Medlin Software, Dennis

Donors-

Posts

1,813 -

Joined

-

Last visited

-

Days Won

83

Everything posted by Medlin Software, Dennis

-

Anyone with Experience with This?

Medlin Software, Dennis replied to ETax847's topic in General Chat

Newman! -

You can ignore the "person on the phone". Their information is useless. There are instances where 941's and W2's do not match, meaning while for most, they match, there are exceptions.

-

For storage (such as retirement) paper rules (or failing paper, PDF's on multiple machines/storage methods). Computers fail. Internet connections fail. Servers fail. You cannot meet the IRS regs by "hoping" you can access the needed data. It is interesting to discuss the "ownership" of things. I agree, the data is the property of whomever created it. It should be something the creator has ability to retain. Thus, printing (or creating PDF) records is suggested, since there is no way to guarantee electronic data can be "used" by other software. The software and resources which can be used to manipulate said data? That is usually licensed for use, with no transfer of ownership. Even if the licensee wants to allow others to use their license "just to view" the data, the other party, such as an accountant, is likely going to need a license of their own, since they are benefiting from the software - even though they are not manipulating the data. I actually get this type of question often. Such as "I am the only one using the software so I want to install it on every machine I own" (did the computer company give you each machine?). Or even more applicable, "Can my accountant use my license?" (The accountant, unless manipulating the data, needs your reports, not the software". Going back to the beginning, software was ruled to be copyrighted, in the same manner as a book. Meaning copies (yes kids, software was formerly distributed on hard media!) were not allowed unless the copyright holder gave permission. In my case, our model for our non payroll programs has recently changed to buy once. No ongoing support is included, but is available on a pay per use basis. No one has needed to pay for support yet, but we have been doing this for 40 years, so the software does self support... We do watch for multiple installs, and do terminate licenses for those who fail to comply after several gentle reminders. For Payroll, it is an annual license. When the license expires, no more new data can be entered, but access to existing data is not stopped. Same as above, we can catch those who "share" their license.

-

Wayfair ruling has emboldened states. The working guidance from MTC is very broad, although untested AFIK. For example. Non CA company. Provides link on web site to trigger an email or start an online chat, and someone in CA uses this function. This triggers nexus in the location of the person who initiated the contact. The thought is it is "after" sale help, and no different than sending someone to the customer's site. (CA is the first state to publish their take on the MTC guideline. NY is up next.) There is valid concern one better get their web site's server in their home state, such as those who offer software downloads, as "hosting" the download in a state may trigger nexus. At least one state (TX) has a special waiver of nexus for web site hosting, which was funded by one of the big hosting players. On the other hand, reality says unless there is profit (a large amount to be gained), many states will ignore this "new" revenue stream. There is likely going to be a position or three in each state (depending on believed profit), where they look for and go after the profitable cases.

-

S corp Health Insurance question please

Medlin Software, Dennis replied to WITAXLADY's topic in General Chat

If they were not an owner, then section 125 is possible. For owners, we get to deduct on our personal returns so the liability is nearly a wash. -

Likely already considered by the client - but with certain state regulations (net metering type rules), Southern exposure may not even be the most ideal. For instance, in CA, with the soon implementation of our NEM3, W and/or WSW may be the most beneficial for the home owner. It is not as simple as Southern pays, as Western can be "the" win for TOU plans.

-

S corp Health Insurance question please

Medlin Software, Dennis replied to WITAXLADY's topic in General Chat

For the company to properly handle: Added to gross pay. As allowed by statue, excluded from certain taxes such as likely SS, Medi, and UI). I have seen nothing which allows exclusion from garnishments, such as child and spousal support (sadly, something which seems to get overlooked as the family services folks likely do not dig deep enough). So yes, other than specifically excluded items, the amount is remuneration, and taxable/reportable. Thus the what I call "game" of only adding it to the W2 is not proper. Whether the owner/emplyoee handles the amount, when properly reported, as an above the line deduction, is up to the owner/employee. 2008-1: "Accident and health insurance premiums paid or furnished by an S corporation on behalf of its 2-percent shareholders in consideration for services rendered are treated for income tax purposes like partnership guaranteed payments under § 707(c) of the Code. Rev. Rul. 91-26, 1991-1 C.B. 184." "The 2-percent shareholder is required to include the amount of the accident and health insurance premiums in gross income" That the amount may be an above the line deduction does not mean it was not reportable and taxable income, upon constructive receipt, and does not allow any special exception for paper handling via a once a year entry. -

