-

Posts

227 -

Joined

-

Last visited

-

Days Won

3

Everything posted by G2R

-

The first statement was referencing debt from shareholder that had supposedly grown through 2021, but no formal loan docs had ever been made. Owner didn't know it was necessary. So, as of Jan 1 2022, all previous loans from shareholders to the company would be reclassified as APIC. For 2022 books, the second statement referenced the possibility of open account debt as of Dec 31, 2022, that stays within the $25k limit. 2023 is looking rather profitable thus far so, he could pay off that debt by year end, not have the formal loan docs requirement and the reimbursements to him wouldn't be considered return of capital. Just throwing the idea out there for opinions.

-

Thank you everyone for the advice and professional experience. I really appreciate it. Curious thought. The amount listed as loans from shareholders is way over the $25k open account limit. Is there any value in reclassifying all of the loan to shareholder to APIC except for $25k? It will be paid off by end of this year.

-

I've made it clear what I expect of them moving forward. They are more than willing to obliged it seems, they have just never had an accountant educate them on what is truly needed to have proper records. They want to do it right so I'm doing my best to get them on the right course.

-

Same accountant for the last 20 years who didn't seem to mind all the comingling that was going on. No more comingling going forward. The 7203 on last year's personal return shows shows zero beginning balance, a $50k contribution (client's know nothing about this so I think this was just plugged in there), and a small positive ending value so the IRS has an ending basis in their records already if they are actually tracking the 7203. Nothing listed in the Debt Basis even if the loan from shareholders was accurate. Not sure how to correct this either. But based on the K-1s I have and all the comingling, they have been personally funding the losses for decades. I confirmed, title of the car, insurance and license are definitely in the owner's name, not the business. I do think your suggestion is exactly what happened. Along with ALL the other expenses the owner paid for the business with personal funds. No trial balance was ever done that I can find. Client provided a P&L only, that's what accountant used to prep the returns all 20 years. I have all 20 years of tax returns. The M-2s match the balance sheet R/E for each year. The previous accountant is deceased. To move forward: can/should I recategorize the loans to capital? how can I properly remove the vehicle from the books? It's not even 100% used for business, though they only took the generic 50% usage and depreciation deduction in the years since purchase.

-

New client, 20 years in business as an S-corp. 2021 ending M-2 shows a large loss. The one and only balance sheet I could find was the 2020 1120S which had a very large balance in "Loans from Shareholders." Client knows nothing about any loans outstanding, so no loan documents. They actually had all past K-1s. K-1s only list the income/losses each year. No distributions were reported. Losses were all taken on the personal return each year. No basis history was provided so I have to rebuild it as best I can. For me to get 2022 on the right path, would you simply reclassify the loan from shareholder to capital? Also, there's a truck on the books that the company doesn't own, yet was depreciated the last two years. Do I get it off the books as if it was converted to personal use in 2022? It was definitely used for the business, but no mileage logs were kept.

-

For those that do renew this early, have you found the discount is worth it?

-

Ok. Just confirming it's nonsense. Thanks!

-

Just curious, why does ATX make you answer the digital currency question to file the extension? I don't understand why that is a required answer before ATX will create the extension e-file. Any idea?

