-

Posts

7,674 -

Joined

-

Last visited

-

Days Won

497

Everything posted by Catherine

-

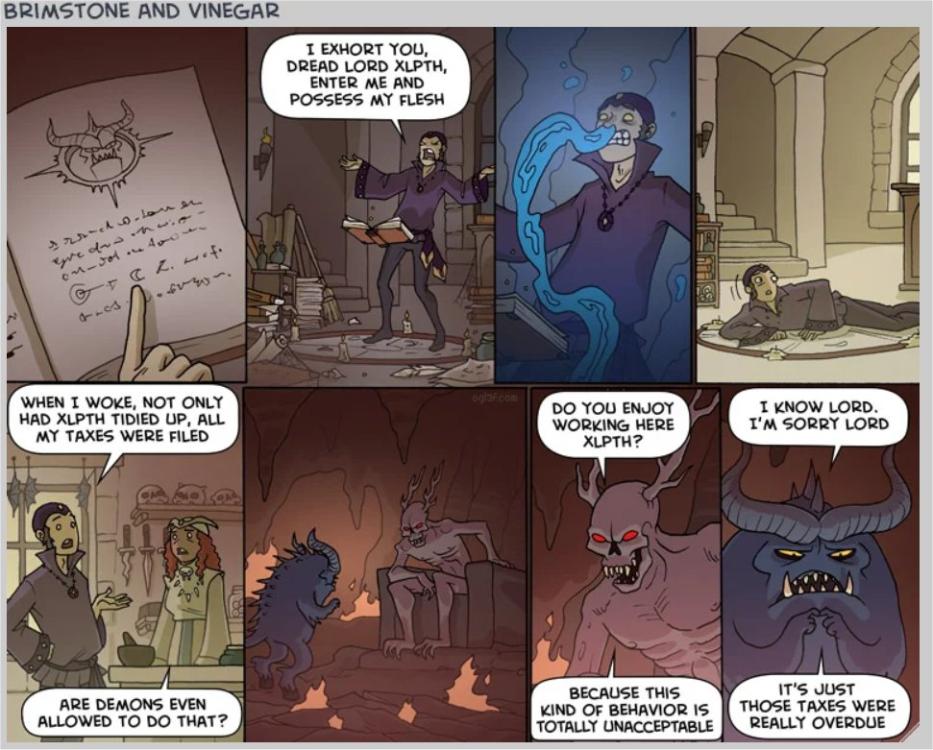

NT: two-minute break for career choice comedy

Catherine replied to Catherine's topic in General Chat

Actuaries are the math people without the personality to be economists. Or even undertakers! -

What to do? Estate income tax returns, lots of pieces remain to be tidied up before the thing shuts down. The estate expenses were used on the MA state estate tax form as deductions, but there was no federal estate tax. Is there any reason I cannot take these expenses at the federal level for the estate income return? I could see that using the estate expenses on the state's estate income tax form might be considered double-dipping on the expenses, but even then to pay income tax on income that was properly used to pay estate expenses seems odd as well. Had those expenses been paid out before the estate return was filed, I'd have taken them without blinking. Am I over-thinking this? (Yes, I am over-thinking this, and have over-thunked myself into complete confusion!) I've been all over the MassDOR (useless piece of garbage) site and found nothing germane.

-

Many thanks to all of you!

-

Yup, and I'm going to make sure I have the last non-subscription version and then turn off all updates. If need be, I'll move to Medlin Accounting or even green ledger sheets. If I have to pay monthly for access to my own data, it's not mine. Ain't happenin' but that's me. You decide what's best for you.

-

That's the issue. All I see on the CA itemized deduction screen is unreimbursed impairment-related work expenses. These are not for an impairment, just remote work.

-

Client worked in LA for a good part of the year and made a point of sending me a flyer from Robert Half about a deduction in California for office in home expenses for W2 employees (that can no longer be deducted on federal taxes). Well, I'm looking at the CA data entry items and bless me if I can find any place where this might go. If someone can point me to what CA form it ends up on, perhaps I can find where to enter the information. I'd appreciate that. ATX entry screens won't help, 'cuz I use Drake now. Thanks!

-

I'm sticking with the desktop version and never moving to the subscription model. I'll go back to green ledger paper first.

-

I ended up making my favorite apple cake with walnuts. Didn't feel like making pastry for pie crust. It's yummy.

-

We come into the mix at about 45 seconds, but watch the whole two minutes.

- 4 replies

-

- 10

-

-

-

-

- 7

-

-

-

I copied the wrong link; this was the video I meant to include. Sorry!

-

And have an anti-pi rant.

-

Apple with walnuts, topped with whipped cream, please.

-

Basis for this lot - you can't make this stuff up

Catherine replied to RitaB's topic in General Chat

And if Ann shows up wanting to become a client, you tell her you're not taking new clients at this time. Then lock the door when she leaves! -

IRS owes preparers partial refunds of PTIN fees!

Catherine replied to TaxCPANY's topic in General Chat

We'll each get back thirty-five cents per year involved. Reportable as income. Pardon me for not holding my breath. -

Yes, the rental-only expenses (cleaning, management or VRBO fees, and the like) do not need to be pro-rated. And you have the depreciation recapture rules correct as well.

-

Yes they should re-register in the new state, but until they do, they may well owe a partnership return to the old state.

-

Good luck!

-

Abby was the first one I thought of, but that doesn't mean he's taking new clients. Maybe I'll DM him; thanks for the nudge, @Yardley CPA.

-

I won't do the FBAR filing anymore; preparer penalties are too high. All I'll do is given the fincen site for online filing. Of course, I also make sure no totals are high enough to warrant the 8938, and I include any foreign interest on Sch B and other foreign income on whatever form or schedule is appropriate. Were I to do one for a client, minimum would be $150 and maybe more like $200, even for a "simple" FBAR, considering I'm opening myself up to penalties if the info the client gives me is wrong (let alone if I make a mistake).

-

An old college friend of my husband is looking for tax help in their area. Spouse who handled it all has some health issues and it's now too much. I do not know for sure but there may be prior year unfiled returns for a year or two. Please drop me a message if you are in generally the right area of Maryland and can take on a new client.

-

Sounds like a good candidate for firing.

-

I thought that Drake (my software) has a choice for "Frist Amended/superceded return" and thought it was both cool and about time.

-

Fortunately in this case, the EIC is not an issue.

-

Thanks, @Slippery Pencil. It's what makes sense - which immediately made me second-guess myself, because "making sense" and tax rules are frequently incompatible.