account, am I responsible for all of the taxes or can I give pre-tax money out to my family and friends and advise them to pay taxes on their own? I optimally would like to give them pre-tax money and tell them to pay on their own, but I wanted to know your opinion first before dividing up the cash. I can prove a paper trail of where certain individuals gave me money to put into this, but I was generally given money through Venmo or cash itself. Let me know when you can. I never professed to be an advisor, but in this case the question seems fairly straight forward. Thoughts?

-

In follow-up to Rich's quote, I would appreciate more information on exactly what the portal provides. Is it's main function the ability to communicate with your client's and share information? I assume both you and your clients can post to the portal. Are there any other features we may not know about? Is it similar to having a corporate webpage where you can post articles and information for all clients to view? As far as signatures are concerned, these products allow for e-signatures? Obviously, if a client has the capability of printing a form, such as an 8879, that I post to the portal, they can sign and scan the signed version back to me by placing it on the portal. I assume these signature programs allow clients to sign the 8879 (or any form) electronically? What does the client need on their end in order to accomplish this? I guess I'm showing my ignorance a bit here, but would appreciate any information.

-

Can someone using ATX Client Portal give an overview of the product? How is it working for you? Pros and cons? Approximate cost? I'm considering it but wanted to get an idea of how it works for others?

-

I too would love to attend but will be spending that day at an orientation for my son's University in Virginia. Please post some pictures and have a terrific time!

-

Eric...thanks very much. Appreciate you continuing to make our community better! <~~ This is a good one

-

This was a challenging year but I'm so very happy to have the opportunity to ask questions and seek advice from the group of professionals on this forum. It makes the year much more bearable and I truly appreciate having the opportunity to learn so much from each of you. Have a good "off season!"

-

While I recognize this is not the Efile forum, I thought it was important enough to post here as an FYI: It's tax day — and the IRS is experiencing technical difficulties. The service that taxpayers use to file online is partly down, according to Acting IRS Commissioner David Kautter. "On my way over here this morning, I was told that a number of IRS systems are unavailable at the moment," Kautter said at a Congressional hearing Tuesday morning. "We are working to resolve this issue and taxpayers should continue to file their returns as they normally would." In a statement, the IRS confirmed that the problem is ongoing. Tuesday is the last day for taxpayers to file their tax returns. It's also the final day to pay any additional money they owe to Uncle Sam for 2017. — CNN's Gregory Wallace contributed reporting http://money.cnn.com/2018/04/17/news/irs-tax-filing-problems-tax-day/index.html

-

It was nice to see KC's name on this post. She was just a great member of this community and I hope she is doing well.

-

Just think of the toner I could have saved...

Yardley CPA replied to Abby Normal's topic in General Chat

Very true...I insert all zeros in the 2019 column which automatically zeros out the rest. It takes a little time to do that...a little time adds up to a lot of time. Would be nice to have the option to check a box for all zeros. Maybe next year...or the next...or the next. -

April 9th...I'm looking for something fun to share. Nothing jumps out at the moment, but I should have something on April 18th.

-

Well deserved!! Way to go, Eric!

