-

Posts

227 -

Joined

-

Last visited

-

Days Won

3

Everything posted by G2R

-

That's a damn shame @cbslee. Wonder if they ever thought back to childhood memories and asked themselves, is this really what we've come to? Had a client who gifted shares of his company to his children. Easily worth millions. The son got mad at at his dad and sold these gifted, never earned them or worked a day in his life, shares to the minority shareholders, which then gave them the majority, and they eventually pushed the owner/dad out of his own company that he had built from the ground up. Most cold-blooded move I ever saw in my career.

-

Correct. Thanks for your reply @cbslee. As always, I really appreciate it. When they first got into this mess, I told them "The only one that's gonna win in this are the lawyers."

-

Family business. The shareholders are in a bitter legal battle with each other over ownership, money handling, trademark infringement, etc. The way I understand, legal fees paid for the protection of company assets (trademark), and in the ordinary course of business (like being sued by a customer or vendor) would be deductible to the company. But the battle over who will retain ownership, buyouts, etc, is NOT deductible to the company. I have asked the lawyers to be very specific in their billing so I can pick through the bill for deductible items. Any one have experience in this area to confirm my research. TIA

-

S-Corp Instructions 2021 Updates, PPP Forgiveness Reporting

G2R replied to G2R's topic in General Chat

Thanks Dev. Do you know when ATX updated this? I was just working on a return last night and didn't see the numbers flow as you've described. -

S-Corp Instructions 2021 Updates, PPP Forgiveness Reporting

G2R replied to G2R's topic in General Chat

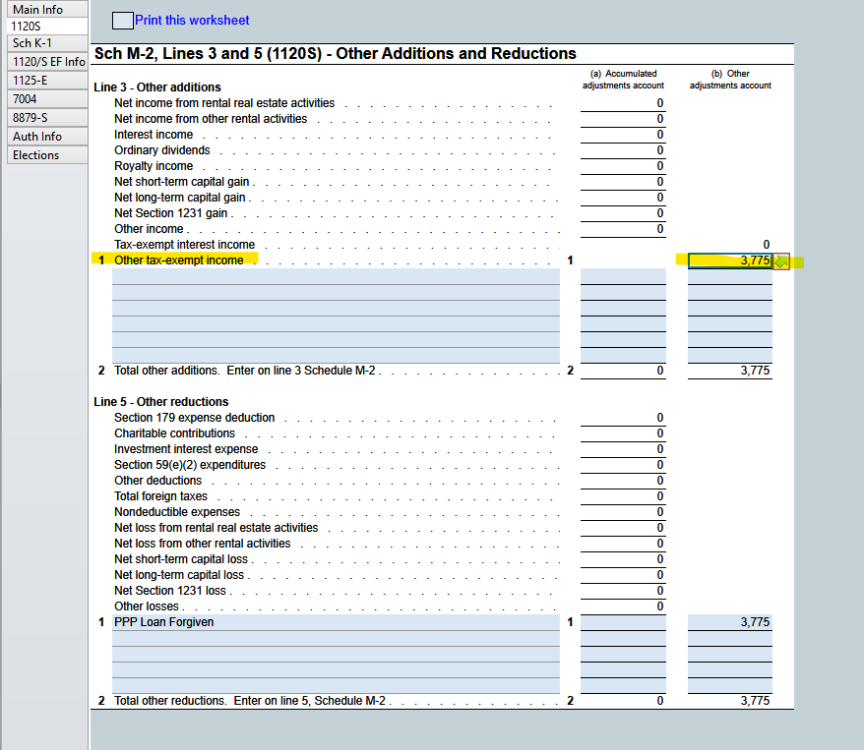

Hi JKLCpa, this confused me. I thought the updated 1120S instructions actually does say to increase AAA. -

