-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

ETax...I agree wholeheartedly with your post. I've built my practice with this philosophy. With that said, there will always be a segment of my client-base who react to price. I'm not naïve to that. There comes a point where clients, when offered a much more economical or free option, will choose to make a change regardless of how good a service we provide. I'm experiencing that currently. For the longest time, my prices were no where near what they should have been. After last season, I made all my clients aware that my prices would increase 25% to 50%. I received notification from some clients who have been with me for 20 years, they will be going with someone "closer to home." I'm okay with that...I expected it. Those individuals who truly value the relationship and all that we offer will stay, for the most part. We do need to continue to be aware of the free file and other low cost options. Some base their decisions totally on that, whether its in their best interest or not.

-

My employer uses Microsoft Office company wide for over 2,000 employees. They receive incentives directly from Microsoft that allow them to offer employees. My company pays a portion of the cost and then offers employees a special discount. Our current cost is $14.99 for the professional edition of 2019 Microsoft Office. I haven't purchased it yet but plan to.

-

https://www.journalofaccountancy.com/news/2019/jan/sec-199a-qbi-deduction-201920483.html?utm_source=mnl:alerts&utm_medium=email&utm_campaign=22Jan2019&utm_content=button Qualified business income deduction regs. and other guidance issued By Sally P. Schreiber, J.D.; Paul Bonner; and Alistair M. Nevius, J.D. On Friday, the IRS released guidance on a large number of Sec. 199A issues, including the eagerly awaited final Sec. 199A regulations (in an as-yet-unnumbered Treasury decision). The IRS also issued new proposed regulations on how to treat previously suspended losses and how to determine the deduction for taxpayers that hold interests in regulated investment companies (RICs), charitable remainder trusts (CRTs), and split-interest trusts. The guidance also includes a notice that provides a safe-harbor rule for rental real estate businesses and a revenue procedure on calculating W-2 wages. Sec. 199A allows taxpayers to deduction up to 20% of qualified business income (QBI) from a domestic business operated as a sole proprietorship or through a partnership, S corporation, trust, or estate. The Sec. 199A deduction can be taken by individuals and by some estates and trusts. The deduction is not available for wage income or for business income earned through a C corporation. The deduction is generally available to taxpayers whose 2018 taxable incomes fall below $315,000 for joint returns and $157,500 for other taxpayers. The deduction is generally equal to the lesser of 20% of the taxpayer’s QBI plus 20% of the taxpayer’s qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income, or 20% of taxable income minus net capital gains. Deductions for taxpayers above the $157,500/$315,000 thresholds may be limited; the application of those limits is described in the regulations. These amounts are inflation-adjusted. (For more on the deduction, see “Understanding the New Sec. 199A Business Income Deduction,” The Tax Adviser, April 2018). Final regulations The IRS noted that the final regulations had been modified somewhat from the proposed regulations issued last August (REG-107892-18) as a result of comments it received and testimony at a public hearing it held. The final regulations apply to tax years ending after their publication in the Federal Register (they have so far only been posted on the IRS website); however, taxpayers may rely on the proposed regulations for tax years ending in 2018. The final regulations focus on determining the amount of Sec. 199A deduction. They also cover determining when to treat two or more trusts as a single trust for purposes of Subchapter J (governing estates, trusts, beneficiaries, and decedents). The IRS says it received approximately 335 comments on the proposed regulations. The final regulations contain modifications based on some of those comments, and the IRS says it is continuing to study some comments it received that were beyond the scope of the proposed regulations. Net capital gain: First, the IRS noted that it had not defined “net capital gain” in the proposed regulations and that a number of commenters had requested a definition. The final regulations, however, reject one comment suggesting that net capital gain exclude qualified dividends. Instead, the regulations define net capital gain for purposes of Sec. 199A as net capital gain under Sec. 1222(11) (the excess of net long-term capital gain for the tax year over the net short-term capital loss for that year) plus qualified dividend income as defined in Sec. 1(h)(11)(B). Relevant passthrough entities: The proposed regulations define a relevant passthrough entity (RPE) as a partnership (other than a PTP) or an S corporation that is owned, directly or indirectly, by at least one individual, estate, or trust. A trust or estate is treated as an RPE to the extent it passes through QBI, W-2 wages, unadjusted basis immediately before acquisition (UBIA) of qualified property, qualified REIT dividends, or