Medlin Software, Dennis

Donors-

Posts

1,813 -

Joined

-

Last visited

-

Days Won

83

Everything posted by Medlin Software, Dennis

-

Final 15T was posted last night. https://www.irs.gov/pub/irs-pdf/p15t.pdf

-

I recently handled (2 years of time) two intestate estates. neither required estate tax returns. If, down the road, I get a nasty gram, I will add to this topic.

-

Pub 15T (2023 draft) has been updated with what appears to be the actual 2023 calculations. https://www.irs.gov/pub/irs-dft/p15t--dft.pdf The usual pattern is to post a draft with changes other than the calcs, then update the calcs, then the final. IOW, there is a 99.99% chance the calcs are good.

-

How much does it cost to have a living trust set up?

Medlin Software, Dennis replied to Pacun's topic in General Chat

I am not setting things up for myself, so I cannot reply on myself to unravel what I setup. I need to leave my heirs in the hands of an expert, with E&O coverage, training, etc. When one gets to a point where there is something to manage outside of intestate, one should likely pay an expert. -

How much does it cost to have a living trust set up?

Medlin Software, Dennis replied to Pacun's topic in General Chat

For me, just completed. Local lawyer, established, but younger than me. Growing firm, not stagnant. Dollar amounts of estate are immaterial. Selected a firm with a flat rate, although we contracted for an additional amount for a custom and separate item as well. Some firms have subscription models, a certain amount to setup, then an annual fee for maintenance/review/consultations/etc. -

My personal position would be I am not beholden to anyone other than my client, or a court I am subject to. Meaning, I would provide required and allowed things to my client, or to a court, and not to any third party, not even my client's attorney. What the client does with the information is up to them, and not "on" me. I actually get this all the time, when someone asks how to provide a pay stub to a lender. It is up to the employee to handle, no employer should be providing documents other than to the tax agencies, a court, or when required, to the employee.

-

Thank you for the cite. In the OP, an issue with software availability was mentioned. If this covered a time within the retention period, the lack of ability to produce the recorder would require proactive notification to the IRS. Their rules for e records are draconian and not something most would want to be subject to.

-

Is there a reason/rule which you are using to keep data from 7 years ago? I get it, tax data is different than what I deal with daily, but my philosophy is to not keep data longer than required since it cannot be used against you... Where I am going with the question is to try to separate client "want" from professional "required" to. I just find it odd when someone says I have my returns from 10 or 20 years ago, or all I have ever filed. My take on the OP is someone is fishing, maybe for helpful testimony in this case, but fishing is still fishing. I would make no response other than under the advice of my own representation.

-

$1.4 Billion in PPP Loans to Big Firms

Medlin Software, Dennis replied to Lee B's topic in General Chat

The first round had zero requirement to show need. IIRC, the qualifier (which were stepped up for the later rounds) for the first round was something along the lines of "may" have losses. Every business should have applied for round 1 as any business "may" have had losses. For corps, it could conceivably be a dereliction of duty to the corp not to have applied. Since the funds were not fully awarded (again, IIRC), it is tough to show anyone who received funds kept others from receiving funds. Of course, the round 1 process was possibly tilted by the processing entities, but the later rounds were likely handled better, so those who really had need could have and likely been funded. The complaint would be if it could be showed the processing entities did play favorites in round 1, and a business could have met the "may" requirement of round 1, but not the revised requirements of later rounds. The above is just dollars and rules, just as tax processing is all about paying the required amount, but not one penny more. Morally, the decision, that is an entirely different process. For non corps, easy, decide and move on. For a corp, if all directors, officers, etc. can get a waiver of fiduciary duty, then they could make a moral decision, otherwise, they likely were obligated to apply, and if they failed, could be personally liable. -

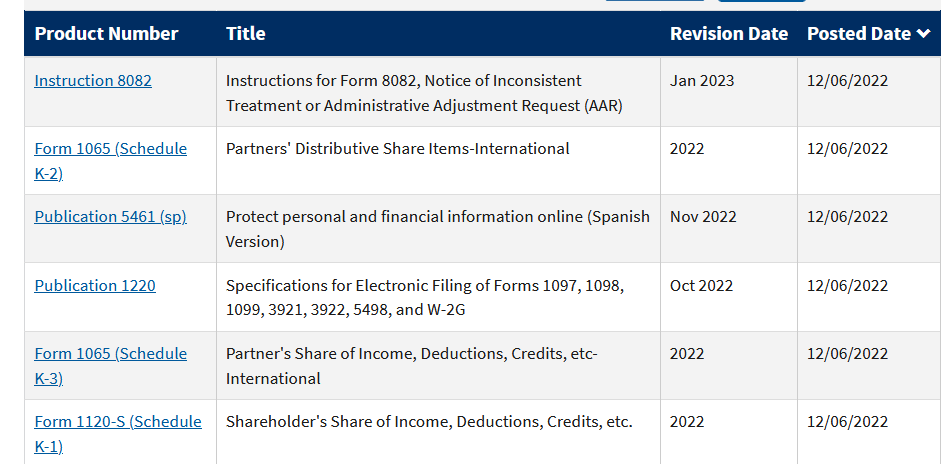

K2/K3 Draft Instructions are good news!