S-Corp Instructions 2021 Updates, PPP Forgiveness Reporting

G2R replied to G2R's topic in General Chat

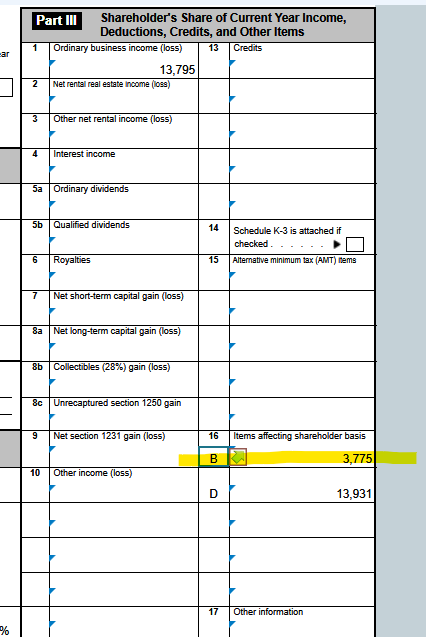

Question: When preparing the K-1 schedule for an 1120S, so a SH can keep track of their basis, I think box 16 should have code B (other tax-exempt income) listed. Can someone confirm this? -

Form NYC-208 Enhanced Real Property Credit - Renter Credit

G2R replied to Chowdahead's topic in General Chat

-

Hi @Yardley CPA I have a client that works in NY, but lives in FL for her own convenience, not the employers. I only file an IT-203 and allocate 100% of the W-2 income from the NY job to the NYS amt column pm IT-203. Another client of mine work in NYC, but come Covid, he worked remotely in NJ the entire year. All wages were still allocated to NY earnings despite his lack of physical presence in NY. I think IT-203B is meant for W-2 jobs where some of the wages are earned inside NY and some are earned outside NY, the deciding factor being necessity. Meaning the wages earned outside NY and are not allocated to NYS because it was necessary for them to be outside of NY to perform the job. I agree with your assessment of the convenience test. I was confusion about the NJ/ Penn reference in relation to NY so if I misunderstood the question, I'm sorry for a pointless reply.

-

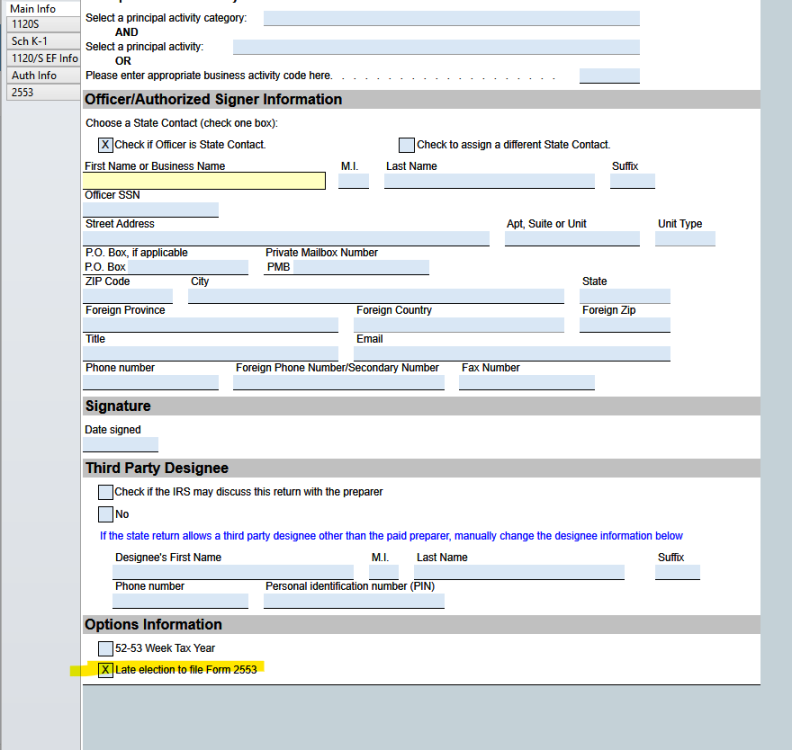

New client, new LLC in 2021. They want to be taxed as an S-corp for 2021. They didn't file timely so I'm filing a late 2553. I found the button in ATX to add the verbiage to the top of 1120S (screenshot below for anyone looking for it). Question: do I attached a PDF of the signed 2553 to the efile or do I have to fax a copy to the IRS? Should I do both?

