-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

A lawyer friend asked me this question: "Had a quick question about IRA rollovers. I have a client who has numerous retirement accounts (he is retired as well – 82 years old). Incident to his divorce, to equalize the assets, we are transferring some of the retirement accounts to Wife. Do I need to do these by QDRO or can we do 3-4 direct rollovers to an IRA(s) in her name without tax consequence? I know we can do the direct rollover to IRA in her name, but I had heard somewhere that this is limited to the transfer of one account per year and if there are additional rollovers, then they can be taxable." My understanding is that you can transfer the IRA from husband to ex-wife but thought it needed to be done via a QDRO?. I wasn't sure if there are restrictions on the number of accounts you can transfer. Thoughts please.

-

Would there be anything wrong with mentioning to the client's daughter that you have some personal concerns about her Mom's condition/health? You've been dealing with her and noted that she doesn't seem well. Is everything okay with her?? Something along those lines? You wouldn't be sharing any financial info, but as a human being, not a tax preparer, you're concerned about her. It may be a slippery slope but based on your post it does sound like you genuinely have concerns about her state of mind.

-

A single client has two sons who are both experiencing issues with drug addiction. They are twins, age 30. Neither worked during the year, they lived at home and the client paid nearly all their expenses. I did read up on the definition of disabled for tax purposes but wondering if anyone can offer thoughts on whether they would qualify as disabled? This would allow for HOH status.

-

MFJ client. Spouse reives Form 5498 with a rollover contribution amount of $307.10. Fair market value of $41,259. No other information is provided on the form. I do have a 1099R for the spouse from this brokerage firm for Gross and Taxable distribution of $14,159, but it's one she normally receives. How should I treat the rollover amount, if at all?

-

It seems like there are two floating around. Very unfortunate.

-

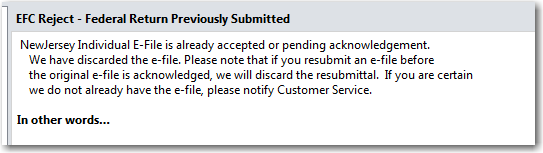

So...I let it rip...and came up empty!! I duplicated the returns as ATX instructed. I tried efiling a New Jersey recreated return and it transmitted. I was pleased. Then I checked the Ack...i.t was rejected with the following reason: Now I'm trying to find out if other files showing as transmitted have been received by three states. As long as they are received and accepted, even if ATX continues to show them as transmitted...so be it.

-

In addition to my laser printer, I have a Lexmark CX410de all in one. This unit gives me the option to suppress printing and instead it sends a pdf to my email address. It's worked well for me. I am seeing less and less incoming faxes. They are few and far between these days.

-

Randall...what do you mean by "rechanging" them? Recreating the State return within the file itself, without duplicating it?

-

I'll let'em rip...Thanks. I did have a few that said Transmitted to Agency. Whats the worse that could happen???

-

Mom deserves to be happy...especially with her tax preparer. All of my affected client had their federal returns accepted. It's just the states in limbo. I did see the blog comment and duplicated all of the returns this impacted. I also recreated the state efiles...I'm just hesitant to transmit them, since they are all showing as having already been transmitted.

-

I have several State efile submissions that are stuck in "Transmitted to Agency or EFC" status. The Federal returns have all been accepted. Are these the files I need to duplicate and recreate, then resubmit?

-

Has anyone dealt with clients who have purchased and sold Bitcoin? I recognize the sale resulting in a gain would warrant classification as a capital gain, just wondering if anyone has clients who have provided transaction history or any other type of statements? I was unable to find any clear-cut indication as to whether this information is reported to the IRS officially? Indeed, it appears barely anyone is paying taxes on their crypto-gains. For example, in 2015, only 802 Coinbase users told the IRS about bitcoin gains, despite the exchange having 2.9 million users in December of that year, according to Milne’s data. Any thoughts on this?

