Medlin Software, Dennis

Donors-

Posts

1,813 -

Joined

-

Last visited

-

Days Won

83

Everything posted by Medlin Software, Dennis

-

Changing Internet Providers - email issues?

Medlin Software, Dennis replied to BulldogTom's topic in General Chat

For outgoing mail, it is arguably more reliable (to actually get delivered at all, and not marked spam) to use your ISP's SMTP (outgoing server). In your email setup (your email software/app), you can set the "from" and "reply to" addresses to whatever you wish. Recipients can disseminate how the mail reached them, via the headers of the message, but few care or do. It used to be sending through gmail was very reliable, but it is less so now, for external accounts, as there are some who have implemented too strict filtering (such as an online spam filter, speaking specifically of a certain fraternal group who uses one, and whose lodges have no idea how to see mail marked as spam). -

Client received a check in her name and her ex's name

Medlin Software, Dennis replied to BobH's topic in COVID-19

If the intent is to cash the check and divide the cash, this may be a case where a check cashing storefront may work. -

I'll bite. Does the mother owe, if the dependency is not allowed? Given the speed of the aid processes, there may be no, or at least not yet, undo process for this case. If you can delay filing, you could inquire for a ruling, or seek more specifics, and also prepare the mother for filing without the dependent. I probably would not return the check with a mailed return, as there is likely no formal process for the return of the check with a tax return filing. Sometimes (usually?) kids do things to become adults, even if it makes no financial sense...

-

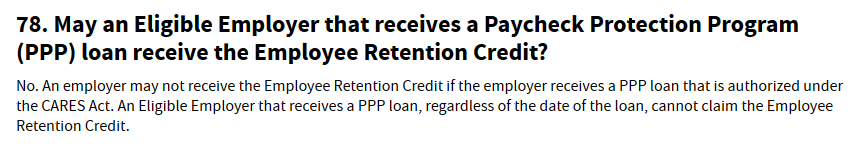

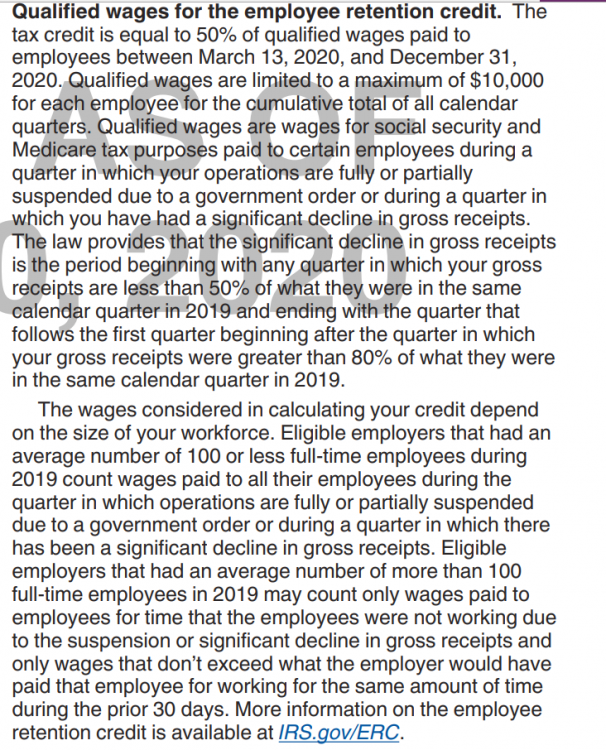

As far as I can tell, the allowed (or some might say, not prohibited) "maximizing" strategies (beyond timing of payroll "paid"): Employer retirement contributions. Unclear as to whether 8/52 (or whatever the time frame ends up being) calculation will do (incurred). Unless there is a contractual contribution in place, could be hard to prove incurred. Most suggest actual deposits (paid), even if not normally paid during the magic time. SEP IRA may be an option for some (not likely for owner employees), as the deposits are discretionary, as long as the same formula is used for all eligible employees. Additional payroll. Nothing prevents adding employees/increasing employee payroll (within the limits of 100k per employee as being counted). Rehire bonus. Likely a legitimate strategy, especially if an existing employee hints they want to stay on the dole instead of working. Might be better than the hammer of reporting the refusal, causing their UI eligibility to end, assuming the employer wants that type of person back. Non veteran WOTC eligible employees. Non veteran WOTC employee credit may be allowed even for the same wages were used for PPP, or maybe for wages other than the amount for PPP. Tough to say, as the end result will not be known until the actual company tax return is done, and what the forms have on them at that time. But, since the 941 expressly deals with and prevents the special veteran type of WOTC credit "and" has no mention of the other WOTC types, this may slip through. --- I stlil suspect the 56 days will be lengthened, because of the press regarding restaurants and others who have yet to reopen. But, until then, or in case the current rules are the final rules, the above could be useful.