-

S-Corp Instructions 2021 Updates, PPP Forgiveness Reporting

G2R replied to G2R's topic in General Chat

Thanks @WBR I'm glad they clarified it! -

I too haven't dug into any NY returns yet. If I run across this myself, I'll chime in if I find anything that can help.

-

S-Corp Instructions 2021 Updates, PPP Forgiveness Reporting

G2R replied to G2R's topic in General Chat

Thanks! It'd be nice if the instructions clearly stated column (a), line 3 for the adjustment. Do you see another way the understatement is corrected? -

Just reading up on the 1120S instructions updates. Found this summary which quotes the 1120S instructions. To Read the Entire Article, Click Here The words in red were written under column (d) instructions for the 1120S so I'm not understanding how this corrects the reporting on M-2 column (a) being understated. Are we suppose to add the PPP forgiveness to line 3 of column (a)?

-

Redemption of B's stock so A become 100%. The two SHs do not want to own the replacement property together. Since the property is tied up in the S-corp, it seems getting B out offers the lowest tax cost overall. A becomes 100% owner of the S-corp and can choose the property he wants inside the corp & B, with the SH buyout proceeds, can purchase whatever property he wants individually. Does that sounds accurate?

-

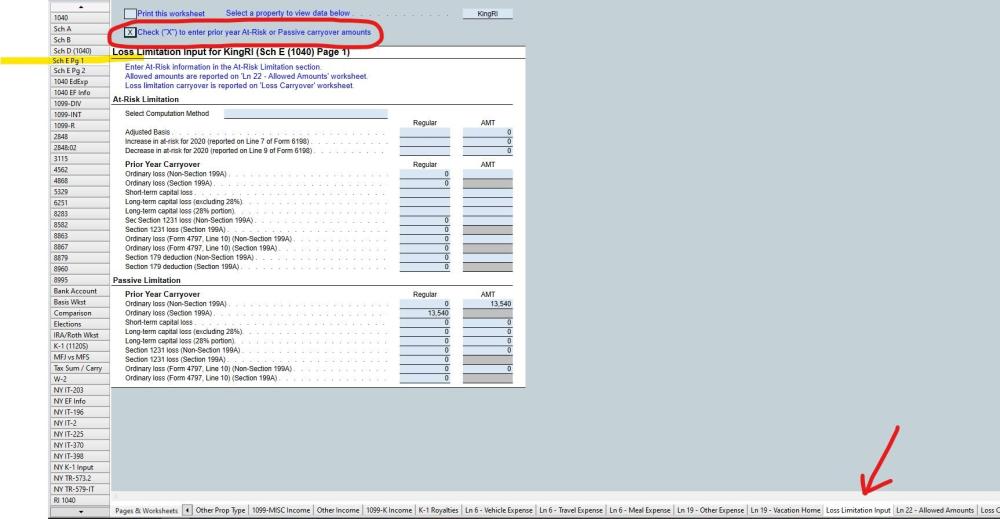

How to enter prior year passive loss carryovers for Sch E?

G2R replied to Abby Normal's topic in General Chat

Agreed! It shouldn't be such a mystery to find. I find those little checkboxes and blips of information ATX throws in above the forms is where they stealthily put a lot of incredibly important data entry clues. -

Thank you @DANRVAN for all your insight on this. It's good to hear another professionals advice on the matter. You're 2nd option for the buyout if they don't have cash is what I was trying to explain in my post above (obviously not well). I've referenced my thoughts in Red below. If you see something drastically different than you analysis, please let me know. I want to learn. This is what I meant by the 2nd bullet point above. "25% of the $100 would be recognized when it's not reinvesting in like-kind property & instead used to buy SH B's stock. (Unless he gets a loan from a bank and finances the stock buyout.) Only problem is I asked the SH if he thought the bank would give me the loan with the recently acquired property as collateral, he said he didn't think so. Seems odd though considering the loan would be for 25% of the property's value. I probably should have noted that BOTH SHs are my clients so the tax ramifications to both are important.