-

Thanks very much for the info. Where can I find the note feature on ATX?

-

While you prepare a return, does ATX provide a "note" feature, whereby you can enter comments or questions that you would like to ask the client?

-

Thanks for posting this.

-

I appreciate everyone's input on this post.

-

I've confirmed the company does have an office in Chicago. He worked within that office from 8/1/18 through 12/31/18.

-

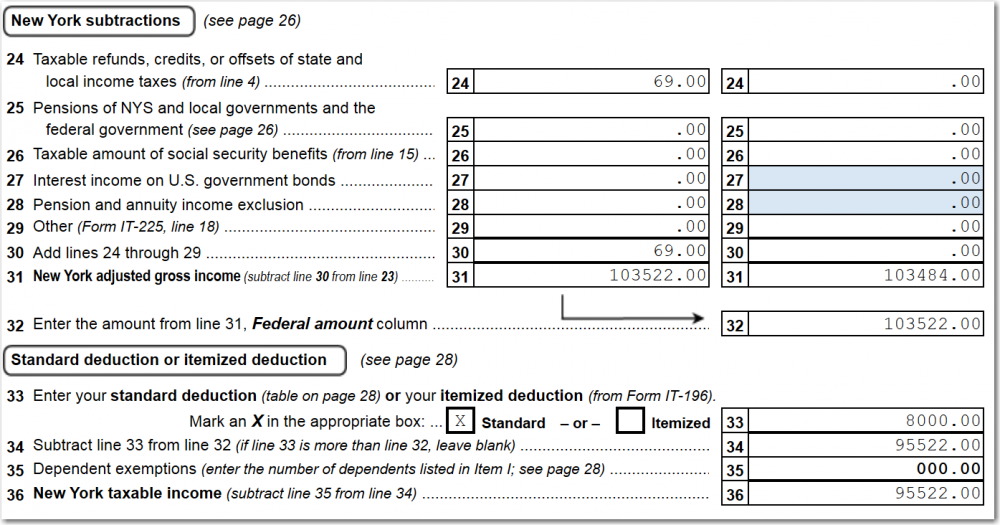

I will confirm and post my findings. I assume that IT203B would be used to allocate that 7months vs 5months? Thank you for chiming in.

-

He physically worked in NYC from 1/1/18 to 7/31/18. He moved to Chicago, working for the same company, but worked from his Chicago home to enable him to see Chicago customers.

-

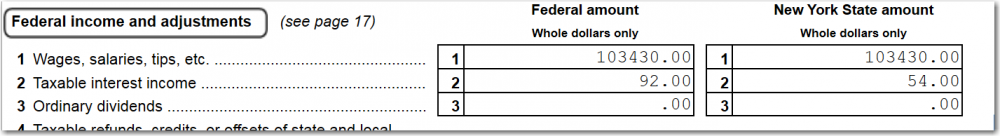

MFS lived in Brooklyn NY from 1/1/18 through 7/31/18. Moved to Chicago on 8/1/18 and lived in The Windy City for the remainder of the year. For the entire year, he worked at a New York City business. In completing his NY Part-Year Return, It seems the allocation from the IT-203B is not populating the IT-203. That results in his entire NY wages being taxable in NY. Is that correct? IT-203: l Shouldn't the allocated amount, 52,749, from the IT-203B, taking into account his non-residency period, flow to the IT203?

-

Michaelmars...I'm sorry you're having issues, but it is nice to see confirmation that other programs have hiccups as well, not just ATX. As I've stated previously in this post, ATX is working well for me and has worked well over the past several years. Let's hope our respective programs have the bugs worked out and we have a smooth rest of the season.

-

I had a client who had back and knee issues. His orthopedist prescribed a hot tub. Client provided me with a copy of the prescription from the doctor along with the invoices for the purchase of the tub. I placed it on Schedule A and moved on. No problem.

