-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

The amount of knowledge and the willingness to share such an incredible amount of detail by people taking time out of their busy day to help others never ceases to amaze me on this forum. What a great resource and absolutely terrific group of members in the ATX Community!

-

I always thought that if the W2 reflects a code V the stock sale was required to be reflected on Schedule D?. Hopefully someone can chime in and verify whether it does or doesn't?

-

Not that you would need to or want to in every instance, but try printing to pdf first and then to the printer. Does that work?

-

I'm sorry I'm asking this question, but I'll ask anyway...doe the printers have the correct firmware update? I assume they do and while that probably won't make any difference I figure I would throw it out there.

-

By the way...mine was coded as a V on the W2. I have not yet efiled the return.

-

Why can't you sell 1/2 of a duplex. Isn't a duplex one structure with two separate and distinct homes?

-

I had this exact situation. The amount of the excercise reflected on the W2 was under $3,000. I placed it on Schedule D as a long term, with the cost and proceeds being the same amount. Not sure if that needed to be done, or should have been done, but I wanted to reflect the exercise.

-

Would you say my situation would not be subject to SE?

-

Thanks CBSLEE. I agree. It is deep in the weeds and I'm reading conflicting reports on whether QBI is eligible or not on the second C.

-

Have a client, MFJ, who is a statutory employee for a life insurance company. He receives his W2 from them with Statutory Employee checked. The wages flow to a schedule C. In addition, he receives 1099- Misc, Non Employee Comp from several independent companies when he sells policies for them. That income flows to a second Schedule C. Based on this scenario, I'm fairly certain the Statutory Schedule C is eligible for QBI. How about the second C? Is that eligible? Here's an article on the topic...it's saying the 2nd C is not eligible. Would appreciate any input as to whether I am reading anything incorrectly. Thank you. https://www.journalofaccountancy.com/issues/2019/jan/qbi-deduction-for-statutory-employees.html

-

Was paid by a local softball organization for assistance during one of their annual tournaments.

-

Client has a significant number of transactions, both short-term and long-term. Short-term is Box A, Long-term is Box D. Just confirming that the totals can be input into the Schedule D directly on lines 1a and 8a, without having to complete 8949 with individual transactions?

-

Full time Junior in College claimed as a dependent on her Mom's return. Received 1099-Misc, Box 7 in the amount of $895. Also received W2 from her school for $150. No other income expenses. She is required to file a tax return as a result of receiving the 1099? And it is subject to Self-Employment Tax? Correct?

-

This does not pertain to direct deposit in anyway, correct?

-

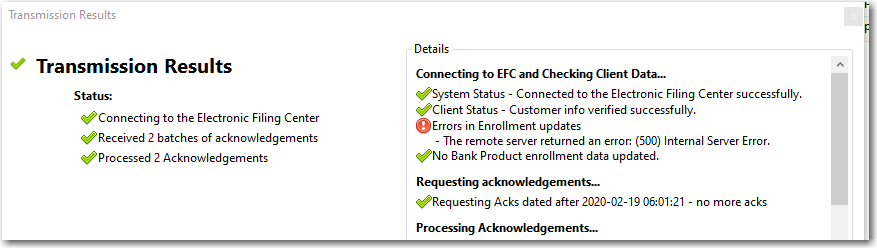

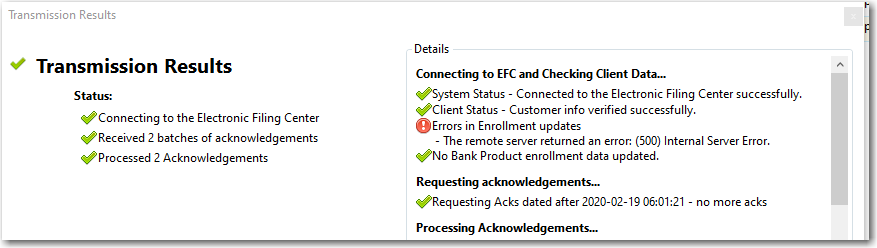

I posted in the Efile section early afternoon. It looks like this: I also had two acks that were accepted in the same notification. Hopefully they went through with no issues.

-

Went into the E-file Manager to obtain acks on two New Jersey returns. I received the following Transmission result: I did receive the Processing Acknowledgement that both of the returns were accepted. I'm happy about that but I have never seen this type of Exclamation point response before. Any ideas from anyone?

-

Eric...good morning. I believe this link works but let's have another member confirm it.

-

As the employer, I would want my name reflected as the one paying the wages to MY employees. I wouldn't want a third parties name and EIN as the payee. It does seem strange. I wonder if Paymasters pays their own employees under a different corporate name/EIN?

-

There may be, but I'm not aware of one. I look forward to additional replies to this post to determine if there is.

-

Rental Property Converted to Personal Use - Sold

Yardley CPA replied to Yardley CPA's topic in General Chat

Thanks so much for the replies. -

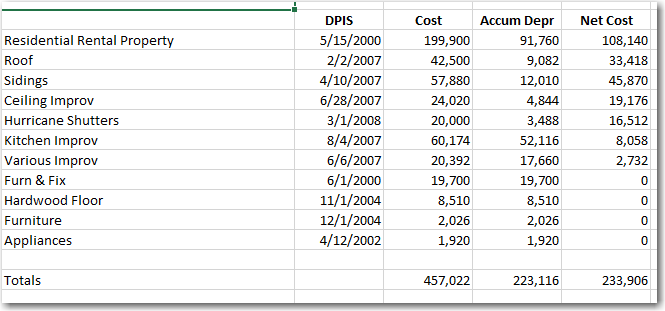

MFJ client purchased rental property in 2000. Rented the property through June 2012. In July 2012 couple moved into the rental property and converted it to personal use. Some information on assets and depreciation through the date of sale: Couple lived in home through July 2019 and sold it for 425,171 (Gross). Closing costs amounted to 25,041. Is the basis at the time of sale 233,906? Are the couple eligible for the homeowner exclusion on this sale? Couple moved to Florida. Rental Property was located in North Carolina. I assume a NC return is required with no exclusion? I would appreciate any insights you can provide. Thank you.

-

Thank you, All. I guess I'm in the minority. I sign the client copy and then place a "copy" stamp over my signature.

-

Can someone provide me with exactly what is required once a preparer completes the tax return? For the longest time, I have given my clients a paper copy of return and form 8879, with my wet signature on both. I also normally provide them with a signed pdf of the return on a usb flash drive (or uploaded to the portal). Is the paper copy still required or does the signed pdf/upload suffice?

-

Normally 1099 b information is reported on form 8949 or Schedule D as a capital gain or loss. Maybe review those forms?

-

Are there ATX Shortcuts not Listed?

Yardley CPA replied to Matthew in the PNW's topic in General Chat

Judy...can this topic be pinned?