-

Posts

227 -

Joined

-

Last visited

-

Days Won

3

Everything posted by G2R

-

Here's a good place to start with a ton of info. (There are so much on the internet now, it can be quite overwhelming. https://www.sbc.senate.gov/public/_cache/files/2/9/29fc1ae7-879a-4de0-97d5-ab0a0cb558c8/1BC9E5AB74965E686FC6EBC019EC358F.the-small-business-owner-s-guide-to-the-cares-act-final-.pdf The Covid-19 forum has a lot of great info already!

-

Just curious if anyone is ignoring NY State's nonacceptance about e-signatures given the current state of affairs.

-

CamScanner is an app I recommend to all my clients. it has different filters that makes the documents really easy to see, a fantastic cropping feature and will put multiple pages into a PDF.

-

Tax payment AND filing dates BOTH now 7/15, 1Q estimate too

G2R replied to Abby Normal's topic in COVID-19

I've had a number of clients call me about this and I remind them, this is FEDERAL. Until their STATE issues parallel timelines, they can't take the July 15th date as their own deadline. And then I reiterate, let's just it it FILED and if you want to delay paying till July 15th, so be it! -

I think this thread might be useful.

-

Just wanted to confirm. My client works in NYC, lives in NJ. Her W-2s only come with the NY state information. No NJ portion allocated on the W-2s. She has Roth 401k, 401k, Health Insurance and HSA as deductions in box 12. When I complete the New Jersey return, I have to manually adjust NJ wages to add back the HSA deduction correct? I'm kind of surprised ATX doesn't automatically do this since the codes are there so it should be easy enough to link, but apparently, they don't.

-

What your starting fee for an 1120S? Do you based it off number of shareholders? What about starting fee for Federal, State and City Corporate returns? (For many, I'm sure city is nonexistent, but I'm in the NYC area so I'm askiing.) I think I'm GROSSLY undercharging....

-

I agree, it's gotta be an input item, but I've poured though the details, and just can't find it! Well, thanks for so much in depth analysis. I really, really appreciate it. This whole thing made me do an impromptu refresher course on DDB, HY/MQ Conventions, and the sorts.

-

I see where you were going now! Well thank you for clarifying. Well, I'd now agree with Drake on it's methodology. ATX though

-

S Corp shareholder QBI deduction reduced by health premium?

G2R replied to scottmcfly's topic in General Chat

Logically it doesn't make sense to reduce the QBI income if it was already reduced at the entity level. Example: S-Corp K-1 box 1: $30k, and SEHI is obviously already included in this as it's a deduction on the 1120S return. Payroll $50k (with $10k being SEHI) 1040 would show $50k payroll + $30k Sch E,pg2, Less $10k SEHI. (Payroll shows $10k more income from SEHI, then SEHI deduction nets it to zero because the deduction was already taken on the 1120S return,) If you then take the $30k Sub-S profit and reduce it AGAIN with the SEHI, you're reducing the profits of the Sub-S twice. Now let's take that same example above except pretend the the profit of the company is ZERO. S-Corp K-1 box 1: $0k, and SEHI is obviously already included in this as it's a deduction on the 1120S return. Payroll $50k (with $10k being SEHI) 1040 would show $50k payroll + $0k Sch E,pg2, Less $10k SEHI. (Payroll shows $10k more income from SEHI, then SEHI deduction nets it to zero because the deduction was already taken on the 1120S return,). Does this mean the QBI is Negative $10k? So if you have other business that are profitable you lose $10k of them for QBI purposes? That just doesn't even make sense. It totally makes sense for the Sch C filers to reduce QBI for self-employee health insurance since it's not included on the Schedule C, but not the S-corp. -

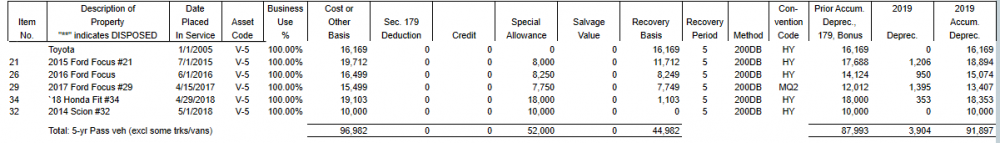

Did you mean 2018 accum depre to calculate 2019 expense? Hmm .. If so, then isn't the 2018 accum depre is $17,688 as shown in the column labeled Prior Depreciation? And for the record, ATX doesn't seem to have that same rate column.