Medlin Software, Dennis replied to BulldogTom's topic in General Chat

-

$1.4 Billion in PPP Loans to Big Firms

Medlin Software, Dennis replied to Lee B's topic in General Chat

On the other hand, we lost many customers who were forced to close because of the pandemic. No or not enough revenue to even consider selling or giving to employee(s). Some of the stories are heartbreaking. -

$1.4 Billion in PPP Loans to Big Firms

Medlin Software, Dennis replied to Lee B's topic in General Chat

Received PPP. Put off a planned price increase for a year. Less overall revenue over the pandemic, but it seemed proper to use the amount by “giving” the PPP to customers, which are mostly mom and pops; although some are medium service providers. I suspect for many, it was a good bene. The problem was no real check for need, which appears to be a result of the desire for expediency. -

If you were representing the union before, it will be a risk to pick a side after the breakup of the union. It likely can be done, will no doubt require extra time to make sure one is not violating privacy of the union, or either former member of the union. Might be a case where taking on an extra 10-15% for the retained client, at least for the first year or two, may be needed to cover your extra time. IRC, I have seen here at least some refuse to represent either after breakup of the union, because of the risk. I can see where it would not be uncommon to have to provide records for both parties, and even the one you elect to retain getting mad at :"helping" the other side. I get something similar when a business is sold, and the new owner and former owner do not make a proper break in the employee records. Many believe the new owner should have access to and responsibility for the employees for the full year. The proper method is the former employer terminates all employees, and the new owner hires any employees they desire, even if they are former employees of the prior owner. All too often, the former owner provides employee data to the new owner, which is never allowed (although there may be specific exceptions I suppose). I had to fire myself and rehire, after incorporating. I had to make sure I collected I9, W4, etc, from myself as a new hire.

-

Backup and restore WITHIN the software used to create the data, will always be the most reliable. Depending on any third party system is not the best idea. Not a repair shop, not the OS, not a “backup manager”, etc. Why? The software vendor knows darn well what to backup and restore, every time. As a for instance, I hear often from customers who are dealing with a repair person who failed to make the new computer have all data the old one had. With that said, I personally use a backup program as a secondary system, BUT it is a system where I manage what gets backed up, so I know what is backed up. “Default” settings will sometimes work, but just as often, will not backup what you really need.

-

Nothing is provided free. Free email? No, the provider is somehow making money from you and trying to limit their expenses such as over aggressive filtering to reduce bandwidth. (One example, and why free email is not wise for business use, or really not even for personal use, the lack of control over what you actually see and when.) “Gmail is a part of (but does not make up entirely) Google’s “Google Search & other” ad revenue segment on their annual report. Which, in 2021, generated $148.95 billion of Google’s total $257.63 billion in revenue.” It is safe to believe getting non generic info, such as via the tracker; is more valuable than just serving ads. On the other hand, many don’t bother with over worry about privacy, accepting the risks and enjoying the “free” services.

-

Thank you. It is not my day, it is a day to remember others.

-

Eventually I will have to have that surgery too. Currently, it is floaters which are the annoyance. Getting older by the second, and an "0" BD tomorrow!

-

I just ran across something stating the PTB want to revise the W2 process to have B,C,2 on one page, but they are delaying because of complaints the new design will not fit in the window envelopes folks already have in stock (or maybe that form suppliers need time to figure how to avoid lost $ from less pages to sell?). The PTB realize few are using carbon paper and impact printing, and do not need all copies to have the same print locations. The PTB may not realize many have been using 4 up copies for decades. The PTB may not realize the employee copies are getting to be moot (other than one) with efile, and the ability for people to access a copy machine (or create their own) if multiples are needed. On the other hand, I would so much be happier if the PTB would get things to a better place, so I do not get blamed for "my software" causing deposit mismatch, incorrect deposit, and other issues "my software" is not causing. Even when I can show the paychecks were entered correctly by the customer, and the software gives correct totals (it does math just fine) based on the customer entered data, the customer still believes it is my fault when they get a nastygram from the IRS. I make and handle enough mistakes my human self, I have some mental space to handle the mistakes of others, but some days... I work harder to find someone to replace me.

