-

Posts

662 -

Joined

-

Last visited

-

Days Won

1

Everything posted by Eli

-

Yes! I definitely agree. Especially for those of us who work solo. Thank you!!

-

Gosh!! Thank you!!!!!

-

I'm pretty certain there's a form missing or I'm missing a click somewhere

-

-

Thank you for responding. I don't see any Non-resident nor part-year resident forms in the Mt state section in forms. I have 4 other states included & they all have those forms available.

-

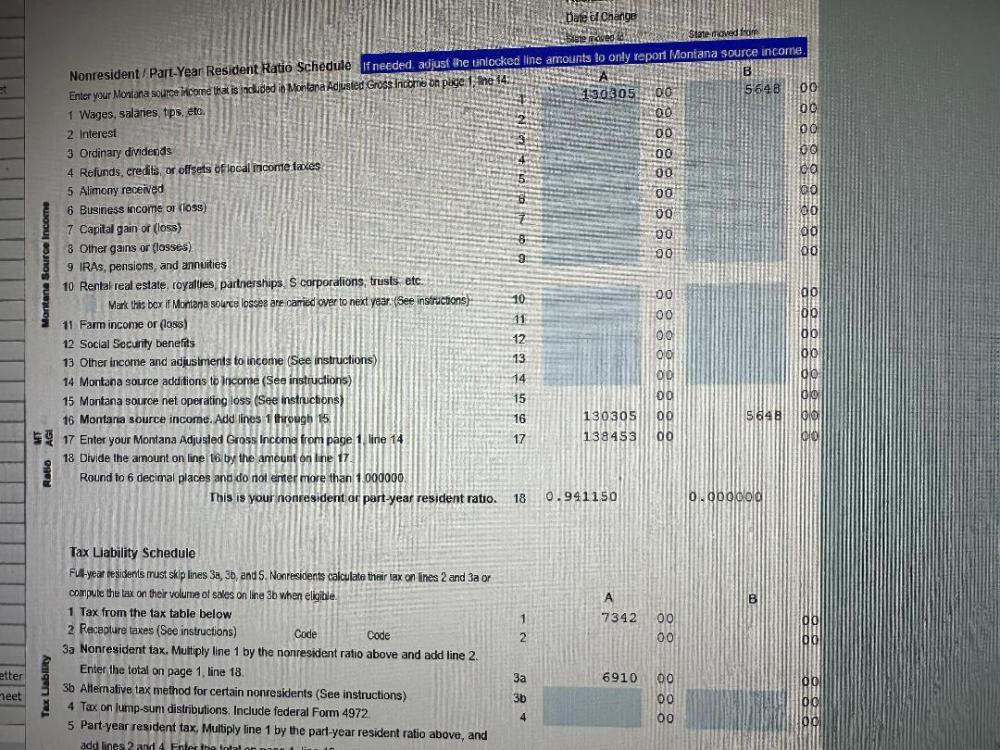

Good evening. I am trying to file a Montana Non-Resident state return. Taxpayer earned $5648 of his 130K in Mt. It says he owes $6100+ in taxes. I have already specified he earned the 5648 & has WH of $319. Anyone familiar with MT taxes? Thank you!

-

It seems this year is worse & lots slower. I may try it this coming weekend. If it doesn't work after that I guess I'll have to contact tech support.

-

I don't see an ATX config file. Sorry a bit short on the tech savvy

-

Good afternoon all! I have a return that includes Georgia & South Carolina. I cannot seem to find how to credit the SC tax on the Georgia return. I'm pretty sure I am missing a check mark somewhere. Any ideas? Thank you! Eli

-

I am having trouble with AZ 140 dependents field. The parents are automatically sent to page 3 & no deduction is being allowed for them. Any ideas? Thanks!! Eli

-

Looking to go to the Dallas forum. It's a good 8 hr drive or a 90 min flight from where I live. Hopefully meet up with Bulldog Tom! Eli

-

Ha! Ha!

-

Anyone else still have Jan clients waiting for refunds?

Eli replied to BulldogTom's topic in General Chat

I have one from February 4 & one from February 14th, I have two that were accepted Feb 5 & have not issued refunds yet. I've called for both & all they will will tell me is that they are being checked. I ask why there hasn't been any correspondence with the taxpayer & their rely is that the don't need any further info. If that's the case, then why can't they just issue the refund? Eli -

Congratulations!! At 83 years young, my mom has about 115 grand, great & great great grandchildren. She still gets excited each time she hears a new one is on the way

-

Well said, Terry!! Glad to hear you have had a great season. Eli

-

Happy Birthday, KC!! God bless

-

Can it really be true???? 12.13 an answer to prayers?

Eli replied to Ray in Ohio's topic in General Chat

I didn't notice any difference. At least it hasn't messed it up any either Eli -

Wow! Good to hear from you, Kerry!! Hope you & your family are doing well. It's been a while since we had seen you on here. I'm sure your kids are growing like weeds Take care & don't be a stranger. Eli

-

Thank you, Maribeth Eli

-

Working on a couple's return. He has 5 K-1's. On one of them there is foreign income, but it says 'other countries'. When I do an error check, it says: If there is an amount on line 3b for other deductions, the line 3b 'Statement for Other Deductions related to Gross Foreign Income must be filled out. Any help where I can find the info that goes on there? Thanks! Eli

-

If you ever want to take credit cards, Square is pretty simple & just charges a per transaction % fee. I've used it a few times this year. Eli

-

Yes, some previous year returns can be e-filed. Update your previous year program. Eli

-

I've got 487 e-files with hardly any problems. I'm using a custom built computer utilizing Windows 7 Ultimate, an AMD Phenom II x4 940 3.00 Ghz processor, 8Gb ram, & 64 bit operating system. Eli

-

She was ALMOST a model client Eli