-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

I have a Dell T1700 that I purchased about three years ago. This will hopefully be my fourth tax season using the desktop. I normally replace my systems every three years but I'm going to see if I can get a fourth out of this one. Fingers crossed. It has treated me well. There have been no issues although I'm starting to detect a little slowness.

-

Children's Surrogate Account - Interest Income

Yardley CPA replied to Yardley CPA's topic in General Chat

Thank you, All. The mother shared, the son is naturally born and received funds from an insurance company due to an accident settlement. The funds remain in this "surrogate" account until he is 18. My initial reaction was...It's taxable and I still feel that way. I appreciate everyone's input and thoughts. It's great to have this forum to turn to. -

Children's Surrogate Account - Interest Income

Yardley CPA replied to Yardley CPA's topic in General Chat

JKL...that's what I'm trying to determine. Not sure why she feels the "surrogate" impacts the taxability of the earnings. I asked her for additional info. I don't think that will make a difference but I would like to know more about the situation. -

Children's Surrogate Account - Interest Income

Yardley CPA replied to Yardley CPA's topic in General Chat

Thank you, Both. The 1099-INT is in the Childs SSN. Mother is listed under the child's name with GDN after her name. I assume that means "Guardian?" In any event, I've asked the mother for additional information on the specifics of the "surrogate account." I prepared the returns assuming all the children's income was taxable. The mother is questioning whether the surrogate account interest is taxable. -

Husband and wife filing MFJ. Their two children both have investment income in excess of $2,100 so I plan on preparing form 8615. One of the children has interest income from a bank that indicates it is a surrogate account. Should the amount from the surrogate account be included when determining the investment income?

-

No one from our ATX Community Family would ever do this though, John.

-

I've personally found the online, webinar or self-study to require more "concentration" than going to a live event. I've gone to many live CPE classes offered by the well known course providers, including CPA Societies. Many of the individuals who attend these live events are either doing personal work or surfing the Internet. At least self-study requires some type of validation, either through a test of some means of substantiating your participation. Anyone who wants to simply "buy" their CPE will do so whether they attend in person or purchase self-study.

-

Jack...wondering exactly how you spot these people in a group??

-

ATX Estimated tax not matching with IRS

Yardley CPA replied to Naveen Mohan from New York's topic in General Chat

If your record shows you entered $4,700 into the ATX Program then something is obviously amiss. I'd call ATX and see what they say from their end before contacting the IRS on this. See if they can verify what you entered and what their system actually processed. If there is a difference they should provide some type of explanation as to why. This is good to know before connecting with the IRS. One more thing, verify with the client that their bank shows only $4,600 taken instead of the $4,700. -

I signed up for a couple of webinars through my Pennsylvania Institute of CPA's membership. I've always found they provide high quality programs. Here's the webinars I'm taking part in:

