-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

Did the renewal come in the US Mail or was it emailed?

-

MFJ client. Husband is a financial advisor and was recently laid-off from his job. He has decided to open his own firm and work out of his house. He is considering constructing a small home office suite and asked me what type of deductions could he take on the construction? I am not aware of any. I provided him with information on the home office deduction and reminded him of the need for the space to be used exclusively and regularly for that purpose. He has not filed any type of articles of incorporation. He would probably be a sole proprietor. Is there anything that I am missing about what he can deduct if he did construct an office? Is he entitled to anything besides potentially the home office deduction? Since we're on the topic, could he convert an extra bedroom into his home office?

-

Just confirming, there is no way to sort Schedule B on ATX? I see the "Apply Sort to Form" button is gray. I think you just have to alpha sort before entering the information, is that correct? I know we were able to sort at one time.

-

For my office copy all returns are printed to a pdf file. I don't keep paper either. All I'm wondering is the ATX file copy similar to Drake's filing copy?

-

Isn't this the same as the ATX filing copy?

-

I can't believe they did this - penalty free 401K withdrawals

Yardley CPA replied to BulldogTom's topic in COVID-19

Tom...as tax professionals we obviously see the negative side to raiding 401k's. With that said, I agree with Max on this one. Desperate times call for desperate measures and some folks would probably be considered desperate for sure. Some will raid it, just to raid it though. Foolish but not much we can do about that. My 401K is now a 201k but I have high hopes that it will get back to it's high at some point in the not to distant future. -

Extremely? I think any method has risk, some more than others. Not sure texting qualifies as extremely....but maybe it does. It's not a common method for me, but I have used it before.

-

Save the picture of the text 8879 to your phone. Attach that picture to an email and email it to yourself. You can print from there. Some folks may be able to print from their phones?

-

I haven't heard of any modifications to clients having to sign. Most of my clients print their 8879's, sign them and then either scan or text them to me. Like Lion, some use the mail slot. Next year it's all about E-signing.

-

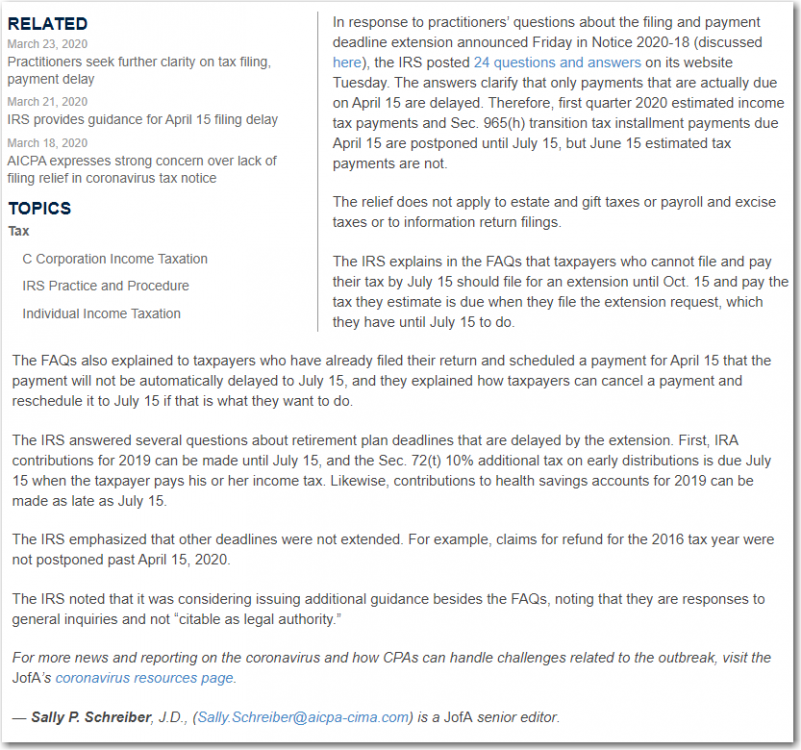

When I prepare a clients return, I click the "Client letter to display "will be efiled"" box and provide them with a copy of the return to review. Checking this box instructs the client to print and sign the 8879 and return it to me. Once the signed 8879 returned, I then click the "Allow program to decide" box. Save the return, create the efile and transmit. Once the returns are accepted and when I go to print the clients file copy, I note that the Federal Client Letter continues to show the same verbiage as though the 8879's are still needed instead of reflecting that the return was successfully efiled? Shouldn't the program be intuitive enough to determine the return was efiled successfully and print that on the letter? Any idea what I'm doing wrong?

-

Judy...thanks for your candor. We're all in this together. This community, in many ways, is our extended "family" and we should be here for each other.

-

It's a tough day today. Watching the vote over Stimulus 3. Difficult to watch this and very sorry for all we are going through.

-

As Terry mentioned, Tenenz has 1" folders that I purchased specifically for ATX. https://www.tenenz.com/category/atx-compatible-slip-sheet-folders/132 https://www.tenenz.com/category/atx-compatible-expandable-slip-sheet-folders/136 <~~ 1 Inch

-

ATX Extended Deadlines Issues - Fixes, Updates, Client Instructions?

Yardley CPA replied to ETax847's topic in COVID-19

Just wondering if your Drake accepts the new date? -

Art they doing whats best for the American People?? https://www.politico.com/news/2020/03/20/senate-coronavirus-emergency-stimulus-deal-friday-138788

-

I'm in PA. I work from home. I have no clients who come to me, it's all done electronically. I have no plans to change my process.

-

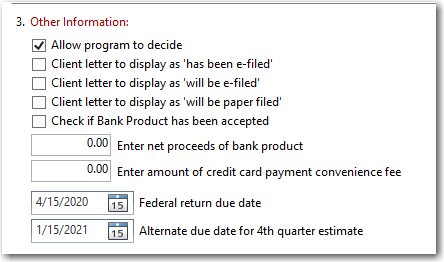

Tax payment AND filing dates BOTH now 7/15, 1Q estimate too

Yardley CPA replied to Abby Normal's topic in COVID-19

Looks like July 15 is the new date. https://www.foxbusiness.com/economy/trump-administration-moves-tax-day-to-july-15 -

-

Tax payment AND filing dates BOTH now 7/15, 1Q estimate too

Yardley CPA replied to Abby Normal's topic in COVID-19

I have read some articles on this and just to make sure my understanding is correct, generally speaking, April 15 now = July 15? Is that correct? Don't have to complete any extensions or file any forms for this to happen. Simply changing the due date from April 15 to July 15. -

Single Taxpayer has both a W2 and 1099 Misc from the same company. Apparently commissions the employee earned were reported to him on the 1099 Misc under box 7, Non-employee compensation. Does this sound correct? If so, would they be reported as other income or on a Schedule C? I

-

I interpreted it as gambling. Good to know. Thank you.

-

I'm not sure whether your situation would apply for 179 or not, but maybe this article can shed some light: https://rsmus.com/what-we-do/services/tax/federal-tax/confusion-over-qualified-leasehold-improvements-may-create-oppor.html

-

If he can substantiate the losses, why wouldn't you reflect them on Schedule A as an itemized deduction?

-

I'm holding a few returns that have a balance due on them before moving forward and efiling. Wondering if there has been any definitive guidance on the potential change in the April 15 deadline. I thought I read, if it does happen it would also push back the due date to pay any balance due.