NECPA in NEBRASKA

Donors-

Posts

1,540 -

Joined

-

Last visited

-

Days Won

19

Everything posted by NECPA in NEBRASKA

-

Need confirmation on California Income Taxes

NECPA in NEBRASKA replied to NECPA in NEBRASKA's topic in General Chat

Thanks, Tom. I guess we will be prepared for whatever shows up on the W2. He has heard both answers from other pilots. -

Need confirmation on California Income Taxes

NECPA in NEBRASKA replied to NECPA in NEBRASKA's topic in General Chat

Lion, If my reading about the Railway Labor Improvement Act is correct, his tax home should not be CA. It all depends on how much of his flight time is spent in CA air space. He is expecting much longer flights, but air travel is unpredictable these days. I am hoping not to strain my brain for CA returns, since I have not prepared one for at least 10 years. I know that there are tax preparers that specialize in transportation clients, so when or if the rules change, they can pay to get their taxes done. -

Need confirmation on California Income Taxes

NECPA in NEBRASKA replied to NECPA in NEBRASKA's topic in General Chat

Thanks, Tom. I will have to wrap my brain around unreimbursed employee expenses again. -

Need confirmation on California Income Taxes

NECPA in NEBRASKA replied to NECPA in NEBRASKA's topic in General Chat

I don't think that it is the same because they are transportation workers. I was hoping that California tax preparers would know if my research was correct. He says that most of his flying would be long distances and not inside of California. He expects his income inside of California to be less than 50% of his total. -

My son will be commuting to LAX as a pilot, but lives in Colorado. He will just be staying in a hotel when necessary. He will not be signing a lease on a crash pad. He told me yesterday that he was told that he will have to pay California income taxes, so that I had better learn the rules. He has flown in and out of California before, but this time it will be his base with the new airline until October. I have been doing some research and I think that he should fall under the transportation worker rules and file in his home state. Am I looking this up incorrectly or has something changed? Thanks, Bonnie

-

I rarely see any 1099S with any of our home sales in Nebraska or Iowa, but I don't have any clients with super expensive houses.

-

I spent way too much time re-creating "expired" efiles.

NECPA in NEBRASKA replied to schirallicpa's topic in General Chat

I always create the e-file before I get a signature to check for errors. I recreate it if it is signed later to make sure that there were not any form updates. -

Cbslee, No I am not preparing the return until they get an answer from the attorney and I have proof that they are a C corporation or I get a K1. The sibling that is in charge of making these decisions is not my client.

-

The property would not be used for vacation, as it is local farm land. They were told that they could go to Florida or wherever and deduct the vacations as board meetings. I only questioned this, because I was looking for a K-1 or the normal share of income from somewhere. The client believes that there is no income tax involved at all and no return needed. I am pretty sure that the attorney and the taxpayers are both confused about taxes. I am only preparing my client's 1040 and will not be taking on the additional taxes. Thank you, Bonnie

-

I have seen LLCs taxed as S corporations or partnerships, but today I was told that an attorney told my client and siblings to put their family farm rental into an LLC that would pay all of the taxes and they would not have to pay anything. In fact, they can all go on family vacations and call it a board meeting! This guy is way more popular than I am, because I asked questions when I did not received the normal rental income and expenses from my client. I have never seen a family farm rolled into a "C" Corp. It is only land and worth about $250K today. Does anyone know if this is something new and I am just slow? Be nice, I know that I'm a little slower to pick up new stuff. Thanks!

-

I have one of those, too. I love her, but it's such a freaking pain.

-

I have been trying to read up on this. I am on a FB group that says that we should be checking this method out for every married couple that meets the income requirements. MFS is rarely a great idea in Nebraska, so there are a lot of moving parts to check. It does not seem correct for each parent to get the credit, but apparently Congress didn't know exactly what they were passing. What a surprise!

-

Please don't rub it in! I still have 8 more clients left. Nebraska changed their unemployent website and it's been a PITA. They have extended the payment and filing deadline to 2/28 because of the headaches.

-

Judy, I was just doing research that included what had been done in other cost segregation studies. An ex board member thought that it was an improvement, so I wanted to cover all of my bases. He isn't in the business of doing accounting or construction, but I still wanted to listen and bounce it off of my back office. ( All of you wonderful people) I would lose my mind without all of you.

-

There was a board meeting last night and they decided that it may be a repair, because it was started with a leaky valve in the bathroom and then pipes started to fail out to the street. The whole place will be falling apart, because it is an over 60 year old swimming pool. I will still keep researching, but it does not prolong the property's life for sure.

-

The bill was $8k for two valves and the building is fully depreciated, so it looks like depreciating is the only way.