-

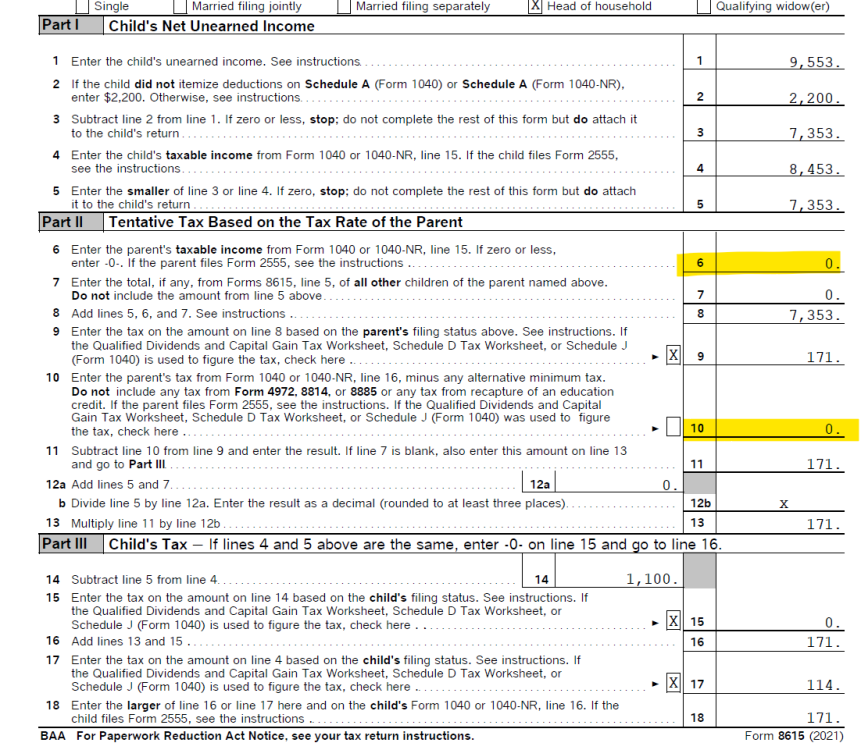

The prior CPA filed both the mom and the kid's return last year. I took the numbers I quoted above from the tax return he filed for mom. Just trying to see if I'm missing something, or if it's an error on his part. I have to complete an 8615 for the kid this year and the previous CPAs 8615 has me second-guessing myself. So here I am, asking the pros.

-

I'm trying to figure out what the previous CPA did. 17 year old son has unearned income, no wages and is claimed by mom. Her taxable income last year was $80k. Tax she owed was $5500. Here's what the previous CPA's 8615 looks like. Shouldn't the highlighted areas have the above amounts listed?

-

Does ATX have the superseded checkbox option? And when you efile this return, does the 1040X still get filed? Or should we delete it before e-filing?

-

Family owns a rental property (2 brothers and sister) and transferred their rental property into an LLC, taxed as a partnership, mid year. A few questions: Does the LLC basically steps into the shoes the partners wore prior and continue on the same depreciation schedule? If so, I'm struggling to make this work in ATX without overriding because the LLC transfer occurred mid-year. The 1065 return wants to give them full year depreciation, but it should only show 1/2 year. I'm tempted to just let it ride and take zero depreciation on the Sch E for the 1st 6 months before it became an LLC, assuming my assumption on procedure is right. Are their any tax implications on the personal return? They didn't sell the property. It's all the same owners. So I don't see why there would be but I just want to confirm. Should I note the transfer somewhere on the return and/or in ATX so the IRS doesn't just see this large asset vanish without explanation? When I build the balance sheet of the 1065, do I list the property and improvements at their original cost and accumulated depreciation taken thus far? If yes, then I assume the capital accounts of the partners are the depreciated basis of the property right? TIAFYH!

