-

Posts

374 -

Joined

-

Last visited

-

Days Won

1

Everything posted by gfizer

-

I have a similar issue but different. My husband is a minister so I'm pretty well versed in tax returns for ministers. I have a new client who is a minister. His pay was properly allocated between salary and housing allowance. The church wants to give him a 1099NEC but the proper way to report the income is on a W2 so that the salary portion can be shown in Box 1 and the Housing Allowance portion can be shown in Box 14. My question is can the church furnish a W2 when they haven't filed any 941 returns during the year? The 941 forms would've been informational only because there was no federal income tax withholding and the wages weren't subject to social security or medicare withholding. Thoughts?

-

I have filed prior year 990-PF's before so I don't think it will be a problem. I certainly hope there's no issue since those are accepted by electronic filing only. They will (eventually) return anything you try to paper file. This I know from past experience.

-

I spoke with a rep yesterday. It sounds great. I have clients who sometimes get letters that take up my time and energy in the off season. They are often wrong but as you said still require a response. The rep said that I could opt to act as a middle man between them and my client or I could simply say, “I have a team of EA’s and CPA’s working with me who will handle the matter.” If I wanted to be completely hands off. I would probably opt to stay involved in the process but still it would be nice to have someone else to deal with the IRS. Also the $2500 return preparer error benefit was attractive. I’ve only had to cover minor penalties a couple of times in my 36 years but you never know.

-

Does anyone have any experience with protection plus? Seriously considering the firm level coverage but wanted to reach out and see if anyone has actually had any experience using them to resolve client issues and if so was the experience good, bad or ugly? Thanks!

-

Just received an email from my insurance agent stating that their tax preparers E&O insurance program is being discontinued. I am a small firm with only 1 employee. Any suggestions as to where I should look for reasonable coverage? Thanks!

-

I had a similar situation a few years ago with a client who received a notice saying she had received 16300 in royalties that weren't reported on her tax return. The 1099MISC showed $163.00. I simply wrote a letter and attached a copy of the 1099MISC and the IRS corrected it.

-

I have a client who is a self-employed heavy equipment operator. He is resident of Kentucky. He has been contracted to do a job in Hudson, NY. He expects the job will take him approximately two months to complete. Is he going to have a New York tax liability and/or filing requirement for 2022? Thanks!

-

Yes they are considered timely filed as long as they are not rejected by EFC

-

We have a large Amish community in our area. They have never taken the EITC or refundable child tax credit and returned all the stimulus money. They would however allow the non-refundable child tax credit to offset tax liability. This year many of them received the monthly advanced child tax credit. Some opted out after the first payment but many of them just simply didn't cash the checks. Now it's time to file their tax returns and some of them are owing because they've already received the advanced checks which are sitting uncashed or in some cases have been returned or destroyed. Still others are showing they are due a refund because now all of the CTC is refundable if it exceeds their liability. Has anyone else dealt with these issues and how are you handling it? I will try to get the ones that have held checks to cash them to apply toward their tax liability but as far as refunds go, do I override the amount of advanced credit received to make it zero out so they are only taking the credit up to the amount of the tax liability or let the refunds come in and have them return the checks to the IRS?

-

It would have to be repaid unless your client qualifies for repayment protection. From IRS FAQ: "A5. You qualify for full repayment protection and won’t need to repay any excess amount of your advance Child Tax Credit payments if your main home was in the United States for more than half of 2021 and your modified adjusted gross income (AGI) for 2021 is at or below the following amount based on the filing status on your 2021 tax return: $60,000 if you are married and filing a joint return or if filing as a qualifying widow or widower; $50,000 if you are filing as head of household; and $40,000 if you are a single filer or are married and filing a separate return. Your repayment protection may be limited if your modified AGI exceeds these amounts or your main home was not in the United States for more than half of 2021."