-

Current drafts: https://www.irs.gov/pub/irs-dft/f941--dft.pdf https://www.irs.gov/pub/irs-dft/i941--dft.pdf

-

Without knowing the experience and knowledge of the likely low level staffer doing the review, "paid" items will be more likely to not cause issues. Also less documentation, compared to possibly providing time card type documentation, and some sort of documentation showing current pay rate for the incurred but unpaid time. I believe the bank only has to do reasonable review, and is insulated from any non obvious fraud, so they have no incentive to use their best for this process. (Same as WC field auditors, at least for me, are almost always new hires...) If the employer is paying every week or every other week, they could (at least with the current rules) adjust their covered period for the payroll expenses, to better align with the pay periods, but that could mean some loss of covered expenses at the front end of the period (where the "paid" aspect could benefit, by including at least some data before the covered period, but paid during). Could all end up moot, as the negotiation for more changes finishes up. Many expect more than 56 days to be allowed, and possibly more leeway in setting the covered period.

-

As was thought before, there is still nothing prohibiting an increase in employees or payroll expenses (over the application numbers). Some businesses may have had a need to add payroll. (Not suggesting no show positions for wife, kids, relatives, but real employees performing real work.) Some businesses may need to, such as to encourage retention, add employer paid retirement or other benefits. -- One example I was asked about is employer contributions to SEP IRA. Typically, for this person, the amount is determined and contributed at end of year. I can see nothing which prevents calculating an "incurred" amount, say based on an average of the last few year's annual amounts, or preventing making an actual contribution to count as a "paid" expense. I would go with "paid", as the current forgiveness app, Sch A, used the term paid for Line 7, even though the place the Sch A figures go to are for incurred expenses and paid expenses. Paid will be easier to document for the low level staffer at the lender bank... With trying to use "paid" as the more desirable method, I can see many doing an out of cycle payroll on their day 56, and paying incurred costs on day 56.

-

Despite gloom and doom, there are still billions left. The "hint" is the loan process will be tweaked or some statements made, to try to get than amount used. A "hint" for forgiveness is the 56 days will possibly lengthened, to accommodate businesses that have been unable to reopen yet, or to allow businesses to pick, within some parameters, their 56 day window (which would only be a very slight tweak). I suspect some sort of "these really are" final rules are made public this week. Many have already finishes their 56 days are are left wondering. The usual example is a restaurant which has been unable to reopen, and has already funded. Many were considering returning their loan today, which is something that should not happen.

-

SBA is supposed to release forgiveness information today. Have not looked yet. The ethical part is interesting, and something I fought with. Business is to profit, and to survive. There is still so much uncertainty, no business can logically say they will have no need at some point. (Noting, there is no "current" qualifier for the PPP.) If it turns out the amount was not needed, it can be used in the community, or in some other way to help others. The trend of states trying to shift medical liability to employer's WC policies is a HUGE potential burden on all employers, as it is a shared pool of sorts... Same with UI, we are all going to pay for the current UI boom, and will also have to make up for the UI costs of failed businesses or any new who get away with UI dumping). What is done with the profit is the ethical aspect, not making the profit. if that seems logical, then a business not taking advantage of all aid, sales, discounts, etc., is foolish at best. A business which may have made it without aid could choose to give pay increases, add benefits, whatever they wish. The business could donate their new found savings to a local charity in need, food banks are in a bad way at present. Those running a corporation have fiduciary liabilities, failing to take available aid could be an actionable personal liability. A fair comparison is how many returned their stimulus payment to Uncle Sam? Not likely many at all. Those who did not need the funds may even have donated their stimulus amount, or maybe just spent it locally. As of a day or two ago, roughly half of the second wave of PPP funding is STILL AVAILABLE. Given that a second round was funded, all who properly apply have a realistic chance of being funded, either with current funds, or more rounds of funding. I saw one article which stated a large number of applications (I don't think it was 50%, maybe 30 to 40%?) were declined because of documentation issues. It does not appear anyone who properly applied early on has not received funding by now. Applications are still being encouraged and rejected.

