-

Posts

227 -

Joined

-

Last visited

-

Days Won

3

Everything posted by G2R

-

I assume you mean this one.... If so, this yes I had read that already. Your IRS FAQs you posted match the above approach. Still looking to see if others preparers that file 1120S are handling this on their returns the same way.

-

Wow, this tax season feel like college. I have to learn something new every week! 1120S, 2 owners. Both on payroll, no other employees. They filed for the ERC in Q3 for $5000. I just want to confirm I'm reporting this credit accurately. 1120S, pg 1, line 7: Reduced the owner wages by $5k. Sch K, line 13g, code P: $5,000 (which prompts form 5884-A to open) Form 5884-A, line 3: $5,000 Does this look right? What I really hate about this approach is that the 1120S wages won't match the W-3. But I guess that's what the 5884 reconciles out. Also, if the IRS uses line 7 as a trigger for unreasonable compensation, this might trip it.

-

Thanks to both of you!

-

Thanks Lion EA! One more quick question. Their other kid has $2k in capital losses. Would you file a return for that kid just to keep the carryforward?

-

Client's kid has $250 dividends, $200 capital gain distributions, and $1300 in capital gains. So I'm in that over $1100, but under $2200 spot for the kiddie tax rules. Can someone please confirm: The fact that the child had capital gains means I cannot put the income on the parent's return. (Not that I want to, I think the tax is zero, but I just want to confirm this anyway.) If I'm calculating this right, the child still owes ZERO in taxes because everything except the capital gains is below $1100 and the capital gains that bumped them over $1100 are still taxed at 0 because they are capital gains. If all the above is true, and the tax is still zero, am I still required to file the return for the child? TIA!

-

I just started using it this year. It's the first online tax portal I've ever used so I cannot compare to others. I like that they are constantly adding upgrades and seeking requests on ways to improve. My clients seem quite happy with it and getting their accounts activated has been very easy. I love how much more organized managing each client has been for me this year. No more One Drive expiring links, fishing for documents in various cloud portals, etc. I feel much more secure in my communications to clients and as they become more comfortable with this way of communicating, I think my days of SS# riddled documents in my email will be minimal. It took me quite a bit of time to understand how to use it and I'm still learning. I don't think I've even scratched the surface of what it can do. If you've already used a online tax portal the learning curve might be shorter. Also, keep in mind the unlimited signatures is true, but if you want KBA signature, it's $1 extra per signature request. I think as I learn to use it, I'll find it better and better. I haven't utilized the workflow feature at all yet. Mostly client communications, doc exchange, signature request and tasks communications. I look forward to post tax season learning about the workflow and pipeline features.

-

I've spent every free moment of the last few days researching this thread's info. I come from a family of accountants and we always maintain books on a tax basis. Our clients are small mom and pop businesses and reporting books that mirror the tax return just makes explaining things so much easier. Quite honestly, I never knew S-corp bookkeeping to be any other way. In fact, my father adamantly followed the rule, "1120S Sch L R/E MUST = Schedule M-2." I now know better thanks to the knowledgeable members of this forum and countless tax articles & publications I've read since. For anyone reading this thread in the future with similar questions to the ones I had, there's another great ATX thread that I found extremely helpful in better understanding this concept and hope it helps you too. Thanks again ATX forum. I'm humbled as usual. _________________________________ Testing my updated Sub-S books to tax understanding... Using only the above details and pretending the profit was all kept in the bank. Books Balance Sheet: Bank Asset: $1,000 Loan Liability: $56,000 R/E: -$55,000 Tax Return: Sch L R/E: -$55,000 M-2 AAA: 0 K-1: Box 1: $1,000 Box 16, Code $56,000 Basis monitoring is done at the shareholder level so it's the responsibility of the SH to report a $1k profit on the schedule E, page 2 and a $55k capital gain for overdrawing their basis on Sch D. SH current basis in the corp: $0 Going forward, there will now be a permanent difference between R/E & AAA. Correct? (fingers crossed)

-

Tracy Lee, you might find this thread helpful.

-

The above order of operations is exactly how I close books. The only difference is I have always changed the name "Retained Earnings" to AAA in Sub-S client's Quickbooks as I found it easier to discuss AAA & basis monitoring with this change. Given I've never had a client overdraw their basis, I wondered how others handled the bookkeeping of that negative balance. jklcpa, Thank you for your time and considerate replies.