-

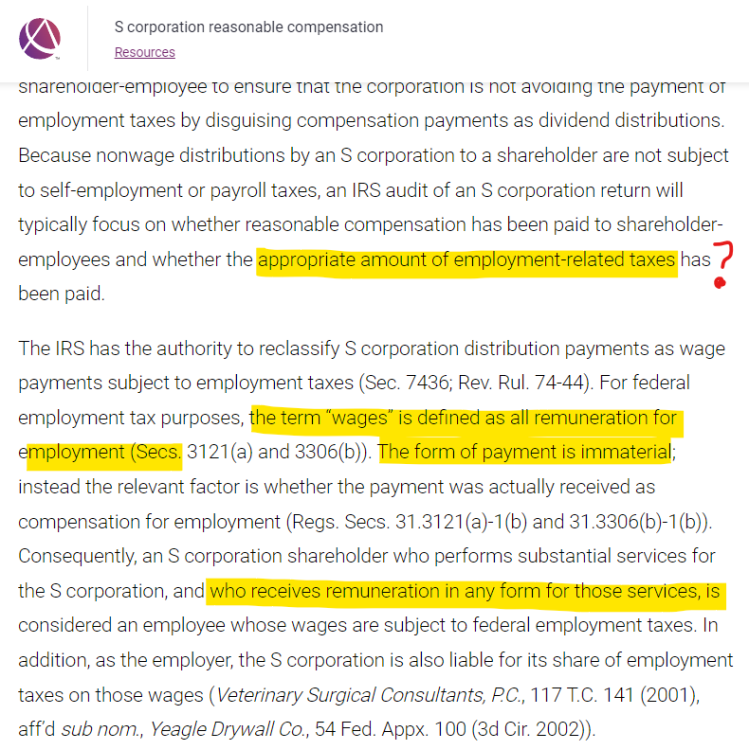

It doesn't seem that there are specific regulations that state this one way or another, none that I have found at least. As @cbslee stated, court cases have focused on the payment and/or avoidance of employment taxes so I wouldn't avoid the employment taxes entirely. I'd expect many of these cases were primarily about compensation being too low and not about HI not being applicable to RC calculations. And as @mircpastated, having Medicare wages be at least equal to the SEHI to get the benefit of the deduction makes logical sense. The way I see it, if you had solid proof that reasonable comp was say $80k for the industry and $10k of it was HI, it would be in the IRS's hands to prove their regs say the HI isn't includable in the RC calculation. JMHO.

-

I've always assumed it was box 1. Is there some place you've read that box 3-5 are the determining factor for reasonable comp? The thread made me dig for more research and though I couldn't find anything that outright gave the answer, this article by the AICPA discusses it ambiguously, but admittedly, it's not a slam dunk. The Wage Compensation for S Corporation Officers fact sheet from the IRS discusses reasonable salary and then mentions >2% Shareholder HI in the same sheet so it seems like they might be alluding to it being included, but if I've read too much into that, I'd definitely want to know.

-

One benefit to including the health insurance amounts in the wages (as you're suppose to do anyways) is that is helps fulfil the reasonable compensation requirement. With health insurance as high as it is, it's a nice chunk of the reasonable comp being covered and it's not subject to FICA. WIN-WIN.

-

Grantor trust sold rental property. There's approx. $40k in unrecaptured 1250 gains. I cannot figure out how to get ATX to push this gain to the 1041 Grantor Trust information. Not sure if it has something to do with it, but ATX says I must delete the Sch D before I can efile. Since this is an information only return, should I just add the gain on the notes section of the 1041 Grantor Trust information sheet?

-

Thanks so much for all the helpful hints. I've printed your reply and stuck it the folder for future reference! Thanks again.

-

Hello, I have to file a simple DC return this year for my one client that lives & works in DC. I've inputted the W-2 info into ATX and I notice the wages pushed to the D-40 is the federal wage amount, not the DC wages listed at the bottom of the W-2. The instructions say to do this as well, I'm just curious how the DC wages on the W-2 were even calculated? Also, ATX is saying I have to attached a copy of the federal return. I assume this is only for a paper, and that I don't have to separately attach a PDF of the federal return for the e-file. Please confirm. Thanks!

-

Input field is at the bottom of the K-1 input under the Basis Limitation section. It still needs to be attached as a PDF before efiling.