-

-

-

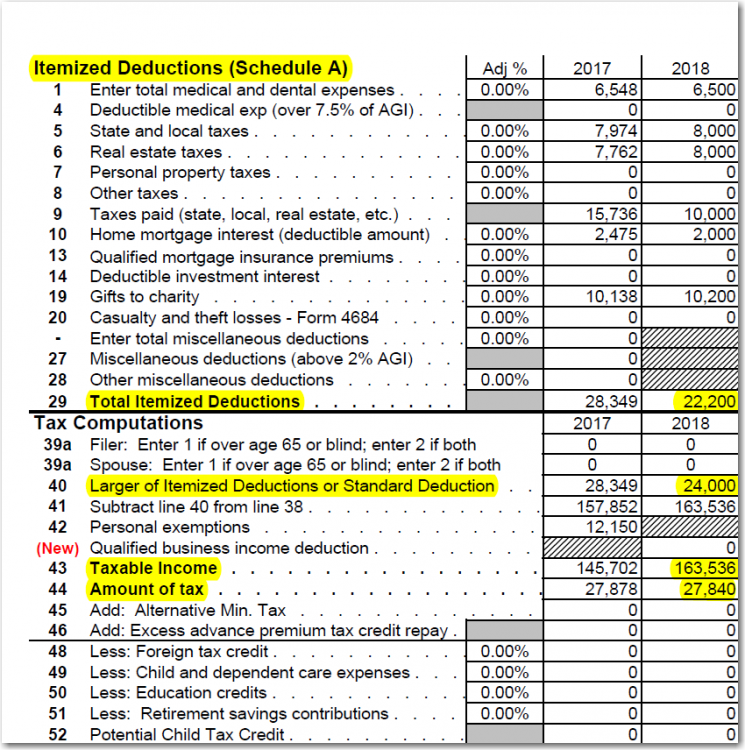

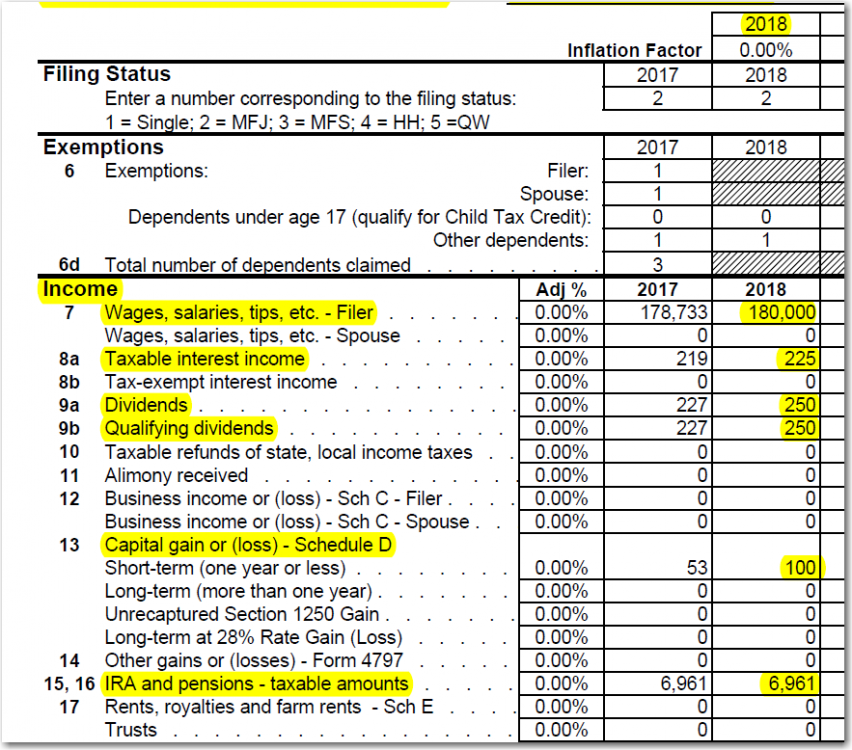

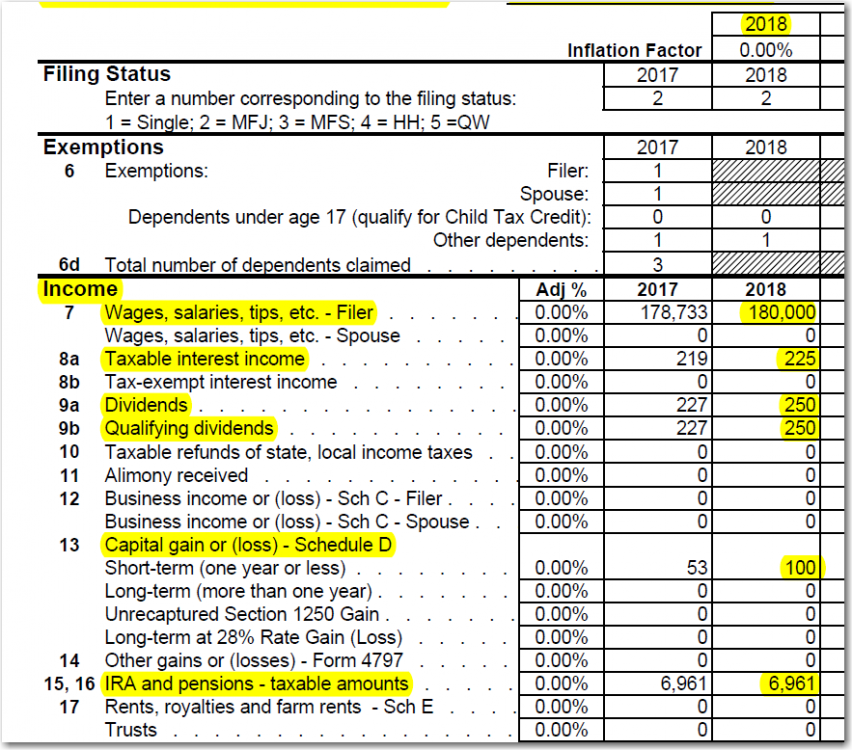

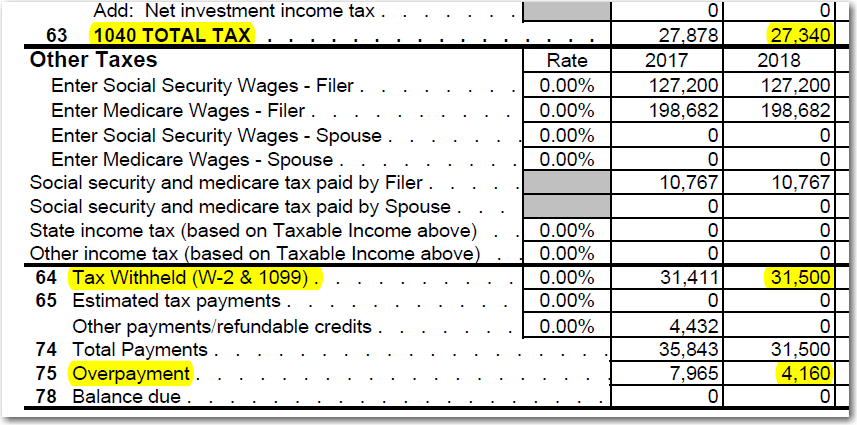

I use the ATX planner for virtually all of my clients. I think it's important to plan for the following year and try to avoid any surprises. The packet I prepare includes a copy of the planner and there is a sheet that provides an overview of how it compares to the current year. My clients know to contact me if there are any significant changes throughout the year. Whether they contact me is another story. As I use the planner, I've noted that the vast majority of clients are benefiting from the new tax plan. I would say at least 80% are being impacted favorably. That surprises me a little, I guess I shouldn't listen to all the doom and gloom media stories about how the plan will turn out to be more negative than positive. Obviously, time will tell how much of an impact it will have on the deficit, but for many of my clients, it seems to be working in their favor.

-

Not looking to jinx ATX, it's been working flawlessly this year. Nice to have a program that you're used to and functions well. With that said, I've noted that it's taking me longer to complete a return this year. I'm sorting through more information, have more missing documents and more questions from clients. Maybe it's related to all the news about the new tax law or maybe it's just because. Whatever the reason, I have noted a time increase. For those clients I deal with in person, I have told them personally. For those who receive my invoice as part of their packet of information, I will include a letter. I plan on raising my fees for 2018 25% to 50% across the board. I'm providing notice to my clients so there are no surprises. There are many reasons for my decisions, with that said, I have several new clients this year who have brought me their previous returns. They easily paid two to three times more than what I would have charged. I always knew I was on the low side, I never thought it was that significant. Shame on me, I guess.

-

Maybe the older eyes, in this case, were the issue??? Don't blame the "younger deer."