-

One of the many articles that have been and will be discussing the new tax form... https://money.usnews.com/money/personal-finance/taxes/articles/2018-08-07/everything-you-need-to-know-about-the-new-tax-form Everything You Need to Know About the New Tax Form From deductions to withholding tables, there are plenty of changes to expect on the new 1040 tax form. Before the tax law overhaul, the Trump administration and Republican-led Congress touted a postcard-size income tax return form designed to simplify filing your taxes. In June, the Internal Revenue Service and U.S. Treasury Department released a draft copy of the new 1040 income tax form. However, critics say that while the tax return is shorter, it may actually be more complicated than ever. If you want to start thinking about taxes, the new draft copy offers a glimpse of what's in store for the 2019 tax-filing season. Read on for a primer on what changes to anticipate in light of the Tax Cuts and Jobs Act, which was passed last December. The size of the form is bigger than an actual postcard. "There is no postcard, just a shorter Form 1040," says Steven Weil, an enrolled agent, president and tax manager at RMS Accounting in Fort Lauderdale, Florida. He adds that while the form is shorter, it requires a taxpayer to use extensive schedules, or forms the IRS requires filers to prepare, along with the tax return when they have certain types of income or deductions. "Take a look at the new form, and you will find it covers a half page on the front and a half page on the back. If it were truly a postcard, it would have room for an address and return address, as well as a stamp on one side," he adds. It's good that the IRS isn't actually sending tax forms on an actual postcard, Weil says, emphasizing that it would be a gift for identity thieves combing through mailboxes. "Most returns today are filed electronically, anyway," he says. Despite the hype, the new form may not make it simpler to file your taxes. "It will no longer be possible to just copy this year's information on the return, using last year's return as a model. When you consider the change in the form, the change in the rules – as to what can no longer be deducted when itemizing, for example, the lack of exemptions and a higher standard deduction – most of us in the tax business expect to see lots of new clients that are more confused than ever," Weil says. Abby Eisenkraft, an enrolled agent and CEO of Choice Tax Solutions in New York City, agrees. "The form reduces two pages to one page but necessitates six additional schedules," she says, referring to additional paperwork that the taxpayer will need to calculate things like deductions. "And this does not include the additional schedules one needs to report self-employment, rental real estate, sales of securities and so on," she adds. Kelly Wright, director of financial planning at Pinnacle Advisory Group, a Columbia, Maryland-based wealth management firm, also thinks the tax form looks more complicated. "No one wants more taxes. However, reducing the size of Form 1040 will not make tax preparation more simple, nor does it affect taxes due in any way. A postcard[-size] 1040 form will simply be a shorter, more confusing form, based on many of the same taxes and deductions that still exist," Wright says. That last part troubles Wright. "Many available deductions and credits are not listed on the IRS draft form," he says. "The IRS simply removed many of the helpful steps that guide people in preparation of their taxes. As much of that direction is now absent, it is possible some will simply think it does not apply to them." Tax withholding tables are different. In February, the IRS changed the tax withholding tables that determine how much income tax should be taken from your paycheck, calculated by the number of allowances you claim and how much you earn. If you haven't reviewed what's in withholding since the new tables came out, now is an ideal time to check. If not enough has been withheld, you could end up owing taxes. Your state taxes may increase. "The standard deduction has increased substantially for federal tax but not for many states. This means state taxes will increase dramatically for many taxpayers, one of the hidden caveats of [the Tax Cut and Jobs Act]," Wright says. Many deductions will disappear. Many deductions will vanish next year, including the personal exemption, the alimony deduction and the deduction for moving expenses. Miscellaneous deductions have also been eliminated, which means that unreimbursed business travel and mileage will be gone, along with the home office deduction. Some deductions will remain, however. The standard deduction will increase to $12,000 for individuals (from $6,350 under the previous tax law), and $24,000 for married couples filing jointly and surviving spouses (up from $12,700 from the 2018 tax-filing year). And head of household filers will see an uptick in their standard deduction to $18,000, up from $9,350. And there is a new qualified business income deduction, which has to do with noninvestment business income, which has caused a lot of confusion, Eisenkraft says. "The new tax act left more questions than answers, with tax professionals waiting for the Congress and the IRS to clarify. We are eight months in and still don't have answers," Eisenkraft says. "Unfortunately, this is not simplification at all, and many tax professionals will be increasing their fees because of additional education requirements, staffing and the complexity of the requirement reporting."

-

Dell T1700 desktop recently had it's Bios upgraded. Since that upgrade, I'm noticing mouse click issues. whenever I navigate within ATX, whether that be within the main ATX menu screens, or within a return, either the mouse is super sensitive or it does not recognize the click at all. I understand this is probably worthy of a call to Dell support. One question though, when you click on a return at the Return Manager page, do you need to double click on it or only click once to open it? I'm finding its super sensitive and opens returns when I don't want them to be opened. Is there a way to require a double click in order to open a return?

-

Congratulations on your retirement. May it be filled with good health and good cheer!

-

Open letter to Microsoft about Windows 10 update problems

Yardley CPA replied to Abby Normal's topic in General Chat

Jack...I think people were saying you were crazy, but it had nothing to do with you not wanting to use WIN 10. -

Does your client have all the data to file for those years? I assume he does, based on your post. Maybe it makes sense to call the IRS, explain the situation and see what they want first? Maybe obtain transcripts from them also?