-

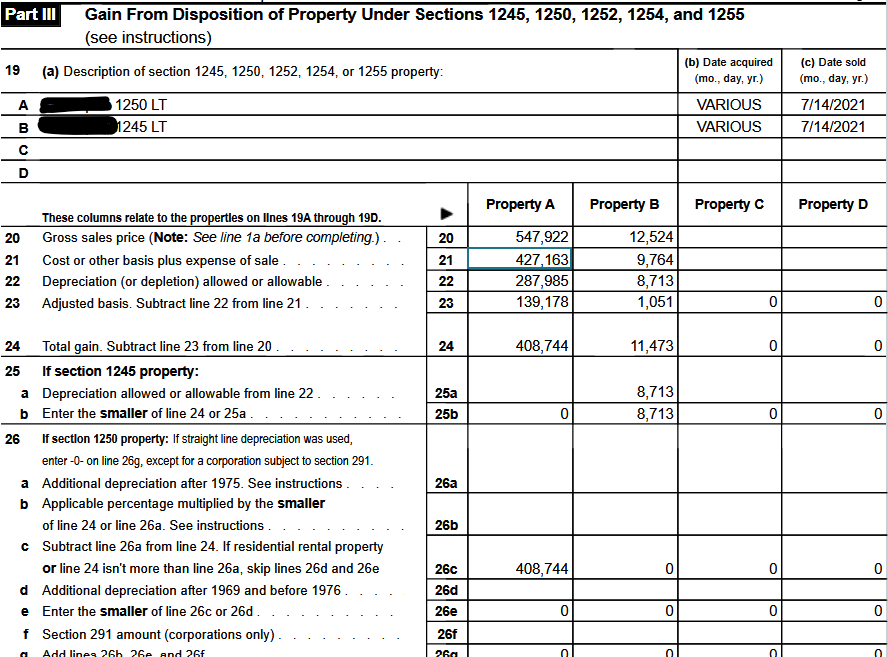

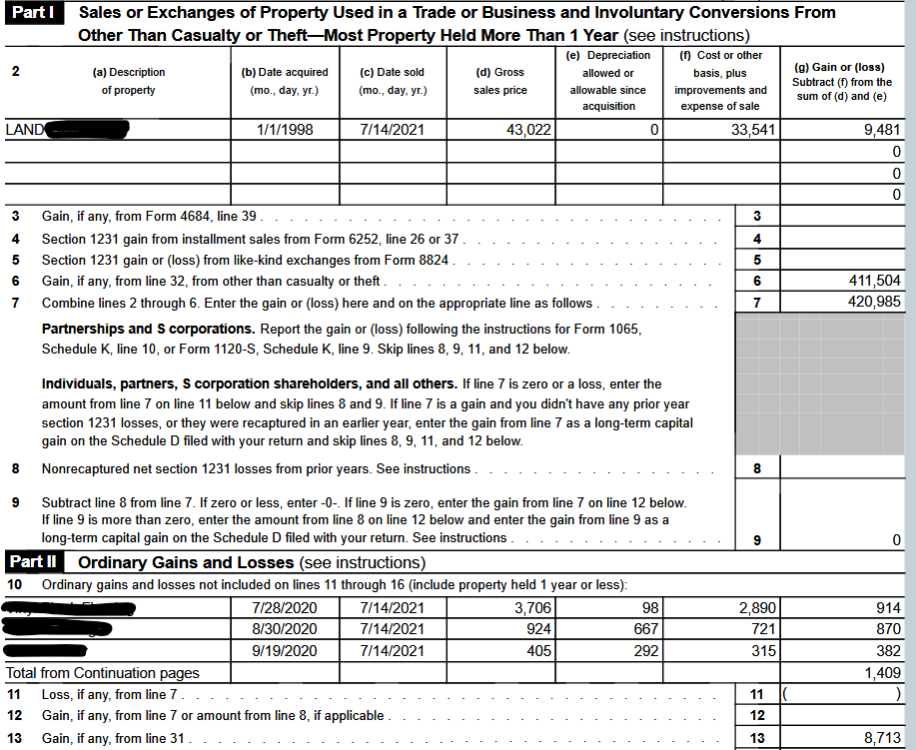

I'm reporting a sale like this now and just want to confirm my method. I have created a spreadsheet that breaks down the 1250 vs. 1245 vs Land, further breaking them down into Long-Term and Short-Term assets. I then did bulk sales for each of these sub-asset accounts in ATX. I divvied out the Sale price and selling expenses based on the cost basis percentage. ie if land cost was $20k and the building were $80k, land would get 20% of the sale price and selling expenses. Building would get 80%. Lastly the unamortized Refi Costs are immediately deducted on the Sch E current year activity. Here's what the 4797 look like: I think I've got this right, but ATX is a bit daunting it how it requires this data entry so I just want to double check my work. Is this how ATX data entry should be done in this situation?

-

I completely agree. I apologize for leaving it out, but honestly, didn't even know what power of appointment was till it the lawyer explained it to me. I too found this confusing and contradictory. I asked the lawyer about this and he said, during her lifetime, the 7% clause was in effect, however the power of appointment language in the trust says that upon her death, she can will the properties to whomever she wanted. This language effectively transfers the ownership of the properties (for estate purposes) to her. Meaning it's includable in her estate and qualifies for stepped up basis because she is legal owner, not the husband's trust. It's an interesting situation that I learned a great deal from. Again, thank you everyone for your comments. I hope this thread helps others in the future.

-

Luckily no. Here's an update for anyone that comes across this in the future. Spoke to the lawyer, they pointed me to the section of the trust that showed the wife had power of appointment for the properties. For estate tax purposes, this means she is the owner of the properties so they must be included in her estate regardless of the deed because at any point in time, she had the power to transfer the properties into her name. The lawyer confirmed this as well. Thank you @Sara EA! So in conclusion: For tax filing purposes, the deed in the husband's trust name meant a 1041 for the husband's trust was required each year. If the properties had been transferred to the wife's name, the trust would be dissolved. For estate tax purposes, the properties are includable in the wife's estate because of the power of appointment clause in the husband's trust. Thank you everyone for all your help and insight. I really, really appreciate it!