Medlin Software, Dennis

Donors-

Posts

1,813 -

Joined

-

Last visited

-

Days Won

83

Everything posted by Medlin Software, Dennis

-

There is also the problem of where you are in relationship to your storage. Cloud is somewhat of a misnomer as it really means a physical storage somewhere on land. Personally, for storage, I can choose a close server farm for main, and different regions for backups. Serving data likely has a main location, hopefully close to you physically, and multiple mirrors in different regions. Advanced usage will offer serving from the closest location possible. A good way to test location variance is to use a speed test app which allows you to select different servers to test. Local vs thousands of miles away differences are clear.

-

Catch-22. Many feel data should only be in the cloud as it is likely more secure than a random box in a home office or small office. Given the number who refuse to even keep their OS current, this is tough to argue. I get daily discussions about how a Vista machine still works fine. There are some who prefer to and have the skill to manage their own data, but we are aging out. There are some laws in a few areas making cloud storage not proper (claiming safety). One issue is connectivity. If one assumes daily connectivity, cloud at rest storage is good for most. There seems to be at least annual bouts of major connectivity issues, which can stretch into multiple days. Another issue is data entry and update speed. Even a one finger keyboard jockey can likely outpace feeding data back and forth to a cloud (especially upload for many connections). The likely best answer is a hybrid. At rest storage online, and a backup local. Working data is local only. All data is secure by the software so walking away from the machine is safe and cloud is safe too. Load time is minimal as download is reasonable for lost, and if there is a local copy, you can compare instead of download. Program load time is what people see. Cleanup is slower but acceptable as upload is often slower, but people expect and accept closing to take longer.

-

Getting the out of trust assets down to whatever the state allows for simple handling (in CA, "small estate") should be a priority. Delay waiting for court to give status/approvals can be costly.

-

Personally, we did not look at tax +-. For us, it is about creating an entity which could be managed by a fiduciary if needed. In a way, just like setting up an entity over a sole prop. While we expect the named persons to outlive us, one cannot be certain. The remaining heirs could be as yet unborn, or will not be of age, so we are more comfortable having a fiduciary if the named trustees are not willing or able. In our case, we expect to have to rewrite again once I get to FRA, so we can sort of preplan that into the framework to reduce the amount of change. What we are finding is the trust items will likely not change, but the remainder (will items, kept under the CA small estate level) will likely change several times. In the case of CA real property holders, unless one expects the property to be sold, there are issues with Prop 19 to deal with. The practical effects are still being fleshed out. Sadly, we had to be somewhat precedent setting, needing to get a (as much as possible) binding letter for out situation. The nice thing, for us at least, is the estate industry seems to have gone to a flat fee model, or a subscription model, with few going the hourly route. The subscription model is very interesting for those on the younger side, who may need multiple changes and monitoring by their experts. I am a bit biased though, after having to sped a couple of years cleaning up two intertwined intestate estates... Even a simple one paragraph will would have saved the estates more than $10k each.

-

does anyone use the medlin a/r program

Medlin Software, Dennis replied to schirallicpa's topic in General Chat

Two completely different processes and programs. I prefer to keep things simple and easy to use. Since Accounting and Receivables require completely different records and data entry, combining both functions into one increases complecity/errors/cost. Some only need one or the other. For those using both, they can share data where appropriate. -

does anyone use the medlin a/r program

Medlin Software, Dennis replied to schirallicpa's topic in General Chat

One of the things I discovered years ago is (opposite of elected folks) our job is to make it easy to be replaced. I discovered it in volunteer positions, as well as paid. Otherwise, the work you are doing is somewhat pointless. Volunteer wise, I have it down well. Professionally, it is in progress at all times, but hard to actually accept as well as do. -

I am just about the 2 year mark waiting for a refund from a deceased TP. Unless a significant amount, or the heirs are not cooperative, it makes sense to disburse if ever received without holding up anything else. In my case, the heirs are not cooperate or uncooperative, they just wait for checks... Thankfully, the bank account can stay open with no fees. I left .02 in it. If I move .01 to another account, them move it back, the account does not go inactive.