qualified PTP income. The final regulations expand this definition by providing that other passthrough entities, including common trust funds described in Temp. Regs. Sec. 1.6032-T and religious or apostolic organizations described in Sec. 501(d), are also treated as relevant passthrough entities if the entity files a Form 1065, U.S. Return of Partnership Income, and is owned, directly or indirectly, by at least one individual, estate, or trust. It declined to treat RICs as RPEs, however, because they are C corporations. Trade or business: After considering all relevant comments, the final regulations retain and slightly reword the proposed regulations’ definition of a trade or business. Specifically, for purposes of Sec. 199A, Regs. Sec. 1.199A-1(b)(14) defines a trade or business as a trade or business under Sec. 162 other than the trade or business of performing services as an employee. The IRS again rejected suggestions that the IRS use the Sec. 469 passive activity rules, explaining that whether a trade or business exists is a different determination than that applied to the passive loss rules. Under the rules, the rental or licensing of tangible or intangible property to a related trade or business is treated as a trade or business if the rental or licensing activity and the other trade or business are commonly controlled under Regs. Sec. 1.199A-4(b)(1)(i). This rule also allows taxpayers to aggregate their trades or businesses with the leasing or licensing of the associated rental or intangible property if all of the requirements of Regs. Sec. 1.199A-4 are met. One commenter suggested the rule apply to situations in which the rental or licensing is to a commonly controlled C corporation. Another commenter suggested that the rule in the proposed regulations could allow passive leasing and licensing-type activities to benefit from Sec. 199A even if the counterparty is not an individual or an RPE. The commenter recommended that the exception be limited to scenarios in which the related party is an individual or an RPE and that the term related party be defined with reference to existing attribution rules under Sec. 267, 707, or 414. The final regulations clarify these rules by adopting these recommendations and limiting this special rule to situations in which the related party is an individual or an RPE. Commenters also asked the IRS to provide safe harbors or factors for determining how to delineate separate trades or businesses conducted within one entity and when an entity’s combined activities should constitute a single trade or business, but the IRS declined to provide this guidance. The IRS warns that taxpayers should report items consistently. For example, the IRS says that taxpayers who treat a rental activity as a trade or business for purposes of Sec. 199A should also comply with the Form 1099 information-reporting requirements under Sec. 6041. The final regulations also provide computational rules. The final regulations clarify the proposed regulations by providing that for taxpayers with taxable income within the phase-in range, QBI from a specified service trade or business (SSTB) must be reduced by the applicable percentage before the application of the netting and carryover rules described in Regs. Sec. 1.199A1(d)(2)(iii)(A). The final regulations also clarify that the SSTB limitations also apply to qualified income received by an individual from a PTP. Disregarded entities: The proposed regulations did not address the treatment of disregarded entities. The final regulations provide that an entity with a single owner that is treated as disregarded as an entity separate from its owner under Regs. Sec. 301.7701-3 is disregarded for Sec. 199A purposes. Accordingly, trades or businesses conducted by a disregarded entity are treated as conducted directly by the owner of the entity. Share of UBIA property: The final regulations modify the proposed regulations with regard to the allocation to partners of the UBIA of qualified property. In the proposed regulations, in the case of a partnership with qualified property that does not produce tax depreciation during the year, each partner’s share of the UBIA of qualified property would be based on how gain would be allocated to the partners pursuant to Secs. 704(b) and 704(c) if the qualified property were sold in a hypothetical transaction for cash equal to the fair market value of the qualified property. The IRS adopted a commenter’s suggestion that for partnerships, only Sec. 704(b), not Sec. 704(c), should apply to determine each partner’s share of the UBIA of qualified property. Thus, the final regulations state that each partner’s share of the UBIA of qualified property is determined in accordance with how depreciation would be allocated for Sec. 704(b) book purposes under Regs. Sec. 1.704-1(b)(2)(iv)(g) on the last day of the tax year. Under the final regulations, for an S corporation’s qualified property, each shareholder’s share of UBIA of qualified property is a share of the unadjusted basis proportionate to the ratio of shares in the S corporation held by the shareholder on the last day of the tax year over the total issued and outstanding shares of the S corporation. Basis for contributed property: Another change in response to comments was for a basis rule for property contributed to a partnership in a