-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

MFJ, Retired couple have 529 plans for their two grandchildren. Their son has asked for some of the funds to pay for their granddaughters 2021 college expenses. The question is what's the best way to accomplish this. In my opinion, having the 529 disburse the funds directly to the school is the cleanest way. With that said, there are some implications to that in regard to aid being received by the student. It could impact that aid negatively. Can my clients have the amount needed disbursed (disbursement will be made in 2021) to them and then they write their son a check? No one is trying to misconstrue funds in any way. We're only talking about $4,000 in total. Growth on that amount is only a few hundred dollars. Just trying to determine the best way to accomplish this without any tax implications to my client and without negatively impacting the aid the student is receiving. Your thoughts please!

-

I have as well and found the information to be very useful. It's somewhat fast paced but easy to follow.

-

Happy to do that, Tom.

-

I agree...they absolutely should include it as part of the MAX calculations. But then they wouldn't be able to make an additional $500 for each preparer who purchases it. I ended making the purchase since I have several clients who work in NYC but live in NJ or PA. I also have several who have kids in college. We'll see how useful it is this year and that will determine if I renew with the feature or not. Time will tell.

-

But that would be an issue for the mother. The intent is to pay her. If her mother does not include that income on her personal return, that is not my clients problem. Right? Obviously, my client would discuss this and maker her aware of her responsibilities, but the rest is on the mother.

-

Received this email from my client: "I have an important tax question; I over donated to my pre tax dependent care account at work. I have had almost $3,900 deducted from my paycheck since 1/1/20. When Covid began, I removed my daughter from daycare but did not cancel or change my paycheck deduction at work until 10/1/20. I only spent approximately $2,500 at daycare and can provide receipt for that. I haven’t done the exact math, but I have over donated by about $1500. My question is this; my mother has provided daycare for my daughter regularly since 6/4/20. Is there a way that I can legally and ethically pay her for daycare so that I don’t “lose” the money that was pretax?" I believe if we show the mother as the provider and list her social security number on the 2441, it would qualify. Am I correct? Can anyone share their thoughts please. Thanks!

-

Software to Gather, Assemble, and Deliver Tax Docs

Yardley CPA replied to Patrick Michael's topic in General Chat

I've been using the CCH Portal with good success over the past two seasons. It's relatively easy to use and even some of my older clients have navigated it without any issues. Now that ATX will offer an electronic signature option as part of it's package (at least for max) the entire process should become much more efficient. Hope this helps a bit. -

I find it to be very user friendly and my clients have had not real issues navigating it. It provides a secure location to exchange information with clients and user friendly. I've received no negative feedback, so I consider that a plus.

-

I reviewed the CCH eSign video they posted online. So, clients need to sign the form with a sylus pen or I guess they can use their finger. This assumes they have a touch screen to accomplish this. Do you find this to be an issue? I assume most people today have a touch screen of some sort?

-

I received an email offering me the opportunity to purchase ATX's Advanced Calculation Module. I renewed Max somewhat early and did not have the option to purchase this module at the time since it was only part of their higher-end package, ATX Advantage. They are offering this module "ala carte" for Max and Total Tax Officer Users. Price is $499. Wondering how those with this module like it? Is it worth the $499. I assume that all depends on how many returns a preparer has with education expenses and multi-state, but wondering the overall thoughts on the module?

