-

Posts

227 -

Joined

-

Last visited

-

Days Won

3

Profile Information

-

State

FL

Recent Profile Visitors

The recent visitors block is disabled and is not being shown to other users.

-

Did you complete a IT 360.1? Also, be sure on page one of IT-201, question E & F correctly with days and months.

-

Just in case the developers at ATX monitor this forum.... Is there a reason the Tax Summary Carryover Summary doesn't detail QBI Carryforwards? I routinely check the 8995 for any QBI CF, but I can see how this is easily missed if it's a new client and/or if the data isn't rolled over the next year (new tax software). Or if there's a netting of QBI CF, then at least have a *** note on the CF summary that says, "QBI CF present." Something of an alert for this and the other CF info that was present in a previous year. Just my two cents.

- 1 reply

-

- 1

-

-

'Keep me authenticated' check box added to ATX Tax!

G2R replied to Abby Normal's topic in General Chat

This was a GLORIOUS discovery. Thank you!! -

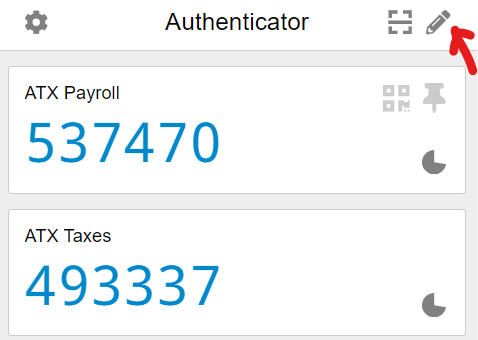

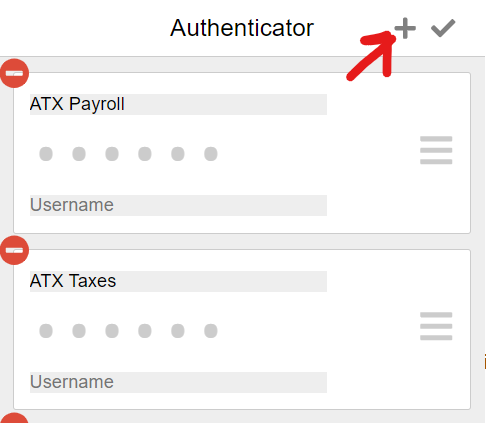

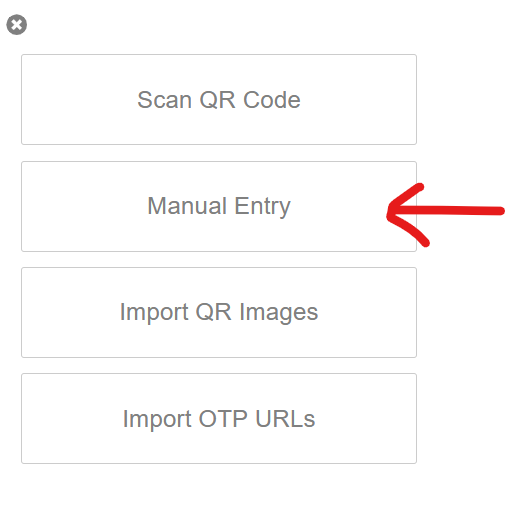

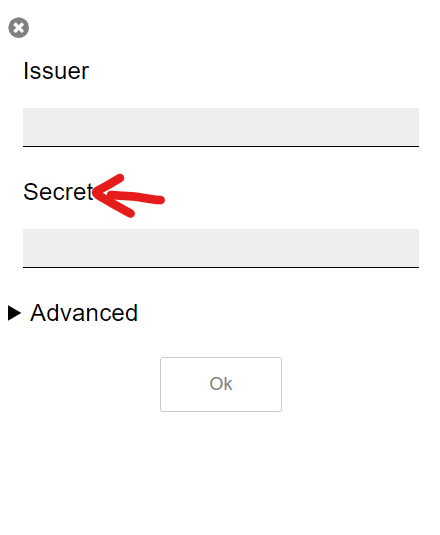

I reached out to ATX. The guy said 95% of his calls since October were complaints about this. Nothing they can do at this point unless rules change. He did advise of a browser based authenticator if cell phone wasn't an option. I tried it and it worked so it'll be a bit easier to explain to my low-tech/no-tech dad. I downloaded the Authenticator.cc browser extension in Chrome. Hope this helps.

-

Not sure how much this might help, but Google being the unasked-for big brother they are often tracks people's location history. If he has a smartphone, he might be able to track each time he went to a rental property to address an issue inside his Google Maps timeline. In addition, email and phone records are also usually stored in the phone and or via the cell phone/telephone records. It's a labor intensive process for the client, but if it's req to avoid a major tax implication, it is what it is.