Sec. 721 transaction or to an S corporation in a Sec. 351 transaction that the property should retain its basis. Therefore, Regs. Sec. 1.199A-2(c)(3)(iv) provides that, solely for Sec. 199A purposes, if qualified property is acquired in a transaction described in Sec. 168(i)(7)(B), the transferee’s UBIA in the qualified property is the same as the transferor’s UBIA in the property, decreased by the amount of money received by the transferee in the transaction or increased by the amount of money paid by the transferee to acquire the property in the transaction. Similarly, the final rules clarify how to determine the UBIA of replacement property under Sec. 1031 or 1033 in response to comments. They also explain how Sec. 743(b) basis adjustments for partnerships should be treated for UBIA but also request further comments on Sec. 743(b) adjustments. Aggregating trades or businesses: The IRS declined to adopt most of the comments it received on aggregating trades or businesses, but it did permit an RPE to aggregate trades or businesses it operates directly or through lower-tier RPEs. The resulting aggregation must be reported by the RPE and by all owners of the RPE. An individual or upper-tier RPE may not separate the aggregated trade or business of a lower-tier RPE but instead must maintain the lower-tier RPE’s aggregation. An individual or upper-tier RPE may aggregate additional trades or businesses with the lower-tier RPE’s aggregation if the rules of Regs. Sec. 1.199A-4 are otherwise satisfied. The IRS also chose to permit taxpayers who have not reported businesses as aggregated on a tax return to choose later to aggregate businesses on a future tax return. However, taxpayers cannot aggregate businesses on an amended return because that would permit taxpayers the benefit of hindsight. Because many taxpayers were not aware of the aggregation rule, though, for 2018, they may report an aggregation on an amended return. Performing services as an employee: The final regulations, like the proposed regulations, include a presumption that an individual who was previously treated as an employee and is subsequently treated as an independent contractor while performing substantially the same services for the same employer or a related person will be presumed to still be in the trade or business of performing services as an employee for purposes of Sec. 199A. However, in response to comments, the final regulations were modified to include a three-year lookback rule for this presumption. The individual can rebut the presumption by showing records that corroborate the individual’s status as a nonemployee. Specified service trades or businesses: A large part of the preamble to the final regulations was devoted to comments received on SSTBs. Apart from a few clarifications in the definitions, the final regulations did not adopt these comments. Proposed regulations At the same time as it released the final regulations, the IRS also released new proposed regulations (REG-134652-18) treating certain issues not addressed in the proposed regulations issued in August 2018, specifically: (1) the treatment under Sec. 199A of previously suspended losses, (2) “Sec. 199A dividends” paid by a RIC, and (3) the treatment of amounts received from split-interest trusts and CRTs. Previously suspended losses: The proposed regulations amend Prop. Regs. Sec. 1.199A-3(b)(1)(iv) to provide that previously disallowed, suspended, limited, or carried over losses (including under Secs. 465, 469, 704(b), and 1366(b) and only for disallowance, etc., years ending after Jan. 1, 2018) are taken into account for QBI purposes on a first-in, first-out basis and are treated as from a separate trade or business. To the extent that losses relate to a PTP, they must be treated as losses from a separate PTP. In addition, the attributes of these losses with respect to Sec. 199A are determined according to the year incurred. Sec. 199A dividends by RICs: In redesignated Prop. Regs. Sec. 1.199A-3(d), the IRS proposed that RICs under Sec. 852(b) may pay Sec. 199A dividends, defined as any dividend that a RIC pays to its shareholders and reports as such in written statements to its shareholders. The rules under which a RIC would compute and report Sec. 199A dividends are based on the rules for capital gain dividends in Sec. 852(b)(3) and exempt interest dividends in Sec. 852(b)(5). The amount of a RIC’s Sec. 199A dividends for a tax year would be limited to the excess of the RIC’s qualified REIT dividends for the tax year over allocable expenses. Split-interest trusts and CRTs: These proposed regulations redesignate Prop. Regs. Sec. 1.199A-6(d)(3)(iii) to state that a trust with substantially separate and independent shares and multiple beneficiaries is treated as a single trust for determining the application of the threshold amount under Sec. 199A(e)(2). In addition, new Prop. Regs. Sec. 1.199A-6(d)(v) provides that in the case of a CRT, any taxable recipient of a unitrust or annuity amount from a trust must determine and apply the recipient’s own Sec. 199A threshold amount, taking into account any annuity or unitrust amounts received from the trust. These recipients may take into account any included QBI, qualified REIT dividends, or qualified PTP income so distributed for purposes of determining their own QBI deduction. PTPs: The IRS