-

does anyone use the medlin a/r program

Medlin Software, Dennis replied to schirallicpa's topic in General Chat

Modern AR is an interesting topic. The pitfall? Electronic communication. Most want/expect it, and few realize how unreliable it is. Meaning, the "I never saw your bill, so you must not have sent it to me, so you cannot add late charges". Then there is the expectation of a simple click something to pay, and not to have it be too expensive in fees. The click to pay inevitably involves a third party to handle the transaction, so there is a 3%+ cost to consider. Once you decide on how you want to get paid (mail, in person, or some electronic form), THEN you can look for a solution. If electronic, it will likely narrow down the choices, and raise the cost, and you will learn to have disdain for email, especially free email accounts. Anything with SMS notices will also be costly. There is no one cheap means to SMS back and forth, the offerings I have seen have a cost per message. The clue is if the SMS recipient does not identify carrier, it is going through a hub at a cost. If the carrier is needed, it MAY be sent free, but there are pitfalls such as incorrect carrier selection, ans messages being cut short. The least important aspect is the software itself. Data entry is data entry, printing (if done) is printing. Decide on your most important needs, and what you are willing to spend, then look for a solution. My AR software? Plain AR handling. You can email invoices and statements, but there is no electronic funds handling. Some use things like PP or similar to collect payments. Still have a fair number of active customers. But, not enough to warrant major changes, such as trying to add a payment system. (Plus the worry about added liability if I had any part of moving funds...) -

Severely disabled adult child - dependency

Medlin Software, Dennis replied to BulldogTom's topic in General Chat

We have a disabled adult child and are part of a parent group. There are no one stop resources for parents in our position. We have to teach each other. -

Severely disabled adult child - dependency

Medlin Software, Dennis replied to BulldogTom's topic in General Chat

If the disabled person has no other income, it is likely the first cent each year the parents spend on the disabled person makes them provide enough support to be more than half. Unless there is money or goods provided by someone else. The disabled person likely has personal property at the parent home, and may even spend time there, so it remains the disabled person’s home (like college students away from home). -

No specific answer here. I can say, as an admin, I have been waiting over two years for a paper return to get processed. If it ever does, then I have to try to again locate the heirs and forward the funds. Make sure you ask the probate court for enough money, aside from any statutory amounts, to handle the tax aspects which are likely to drag out.

-

Part of the "it has to be the responsibility of someone else" movement (replaced now uncommon sense and self responsibility). If a community property state, that may be a deflection item to look at if needed. But, being asked for something may not correlate with what you are obligated to provide based on the scope of your engagement... so don't respond to fishing expeditions. Unless it comes from someone who engaged you and is within scope, or a court, it goes in the bin (same as reference letters, lender requests, etc.). Run it by your legal representative if you need to get their E&O policy involved (for acting on their advice). I anticipate truth, but verify when needed. Even truthful people may look for recovery if your pockets are deeper.

-

Personally, as a software author since the 80's, I write at length on software updates, licensing, etc. But I try not to as no one wants to hear it. So... Downloaded from torrent or other grey sources? Nope. So easy for a insurer to use to leave you out of pocket for any sort of defense/settlement. So easy for a judge.jury to find you negligent. There is plenty of current free software to use if cost is an issue, or free is the desire. Likely not a good idea to post, in a public forum such as this, about using software which (probably) has not had any security updates in years, was downloaded from a grey source, or (hopefully not the case) is not properly licensed.

-

I have, but not for a few years. Customer was asking me what t do (How about not short employees? ) My impression is both parties know what they are doing, and accept it. On the other hand, there are some naive "employees" who get bamboozled into believing they make more money as a "contractor". Somewhat like the PTB have tried to fool people by manipulating withholding to give the appearance of increasing net pay (not a left or right exclusive deal, both have done so).

-

Printer Driver/Issues Reminder

Medlin Software, Dennis replied to Medlin Software, Dennis's topic in General Chat

Even the download version may have extras... It is tough to just install the driver without paying careful attention. There are also cases where the current driver is not the one, and an older version will work better. It is the good and bad of having one "control" for the printer, instead of each program having to know and control the various printers. Escape codes were a real PITA... I had a multi page chart of codes to make various printers do certain things. Explaining those codes to customers was time consuming, even back then when all who used a computer were experts at using a computer. -

If you do not trust your software vendor, you are likely using the wrong software vendor... You cannot stop the vendor from adding something, since it could be tied in with something you have to have... The issue, as I have been told countless times, is some are forced to Intuit for reasons they cannot control. I was just writing with a likely now not former customer, who was wanting to switch because their accountant told them they would only take data from Intuit backups. Since it was a long time customer of mine, I was bold and asked who works for who(m)?, and it is entirely possible for any accountant/provider to take an EOY ledger to get figures from, with only one figure per account needing to be entered... by the accountant/provider's likely low wage data entry person. Even for once a month, one figure per account is not too much to ask of a service provider to bang on their keyboard. There are plenty of provider's looking for work that do not require pre formatted data so they can import, print, and bill. Some (like all here) actually review the data for "looks out of place" issues.