-

Thank you! I constantly remind and borderline harass my clients about keeping their personal and business finances separate. In the follow year, assuming it's profitable, do I net it against the negative R/E first? Then once all the negative R/E is exhausted, proceed as usual with the AAA?

-

Client is a new single owner S-corp. Profit was $1k this year. Company took out a $56k loan from the bank. Then proceeded to issue a stockholder draw to the owner for $56k. Aside from simply reclassifying the $56k draw as a loan to the shareholder, lets say that isn't done. Then owner has overdrawn their basis by $55k and he's got a $55k LTCG on his personal return. But how is the $56k draw account closed out for the year? I usually close out all draws to AAA, but since AAA can't go negative by distributions, only losses, what is it closed to? Meaning, in my YE closing entries: DEBIT: AAA $1,000 DEBIT: ???? $55,000 CREDIT: Stockholder Draws $56,000

-

This worked! Thank you very much for your advice!

-

Just had a 2019 South Carolina efiled return bounce. EFC Reject says "Wrong Submission Year" "Year in Submission ID is incorrect: 2020, should be 2021." I'm in ATX 2019 so just curious if maybe SC doesn't accept past years being efiled. Can any SC tax preparers please confirm? TIA!

-

My apologies. Her TAXABLE INCOME is negative. MFS because her husband lived in RI all year and she's the only owner of the VA property. He made a good amount of money and so their Federal and RI is MFJ. She mentioned filing the VA return anyway for school/residency purposes? But if I'm reading the VA tax rules correctly, she's only allowed to claim one of their two dependents AND only if she herself had provided at least HALF of the earnings. Correct?

-

Lastly, when assessing only HER income, her AGI is negative. So, if filing even still required?

-

Every time I get an email from this client, I cringe knowing it's another new item to add to a multiple-times-completed return. Client is Married. She has a place of abode in Virginia. She spent 44 days in VA. The remainder, she was in RI with her husband. Her driver's license is still Virginia and I'd wager she didn't update her voter's registration either. She's bounced around various states and hasn't actually met the 183 days in VA since 2013. I assume because she hasn't taken the necessary steps to separate herself from VA residency I have to file VA tax return, MFS correct?

-

Need to file an amended Rhode Island tax return. Clients originally filed MFS, now want to amend and file, MFJ. I called RI and they do accept amended returns electronically, but ATX says, "RI DOR does not currently accept electronically filed amended returns" in the Check Return feature. Is this only because the portal is currently not accepting them till the 2/12 date, or does ATX just not offer this service?

-

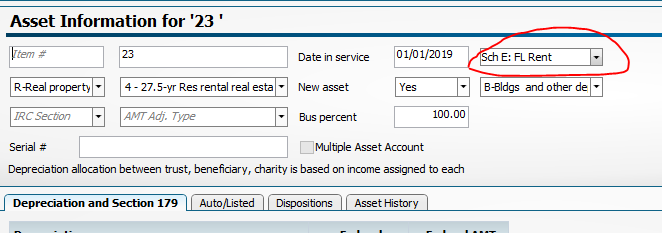

HI Dan, Thanks for the reply. Given there's no K-1 for this kind of trust (the Grantor is given the 1041 Grantor Information form), I was able to find an old forum discussion about 1041s and JKLCPA mention this area of the Fixed Assets data entry that corrected the depreciation not flowing in my 1041 return. I'm adding it to this discussion so hopefully it helps someone else in the future. Thanks DANRVAN & JKLCPA for your assistance.

-

New Client. Needs me to file her Irrevocable Trust return which has rental property. After reading the trust documents, I reached out to the lawyer and confirmed it's a GRANTOR, IRREVOCABLE trust. A unique setup done for Medicaid purposes I'm told. Fine. I have to file a 1041, but for informational purposes only. Then, the grantor is given a 1041 Grantor Trust information form to include the rental income & expenses on her personal return. When I complete the return in ATX, it's not flowing the deprecation through to the information form. I've research this and do see where Sec 179 is not allowable on trust returns, but I don't see where SL depreciation is disallowed. Because the return is really just an information return, am I to exclude the 4562 from the 1041 return, and only include it on the 1040 personal return of the grantor? Or perhaps include a copy of the 4562 with the 1041 Grantor Trust Info form? Or perhaps the deprecation somehow disallowed?