-

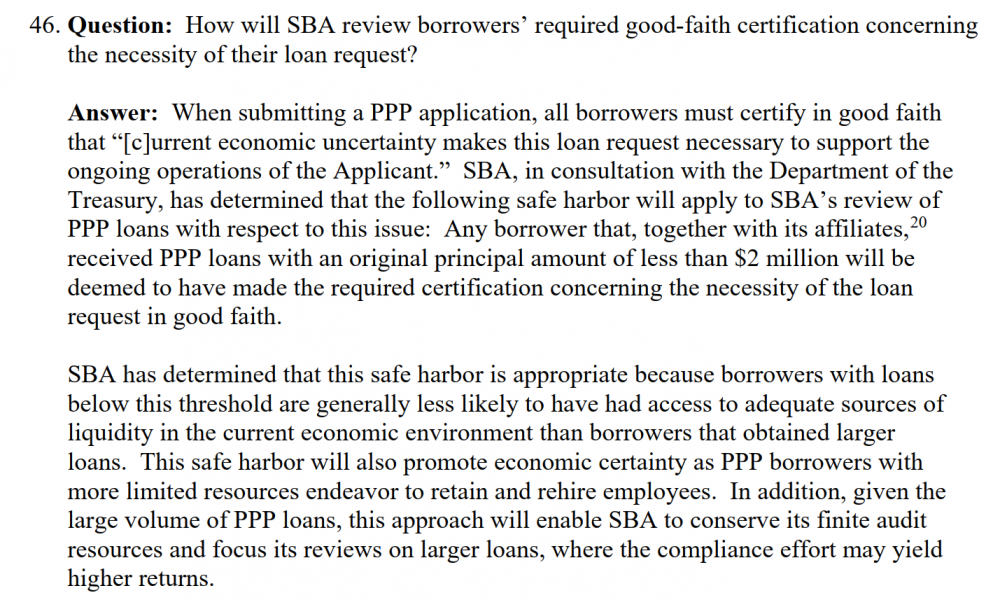

Some think yes, some think no. One issue is whether or not it is considered a state or local tax, and that some states have the employees at least partially pay. Another issue is the timing of the WC premium payments, and whether or not they fall within the forgiveness guidelines (as of yet unpublished - have not checked today). As for application, anyone asking for under 2 million, is presumed to be necessary, so the intent was, and now is, to get money to all businesses who properly qualify. Clearly, that makes it foolish (at best) for all who meet the numbers requirements not to apply...

-

Just reminded of the new WC rules, presumptive WC eligibility for employees with COVID (at least 8 states so far). For CA, the employer has a high, if not impossible burden, to prove COVID was caught away from work. Another cost necessary for employer planning due to COVID, if not from claims against own policy (experience rating adjustments), there could well be a price increase going forward for all in "presumptive" states.

-

Just received and replied to a nastygram from a customer who feels PPP should be for those who would close without it. I can see their point, but that seems to not be the point of the PPP program, stated anywhere, or shown in the application (Apr 3). The PPP app (Apr 3) stated there "is" economic uncertainty. The employer does not have to prove any such uncertainty in their own case. The employer has to agree to use the funds to "support ongoing operations". Nothing about only if people would be laid off, or a business drop. The funds must be used to "retain workers and maintain payroll", and for other allowed items. Nothing about using the funds to "prevent" loss of workers or payroll reductions... So far, the only fraud items I have noticed are the couple of dolts who were arrested for not having employees at all. I concede, some businesses may end up not in pain because of COVID, and may even profit. But, the PPP process has no financial requirements as part of the application, nor is a statement of projected loss required. Legally, it is a good argument that all who manage a qualified corporation who cannot show taking a PPP would cause harm, breech their fiduciary duty if they pass on the PPP. (I expect those who were goaded in public can argue loss of goodwill, but many gave back their loan our of pure fear only, including mom and pop's.) Interesting discussion for certain, as it forces people to see the purpose of business is to profit. The morality comes in as to how much profit to seek, and what to do with those profits. --- Is there any scenario where a business, otherwise qualified, could not attest they want to maintain payroll (at the least)? If the answer is no (or very limited), then there is no (or very limited exceptions) otherwise qualified business who should not apply for a PPP. --- I am not special/diffenent than any other business, other than maybe unusually and brutally candid. Looked at the situation, applied, and was finally funded. I can easily live with my guesses as of Apr 3. I know there will be less income for several years. I would have had to skip a payroll or two. Instead, I did not have to skip payroll, and because I "can" live without it, I will not go forward with a planned price increase for 2021, even though the PPP will not cover that "loss". I actually found it necessary to increase payroll for the short term, so I could devote the time needed to deal with the support issues and program changes caused by PPP, FFCRA, Retention Credit, etc. I struggled a short time with the morality. My personal issue was addressed as I could not find an appropriate reason not to apply. We are all going to pay, and there is no reason not to limit our costs to the best of our ability, at least under our current system. Self, family, employees, and customers deserve our best efforts.