-

Thanks for taking the time to figure this all out. The mid-quarter gets me closer, but I never considered the switch to SL! Thanks for that tip!. Gotta question, in the pic, it looks like prior year depreciation is $17688, so where are you getting the a/d of $16,339 from? No, not that I've found. And the picture of the Drake printout was a big help, THANK YOU. Seeing the RATE column let's me see that DRAKE is using the HY DDB convention for 5-year property table. Now, I gotta see if ATX will give me that same column information on mine and see if I can backtrack to which table it might be using. Wish me luck!

-

I have not, however, just wanted to remind you, if you e-file the return, you need to add the signed Form 2553 as a PDF to the return for it to be filed.

-

I figured out it has something to do with the midquarter convention, but I still can't get the number to be exact. When I use the MQ DDB tables, I get closest to what ATX is calculating. Still not exact though. The other two I referenced earlier as being off as well, were spot on when I used the tables, so it's gotta be something with special about that Ford Focus. Anyways, thanks for your input Terry D! I'm close enough to keep trudging along.

-

I don't know if I'm really that tired, or dumb, but for the life of me, I cannot figure out how ATX is calculating their depreciation for my client's vehicles. Help! In the below detail, the 2015 Ford Focus. My calculation is: $19,712-17,688= $2,024/5 = 404.80 * 2 = $809.60 ... They get $1,206. What am I missing? My calculation works for the 2016 Ford Focus, but the other two I'm off again.

-

Hi! I've always entered the total of NYS & NYC together in the NYS taxes paid. So far, I've never found a reason the NYC tax estimates need be separately reported since they are totaled on the return on line 75 anyway. Truthfully I have no idea why they have that NY City taxes entry there in the detail section of Line 75.

-

Sorry for the late reply Margaret. Originally I was asking clients to upload to various Clouds they may have that I also have; One Drive, Dropbox, Google, etc. But this year, I'm trying out SignRequest. So far, it seems easy. The only annoying thing is that it's a separate email to the client, rather than part of my original email with the return information. We'll see how my clients respond to it. As for encrypting docs upload to OneDrive. No I don't encrypt them. Once the engagement with the client is completed, I delete their info from my drive completely.

-

Finally got someone on the phone. They instructed I delete my EFIN number, save. Then reentered it. It fixed the problem.

-

Did you ever get a solution for this. I too and getting this 77 error code, "You have transmitted an EFile using a transmission relationship that is not valid in the EFC Client Database."

-

I use OneDrive expiring links. I upload the documents I need to send with a link that expires in 3 days. They can download from there anything I'm sending. Since the link expires, I don't have to worry about a hacker getting their info from these links and my inbox and theirs remains "personal-info-free."

-

My client is an engineer and owns his own S-Corp. He got his bachelor's degree from a smaller school, has been working in the field for a couple years now and wants to get his PE license. However, the school he got his bachelor's degree from doesn't qualify him to sit for the PE license since it didn't have the right accreditation. So he has to take many of these classes again from an accredited school to qualify for the PE license. My question is this. I think if he were getting his bachelor's degree only, the education expenses wouldn't qualify as a business deduction because the IRS views a bachelor's degree as "training for a new profession" regardless if you're already in the profession. But an MBA in the field WOULD qualify as education expenses of the S-Corp because they "maintain & improve skills in your current profession." So here's the tricky part. Since my client already has the bachelor's degree, and he's only taking some of the undergraduate classes to qualify for the PE license, you think that's enough separation to qualify for the "maintain & improve skills in your current profession" and take the deduction through the business? Or am I really reaching here?