-

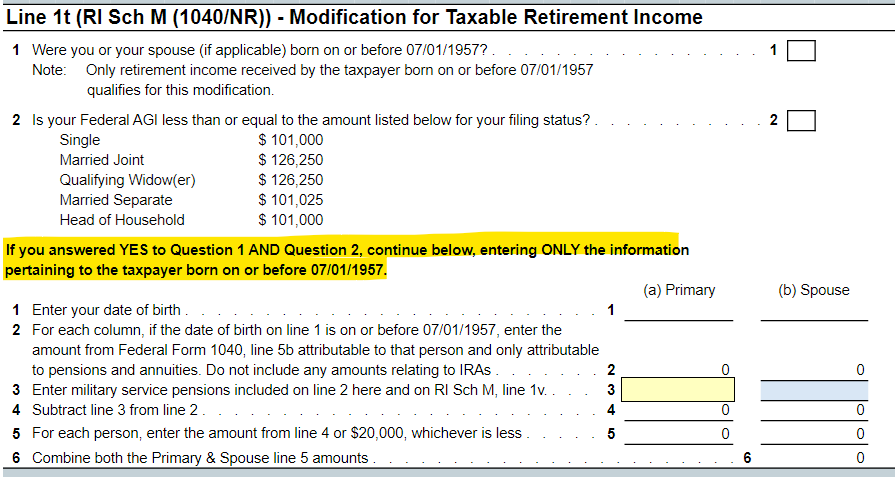

I got a reply from ATX regarding this issue. In case this comes up for anyone in the future. ATX resolution: Additional Note: Not only did the Line 3 instructions throw me off as ATX reports in the resolution, but it was the ABOVE 2 questions being NO, and the highlighted above stmt that said "If you answered YES to Questions 1 AND Question 2, continue below, entering ONLY the information pertaining to the taxpayer born on or before 07/01/1957." Personally, I don't think interpretation of the worksheet instructions are the problem, I think ATX instructions are just flat wrong. Had I followed them, the client would have owed $4500 more in RI taxes. ATX gets alot right federally and catches things I've missed time to time, but on a state taxation level, I find I have to be much more digilent about the return's accuracy on specialty items.

- 1 reply

-

- 3

-

-

@jklcpa You're a genius! Yes there is! For anyone looking for this in the future, the rabbit hole map is: 1120S, pg 4, 17d (yes the greyed out field) and JUMP to Linked Field which takes you to: Line 17d, Sch K (1120S) - Other Items & Amts. Scroll to AC, and click the JUMP to Linked Field which takes you to: Line 13 (1120S) - Interest Expense. Depending on how you answer the schedule B question, the "IRS Sec 448 Gross Receipts Test equation is explained. For the record, it's the preceeding three year average fo gross receipts OR the CY gross receipts. Thank you @jklcpa !!

-

Thank you @jklcpa. I also saw that information at one point in my research. Unfortunately when I manually apply this method to a return I've done in ATX, what I calculate and what ATX calculate sis completely different. I cannot find where ATX explains themselves.

-

Anyone know how ATX calculates the 1120S, Box 17, Code AC (Gross receipts for section 448(c)). I've tried to figure out what ATX is doing and for the life of me, cannot determine their method. TIA

-

G2R started following Rhode Island Military Retired Pay Exclusion, 2023

-

Any RI tax preparations that are familiar with the data entry in ATX for military retired pay? I have a client that received miitary retired pay and starting with 2023 tax year, Rhode Island no longer taxes military retired pay. I believe I found the correct section to enter the reduction on the RI personal return, however ATX is throwing me off with their data entry screen information. My particular client was born after 1957, but I'm pretty sure they still qualify for the exclusion based on Rhode Island publication on the matter. Any chance someone's been down this road and can point me in the right location to enter this into ATX, or confirm ATX's data entry info is out of date? FYI, I do have a case open with ATX to get their take on the matter too. ATX Data Entry Screen: Rhode Island Publication:

-

They are trying to catchup from a year that was far too lopsided. I have explained the need to even it out, but cash flow has prevented them from retifying the issue all in one shot. Dad is the one being shortchanged by the son. He's knows he's losing value each day they don't even it out.

-

Thanks @Abby Normal. Year after year, I have reminded them of this, and the potential fallout should they not follow these rules. You can lead a horse to water .....

-

I found a mistake on the K-1s for a corporate return I filed. The distribution amount listed in box 16, code D is wrong for each shareholder is incorrect. The sum of the two numbers is correct and matches page 3's amount on the 1120S, but the actual amount of each shareholder's individual distribution is incorrect. Would you amend only to correct the amounts in Part III, Box 16D amount? Or just give the shareholder's the corrected K-1 amounts so they can file their personal returns with accurate information?