S corp Health Insurance question please

Medlin Software, Dennis replied to WITAXLADY's topic in General Chat

The notice which started this issue was "incomplete". It reflected only a small part of the ramifications of the notice. Thus, the proper handling is left up to interpretation. ACA added complexity as well. The keys are the amount (if eligible) is considered remuneration. What most miss is remuneration are taxable and reportable as earned (benefited from), so this really leaves out annual adjustments (although I know of no enforcement reports). For me, I include a proportional amount on each paycheck for ease of processing. It raises withholding, but the employee could submit a revised W4. There is nothing prohibiting reimbursement, within ACA allowed circumstances. -

Same old same old. Getting employers to change could result in dismissal. If one wants to go that way, offer the employer one chance to rectify, then move on. I used to think ignorance was the usual reason, but it has drifted to known non compliance. Nexus issues will get worse over time as states increase efforts to use obscure rules to increase income (recover lost income?).

-

Often times, the TPSP provider does not withhold, and neither does the employer. Thus two W2’s are normal, and under withholding is as well.

-

PA taxes retirement contributions (no deferral) so a full PA year with day a 401k will show PA taxable wages higher than federal.

-

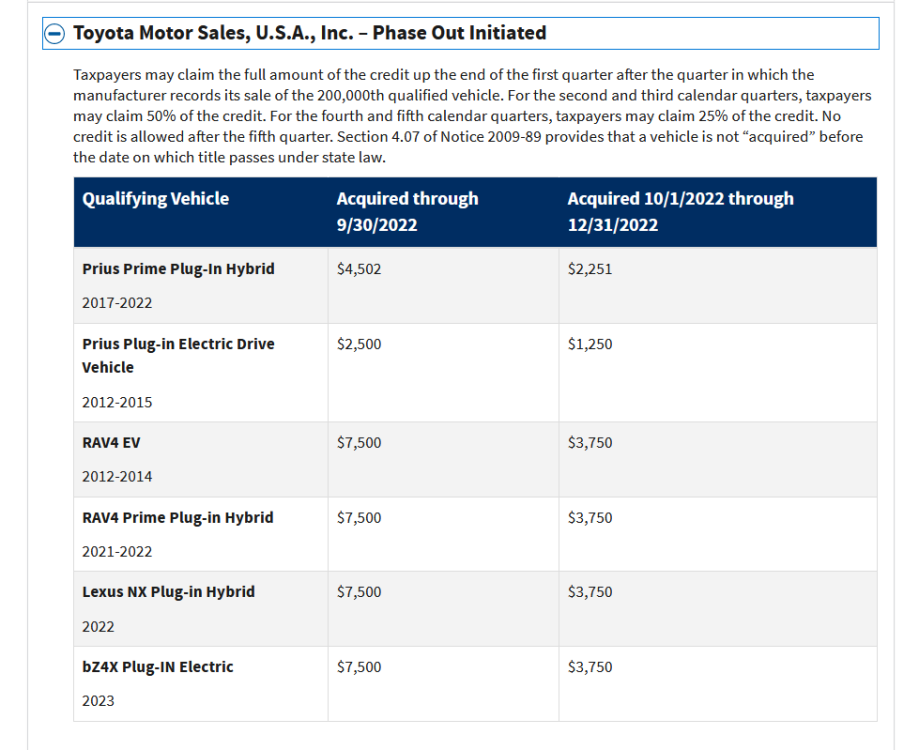

https://www.irs.gov/credits-deductions/manufacturers-and-models-for-new-qualified-clean-vehicles-purchased-in-2022-and-before

