-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

Treasury considering extending 4/15 tax deadline - coronavirus?

Yardley CPA replied to ILLMAS's topic in COVID-19

Looks like we may get some extra time to complete those returns: https://www.wsj.com/articles/u-s-treasury-likely-to-push-back-april-15-tax-filing-deadline-sources-11583897351 WASHINGTON—The Trump administration is likely to extend the April 15 tax deadline as part of an effort to mitigate the effects of the novel coronavirus on U.S. households and businesses, according to an administration official and another person familiar with the matter. -

Gail...in the event it was business related, maybe. This is a normal Joe (no offense to Joe's), a married couple who had planned a vacation to Italy No business about it.

-

I agree with Jack...sounds like an expense item. With that said, I did find this online: Assuming that fits your situation then you may be able to capitalize it and use 179 potentially.

-

Client is dealing with airline trying to obtain a full refund due to Italy being closed for business/travel. (My Poor Italy!) Anyway, the Airline offered them a voucher to use up to the value of what they paid for the Italy tickets. That voucher could be used up to the end of this year on any tickets for any travel on the airline. The client preferred the refund. The airline told the client, if the refund is approved it would be considered taxable income?? Is that correct?? I'm having real trouble understanding how that is possible? Are they just trying to entice the client to take the voucher?

-

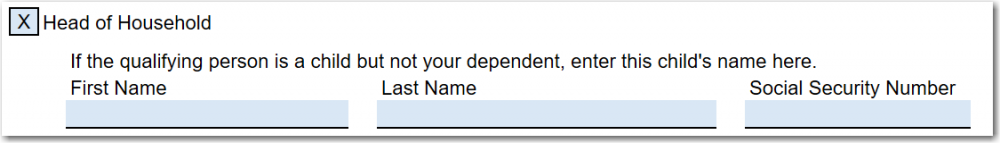

What about situations where divorced parents split the dependency by year? I was under the impression the parent that the child lived with during the year could still claim HOH but not claim the child as the dependent that year since the other parent was. Maybe we're referring to the same thing but just saying it differently and you actually mean qualifying person instead of dependent?

-

I didn't think you had to take QBI. If you don't check the QBI eligible box, is QBI still calculated?

-

My donation is automatically debited from my account each year. A nice feature that makes it easy.

-

How does being claimed as a dependent impact interfere at all with medicare benefits? If the father is paying more than half half of the daughters support, she lives with him, has no wages, and does not file a return, why wouldn't she be considered as a dependent (assuming she is not claimed by someone else)? As for your statement that he "must" carry her as a dependent, is that accurate? If he chooses not to file HOH or claim her, he has no obligation to do it...does he?? I'm not overly versed in HOH but I do believe he qualifies for it and I think he is eligible to claim her as a dependent as well.

-

Judy...your insights are very much welcome and I always appreciate reading them so please keep'em coming!

-

Hi, Judy...yes, ATX automatically calculates this. I've had a couple clients already this year who were "forgiven". I don't recall ever seeing it applied for underpayment penalty though.

-

PA has a Tax Forgiveness program. Not sure it pertains to underpayment penalties specifically but here is some info on it: https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PIT/Documents/rev-631.pdf Tax Forgiveness Depending on your income and family size, you may qualify for a refund or reduction of your Pennsylvania income tax liability with the state’s Tax Forgiveness program. Retired persons and individuals that have low income and did not have PA tax withheld may have their PA tax liabilities forgiven. For example, a family of four (couple with two dependent children) can earn up to $34,250 and qualify for Tax Forgiveness. And a single-parent, two-child family with income of up to $27,750 can also qualify for Tax Forgiveness. Nearly one in five households qualify for Tax Forgiveness. See if you qualify for all or part of Tax Forgiveness when you file your state income tax return. Simply file your state income tax return and include PA Schedule SP. For more information, see the department’s brochure on the Tax Forgiveness program. Taxpayers who qualify for PA’s Tax Forgiveness program may also qualify for the federal Earned Income Tax Credit program. For more information, visit the Internal Revenue Service’s Web site at www.irs.govOpens In A New Window or call the IRS toll-free, 1-800-829-1040.

-

Let's not look a gift horse in the mouth. I'm not sure why there hasn't been an update recently. Maybe the program is running as expected and there is only a need to update forms.

-

It sounds like that is the case, yea. She will also be subject to the local depending on the amount of time spent there.

-

I prepare a significant number of PA returns. The husband's w2 is more in line with what I see. His local is a bit high, but I have seen similar. I have never seen a W2 with as significant a difference as the wife's. There may be an explanation for it...but I have never seen that big of a difference and I would suggest she check with her payroll department to obtain some type of explanation.

-

GGRNY...I had to contact ATX Chat Support about 40 minutes ago. It was an immediate connection and I did not wait at all. Maybe it's worth trying to discuss this with them? https://support.cch.com/atxchat/

-

Happy to know ATX is "correct". At least you were able to figure out the issue.

-

I guess that depends on the total amount withheld and what 15% equates to and whether she would receive a refund of that withholding? With that said, as a non-resident of Canada, I don't think you are required to file a return in the majority of cases...yours being one of them. However, here are a few articles that hopefully provide a bit more information: https://www.canada.ca/en/revenue-agency/services/tax/international-non-residents/individuals-leaving-entering-canada-non-residents/non-residents-canada.html https://www.taxesforexpats.com/canada/us-tax-preparation-in-canada.html https://turbotax.intuit.ca/tips/how-are-taxes-assessed-for-u-s-citizens-working-in-canada-347

-

More than likely this won't do squat...maybe try closing the program, rebooting your system...and reopneing?

-

I'm very pleased with ATX and all that it offers. Anytime I've contacted their support, they provided me with good service and rectified my issues. Sorry to hear others have not had the same results. I tried Drake and prefer ATX over what it offers.

-

thanks to all who responded. I didn't know if the contribution to the 414 h resulted in any type of saver credit on the federal return. That's why I was wondering if there was a field to input the amount on the W2 input screen or on the 1040 itself. But I believe the 414 h contribution is considered an employer contribution, so I probably answered my own question.

-

Are you using ATX? Can you create an efile through the program for 2018?

-

Thanks, Michael. The amount is included in the taxable wages for the State. I was curious more from a Federal end.

-

Is anyone seeing contributions on a W2 to a IRC 414 (H) plan? In reading about it, it's similar to a 401K. In my specific situation of a MFJ client, it is included on the W2 in Box 14 Other. Should this be documented anywhere on the W2 entry screen? There is no drop down for a 414 (H). Thanks!

-

I guess I'm undercharging as well. I would be nowhere near that charge for that return.

-

Who in this group, uses portals to send documents to clients?

Yardley CPA replied to Jack from Ohio's topic in General Chat

I am also using CCH Portal for the past two years and it has been well received by my clients. I believe you need an add-on program from CCH that will allow you to offer e-sign capabilities. Maybe it's this: https://taxna.wolterskluwer.com/firm-management-and-workflow/esign Haven't pursued it yet. I may next year.