reserved for further study and comment the treatment of qualified PTP income in qualified Sec. 199A dividends distributed by RICs, noting several technical and administrative problems of their proper characterization with respect to recipients. These proposed regulations are effective when adopted as final, but the IRS stated that taxpayers may rely on them in the interim. Calculating W-2 wages Rev. Proc. 2019-11 provides guidance on how to calculate W-2 wages for purposes of Sec. 199A. Sec. 199A(b)(2) uses W-2 wages to limit the amount of a taxpayer’s Sec. 199A deduction in certain situations. Sec. 199A(b)(4) defines W-2 wages to mean amounts described in Secs. 6051(a)(3) (generally remuneration paid for services paid by an employee to an employer) and 6051(a)(8) (elective deferrals and deferred compensation) paid by a person claiming the deduction with respect to employment of employees by that person during the year. W-2 wages does not include any amount that is not properly allocable to QBI under Sec. 199A(c)(1) or any amount not properly included in a return filed with the Social Security Administration (SSA) on or before the 60th day after the due date for the return. The revenue procedure provides three methods for calculating W-2 wages: the unmodified box method, the modified box 1 method, and the tracking changes method. The IRS cautions that using one of these methods does not necessarily calculate the W-2 wages that are properly allocable to QBI and eligible for use in computing the Sec. 199A limitations. After using the revenue procedure to calculate W-2 wages, the taxpayer must then determine the extent to which they are properly allocable to QBI. The IRS also cautions that the revenue procedure cannot be used for determining if amounts are wages for employment tax purposes. The unmodified box method described in the revenue procedure involves taking, without modification, the lesser of (1) the total entries in box 1 (wages, tips, and other compensation) of all Forms W-2, Wage and Tax Statement, filed by the taxpayer with the SSA or (2) the total entries in box 5 (Medicare wages and tips) of all Forms W-2 filed by the taxpayer with the SSA. The modified box 1 method involves making modifications to the total entries in box 1 of all Forms W-2 filed by the taxpayer with the SSA by subtracting amounts that are not wages for federal income tax withholding purposes (such as supplemental unemployment compensation benefits) and adding the total amounts of various elective deferrals that are reported in box 12. Under the tracking wages method, the taxpayer tracks total wages subject to federal income tax withholding and elective deferrals reported in box 12. Rental real estate activities Many of the comments the IRS received regarding the proposed regulations dealt with the question of when rental activity qualifies as a trade or business. Therefore, in Notice 2019-07, the IRS has issued a proposed revenue procedure that would provide a safe harbor for taxpayers. Under the proposed safe harbor, a “rental real estate enterprise” would be treated as a trade or business for purposes of Sec. 199A if at least 250 hours of services are performed each tax year with respect to the enterprise. The IRS says this includes services performed by owners, employees, and independent contractors and time spent on maintenance, repairs, rent collection, payment of expenses, provision of services to tenants, and efforts to rent the property. However, hours spent in the owner’s capacity as an investor, such as arranging financing, procuring property, reviewing financial statements or reports on operations, and traveling to and from the real estate will not be considered hours of service with respect to the enterprise. A rental real estate enterprise is defined, for purposes of the safe harbor, as an interest in real property held for the production of rents. A rental real estate enterprise may consist of multiple properties. The interest must be held directly or through a disregarded entity. Taxpayers either must treat each property held for the production of rents as a separate enterprise or must treat all similar properties held for the production of rents as a single enterprise. Commercial and residential real estate cannot be combined in the same enterprise. The proposed safe harbor would require that separate books and records and separate bank accounts be maintained for the rental real estate enterprise. Property leased under a triple net lease or used by the taxpayer (including an owner or beneficiary of a relevant passthrough entity) as a residence for any part of the year under Sec. 280A would not be eligible under the proposed safe harbor. AICPA webcast On Jan. 23, from 1 to 3 p.m. ET, the AICPA will present a comprehensive overview of the final IRS guidance. The webcast will review the issues that the final regulations modify and explain, including expansion of the aggregation rules, clarification around rental real estate activities, examples, and more. Don’t miss this opportunity to understand the final regulations before helping your clients with this new area of the tax law. Click here to learn more. — Sally Schreiber, J.D, ([email protected]) and Paul Bonner ([email protected]) are JofA senior editors. Alistair Nevius, J.D., ([email protected]) is the JofA’s editor-in-chief, tax.