-

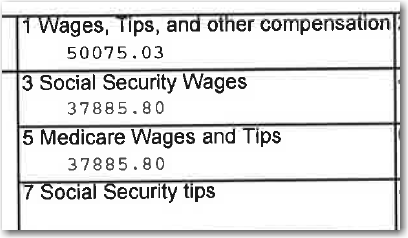

Military Wages higher than Medicare Wages

Yardley CPA replied to Yardley CPA's topic in General Chat

I received this from the spouse of the taxpayer in question: I am sure that the difference in his Wages vs. Medicare Wages is because of his BAH housing allowance, which I believe is not subject to fed tax and was around $2,000+/mo. I have no idea how to get a letter or who to get it from regarding this discrepancy. I can’t even access his old pay stubs on the mypay website at this point….. Only W-2s. Could the difference be due to the housing allowance?? Thoughts??? -

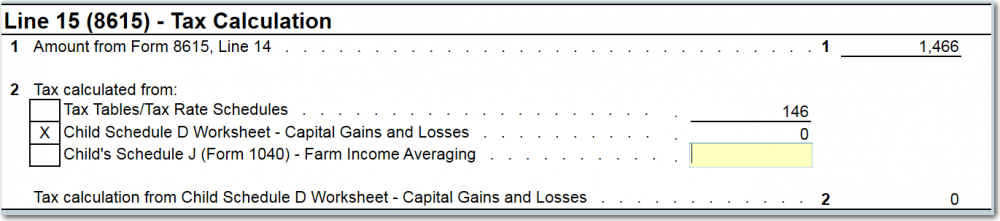

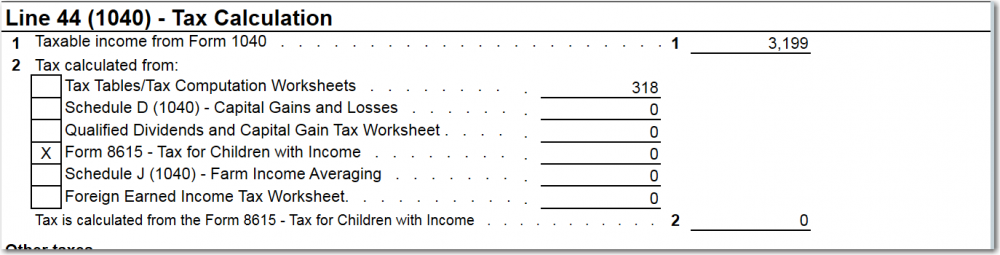

In calculating the tax for children who have unearned income, must both line 15 and line 17 be filled out? It asks for the tax on the child's filing status. But also gives the option of the Qualified Dividends and Captial Gain Tax Worksheet? I'm including a screenshot of form 8615's tax computation, along with the schedules ATX jumps to for 8615's Line 15 and Line 17. The Qualified Dividends and Capital Gain Tax worksheet calculate zero tax for both. The tax table for Line 15 is $146 and for Line 17t it's $318. Can I use the Qualified Dividend and Capital Gain tax of zero for both lines? Tax Computation Section: Tax Computation for 8615 Line 15: Tax Computation for 8615 Line 17:

-

Military Wages higher than Medicare Wages

Yardley CPA replied to Yardley CPA's topic in General Chat

Thanks very much, Edsel. Appreciate you chiming in. I was stumped as well. We'll need to get an explanation from the employer as Pennsylvania is asking for one. The employer is the Defense Finance and Accounting Service. Ironic. -

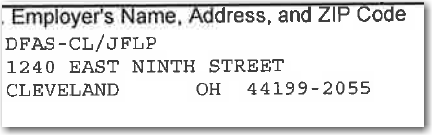

Military client shows a W2 with Box 1 Wages of 50,075 and Box 5, Medicare Wages of 37,886. There are no other reconciling amounts listed on the W2. Any clue as to what makes up the difference before we ask for an explanation?

-

Great video!!

-

Thanks very much for posting this, Abby. What a great recap and awesome pictures to boot! Looks like it was a fabulous time.

-

As with any change, adapting will take time. In the case of the new "postcard" 1040, I anticipate the coming tax season to be very challenging. Time will tell if it will become routine, but a quick review of the forms JKL includes above makes me think more people will initially seek to have their returns prepared by a "professional" versus completing it by themselves.

-

What a terrific instructional video. Thanks very much for posting it. Your customized letters provide so much more detail. I'll look to play with this during the off season. Thank you again.

-

Depreciation Recapture - Former Rental Property

Yardley CPA replied to Yardley CPA's topic in General Chat

Pacun...I very much appreciate your reply. I assume this is handled on Schedule D and can be listed as nonqualified gain? -

I'm currently using a Lexmark T644 and have been for the past 5 years. It's been a true workhorse for me. With the exception of replacing the toner every couple of years, it just provides printed sheets one after another after another. It can only be purchased used but there are other Lexmark models that are comparable. Good luck!