-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

It's not a big deal for me. Having the names, dependents, etc...on page 1 and the financial info on page 2...so be it.

-

Partnership Dissolved - Passive Activity Loss Adjustment

Yardley CPA replied to Yardley CPA's topic in General Chat

So would the amount of the mortgage relieved be added to the sales price on the 4797? Thank you again for all the feedback. -

Partnership Dissolved - Passive Activity Loss Adjustment

Yardley CPA replied to Yardley CPA's topic in General Chat

Clients were relieved of their portion of the mortgage which amounted to $75,910. Where would this figure be entered on the 4797? -

Partnership Dissolved - Passive Activity Loss Adjustment

Yardley CPA replied to Yardley CPA's topic in General Chat

I very much appreciate all the advice. I will look into how much debt was relieved. -

Partnership Dissolved - Passive Activity Loss Adjustment

Yardley CPA replied to Yardley CPA's topic in General Chat

I am preparing the clients 1040 along with the 1065 for the Partnership. All income and expenses were handled on the individuals Schedule E. Nothing really flowed through the partnership. Not sure if that is correct, but that is how it was setup originally prior to my involvement. K-1's had little to no activity reported on them. My clients were paying half of the mortgage. The other party became unresponsive to communicating. Other party would rarely engage my clients. So the relationship went south and in order to relieve themselves of any obligation (or continued stress) they agreed to sell their share for $1 and be done with that "investment". -

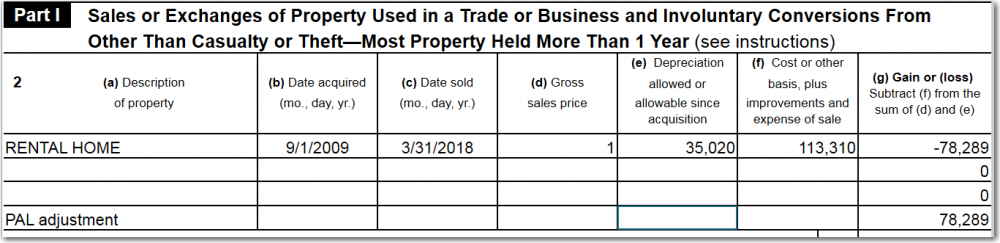

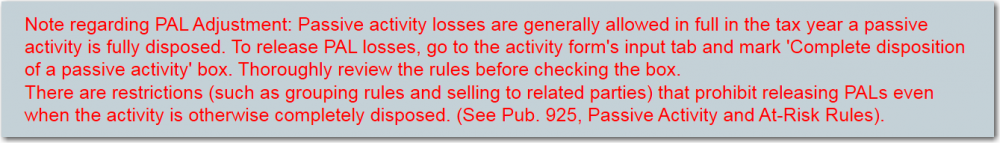

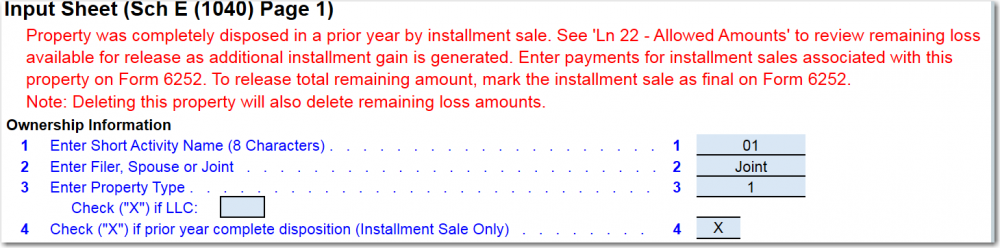

Client, Husband and Wife, MFJ...were in a partnership with a third party. They owned a rental home together since 2011. Shared income and expenses 50% / 50%. The relationship went sour and my clients sold their share to the third party for $1 on 3/31/2018 and are no longer involved in the partnership or with this third party. The partnership will be formally dissolved. I've never dealt with this type of situation and would appreciate any comments, suggestions on how to handle this. Here's what the 4797 looks like: This note is located on the top of the 4797: I assume I go to the Schedule E Activity Page and place check Line 4 with an X? Is this correct?

-

Will definitely look to see if ATX offers this. Thanks very much for all the suggestions and information.

-

I'm thinking "other" as well for the paternity leave. I imagine it may raise their eyebrow. I plan on including an attachment explaining the "other" which amounts to 88 days. We'll see how that goes over.