-

The new charitable deduction for nonitemizers By John McKinley, CPA, CGMA, J.D., LL.M.; Luke Richardson, CPA; and Jonas Lee September 1, 2020 Residents of the United States are frequently ranked as among the most generous in the world (Charities Aid Foundation World Giving Index, October 2019). Charitable contributions flowing from these taxpayers enable many churches, youth sports charities, and other not-for-profits to fulfill their charitable missions. However, many of these organizations are now experiencing a decline in giving as the United States finds itself grappling with a public health crisis. In response, Congress included a provision in the Coronavirus Aid, Relief, and Economic Security (CARES) Act, P.L. 116-136, intended to provide some relief for charitable organizations. Section 2204 of the CARES Act permits eligible individuals who do not itemize deductions to deduct $300 of qualified charitable contributions as an "above-the-line" deduction, i.e., as an adjustment in determining adjusted gross income (AGI), for tax years beginning in 2020. Allowing nonitemizers to deduct charitable contributions is not a new concept. The Economic Recovery Tax Act of 1981, P.L. 97-34, allowed a charitable contribution deduction from AGI for nonitemizing taxpayers (Sec. 170(i), before deletion by the Omnibus Budget Reconciliation Act of 1990, P.L. 101-508). Although the amount of the deduction was generally limited to 25% of up to $100 in contributions (i.e., $25) for tax years 1982 and 1983, it climbed to 100% of up to $300 for 1986, after which it sunset. Since then, Congress has introduced bills on multiple occasions to reestablish a charitable contribution deduction for nonitemizers or provide a larger one than the CARES Act's. These include the currently pending Universal Giving Pandemic Response Act, S. 4032, and a companion bill, the Universal Charitable Giving Act of 2019, H.R. 5293, both of which would provide a deduction of up to one-third the amount of the taxpayer's standard deduction (i.e., for tax year 2020, $4,133 for single individuals and $8,267 for married individuals filing jointly). S. 4032 would also allow contributions made under this provision after Dec. 31, 2019, and before July 15, 2020, to be treated as made in calendar year 2019. QUALIFYING FOR THE DEDUCTION Under new Sec. 62(a)(22), for tax years beginning in 2020, eligible individuals may deduct up to $300 in qualified charitable contributions made to qualified charitable organizations. Any amount that exceeds the $300 limit may not be carried forward to future tax years or claimed as an itemized deduction (Sec. 62(f)(2)(C)). Moreover, charitable contribution itemized deduction carryforwards arising in tax years beginning before 2020 may not be claimed as an above-the-line deduction. The Joint Committee on Taxation (JCT) estimates the government's revenue loss for the new deduction at $310 million and $1.241 billion in fiscal years 2020 and 2021, respectively (Description of the Tax Provisions of Public Law 116-136, the Coronavirus Aid, Relief, and Economic Security ("CARES") Act (JCX-12R-20) (April 23, 2020), p. 107). This projected revenue effect is considerably lower than the estimated $96.75 billion revenue reduction from itemized charitable contribution deductions in fiscal years 2020—2021 (Tax Expenditures, U.S. Department of the Treasury, Office of Tax Analysts, Feb. 26, 2020) or the $180.5 billion in cash charitable contribution deductions by individuals for tax year 2017 (IRS Tax Statistics, Individual Income Tax Returns, Table 2.1). ELIGIBLE INDIVIDUAL An individual eligible to claim the deduction is any individual who does not elect to itemize deductions for 2020 (Sec. 62(f)(1)). The $300 limit per filing unit applies regardless of filing status. QUALIFIED CHARITABLE CONTRIBUTION A qualified charitable contribution for purposes of Sec. 62(a)(22) is a charitable contribution as defined in Sec. 170(c) (Sec. 62(f)(2)). Such contributions must be made in cash, not taking into account the revised percentage limitations of Sec. 170(b). (The CARES Act also effectively suspended the ceiling for qualified charitable contributions made in 2020 by limiting the deduction to 100% of the taxpayer's contribution base (CARES Act §2205).) Therefore, contributions of noncash property are not allowed as an above-the-line deduction. However, these contributions are still available for individuals who itemize their deductions. Cash contributions are any contributions paid with "cash, check, electronic fund transfer, payroll deduction, etc." (IRS Publication 526, Charitable Contributions). No part of a gift that a donor makes in consideration for goods or services received is a contribution for this purpose (Regs. Sec. 1.170A-1(h)). Sec. 170(f)(8) requires that for any cash contribution over $250 the taxpayer must keep a "contemporaneous written acknowledgment" of the donation. The substantiation requirement applies on a gift-by-gift basis (IRS Publication 526). Because the $300 charitable contribution deduction qualifies as a deduction under Sec. 170(c), one can reasonably infer that the substantiation requirement applies to it in the same way as to an itemized charitable contribution deduction. QUALIFIED CHARITABLE ORGANIZATION A qualified charitable organization is any organization that qualifies as a public charity under Sec. 170(b)(1)(A) (Sec. 62(f)(2)(C)(i)). The contribution cannot be made to a supporting organization described in Sec. 509(a)(3) or to a donor-advised fund. In general, a contribution to a charitable remainder trust does not qualify as a charitable contribution. But if the charitable remainder interest is paid in cash to a qualified charity during the applicable time period, then the amount may still qualify as a contribution under Sec. 62(f)(2) (JCT, Description of the Tax Provisions of Public Law 116-136, the Coronavirus Aid, Relief, and Economic Security ("CARES") Act (JCX-12R-20) (April 23, 2020), pp. 22—23, 26). OTHER CONSIDERATIONS However, a couple of issues might arise for taxpayers claiming the $300 above-the-line deduction. First, low-income taxpayers whose AGI does not exceed the standard deduction will largely fail to realize the deduction's intended benefit. Even if these individuals do have any taxable income before credits, nonrefundable credits (e.g., the child tax credit, child and dependent care credit, etc.) may reduce their taxable income — and, in turn, their tax liability — to zero. The second issue might arise when a married individual filing a separate return whose spouse itemizes deductions is not eligible for the standard deduction (or has a zero standard deduction), raising the question of whether such an individual may claim the above-the-line charitable deduction(Sec. 63(c)(6)(A)). Assuming such an individual does not also itemize deductions, an above-the-line charitable deduction would seem to be available, since ineligibility for a full standard deduction is not, per se, an election to itemize (Sec. 63(e)(1)). But some IRS guidance on this point would be welcome. Practitioners with clients who do not regularly itemize post-TCJA should consider alerting these taxpayers to the above-the-line charitable contribution deduction. The amount may be relatively small, but in the throes of a health care crisis, every bit can make a difference — in this case, for both the donor and the donee. John McKinley, CPA, CGMA, J.D., LL.M., is a professor of the practice of accounting and taxation at Cornell University in Ithaca, N.Y.; Luke Richardson, CPA, M.Acc., is an instructor in accounting and taxation at the University of South Florida in Tampa, Fla.; and Jonas Lee, MPS, is a recent graduate in accounting from Cornell University. To comment on this article or to suggest an idea for another article, contact Paul Bonner, a JofA senior editor, at [email protected]. https://www.journalofaccountancy.com/issues/2020/sep/cares-act-charitable-deduction-for-nonitemizers.html?utm_source=mnl:cpald&utm_medium=email&utm_campaign=07Sep2020

-

- 3

-

-

-

Happy to see ATX had a decent showing. I've been using the program for many years, back to the days of Parsons Technology, and it has treated me well. That's not to say there isn't the occasional hiccup, but overall I'm very pleased with the product.