-

Are you referring to the client letter included with the return? Is it possible the letter was somehow overridden, forcing it to print that the payment should be mailed? I know there are options that you can check mark on the letter to make it indicate it will be efiled, etc. As long as the return was efiled and accepted with an electronic payment option, the letter shouldn't matter...no?

-

A client had banking issues that caused the bank to change her account to a new account number. Client owes the IRS and her old account number is reflected on the accepted efile. Best way to deal with this? I am going to ask her to contact her back and see if the old account may be linked to the new account in some way? Any other ideas? Contact the IRS and make them aware?

-

I'm not overly surprised by this ruling. https://www.journalofaccountancy.com/news/2019/mar/court-upholds-irs-ptin-program-201920752.html?utm_source=mnl:alerts&utm_medium=email&utm_campaign=04Mar2019&utm_content=button Court upholds IRS PTIN fees By Sally P. Schreiber, J.D. The IRS has authority to charge a user fee for preparer taxpayer identification numbers (PTINs) a federal appeals court held on Friday, paving the way for the agency to reinstate the charges for obtaining and renewing a PTIN (Montrois, No. 17-5204 (D.C. Cir. 3/1/19)). A valid PTIN is required for anyone who prepares or assists in preparing a federal tax return for compensation. The IRS stopped charging a user fee for PTINs in 2017, after it lost a case in federal district court (Steele, 260 F. Supp. 3d 52 (D.D.C. 2017)) that held the IRS had no authority to charge a fee to tax preparers to obtain PTINs. The district court had agreed with the tax preparers who filed the suit (a class action on behalf of more than 700,000 tax return preparers) that the fee violates the Independent Offices Appropriations Act (IOAA) (31 U.S.C. §9701) and had found that “for an assessment to qualify as a fee under that Act as opposed to an unauthorized general tax, the assessment must relate to a specific benefit conferred to an identifiable set of users” (slip op at 6). The district court agreed that the PTIN program does not confer a specific benefit on tax preparers and also rejected the IRS’s argument that the PTIN program provides a benefit to tax preparers by protecting their Social Security numbers (SSNs) from identity theft. The IRS appealed the lower court’s decision. The IOAA permits federal agencies to impose fees to provide specific services to members of the public who specifically benefit from the service provided. The appeals court explained that an agency must prove “(i) that it provides some kind of service in exchange for the fee, (ii) that the service yields a specific benefit, and (iii) that the benefit is conferred upon identifiable individuals” (slip op. at 10). The appeals court looked at each factor in turn and concluded that the IRS provided a specific service to tax return preparers in exchange for the PTIN fee because it required personnel and resources to generate a PTIN, thus providing PTINs was a service. The court found that the PTIN program conferred a specific benefit to preparers of being able to use a number other than a SSN on tax returns, which protected the confidentiality of the preparers’ SSNs. According to the court, although anyone can be a tax return preparer, so anyone in the public at large can request a PTIN, the service was bestowed on identifiable individuals — tax return preparers — and not the public at large. The next issue was whether the IRS’s decision to continue charging the fee for the PTIN program after the court invalidated the registered tax return preparer program in Loving, 742 F.3d 1013 (D.C. Cir. 2014), was arbitrary and capricious. The appeals court found that the IRS decision to recover the substantial cost of providing PTINs and maintaining a database by charging tax return preparers a fee rather than obtaining funding for the program from the public was not arbitrary and capricious. The service of providing PTINs is distinct from the service involved in Loving, which was the registered tax return preparer program that was struck down. Having upheld the IRS’s authority to require return preparers to obtain a PTIN and charge a fee, the court then discussed whether the fee the IRS charged was excessive. It noted at first that the IRS had lowered the fee from $50 to $33 (plus a separate processing fee). The appeals court remanded the case to the district court to determine whether the fee is reasonable and complies with the IOAA. — Sally P. Schreiber, J.D., ([email protected]) is a JofA senior editor.