-

Posts

1,569 -

Joined

-

Last visited

-

Days Won

12

Everything posted by Tax Prep by Deb

-

residence converted to rental and then sold

Tax Prep by Deb replied to schirallicpa's topic in General Chat

This too is what I found out researching it yesterday. I had a client in a similar situation except it was a rental before she moved into it, do there are non qualified days, but correct me if I'm wrong, we don't go back to when the house was first purchased to establish non qualified days, we begin from January 1, 2009 correct? -

residence converted to rental and then sold

Tax Prep by Deb replied to schirallicpa's topic in General Chat

Correct me if I am wrong but I believe this was changed a few years back. I believe a partial exemption but not full. I will have to double check but I do believe you forfeit full exclusion. -

California will have the penalty mandate starting in 2020. So we are not out of the woods yet!

-

how to invite client to client portal in drake

Tax Prep by Deb replied to schirallicpa's topic in Drake

Also the invite is just to set up their end of the portal. It doesn't specifically invite them to send you anything, but once set up it's pretty easy both directions. I set myself up as an individual and sent myself the invitation and played with it going both ways so I could better help my clients. They loved it! -

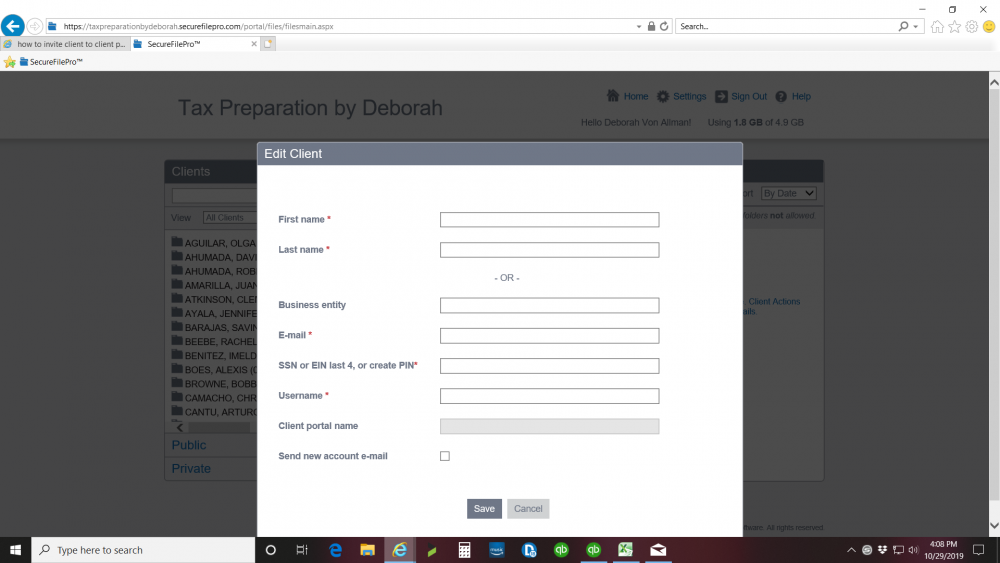

how to invite client to client portal in drake

Tax Prep by Deb replied to schirallicpa's topic in Drake

Under edit client there should be a box to check to send an email invitation. The screen shot is if starting with new client, but after selecting your client there should be an edit button which will open up and you can look for the box to invite. -

rejected by processing center, but no rejection status

Tax Prep by Deb replied to schirallicpa's topic in E-File

I didn't use ATX this year but if memory serves me correctly, you log into your ATX account go the e-file section search for the e-file you are having trouble with, then on that screen there should be a selection that says rehang ack. Sync won't do it, you have to ask for a rehang, wait a bit then ask you program to request acknowledgments. Hope this helps! -

I have been working with Splashtop and have not had any problems other than display settings. My main computer is a 24" monitor and my laptop is 15#. My log on screen is very small (more of an annoyance than anything) and the tool bar is so small I can barely see it. I thought about calling in to see if a setting might make a difference. Performance wise I have had 0 issues. I had disconnection issues a lot with GoToMyPC but I'm sure it had to do with my clients internet service. For the price difference I am very happy with Splashtop.

-

I have had this same situation and never ran into a problem with the e-file. Just put the info in the way it should be.

-

You will need to have Drake accounting to do payroll. This is the one area I think ATX is better in, but it works for me . Drake will be happy to answer your questions without being pushy. Just let them know what you would like to be able to do and they will tell you if their program will do it .

-

I actually downloaded the week trial and am playing with it. For the price difference I am going to change. I hate to call and try to get a cheaper price. If they truly want to keep me as a client, then they need to act like it. In all honesty I really don't see a lot of difference in terms of how I use the product. So it's good by for me!

-

I have been using GoToMyPC to remote into my desktop when away from my office. They are pricing themselves out of my budget and was wondering if anyone has used the built in remote access that comes with Windows 10? If so is it easy to set up or do I need my tech guy to set it up for me?

-

I would suggest either calling Drake (they are super friendly and will gladly answer any of you questions) or try to go to one of their sale seminars. That's what I did and they were able to answer all of my questions to my satisfaction. I signed up on the spot and have not looked back.