-

So many believe they do better not paying RC and payroll taxes, versus a good long healthy contribution to SS... While it does not come up often among my customers, I have yet to hear from one who was doing better with their investments over SS, as many seem to skirt RC. I share this as often as I can. In the last couple of decades (maybe longer?), SS is still a better "deal" for the average person. What often gets overlooked is coverage for non working spouses, disability, survivor benes, and how a disabled child/adult can transition from SSI to SSDI when a parent claims SS (or on death). I have a huge bias - to be clear. My grandmother collected well from SS for 50 years. I was a survivor bene recipient. I have a non working spouse. I have a disabled child/adult - who will likely draw SSDI from my record for 30-40 years (a significant "raise" from SSI, and with no means test).

-

G2R’s quote actually has the answer for RC. “Remuneration”. This means they insurance counts towards RC since is is money received because of employment. Remuneration is the term to stand on, and their definition is favorable. back when we got our first mortgage I was an employee only. The lender said we did not have enough income. “Suddenly” I had a new stub with no Section 125 (health insurance) and that same amount added to taxable wages. I also had a letter from employer stating I declined Section 125 going forward. Silly exercise, but it worked.

-

Depends on who is asking and how the owner/employee replies. Mortgage lender, does not likely count Section 125 or S corp insurance. Other lenders, make them define what they are asking for and they may ask for Box 1 earnings. I push to include health premiums as pay. I am going to have insurance, pre tax or not, so why should I be punished (lower countable pay) just because I can avoid taxes on the premiums. For those trying to just meet RC, this is a real issue to ponder since their premiums could be 20k plus (family).

-

Windows Task Manager is also a fair way to see what is running. History and fact. Most of the issues with preloading and startup are user caused. What I mean is devs are inclined to preload to lower customer complaints about software startup speed. Same reason we (computer users) still, since Windows 3.1, have issues with lost data from power interruptions (disk caching enabled). Disk caching is when the OS loads memory with what it thinks can be safely handled later. Exactly like a child promising to get chores done now, when the child really means they will try to get them done before they get caught. Then, add in networking, and you get unexpected delays from another machine, and just plain delays from the OS checking and waiting to see if other machines are connected, and complication exponentially grows.

-

Correct, depending on the vehicle. The unknown is when the battery spec restrictions will start.

-

I think GM had met the volume restrictions and was ineligible. Jan 1, 2023 the volume restriction went away. Currently, we are in a time/loophole window while the battery restrictions are being developed and published Written as I smile while waiting to pickup our new Tesla. The 9500 total (fed and state) credit /rebate was too much to ignore.

-

California middle class refund

Medlin Software, Dennis replied to grandmabee's topic in General Chat

IRS and logical in the same sentence... Not good to see/read while eating! Feb 14, and I am still dealing with folks who do not understand that 0 withholding can be proper, than there was a HUGE adjustment to the withholding brackets for 2023, and the prior W4 "change" is still biting many employees. -

It seems I forgot everything I knew about ATX

Medlin Software, Dennis replied to BulldogTom's topic in General Chat

I get the same every year when I look back to remember how to reverse distributions. It is the once a year items which I have to be careful of. It has taken be decades to let go of Dr and Cr entry "speak", and just think of where it is going and where it came from (like my customers think). -

Since you did not say he gives all deposits from the December statement from his separate business account, and all cash/checks/cards go through said separate business account... (you likely know where I am going). I do not miss shoe box accounting, writing checks, or using cash (for business). Long live charge cards with rewards and their detailed monthly statements!

-

In this specific case, since the employer is in MA, probable more delicate than difficult. I suspect an oversight, maybe belief the pandemic rules were still in place, maybe new payroll person. Normally, I would pass. But this case, I would share the options with the potential client and let them adult. If they want to do it right, I would take it on.

-

That’s the rub we have gone over here more than once. In this case, ot may be an oversight since the employer is based in MA.