-

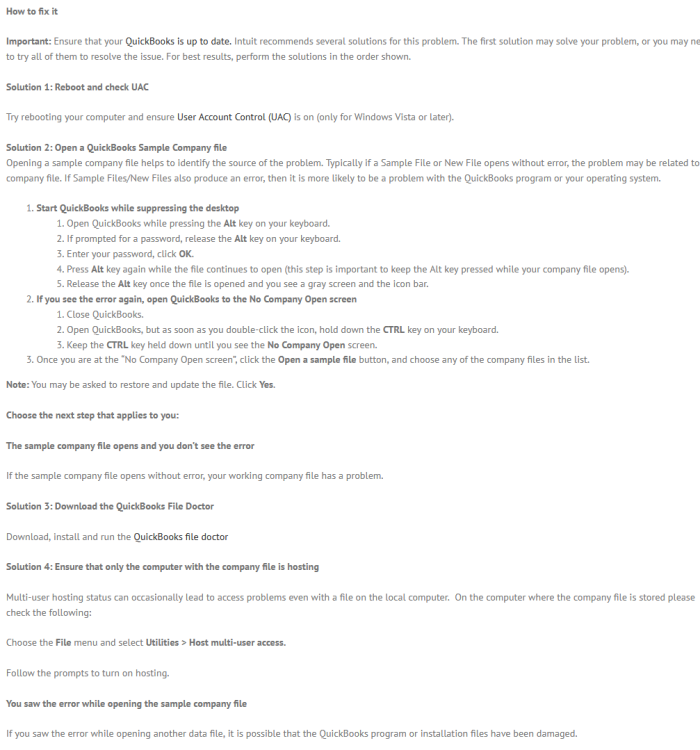

The software is actually opening, but fails shortly thereafter, with some sort of memory issue. They have a catch all handler, with the 8 digit error message, but since it was an "unexpected" error, they close the software, instead of repairing the issue, deleting the data causing the issue, or some other more graceful action. In my case, I handle unexpected errors, such as a memory corruption due to bad data, via a more graceful (that is the intent anyway) message. While I am not fond of such things, there can be reasons to kill off software. We are talking about what most would call data which needs to be kept secure and private... and in no way, can an abandoned OS be considered secure. I know for sure I have a few old timers using a DOS based version, as I still get asked if they can update (not since about 1999). Economics 101. Online cloud based software is cheaper for the maker. Why? They do not have to support the endless updates and personal issues on their user's hardware. The SaaS either works on their hardware or it does not. No install or removal support issues, etc. Local install software has an exponentially higher cost of support, as you are forced to support dealing with things like faulty "security" software (all "security" software but a select few are over zealous and faulty, as a means to get their fee from their users). If I had 1$ from every time I had to help someone with their choice of "security" software... Or supporting folks when their computer "expert" wiped out their data. -- To continue rambling... For me, I am getting more "in your face" with forcing backups (secure online, no extra cost), as I am tired of being blamed for user error (no backup, bad human actions). Likely in a year or two after, there will just be backups made, with zero interaction (of course, securely stored) - tough for me to get there now, personal feelings I suppose, which I am working on. Same with keeping the software current. Will start requiring keeping the software current - instead of giving reminders and expecting compliance - as I am tired of being blamed for "letting" someone use outdated payroll calculations. I don't see having online software as a need, as the data entry is just too darn slow. Same with the voice entry as discussed in another thread! I can see having all at rest data securely stored online (along with a local copy for connectivity issue situations). Will always keep the option to have date only be local, as some don't want their data, even if securely scrambled, online. Those folks are less and less every day, as even the least tech person is nearly always "connected" now. (For me Starlink was the missing piece I needed. Even when there is a wide power issue or fiber issue, they have good ground station redundancy, and more birds by the month.)

-

Compatibility with different Windows versions. The error above, to me, looks like some sort of "unhandled" or unexpected error, one where the programmers did not build in a graceful exit. These are usually caused by using "undocumented" features in Windows, such as non public API calls (guilty in the past, never again). The other usual cause is simply bad data, such as something causing a divide by zero (which most programmers catch, unless the data file is actually corrupted). The error above is not likely a no internet issue at all. Compatibility work arounds are unlikely to work either (if it is an API issue for example). But, as tax preparers, unless you are grey area (not signing the forms in any manner, preparing "for" the client to sign and submit), you likely fall under the IRS "security and privacy" rules. With that being the case, using ANY outdated and/or abandoned/unsupported software is likely a violation of the terms you have to agree to follow. (Food for thought only, not an opinion on said rules.) (Oddly, I have far too much experience being asked for help with the products of others... Back when we offered phone support, I was often asked because the other company had no free phone support. Now, it is because I answer every message as best I can, even for software of others within time constraints.)