-

I'm going to try a local shredding truck for a bunch of old boxes of files from the days before I scanned almost everything. My current shredder that I use just for day to day shredding takes forever to shred old papers and files because it only shreds about 10 pages at a time without stopping. It is a micro shredder and then we compost or burn the shred when it's full.

-

I decided that it must be 39 years, because it was an improvement bringing utilities to the building.Thanks everyone!

-

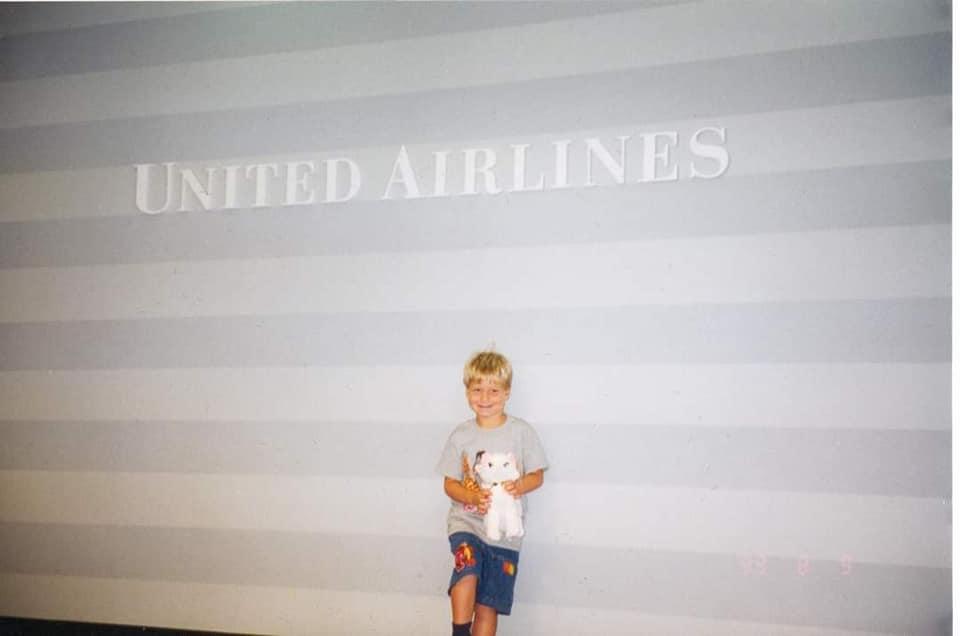

NT-Just a mom bragging about her son

NECPA in NEBRASKA replied to NECPA in NEBRASKA's topic in General Chat

That's great. It is very hard to stay current if you don't fly all of the time. Andrew is keeping his CFI current, because it's too hard to do it all over again. He does not fly private planes much anymore, but always has another good pilot with him. He says that it's way different than a jet and it's very easy to make mistakes. -

NT-Just a mom bragging about her son

NECPA in NEBRASKA replied to NECPA in NEBRASKA's topic in General Chat

Randall, his training was all civilian. He started flying very young and soloed on his 16th birthday, then got his certificates on his 17 and 18th birthdays. He received his Bachelors in Air Transport Administration from the Aviation Institute at UNO, because it was much cheaper to get his flight hours on his own, instead of through the University. I did not believe his first flight instructor when he had a plan to get him through, but it turns out that he was correct. He started instructing at 18, so he built a lot of hours over time. -

Andrew was hired by United and started training January 4. It was hard for him to leave SkyWest, but this has been his dream job since he was little. He will be flying 737s out of LAX until a spot opens in Denver. We are super happy for him. I am looking forward to more fun trips to places that I have never seen.

- 11 replies

-

- 16

-

-

-

I know that our meter is owned by the city, because they are coming to fix a gas leak outside my house before the meter on Thursday. They already replaced the meter. The gas and water company are the same utility here. I will have to check and find out who owns the pipes and shut offs at the street for my client. Thanks for the help.

-

Me too! I have been trying to stop taking new clients for a few years. I turned two down today that I knew, that's much harder than the random phone call. I just know that this tax season is not going to be much better than the last two. I had three more clients pass away this month and that always means more time needed for their returns and dealing with family. I will miss my clients when I retire, but I won't miss worrying about data security, the constant liability and new tax laws.

-

I was looking at a table for cost segregation studies and I an unsure if water line shutoffs at the street would be considered land improvements or building improvements, because it is carrying utilities to the building. It is definitely an upgrade and included having to cut the street. Thanks for any ideas. I have not run across this one before and the difference between 39 years and 15 years is fairly sizeable. Bonnie

-

Congratulations, Terry!