-

That was my only logically solution too so thanks for the reassurance. I just always wonder, before computers were doing all these calculations for us, how in the world did accountants figure this stuff out?

-

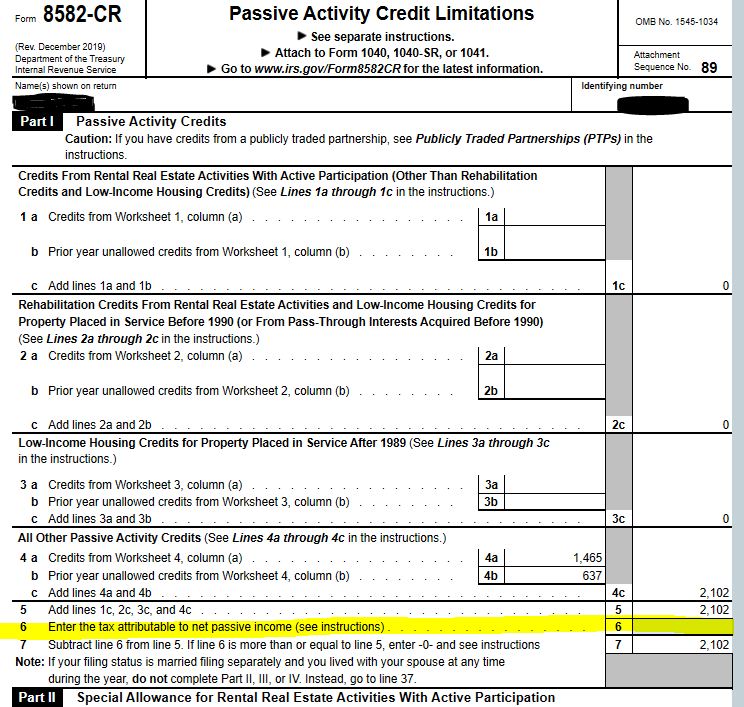

Anyone have experience with the 8582-CR form? I have a new client. She gets a credit each year from a partnership for Employer SS/MED taxes on the K-1, and she many years of disallowed credits that she's carried forward. I think the previous accountant was using Drake, so I'm hoping some of the Drake users here might know. When I'm calculating the 8582-CR, line 6 amount on page 1, ATX does NOT auto-calculate this for you, it wants me to calculate it. I've manually calculated it, but when I go back and use my methodology to check myself on the previous returns filed, I don't get the number that's on that return so I'm second guessing my methods. Does Drake calculate this number for you? And if is, do they show you somewhere HOW they calculated the number? My method of calculating follows the IRS instructions for 8582-CR. Tax on Taxable Income with Net Passive Income MINUS Tax on Taxable Income without Net Passive Income. Seems simple enough but perhaps there's a step I'm missing? I'm using tax tables to calculate the tax for both.

-

So I got tired of trying to remember all the steps to take doing this and finally took the time to document it all. I hope this helps save someone else a lot of time and aggravation going forward. If there's spelling, grammar issues, I apologize. When I created this, I didn't intend to publish. Reconciliting Self-employed health insurance and premium tax credit.pdf

-

Thanks for the heads up on the link. MODERATORS, help! I can't edit the post anymore. I'm not a customer of theirs, but somehow got on the email list anyway. Hmm, I'm so tired, maybe I was researching in my sleep.

-

This was a solid read regarding the various options for small business assistance from the U.S. Senate Committee on Small Business and Entrepreneurship. It answered a lot of questions I keep seeing people ask. Hope this helps others. The Small Business Owner’s Guide to the CARES Act In addition, I subscribed to Live Oak Bank emails and they have been great about getting specific and changing information out really quickly. Here's an example of what they sent out yesterday. Live Oak Bank Wed, April 1 Email (link was removed, contents posted by JKL in a post below) All the best ya'll. Last year's tax season was brutal with all the tax reform changes, and I thought this year would be much, much easier. HA! Enter, the Coronavirus & CARES Act. BAM! I'm a hot mess again. Be well!