-

The irony (or other suitable term) is, if taxation was simple and fair, we would not be having this discussion at all... as we would be in some other line of income generating activity. It is something I actually discuss with those who ask me about what I do, or about any sort of job with bookkeeping, taxation, and the like. One has to accept the unfairness or waste (to me) time thinking about the unfairness. Why a waste of time? IMO, few who have (now un)common sense are in a position to make changes, and those with (now un)common sense have enough of it to not get into positions to be able to make changes (smile). Fair or not, my (our?) business is dealing with the field given, always looking to pay all we have to, but not one cent more.

-

how many computers can I have my software on?

Medlin Software, Dennis replied to schirallicpa's topic in General Chat

Sounds worse than doing the entries yourself, and likely more costly for your customer. Funny though, I get comments from my customers that their tax person is “making” them change to QB. My usual comment is why, as the tax person likely needs the reports, not access to make or change entries, since the tax person is not likely being paid for data entry. My preparer, if they have a concern about a figure, make me explain or correct myself as they are not retained as my bookkeeper. -

I need a new Tax Forms Vendor this year

Medlin Software, Dennis replied to BulldogTom's topic in General Chat

Indeed, B&W W2/W3 forms can be used, from approved vendors, since TY 2001. Look at the output. There will be a "vendor" code on the output if approved, and you can ask to see the SSA approval letter for the particular tax year. Use decent quality printer paper, non glossy. Also, use a laser printer for the best results, although many jet printers will also work (if it is a TY where the form text is not too close to the bottom of the page). Caution on the IRS free forms. Generally (have not tested personally in a few years), they work well only for manual fill in. The alignment is not usually the same as forms approved for computer printing. (Meaning I get, every year, complaints about the free forms not working in someone's printer.) 1099 forms can be B&W printed, except for the red drop out ink copies sent to the IRS. Some say the IRS accepts the B&W printed forms, but officially, their policy is drop out ink only. -

I would move one to a different physical location. Don’t rely on just one location, not even a safe which claims to be disaster proof (they are not, if consumer priced). Aversion to online storage is a red flag for a tech (to me). Even if one does not trust the security of their online vendor, one can encrypt before upload. Online storage means you can have fresher backups and do not have to spend as much time recreating what happened since the backup was made. Two backups are not enough, and stored in the same place is not good enough.

-

You can put anything in W2 box 14, but there is no requirement to put HA there. Cleanest is letterhead, once when "hired" (has to be documented in advance) then annually at EOY (restating the next year's amount, and listing the year closing's amount). Whether or not the clergy person receives remuneration triggering 1099 or W2 is immaterial to HA (some may get HA as a retirement bene, for instance, or receive other income via direct gifts, or no other pay at all). For tax prep, you likely have a good idea of what reasonable and allowed housing costs are in your area, and can inquire deeper if the amount seems excessive. I would prefer not to have to rely on an email (as mentioned in the OP) for audit, but letterhead is acceptable. Even those who use Box 14, that alone will fail audit, since there must be documentation showing the planned HA in advance of receipt of the money. I cannot remember an exact reference, but there is at least one great independent resource for clergy/church accounting. I would not reply only on the denomination provided information. Sometimes the denomination is mistaken, or too risky with their advice.

-

Experts in that area say HA should be documented twice a year. Once to award, and at EOY. Letterhead suffices. I say nothing on a tax doc unless required, so no HA on a 1099 or W2, since there is no such requirement to do so.

-

While not reasonable, it is reasonable I suppose. It comes down to cost. There are ways to give better uptime, but they are more costly. Latency is more likely your connection to the server. I have been testing my choice of servers for a few years. No significant downtime yet. Is not AWS, Asure, etc. Mains are in TX, to reduce distance to the coasts. Even with what seems like a reliable connection, I am still going the hybrid route for the reasons shared above. Personal connectivity often gets the blame. In my personal case, my wired connection is not symmetrical. They give up on upload and sell download. (Cable, and they will eventually roll out better upload, maybe even symmetrical.) I have other connections I can route through when desired. - For me, the "events" so far, flood in '86 (a week without utility power), quake in 2014, and bug out for fire/smoke a couple of times in the last few years. There have been other events, but those three are the ones where our lives were changed. The best way to see your "status" is to try recovering without accessing your current computer or connection. THAT will tell you how ready you are for any sort of outage, loss, theft, or failure. A good time is when you get a new computer, try setting up without touching your existing machine.