-

- 2

-

-

Would like to provide clients with a digital newsletter for the 2019 tax filing season that contains general information. I will post it on my portal and also email it to them. I've used Tenenz in the past, but was hoping for something that is either free through a Society, or much more economical. I know, "you get what you pay for." I want a quality newsletter and maybe that and "Free" are not possible? Would appreciate any suggestions.

-

Is anyone willing to share a copy of their engagement letter?

-

I am pleased to announce that I am member in good standing. No Warning Points so far. This tax season may significantly change that.

-

Can someone with iPortal experience offer information on how to import clients into the portal. I know the instructions indicate using a .csv file. But does that information come from 2017 ATX or 2018 ATX. I normally rollover clients only when I am working on them. I do not do a mass rollover from the previous year to the current. So I'd like to produce the .csv file from ATX 2017. I assume that isn't an issue? Then, when I start working on a client this year, I'll rollover from 2017 into 2018.

-

Thank you NYTaxLady. I appreciate this info.

-

Would you change the name to something like Smith, John 2017, to differentiate?

-

Thanks, Deb. I will keep an eye out.

-

Bob...I purchased and just sat through CCH's iPortal training that Deb is referring to in her post. It looks fairly straight forward and syncs with the ATX Tax Program. Here's some additional information on the product: https://taxna.wolterskluwer.com/firm-management-and-workflow/ifirm/portal I hope to set it up this weekend.

-

Anyone else not looking forward to tax season?

Yardley CPA replied to SaraEA's topic in General Chat

I think it's going to be a challenging year, for sure. I'm also concerned about the new tax law, specifically what cbslee mentioned. The 20% PTE will take some time to get used to and familiar with. Lets hope it goes smoothly for all of us. -

Happy New Year! Let's hope 2019 brings all of us nothing but the very best!

- 1 reply

-

- 5

-

-

-

After the 2017 returns were completed during the 2018 tax season, I made each of my clients aware that I would be raising my rates 25% to 50%. I knew my fees were low, but during the past year a few new clients provided me with a copy of their previous year return to review. Those returns included invoices from the prior preparer. In every instance, I was moderately to significantly below. Shame on me.