- 1 reply

-

- 1

-

-

The only time I called in had to do with uploading into their portal after I imported a return from my laptop. It didn't happen with every file but occasionally it gave me an error message. I contacted support, he tried a few things, couldn't figure it out, promised me he would look into it and call me back. A couple of weeks had passed, in the meantime I found a workaround, so no big deal. Then the phone rang and it was the same guy from Drake who called back with a fix. It didn't completely solve my problem, but he emailed me the fix and said if it happens again this was what I needed to do. So when it did, it saved me a whole lot of time and frustration because I already had the steps needed to get it to work. I am very pleased with the service. It reminds me of the good old days when ATX was small and cared. Had the same team stayed with ATX I would never have left. I would gladly have paid more for the program! With the current owner of ATX I feel they are only interested in the money, not me nor my time. Not so with Drake!

-

I've had a couple of these situations and we paper filed. One has been out of the picture my client doesn't even know where her husband is. The second ones husband was incarcerated and she no longer has contact with him. Both women let husband do everything do had no ss number.

-

It is a little different, everything gets entered into worksheets, but I found that within just a little while I was moving as fast if not faster than ATX. There was a few times I couldn't find where I needed to input something, but a quick google usually solved that problem. I was like you, very concerned about the difference, but with all the new changes to the tax return, I chose now to make the switch, and I am not disappointed at all. Also there are several users here on this board that are quick to respond for help! And should none of us be able to help, a quick call to Drake will get you up and going. The support is fantastic, geared to our busy schedules.

-

One of the reasons I left and went to Drake. Also what was once included in the price of the package is now being pieced out (payroll module) and I think what really nailed it for me was the last time I renewed I was given a very special gift, the previous years books for which I threw away because I had already received them when I renewed the previous year. I was once a fan and defended the company, but I am so glad I left and went with Drake. I know exactly what to expect to pay from year to year.

-

I know many have great success with HP, but I have had nothing but problems with them so much so I don't even look at them. On the other hand I have worked with many Dell's both my own and with clients and have 0 problems. Just ordered my laptop, hope it is as good as the one it's replacing.

-

With the exception of two HP computers (for which I will never go back to HP), I have always used Dells, both desktop and laptops. I am currently looking at Dell for a new laptop as mine is over 7 years old with Window 7 in it and I will have to upgrade in January due to 7 not being supported any longer. I can not say enough good about Dell. My desktop is 2 years old and I have to say that the only problem I have had was due to a software conflict. I had encrypted my hard drive using Symantec and Windows 10 did not like it on the larger updates. The problem got so bad that Symantec or Windows locked me out of my own computer. I spent tons of money to get my computer back up and running, only to find out by researching that the problem was with Symantec's. Windows 10 pro has it's own encryption and that seems to have solved my problems. Like I mentioned, I am currently looking to replace my laptop, and I won't consider anything but a Dell. If you can find the configuration that you are looking for at Costco or even Sam's Club, they have the best return policy around. Mine however can not be found there so I am going to order directly from Dell, which I have also done in the past without any problems. Hope this helps. Deb

-

Have any of you had problems with client sending the payment with the amended return only to have it refunded later because they have nothing to pin it to? Then get a bill for the amount due when they finally get around to posting the amended return? These has happened several times for me, so much so that I don't have client send in the payment but rather have them wait till they get the bill. I have even had a couple where the amended return shows a refund and instead my client got a bill. Back when IRS would actually talk to you we were able to get it straightened out when the agent saw that a number had been dropped when they keyed in the amended information. They made the correction on the spot and client did receive his refund. Close to two years ago I did an amended were the client owed a little over 300. Because of my past problems I suggested not sending in a payment and a few weeks later he received a refund check of over 6,000. To this day we still have a descrepency, but I believe the client is going to pay just to get them off his back. What a mess! And the sad thing is the clients sometimes think it's on our end, but I rechecked everything and I was right, but again I believe a miss keyed figure was the blame.

-

Shopping for Drake? - member testimonials and comments

Tax Prep by Deb replied to jklcpa's topic in Drake

Totally agree! I did attend one of their presentations and was totally impressed! I had previously obtain a trial version of the software and didn't like it much, but after attending the presentation and having the ability to ask questions and see live demonstrations I was sold! -

Shopping for Drake? - member testimonials and comments

Tax Prep by Deb replied to jklcpa's topic in Drake

Policy is the same. -

First year Drake user and even when ATX offered me a terrific deal I will not go back until Drake gives me a reason to! I just don't see that happening. Their support cannot be beat, their product performs for all my needs, and their price is something I can afford!

-

Yes. What little problems I did have I was able to post on the Drake forum here on this community and was helped. The only real problem I had was with a client who had multiple rentals and for some reason ATX had empty spaces (Numbering of the properties), but all I had to do was reassign the proper for number and everything worked ok. I won't kid you, there is a learning curve but I found Drakes knowledge base very helpful. The one problem I did have was in using the portal that is available. I had a small issue with files that were restored from my laptop not wanting to go into the working portal, they wanted to go into what is called an archive portal. But I called Drake (spoke to a live person within 3 rings) who tried to figure it out. He promised a call back and about a week later he did call with a fix. Very impressed with the program and customer services! Plan on early renew which I haven't done with ATX since 2012.

-

I wasn't keen on learning a new program either, but decided to jump boat this year because I could see the pricing was getting out of hand. I went to Drake and will save quite a bit of money over ATX. The learning curve was much easier than shelling out more dough!

-

Thank You, I will give it a try.