-

If hesitant to apply for PPP, consider this. With restrictions being relaxed, there may well be a "bounce" in cases. Businesses who predicted a steady income during the crisis should consider the costs of having employees on FFCRA PTO. With employers having to front this cost (until their next 941, filing of a 7200, or possibly via lesser tax deposits), the potential of FFCRA PTO itself could be hardship enough to reasonably attest to a need for a PPP loan.

-

The next SBA "date" is the 15th, when the forgiveness guidelines/app/something is supposed to be published. At least, as of today, those who have not yet returned their funds out of fear, and those who were on the fence for applying, have a solid idea of the application process - even though the application process started Apr 3. While subject to further legislation, whatever comes out, assuming it does, on the 15th, will hopefully be reliable enough for the forgiveness aspect. Personally, I worry none about the bank/lender, since their only liability is to do the minimum of what the SBA requires. They are already "held harmless" and likely have already collected their fee. Those who were able to get approved early are likely in their last week, if not already done with their magic 8. In this case, being late to the party may be better.

-

Hard to grasp. One thing for certain, we all will pay in many forms. Thus, we all have a duty to ask for, accept, and use all possible aid we have access to, business and personal. The philosophical aspect in interesting to discuss. There is no free money. It all has to come from us. If we have access to funds we do not partake in, we pay at least twice.

-

The "next" proposed aid bill is out. 1800+ pages IIRC. Of course, it is from one party, so it could be a dud, or more likely, will be negotiated to "something". More stimulus payments. 24 weeks for PPP expenses. Extra $13 per hour for essential workers. 10k in student loan forgiveness. But wait, there's more! (many more items, my eyes are getting fuzzy). These are the first 4 which would effect me in one form or another. Another I think I caught was the PPP funds "returned" would be reserved for applicants with less than 10 employees.

-

Agreed 100%, normally. But the "bully" news about the repay if not necessary date, the unknown definition of "necessary", and of the forgiveness criteria makes this not normal. Even some who are clearly in need are hesitant to let anyone know they received the loan, and are considering payback because the likelihood of the list of loan recipients becoming public (and maybe a neighbor business complaining that they got something the neighbor failed to get). (Interestingly, I saw an opinion which is precedent for corps and the definition of "necessary", which if applicable, means all corps could easily claim "necessary".) Having the rules change after a legal loan app and legal loan acceptance are consummated is ridiculous. I am NOT saying I believe the new rules or suggestions are out of line, but the rules were the rules on April 3, and for the mom's and pop's, they should be able to rely on the documents in their hands, not some later news release that if other funds were readily available, they need to turn back their legal loan or face fines and jail. We went from "all should apply for the free money", to "you better really have a need or you are getting fines and maybe jail time". Remembering and documenting the need on April 3, or whatever the application date was, will be tougher 8 weeks after funding when the lender forgiveness app is due. Real questions I am getting (likely because there is no one source of information, and because my customers know I will reply). Am I keeping someone else from getting a loan as the news talked about? (Not likely, there are still funds available at the moment, applications are being accepted, and at least some of those who failed has application/documentation issues, which could have been corrected. Either way, your obligation to self, employees, and customers, is to remain viable.) Is there a fixed dollar criteria to prove my need? (No, you have to affirm whatever is on your application. How you affirm is up to you, although there are reasonable suggestions which can be followed.) What can be forgiven? (No one knows for certain. The only prudent course is to spend as normal, similar to the prior year, as best you can under current conditions.) Can my lender not approve forgiveness? (Certainly. You should be carefully documenting what you believe are allowable items for forgiveness, as well as a statement, letter, or memo stating why the loan was "necessary".) - I do not normally offer such detailed suggestions to my customers, as it is not in my normal scope of support. But, we need each other, so we are sharing, both ways, our experiences, knowledge, and suggestions.