-

Thanks for the kind words. Made me think. What I see trending is many don't prepare their own accounting. They rely on their bank electronic records to be read into their accountant's (or their own) software. Years ago, a certain company tried and failed to become the defacto data format standard. The last time I looked into it, there was still no workable "free" format commonly in use. Thus, the big company sort of won by default, as they can force, through their accountant's telling their clients what to do (imagine that!), to only use certain software. That company can also charge enough to be able to pay commissions (for those of a certain age, payola is the term) to banks for using their format, and via that incentive, not offering other formats. I also hear from accountant types who hate being forced to use the one program, but their clients provide data in that format, so they give in. Most of our accounting software customers either DIY completely, or they give their accountant/preparer end of year reports for figures (which makes sense, as the accountant/preparer likely does not need detail, unless they are auditing). In our own case, we give the eoy company GL to the tax preparer. They do not ask for or expect every transaction record. For the bookkeeping, I use the bank statement, since we have so few non electronic transactions these days. The odd check received (such as one from yesterday, a "dividend" from our WC provider, I have to take note of so I don't include them as income... I do not even break down the sub totals to individual transactions any more, but I keep the statements with the monthly GL just in case. So my monthly is < 20 entries... but I know I am an exception.

-

Thanks for the kind words. Our Accounting does not have options for what most would call "department" accounting. All totals and percentages are on the whole, not split among different cost centers, locations, etc. Goes back to the 80's, with KISS. Program for the 90%, not make things complicated for the 90%. The reality is, programming for the 10% with complicated needs then becomes the driving force, with updates, support, and having to recover those costs across all customers. Same for our Payroll. I get asked often for strange things, rare things, or even custom things, which I say no thank you. As of Sep 1, 2022, our license for Accounting is a one time permanent license...

-

A reminder, which bit me. For those who need to print accurately, or have any printer issues, remember to install and use the latest driver from the printer manufacturer. The driver Windows may install automatically is less and less likely to be accurate. In my case, the Windows installed driver was scaling down and centering. Not good when I have to print at specific locations to get SSA approval for plain paper W3/W3 forms. Even with the printer manufacturer driver installed, there still has to be a user adjustment to allow for driver inaccuracies, and for paper handling issues.

-

I am sure there are many good choices. A few will not require online activity. Even us dinosaurs are crawling to an online component. In my case, for our payroll, we will be offering online data storage - not live data usage. The reason? as computers have become appliances, the users do not have experience or training the the computer use aspect, and often neglect backups. There even seems to be an expectation the software will protect the user from themself, and automatically make backups. This is a big change from the "keep your 'hands' off my data of years ago. My accounting and receivables remains desktop/laptop only, (local use), although the user can securely store data online via our backup function.

-

Incorrectly classified as 1099. The usual is the employee will not want to make waves, and they will handle it themselves via their personal taxes. IIRC, this has been discussed many times here with comments of how it was added as some sort of other income on the personal return. If the employee has left, they will rarely use the labor rule body to enforce proper classification. Typically, this will only happen if the former employee needs something else, such as WC or UI coverage. I have not personally run across any employer who has cleaned up their error willingly or happily. Employers do this on purpose, it is not an accident, no matter what they say after. I have heard cases where the employer warded more money to help cover the taxes, or to make the issue go away. As wonky as it is for me to say, having the default be employee is better for the worker. The CA ABC test is a bit harsh, but it is better to err for the employee. The old 20 way test is both unworkable and badly abused. The money to be made by abusing 1099's is incredible. Consider AMZ, FedEx, DoorDash, Uber, etc. I have an acquaintance who part times for DD, and they fail to realize they lose money or work for single digits per hour most of the time, if they considered what it really costs them for their vehicle miles and taxes.

-

Likely, yes. Employer's are "supposed" to register/report in each locality they perform work (some exceptions, but not many). Businesses should have a license in each jurisdiction as well. I happen to peruse our local licenses from time to time, and there are many from out of town and out of the state. Or in my personal case, I have to have a local license (as expected), but being a home office, I must have and maintain a PO Box, as we are not allowed any reference to, publication of, or use of our home address, other than for mail. (Exceptions are for things like piano or swimming lessons). It is safe to assume every jurisdiction wants a cut, so always look for the license/permit authority. Could even need an addendum or alternate insurance policy.

-

A healthy understanding of the risks is a good thing. Paying for defense is no joke, but most things get settled from what I can glean. Personally, the lack of (what used to be common) sense is the eye opener. Daily, multiple times, I try to educate customers why using an old OS is bad, and explaining to those who care for data of others, why I have code to warn/block them from using an outdated OS. While I am not "into" believing an old OS cannot be used safely, the issue is there are now rules making such usage a default fail/loss/culpable action for those subject to the regulation, and in reality, for all. Same issue when not keeping paper records. Unless updated (and it could be, I have not checked), the IRS rules allowing non paper data retention are like being subject to any time probation search... which no one wants to be subject to.