-

Thank you both for responding. She is licensed in New Jersey as a cosmetologist. She lives in PA. She will complete the paperwork to file as a PA LLC, allowing her to complete a Schedule C. She will obtain the necessary insurance. At some point, she may move the business into PA, that is why I suggested setting it up on PA. Thoughts on this? I know she will need to file NJ Non-Resident.

-

Client is MFJ hair stylist. Up until now, she was receiving a W2. With the Covid environment, beauty salons are highly requlated. As a result, she is going to open her own business and rent a "styling room". She is a resident of Pennsylvania and will be renting the room in New Jersey. My advice was for her to file in as a sole proprietor in Pennsylvania which would allow her to file a Schedule C. Does that sound correct? I don't see the advantage of her filing as a corporation. Is my thinking to file in PA correct?

-

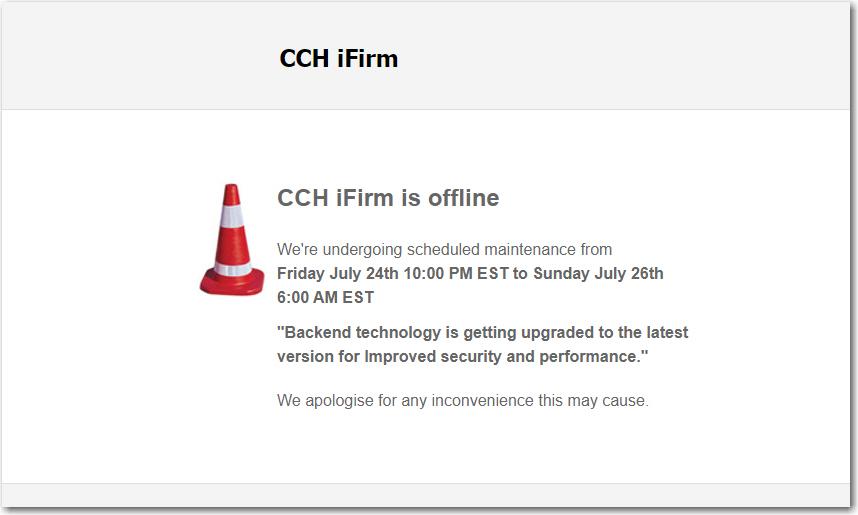

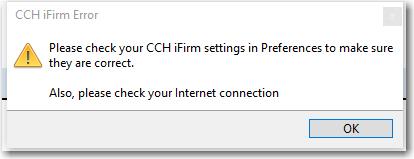

I may have found a connection to this error message. When I log into iFirm, I receive the below message. I assume they are related. Maybe with IFirm having scheduled maintenance, it throws an error for ATX. Just assuming that is the case.

-

Used the program extensively yesterday with no issues. Rebooted my computer and opened the program this morning. As I attempted to open a return I receive the below error message. I rebooted and opened again...same error message. Anyone else experiencing this? After clicking okay, it basically closes the program.

-

It happens. We're human. We're all dealing with this crazy environment right now and doing the best we can. Don't beat yourself up.

-

Thank you. How the heck did I miss that?

-

Client had IRA mature at Bank A on 10/15/19. Client found a better rate at a different bank and had the mature funds distributed to her and then she deposited the amount into Bank B on 11/13/19, within the required 60 day period. Bank A issued a 2019 1099R coded as 7. Where/how on the ATX return do I show the rollover? Would appreciate any insight.

-

I have been using it for two years now with about 70 clients subscribed to it. Of the 70, a fair number are senior citizens. Overall, my clients are very happy with it and find it easy to navigate. I've started to use this as my primary means of exchanging information with clients which has helped reduce paper. I also now post a copy of their successfully efiled return (client copy) to their portal for them to download and save which has significantly decreased the number of packets I have to mail. I'm very pleased with how it works. Hopefully CCH will continue to improve it.

-

Does anyone know where the name ATX originates?

Yardley CPA replied to Abby Normal's topic in General Chat

Does anyone remember Parsons Technology? I thought Parson's was purchased by ATX ultimately. Maybe I'm wrong. -

Mine is done automatically each year as a direct debit. I'm happy to donate.

-

I have been using their portal and was going to subscribe to eSign. Maybe there won't be a need to sign-up for it? I hope that's the case.

-

I never received a mailing but I did receive a phone call from my rep yesterday. I'm all set and renewed for next year.

-

Does anyone know if you can export the planner to Excel? If you can, how? Thank you.