-

ineligible taxpayers should return their stimulus pymt

Medlin Software, Dennis replied to schirallicpa's topic in COVID-19

Hear Hear. If the amount is a credit on the 2020 return (as is what I believe to be the case), then those who were alive on any date in 2020 should be eligible (including some COVID babies!). For those who passed before 2020, it seems reasonable there could be a claw back attempt, but at first, I remember reading articles which stated no claw backs. Like PPP forgiveness, until we see the rules, it is only a guess, since I suppose the credit could be given a specific must have been breathing date range. -

I have been getting a large number of questions about the ethics of taking a PPP loan, and what the qualifications are. After way too much thought, I came up with what seems like a reasonable reply. If a business is eligible for a PPP, and likely forgiveness, it is a complete disservice to the business, self, employees, and customers to not do so. (This still allows for those who have other reasonable alternatives to not take a PPP, given the Apr 23 "guidance".) It is no different than decisions a business owner makes daily, such as where the best buy for supplies can be had, recording items for tax deductions, etc. There is an obligation to keep the business viable, and it is an ethical (or for a corp, a legal) REQUIREMENT. The one which really made me think (and for good or bad, share with the customer) is an MD who has less income at present, but probably can get by if all goes perfectly. The problem is, he may get COVID, or staff, or someone have to take leave if a family member is affected (which is out of pocket for at least two weeks). He was thinking of not applying. When we chatted about him being easily able to affirm the loan app statements, and the loan making it possible to survive should something else happen, he derided to apply, for his staff and patients' sake. Note, there is no requirement he seek aid privately, or even come out of pocket. He realized he could not afford FFCRA PTO while waiting for repayment (without seeking a loan), and had already realized what will happen should he be unable to work. There is also no requirement to ask for forgiveness, even if foolish not to do so. The other reality is, we are all going to pay for the billions/trillions in aid, which if you accept that, not taking what is allowed means you pay (at least) twice. This led to a discussion about the loan app affirmations, and how to ethically live with them. I found many JD types who have posted their thoughts and opinions online, and finally came up with one which is not only reasonable and thorough, but is in mostly plain language. I know nothing about the firm, other than this one article, to take it for what it is worth. I am sharing this because I suspect many here have the same struggle personally, as well as hearing the same from their clients, especially with the press all over the now May 14 "no questions asked give back" date. The other issue is many applied the first day, before the Apr 23 information was published, and their terms were much looser. I have seen where a company is preemptively seeking a ruling so they can keep their funds based on the original rules, when they applied, not the Apr 23 rules. https://www.velaw.com/insights/new-treasury-guidance-on-certification-of-necessity-for-paycheck-protection-program-loans/ "There is no bright-line test for determining the necessity of a PPP loan." Their section under the heading of "Documenting the Good Faith Determination of Necessity" is the best advice I have found for a business owner to self handle.

-

I was sent that by a snarky customer who was disagreeing my suggestion to, under the present (and long existing rules) remember their PPP forgiveness is clearly not 100% of payroll costs, partially because the amount forgiven must be counted, less the effective tax rate for the company, proprietor, partners, whomever pays taxes at the end. This is not a "now" issue, it is a several months down the road issue. I chortled at the angry customer's message, as it was written as if AICPA sets the rules... AICPA is also begging for the PPP rules to be altered, such as letting the recipient determine their magic 8 weeks and raising the other allowed expenses to 50%, which some are reading as the actual rule, causing even more confusion.

