-

Posts

1,400 -

Joined

-

Last visited

-

Days Won

14

Everything posted by Yardley CPA

-

Thank you, Possi...that's my understanding as well but wanted to make sure I am not missing something.

-

Just making sure I am not missing anything. Single client was laid off during 2020 as a result of COVID. She filed for and received unemployment benefits during the year and received a 1099-G. These are not additional unemployment benefits, they are just her initial, normal unemployment benefits. From a federal perspective, those benefits are considered taxable income, correct?

-

I've received that message and still attached the file. I had no issue with it successfully going through. I would attempt to attach it and try e-filing.

-

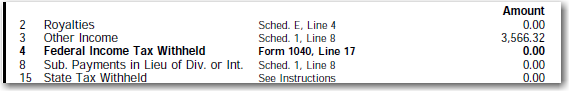

It was on a personal tax reporting statement, no trust. Based on the information provided it seems like some type of interest or dividend and that is why I wanted to seek input on here. I never saw this before either. I'm placing it on Line 8 and moving on.

-

FYI: IRS says it won't extend this year's tax-filing deadline

Yardley CPA replied to ETax847's topic in General Chat

Hopefully the new administration will follow the lead of the previous administration when it comes to this. Even an additional month would be useful. -

Thanks for the response, Margaret...I did: The income was reported on Line 3 and the instructions indicate they are generally reported on Line 8 of the 1040. Just wanted to see if anyone had any experience or knowledge with this.

-

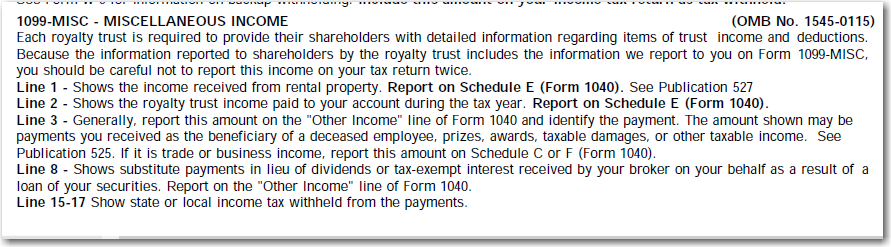

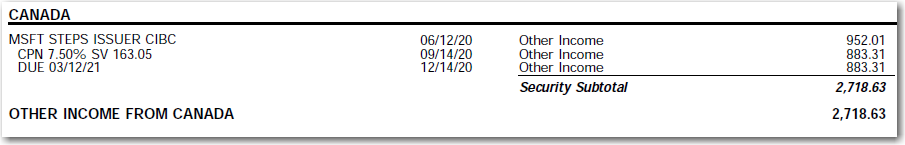

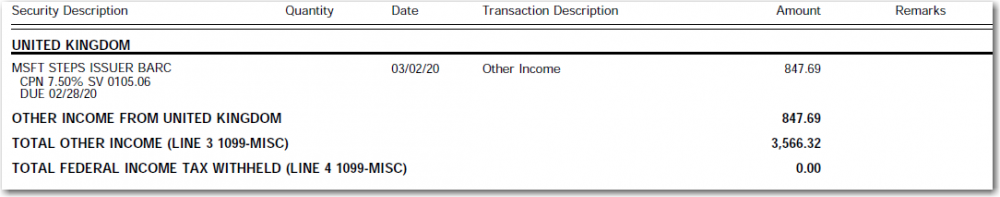

Reviewing a Merrill Lynch 2020 Tax Reporting Statement and came across this entry for "Other Income. Any insight on where to include this on the 1040? Line 8, Schedule 1 Other Income?? Additional information on the statement indicates a portion of the income is from Canada: The other portion is from the United Kingdom:

-

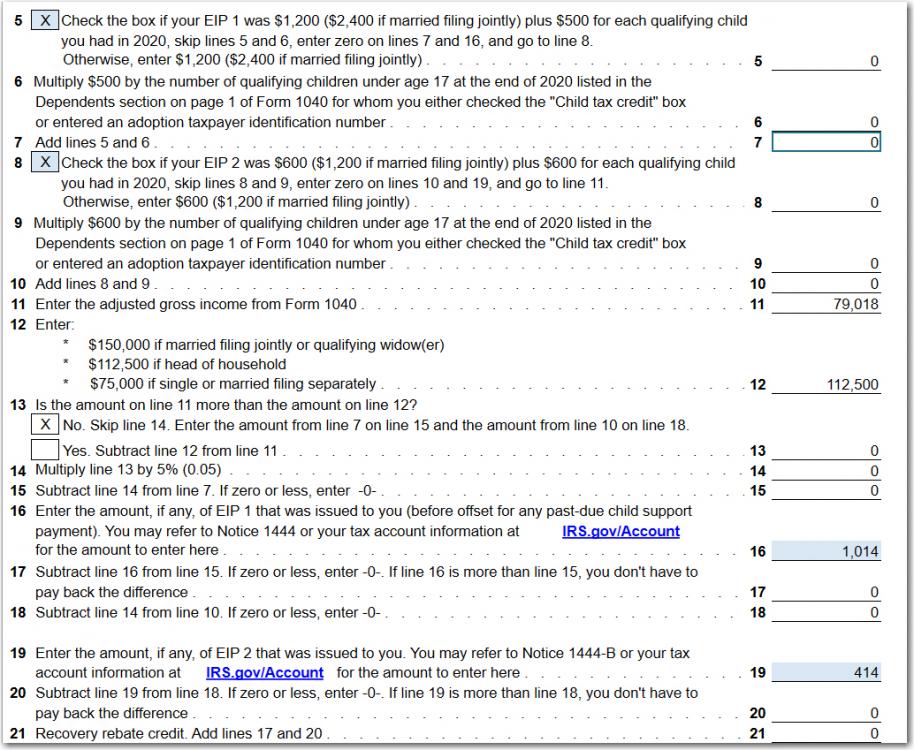

Just confirming my understanding of this worksheet. Divorced, currently single, client provided me with the following information on the amounts she received for the stimulus payments: 4/15/20 -$1,014 1/4/21 - $414 In completing the spreadsheet you would check the box for line 5, EIP1 of $1,200 and check box 8, EIP 2 of $600. I then entered $1,014 on line 16 and $414 on line 19. Is this correct?

-

Sara...just to clarify, you wouldn't take the $250 expense deduction for the teacher given Possi's question?

-

Here's the excerpt from the IRS webpage: Qualified expenses are amounts you paid or incurred for participation in professional development courses, books, supplies, computer equipment (including related software and services), other equipment, and supplementary materials that you use in the classroom. For courses in health or physical education, the expenses for supplies must be for athletic supplies. Qualified expenses also include the amounts you paid or incurred after March 12, 2020, for personal protective equipment, disinfectant, and other supplies used for the prevention of the spread of coronavirus. I don't know that internet or cell phone expenses actually qualify (maybe they fall under computer equipment :-)) as a deduction normally but given the COVID situation and the relatively small amount of the , $250, I wouldn't be overly strict. Maybe I let my personal feelings influence my decision but that's my thoughts.

-

I've already transmitted a couple less complicated 1040's. Fingers crossed.

-

I think it would all flow from what is input on the stimulus worksheet on line 30. If you indicate stimulus 1 or 2 has been received the program factors that into the calculation. If you indicate only one or none of the payments was received, the program factors that as well. I'm not aware of anything besides completing that worksheet.

-

ATX - Preferred Preference Options and Customize Form

Yardley CPA replied to Yardley CPA's topic in General Chat

Thank you! -

CCH's iPortal has treated me relatively well over the past two seasons. Looking forward to using it again this year.

-

I know this has been discussed in previous years but I am having some trouble locating the content. Can you share some of your preference options and how you customize some of your forms? For instance, I choose to have my forms open at 190% to make it a bit larger on the screen. What do other users do for convenience sake? Thanks very much!

-

Abby...so based on the rumor, anything filed February 8 or beyond should be "safe"? I don't plan on filing until February 12 or later but was just wondering how it would work.

-

Thanks, John. Very helpful. I appreciate you posting it.

-

I sent my "new tax year" email to clients on January 2. Looks like I may need to follow-up with another email to update the efile date of February 12; but more importantly to offer additional guidance on what clients should be providing me in regard to stimulus payments. Did they receive the payment(s) and how much exactly?! It should be a "fun" season!