-

How to enter prior year passive loss carryovers for Sch E?

G2R replied to Abby Normal's topic in General Chat

-

Ok, between your article @DANRVAN and the one @cbslee linked, I think this is how it goes. Cbslee's article discussed one shareholder wanting 1031 & the other wanting to cash out. What I thought they were saying was that it's all or nothing. If any cash is taken by a SH, then the entire 1031 exchange is taxable. But actually, reading it a second time, what it's saying is, the portion not reinvested is recognizable proportionate to the SH ownership. (Typical 1031 stuff.) Say they sell property for $100. Shareholder A wants to 1031 his portion, the company reinvests $75 into a like-kind property and no gain recognition will occur on that. But SH B wants their portion for themselves, so if they distribute $25 to themselves, that triggers gain recognition to the shareholders based on ownership. (25% of the sale's proceeds aren't reinvested, so SH A would have to recognizes 75% of that 25%'s gain!) That's unfair to SH A, but that's how it would play out. So, I'm not seeing a way around 50% of of the gain being recognized by the SHs without financing the stock buyout. 25% would be recognized by SH B when he sells his stock in the company. 25% of the $100 would be recognized when it's not reinvesting in like-kind property & instead used to buy SH B's stock. (Unless he gets a loan from a bank and finances the stock buyout.) The timing of the SH buyout is irrelevant. Then I found this article: https://legal1031.com/1031-exchange-resources/1031-exchanges-s-corporations/ In the article, they give a potential solution, but I'm struggling to understand OPTION 3's execution.

-

True. Thanks for you take on the subject!

-

So the 25% SH needs to be out BEFORE the 1031 happens or the entire gain will be recognize. Is that how you read that? I wish there was a more direct publication that specified the rules for shareholder buyout and 1031 timing.

-

Perhaps this article might help... It's not an exact answer, but it hits many of the points you might question. https://farr.com/1031-exchange-into-principal-residence/

-

Client is a 75% owner in an S-Corp. The S-corp owns property that is about to sell for big bucks. Client wanted to do a 1031 exchange but wants to be 100% owner of the new properties. I explained that usually the same owners must sell and buy the exchanging properties in a 1031 exchange. If the S-corp buys out the 25% owner shares, then my client becomes 100% owner of the S-corp and can proceed with the 1031 exchange under the S-corp umbrella. What do you think? Is there any advantage or disadvantage to 1031 occurring BEFORE the 25% shareholder is bought out?

-

Deadline to opt in for 2021 is TODAY. This is from an email NY sent out a while back: To opt in: Log in to your S corporation's or partnership’s Business Online Services account. (If the business doesn’t have an account, we recommend creating one by October 8 to avoid missing the election deadline.) Select the ≡ Services menu in the upper left corner of your Account Summary homepage. Choose PTET web file from the Corporation tax or Partnership tax expanded menu, then select Pass-through entity tax (PTET) annual election. Reminder: Tax professionals cannot make the election on behalf of their clients.

-

Let me add, it only seemed really advantageous for the higher earning clients. Those making under $100k profit in their business, and/or not in the higher tax brackets personally, it mathematically didn't justify the election.

-

I'm doing a side by side analysis of my NY clients and how it affects them. It seems to be a great deal. Even with the lower QBID deduction, the fact that it lowers AGI, those on the borderline of phaseouts will reap the benefits. I'm still a bit shaky on the NY personal return effects. I read that they get a credit on the NY return, but is that credit AFTER the tax is added back on maybe the IT-225?