-

Opinions Please - Workers Comp costs & PPP forgiveness

Medlin Software, Dennis replied to BulldogTom's topic in COVID-19

If one looked at it as not getting the loan amount 100% forgiven, but 8 weeks of allowable expenses forgiven, then one should be VERY happy. Makes sense actually, as the PTB seems to have wanted to get enough out to cover the 8 weeks, with no shortage. The extra amount is trivial in interest cost, and can be paid back once the forgiven amount is known. 1% annual on just over 2 months is all it will cost... We do not know what the forgiveness rules will be. I am hoping for a reasonable combination of incurred and paid, but even a literal "and" is still a great bene. Anyone who expected 100 forgiveness was not hip to the likely rules, or figured they could stuff expenses. It may even be that those who ask for much over 70% of their loan amount to be forgiven will raise red flags. I saw some wonk's calculation stating that flat expenses will result in something like 70 to 75% forgiveness (of the total) to be asked. (Too tired to do the math or look for it again.) --- I have a gut feeling the intent of forgiveness is mainly paid (cash basis), since there is supposed to be enough actual money out to match for forgiveness ask. I think the "incurred" ties more in with the no prepayment shenanigans. It could also be tied to something legitimately prepaid being allowed to 8/52 "in". Examples are some sort of annual bill paid during the 8 weeks might have to be calculated 8/52. Maybe someone pays health care quarterly for example, and the payment was just before loan funded, and 8/52 would be nice to have for this. I am getting asked all sorts of crazy (to me) scenarios, the latest was if I though an unpaid payroll from January could be paid during the 8 weeks and forgiven. -

Opinions Please - Workers Comp costs & PPP forgiveness

Medlin Software, Dennis replied to BulldogTom's topic in COVID-19

The 75% relates to the max forgiven, the max to be forgiven (currently) has to include at least 75% payroll type expenses. The loan itself, can be "offset" (so it is not fraudulent) on any allowable item, payroll, rent, any of the items on the application. Must separate the loan from the forgiveness. Should be no issue for an ongoing concern to eventually have enough allowed expenses to properly cover the loan amount within 2 years. The loan was only 2.5 months (in most cases) of allowable expenses. Forgiveness is an entirely different animal, with unknown rules at present. That is where the business as usual spending is the only viable option. On the side, practice calculating and planning for maximization, and if it can be afforded even if not forgiven, maximize to your comfort level during week 8. I feel for those who were funded early, and maybe their magic window closes before the rules are published, but some are fighting for some allowance in setting the magic window. -

Opinions Please - Workers Comp costs & PPP forgiveness

Medlin Software, Dennis replied to BulldogTom's topic in COVID-19

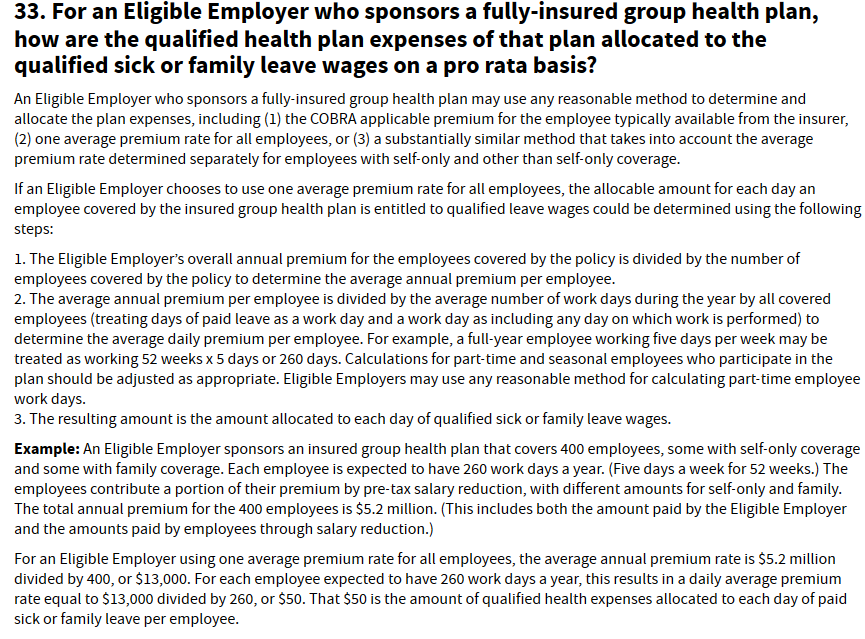

Here is one example the IRS came up with to calculate qualified health plan expenses for FFCRA PTO. Hopefully the SBA does something similar for eligible incurred items.