-

Not sure if this topic has already been discussed in this forum or not, but here is some information on the expanded program. I think it's a terrific idea but I can see issues if clients lose their assigned PIN. https://www.accountingtoday.com/news/irs-expanding-ip-pin-opt-in-program-to-all-taxpayers IRS expanding IP PIN opt-in program to all taxpayers By Michael Cohn December 03, 2020, 11:45 a.m. EST 3 Min Read Close extra sharing options The IP PIN is a six-digit number that is assigned by the IRS to eligible taxpayers to help safeguard their Social Security number from being used on fraudulent federal income tax returns. An IP PIN also helps the IRS verify a taxpayer’s identity and accept their electronic or paper tax return. The IRS made the announcement Wednesday as part of its National Tax Security Awareness Week initiative with its partners in the Security Summit, which includes major tax prep chains and software vendors, as well as state tax authorities. The online Get an IP PIN tool at IRS.gov/IPPIN displays the taxpayer’s IP PIN. It employs Secure Access authentication, which uses several different ways to verify a person’s identity. “When you have this special code, it prevents someone else from filing a tax return with your Social Security number,” said IRS Commissioner Chuck Rettig in a statement. “The fastest way to get an Identity Protection PIN is to use our online tool but remember you must pass a rigorous authentication process. We must know that the person asking for the IP PIN is the legitimate taxpayer.” For taxpayers who can’t pass Secure Access authentication, there are some alternatives. Taxpayers with incomes of $72,000 or less and with access to a phone can fill out a Form 15227 and mail or fax it to the IRS. An IRS employee will call the taxpayer to verify their identity by asking a series of questions. Taxpayers who pass the authentication will receive an IP PIN the following tax year. Taxpayers who can’t verify their identities remotely or who are ineligible to file a Form 15227 can make an appointment with an IRS Taxpayer Assistance Center and bring two forms of picture identification. Because this is an in-person identity verification, an IP PIN will be mailed to the taxpayer within three weeks. Taxpayers who get an IP PIN should never share their code with anyone but their trusted tax provider. The IRS will never call to request the taxpayer’s IP PIN, and taxpayers should beware of potential IP PIN scams. The Get an IP PIN tool will be available starting in mid-January. This is the preferred way to get an IP PIN, and it’s the only one that immediately reveals the PIN to the taxpayer. Taxpayers who want to voluntarily opt into the IP PIN program don’t need to file a Form 14039, "Identity Theft Affidavit." The IP PIN will be valid for only one year. Each January, the taxpayer needs to get a new IP PIN. The IP PIN has to be entered properly on any electronic or paper tax return to avoid being rejected or delayed. Taxpayers with either a Social Security number or Individual Tax Identification Number who can verify their identities are eligible for the opt-in program. Any primary taxpayer (who is listed first on the tax return), or a secondary taxpayer (who is listed second on the return) or dependent can get an IP PIN if they can pass the identity-proofing requirements. The IRS intends to offer an opt-out feature in the IP PIN program in 2022 if taxpayers decide it’s not right for them. The IRS noted that there’s no change in the longstanding IP PIN program for confirmed victims of tax-related identity theft. Those taxpayers should still file a Form 14039 if their e-filed tax return is rejected because of a duplicate Social Security number filing. The IRS will look into their case and once the fraudulent tax return is removed from their account, confirmed victims automatically will get an IP PIN through the mail at the beginning of the following calendar year. IP PINs will be mailed every year to confirmed identity theft victims only and participants enrolled prior to 2019. Because of security risks, confirmed ID theft victims can’t opt out of the IP PIN program. Confirmed ID theft victims can use the Get an IP PIN tool to retrieve any lost IP PINs that have been assigned to them.

-

Here's an article that provides a review of the 2020 program and some of the enhancements. https://www.cpapracticeadvisor.com/reviews/review/21140114/2020-review-of-atx-tax

-

- 1

-

-

Can someone provide a general overview as to how these stimulus checks are treated on the 1040? Specifically what needs to be done to "claim" them? I assume we'll need to make sure we ask our clients if they received them. Is the IRS sending out any type of 1099?

-

I've used both Webex and Zoom. I think, generally speaking, both are similar and you can't go wrong with either platform. I'm not completely versed on the level of security either offers though and maybe someone with more experience on that will chime in.

-

I have the iFirm portal. This will be my third year using. Overall, it's very basic but provides the functionality and security that I want for my firm and my clients. Feedback has been positive and even some of my more senior clients have found it easy to use. You have the ability to print directly to the portal from the program which is a nice feature and save a little time. I think my initial cost was around $500 and there is a $300 +/- fee each year.

-

Correct....if it's disbursed directly from the Grandparent's 529 to the school it does impact the FAFSA. I'm thinking they have the disbursement made to their checking account in 2021 and then transfer the funds to the son for payment to the school. I don't think there are any tax implications to that.