-

Just got a notice about this from PayPal. They are no longer refunding ANY of the PayPal fees when refunds are processed. This is gonna piss off of people. Many of my clients will probably skim right over this unaware. Just in case you've also got clients that utilize PayPal, you might want to let them know too. https://www.theverge.com/2019/9/20/20876570/paypal-refund-fee-policy-change-sellers-controversy?fbclid=IwAR3Hsky9TmN_uTd84i7CupJTuoFCSkwuSeYrM8jM2GVcp_D-KcHeiYrKvgk

-

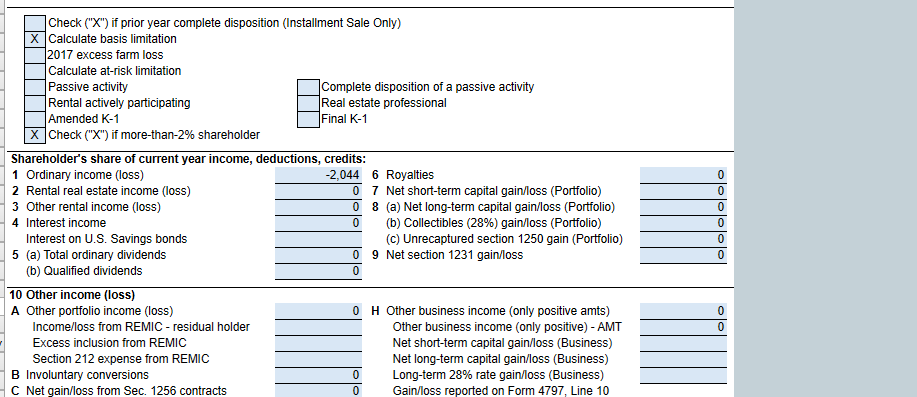

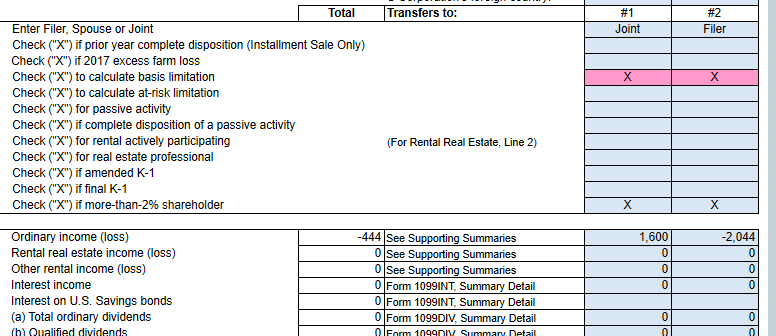

This is what I've already done so thank you for confirming it. My belief that I was still somehow overriding it was based on the DETAIL tab of the 1120S K-1 data entry. When I check mark the "calculate basis limitation" box on the K-1 1120S K-1 INPUT tab: I then get the pink "override" boxes automatically filled in on the DETAIL tab. Not sure why ATX would do that since it makes you think you've done something wrong, but things flow through nicely and line up with my paper copy so I'm happy. Thanks for all the insight everything.

-

Oh, I still don't see how to enter this information into ATX without overriding a box. Any clue how to get the new Schedule 2, page 2, line 28 box to be check-marked in the first place?

-

Interesting. I have filed other S-Corp owner returns, but this is the first with a loss so it piqued my interest. I can see them sending letters for lack of basis reporting if a loss if reported or stock disposal, but I wonder how much enforcement there will be for distributions only as I would think most S-Corp shareholders have distributions. It's my understanding that reporting the basis information is only required if a shareholder reports a loss, receives a distribution, disposes of stock, or receives a loan repayment from the S corporation.