-

I don't think you have any responsibility at all to the son at this point. With the exception of possibly reminding him that he was taken as a dependent on his parents return. He can then take responsibility to find out what that means. Hand back the son's information and then allow him to take care of his own return filing.

-

Contemporaneous Acknowledgement for Contributions

Yardley CPA replied to Cathy's topic in General Chat

Sometimes my clients provide me with a list of contributions, including canceled checks and receipts from the charity ... sometimes, it's just a figure. Like Abby Normal, I don't verify them either. I also have an engagement letter. -

I want to wish everyone a wonderful Easter!

Yardley CPA replied to schirallicpa's topic in General Chat

Buona Pasqua! -

NJ Resident Working IN New York - IT 203B

Yardley CPA replied to Yardley CPA's topic in General Chat

-

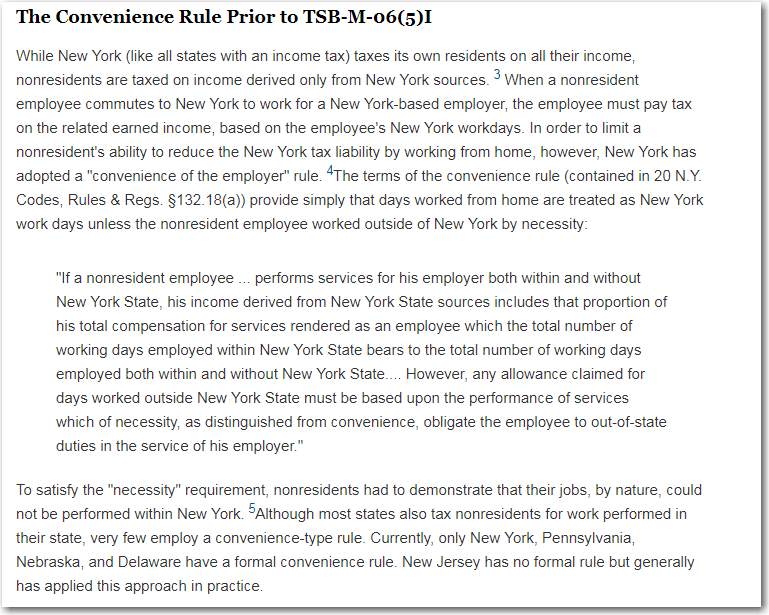

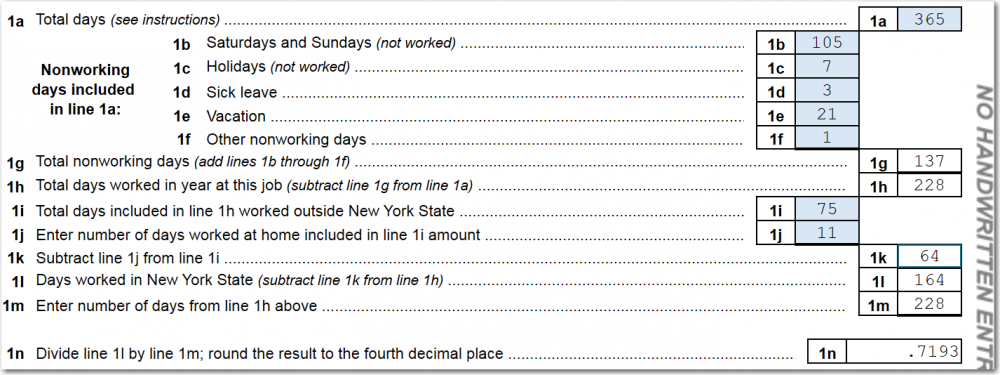

Full-year NJ resident working in New York. I've completed the NY IT 203B to allocate his wages: H He does not live in New York, why would line 1l "Days worked in New York State" include his days worked from home, 11?? Wouldnt his days worked from home count as days worked OUTSIDE of New York State, making line 1k 75 and line 1l 153??

-

Roberts...what program are you transitioning to?

-