-

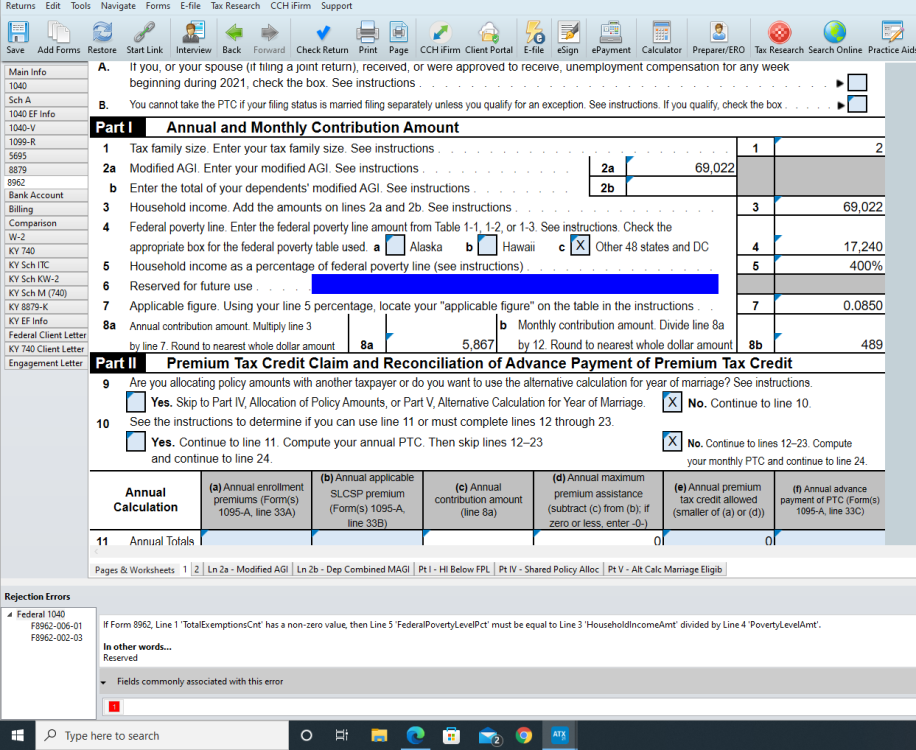

E-filed return with Form 8962. Modified AGI puts them right at the 400% poverty line (works out to 400.35962877% if you do the math - but ATX rounds down to 400%). E-file rejected by IRS with a code that says "If Form 8962 Line 1 "Total Exemptions Count" has a non-zero value, then Line 5 "Federal Poverty Level Percent" must be equal to Line 3 "Household Income Amount" divided by Line 4 "Poverty Level Amount". I've attached a screenshot of the form so you can see the actual figures. Any idea how to resolve this or do I just need to paper file the return?

-

My son married in July. His wife was claimed as a dependent on her mother's 2020 tax return and her mother received the $1400 EIP3 for her as a dependent. Now that they are married they will file jointly for 2021. Am I correct in saying they are eligible to claim the recovery rebate credit to get the $1400 for her even though technically her mother already got her EIP3 payment? The FAQ's on the IRS website seems to indicate so but I just want to be sure I am interpreting this correctly. IRS FAQ - "Dependents: I didn't receive the Economic Impact Payment because I was claimed as a dependent on someone else's 2020 return. Can I claim the Recovery Rebate Credit if I'm not a dependent in 2021? A9. Maybe. If you were claimed as a dependent on someone else’s tax return for 2020, you were not eligible for the third Economic Impact Payment. If no one can claim you as a dependent for 2021 and you are otherwise eligible, you can claim the 2021 Recovery Rebate Credit on your 2021 tax return."

-

Word of caution on at least some newer HP laser printers....I have an HP LaserJet MFP425 that is an absolute workhorse and I dearly love it. I can get generic toner online from Amazon very cheap (4 high yield cartridges for around $50). I needed a new printer for another computer in my office so I decided to move the current printer to that computer and upgrade to what I believed to be a newer model of the same printer - it's a MFP428. Mistake! I love the printer and it works great but the toner cartridges have a proprietary chip which so far I have had very little success in bypassing. I've had to buy OEM cartridges for it and the high yield cartridge is about $200! Needless to say, it's been moved to a location that sees very little use. I was able to purchase a lightly used Lexmark xm3150 which is a commercial all in one for little of nothing from a local business machines supplier and so far it's working out great.

-

I am working on finishing up extensions and just noticed on current return I am working on that the unemployment exclusion that was automatically populating as a negative figure on Form 1040, Schedule 1, Line 8 is no longer automatically populating. I had to manually enter the negative number. Anyone else noticed this?

-

Trust & Tax-Exempt Experts: Use Form 990-PF or 1041?

gfizer replied to gfizer's topic in General Chat

After speaking with the attorney and reviewing the trust documents with the trustee, we determined that the trust did qualify to be taxed as a 4947(a)(1) non-exempt charitable trust. I looked through my file and it looks as though I simply filed the 990-PF for 2008 marked as an "initial return." I can't find that I did anything else to make the switch. The trustee never received any correspondence from the the IRS and we've been filing the 990-PF ever since. That being said, I'm not sure if or how that would work today. When my situation occurred we were still filing the 990 series on paper. Now that those forms are required to be filed electronically you might (and I expect you would) get a reject code showing that the entity type doesn't match the entity type listed on the EIN application when you try to electronically file the return. I wish I could be of more help. Good luck. -

I have a retired client who decided it would be a good idea to withdraw $70k from his 401k to purchase a new pickup truck. He received advance premium tax credit payments amounting to almost $10k. The additional retirement income throws him over the 400% threshold. Is it really true that he won't need to repay the $10k thanks to the cares act? Seems too good to be true.

-

Paypal allows you to send and receive payments for goods and services which are subject to Paypal fees and payments from friends and family which are NOT subject to Paypal fees. Both types of payments are reported on 1099K if they meet the IRS thresholds. That being said, I would be surprised if it were questioned by the IRS. Venmo and cashapp are also popular in my area.

-

Yeah. Kentucky used to have separate returns for general partnerships, LLC partnerships, corporations, and s corporations but decided this year to consolidate them all into this PTE form. It should've been named the PITA in my humble opinion.

-

The LLC will have to file an extension and remit the Limited Liability Entity Tax on KY Form 41A720SL. The partners will also have to file individual extensions if they are required to file in KY. The PTE form is new this year and looks worse than it is. It is due on May 17th this year (Kentucky doesn't use the March 15 deadline like the Feds).

-

No local return required if all you're dealing with is local income tax withholding on a W2.

-

Enter as interest on 1099-int worksheet

-

Just received this response to an email I sent to KY DOR yesterday. I think I will go ahead and make the adjustment as an addition back to AGI on Schedule M and turn loose of the ones I've been holding on to. The natives are getting restless. "RE: Income Taxes Inbox DOR WEB Response Individual Income Tax <[email protected]> 9:40 AM (8 minutes ago) to me Kentucky has not adopted legislation at this time for the $10,200 of unemployment not being taxed. If that legislation is passed, it will be posted on our website. As of now the income will need to be added to your Kentucky return as taxable on the SCH M. Thank you. XXXXXXXXX XXXXX, Section Supervisor Department of Revenue, Office of Income Taxation