-

Agreed...it is a PITA. But if you['re a non-resident you can allocate your wages, on form IT-203b, based on the number of days you work "Outside" of New York.

-

I don't want to jinx anything but I think the program is working great. No issues on my end.

-

I recall seeing in an earlier post about 2441 that a child does not need to have expenses in order for them to be listed, with the box checked, as a qualifying person on form 2441, is that correct or did I miss read it?? I have a MFJ with two children, 10 and 7. Only the seven-year-old incurred expenses at a child care center. I can list and check each child as qualifying on form 2441?

-

TAXMAN...wouldn't entering the information individually on he QBI worksheet ultimately combine both? I'm not familiar with the specifics on a MFJ who both have a Schedule C, but I would think you enter the information on the worksheet and it will then combine. Look forward to seeing what the answer is.

-

2018 IRA Distribution - Rolled Over within 60 Days 2019

Yardley CPA replied to Yardley CPA's topic in General Chat

Do you think they did?? All my correspondence with my clients says to reach out to me during the year if you anticipate any changes or look to withdraw any funds from an IRA or Pension. Not many listen. -

2018 IRA Distribution - Rolled Over within 60 Days 2019

Yardley CPA replied to Yardley CPA's topic in General Chat

Good morning...the 1099R is coded as a 7 and when I saw that I immediately thought a CP2000 may be in our future, Max. Lou...your thoughts are mine as well. I have already asked the client for paperwork showing the re-deposit and plan on attaching it to the return. Thanks to all those who chimed in. Much appreciated. -

Lion...spoke with the employee. The employer requires this as part of his job. He travels the majority of his year to clients throughout New Jersey. The employer requires him to do this. Also...just found out he was on Paternity leave for 3 months. I assume that will factor in to his time working outside of NY as well?

-

New Jersey full year resident employed by New York City company for the entire year. Performs the majority of his job working from home in New Jersey and visiting clients in New Jersey. I completed IT-203B and allocated his Income. Line 1n percentage is .5551 Line 1o is the total amount of Federal Wages flowing from his W2 Line 1p applies the percentage allocation from Line 1n. This figure flows to the IT-203 line 45. I also use this figure to calculate taxes paid to other jurisdictions in NJ. Is this correct? It does not pull the New York wages for the calculation....but the Federal?

-

A client, MFJ, 72 years old, had a distribution from her IRA to help purchase a home. The distribution of $222,350 was made on December 10, 2018. A new home was purchased on December 17, 2018. Their Old home was sold the day after. Exclusion applies. Proceeds from the sale of the old home were used and $210,000 was re-deposited back into the IRA on January 2, 2019. The $210,000 can be treated as a tax-free distribution since it was rolled within the 60 day period, correct? The ATX entry on the 1099R would show: Gross Distribution $222,350 Taxable Amount $222,350 Rollover Amount Included in Line 2A $210,000. Is this correct? Questioning myself because the rollover, while within the 60 day period, did not happen until 2019.

-

I do use it and my clients seem to find it useful in planning their withholdings. You're certainly right, assuming things remain relatively equal, there shouldn't be big changes from year to year. With that said, I do have my print options so zeroes disappear.

-

Does the employer have a Flexible Spending Account? Wouldn't the expenses be paid directly by the taxpayer, then the taxpayer would seek reimbursement through the plan for qualified expenses? Form 2441 would show the total expense incurred by the taxpayer and total amount paid...the amount of Box 10 would normally flow to line 12 of the 2441.

-

-

I wonder how strict the IRS will be in enforcing these QBI submissions? They can't possibly have the resources needed to scrutinize every submission that contains them to the degree that's needed. Maybe there will be some automated control that spits out blatantly incorrect ones? I guess time will tell.

-

This is my first year using the CCH iPortal. What a great tool and so far my clients seem to be transitioning to it without much difficulty. Instead of receiving emails full of scanned documents, they upload everything to the portal. Based on the information I've read, it's a secure option and is working well for me. After I complete a return, I create a folder "2018 Tax Returns" and upload a copy of the return and instruction sheet to the folder. Once the folder is populated, the iPortal automatically sends an email to notification to the client, informing them there is a new entry for them in the portal. I can see when they open the any documents within the portal. They can then sign the signature forms and upload them. Allows me to efile after that takes place. I'm also going to upload my invoice. This saves me some time in not having to prepare their packet right away and allows me to concentrate on preparing returns versus mailing returns. I assume a pdf version of the return can take the place of a paper copy...we're not required to provide a paper copy, right?