-

-

Sitting through a webinar for Section 199A. I guess I didn't expect this provision to be as complicated as it is...silly me. Maybe my interpretation is misguided? The webinar speaks to a bunch of different provisions that surround 199A. Do you think ATX will incorporate any type of technology to assist us with this? Even through the "Check your Return" review? Has anyone found a straightforward guide that speaks to it?

-

Rita B is a Young Gun??? Really?

-

Congratulations! Wishing you the very best in your "retirement." May it be filled with good health and good cheer. Look forward to continuing to have your contributions on this forum. It wouldn't be the same without you.

-

I don't know, Rich...sounds like a little fluff in that statement.

-

It's so hard to comprehend 1.6 Billion. That's a crazy number. At one point last night the news indicated that 25% of combinations had yet to be played. How is that possible?? With all the states that play and all the individuals buying tickets, how can 25% still not have been played. Amazing. Anyway, it was nice to dream for a bit. Now any lottery that doesn't hit a billion will seem small.

-

Thanks to all who replied. For arguments sake, assume you have three vehicles that are all mileage. If you purchase a fourth vehicle can it be depreciated conventionally or must you select mileage for the fourth? Based on the discussion in this post, I think you can choose mileage (since its less than five) or you can choose conventional depreciation? I recall you couldn't change the selection from year to year and if you pick mileage for a vehicle it stays mileage. However, you can choose conventional deprecation on a case by case basis for any NEW purchases. Again, keeping in mind that once you reach five vehicles, you can't use the mileage method for that fifth vehicle or any vehicle purchases that follow. I hope I haven't made this more confusing.

-

It is my understanding that you have to use the same method for all your vehicles. Pacun...I recall that all vehicles needed to follow the same method as well. However, the LLC currently has four vehicles using the mileage method. In follow-up to Abby's comment about that you can't use mileage for 5 or more vehicles, I'm having a difficult time finding an opportunity to choose the mileage method for this fifth vehicle. Maybe ATX, following the regulations that Abby sites above and does not allow the mileage method as an option. I've added the vehicle to fixed asset manager and will depreciate it accordingly.

-

A couple of questions pertaining to an LLC- Sole Proprietor. Landscape Business. Can the owner of the LLC sell the business his personal truck to be used by the business? Business currently has 3 business vehicles. In each case, it was more advantageous to utilize the mileage versus actual expense method in determining the amount to be included on the Schedule C as auto expense. None of the three vehicles are being depreciated in the true sense. It's my understanding the mileage method incorporates a component of deprecation? The owner has purchased a new business vehicle which he expects to have much lower mileage than the fleet he currently has. Can that new vehicle be depreciated versus using the mileage method?

-

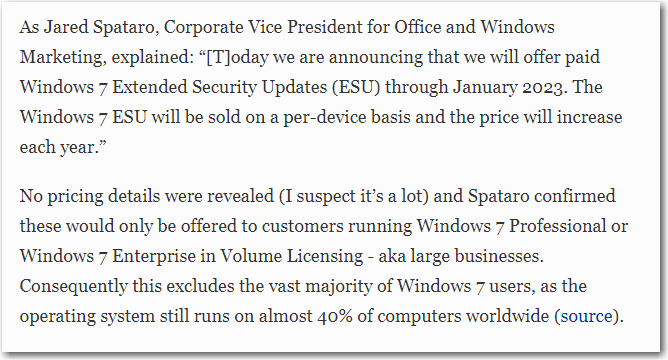

Microsoft to charge monthly for Windows 7 updates

Yardley CPA replied to Abby Normal's topic in General Chat

What is meant by "Spataro confirmed these would only be offered to customers running Windows 7 Professional or Windows 7 Enterprise in Volume Licensing - aka large businesses." I run Windows 7 Pro on my stand alone desk top. I assume I'll still be charged a monthly fee? I plan on upgrading prior to this, but just curious.