-

Posts

3,394 -

Joined

-

Last visited

-

Days Won

315

Everything posted by RitaB

-

Yes! The first one that called me after consulting the They Said I Heard Tax Club with the question about whether their return (refund) would be affected 2020 - Oh, my soul. I don't even remember how he asked the question now, but wow, I tried way too hard to answer it. He finally said, "I don't understand," to which I replied, "I know you don't."

-

Phone rings yesterday. I pick up. I know, don't ask me why, but I did. What can I say? I don't have caller ID, and sometimes it's google, and I can just slam it back down. Retiree Caller: You know that stimulus payment? Me: (Thought Bubble: Just yes or no, Rita, yes or no.) Yes. RC: Is it taxable? Me: (TB: Don't adlib, Rita, yes or no.) No. RC: Is the interest [income it will earn in the bank CD I'm putting it in] taxable? Me: (TB: WTH do you think?? Are you kidding me right now?? Yes or no, yes or no, yes or no...focus...) Yes. God is working in my life, y'all.

-

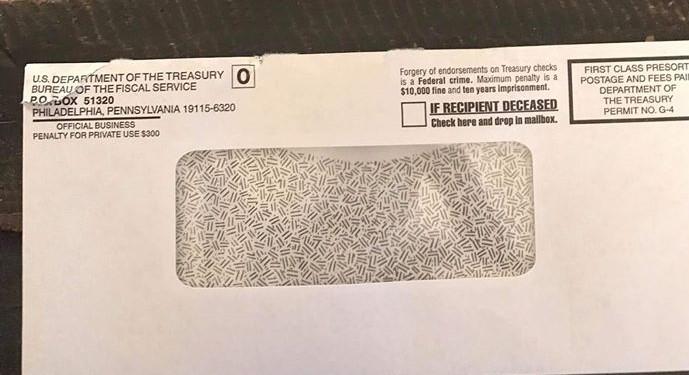

Ask her if the envelope has a box to check indicating that it was mailed to a deceased person, and checking the box instructs postal service to return to sender. Top of envelope, a little to the right of center.

-

He wanted to know how the audit lottery would go.

-

He's spending 50,000 because he enjoys what he's buying. Just like the guy with the swimming pool would still install it, and ask his tax pro after he filled it up. If only elements of personal pleasure was addressed by the nine factors...

-

We all know this one is a hobby. Imagine if he put in a $50,000 swimming pool and called it a business because he sold three neighborhood kids $100 season passes. For some reason, people think hobby farms are treated differently than hobby swimming pools. Probably because they get away with it. All the time. I would just tell him you can't reduce taxable income with hobby losses. Because you can't.

-

I give the entire response a 10. And this part an 11.

-

I believe the intent of the Paycheck Protection Program was to enable business to continue to pay employees while revenue is down and/or stopped - to keep employees tied to the business (employed) so those businesses will have an easier time opening back up and carrying on. I think that's smart. I also think it's being abused. Honor System 101. I hope the people it's intended for get the grants. I do. It's better for all of us if the country gets back up and running as smoothly as possible. I have seen a few of my business owners really taking advantage here, one in particular has a business that is booming, and I am completely disgusted at him. I'm not sure if people don't understand what they're attesting to or understand completely and think it's great. Some of both types I think. Also, I agree that it was a huge mistake making unemployment income exceed the earnings it is supposed to replace. That one will cause a lot of unnecessary problems.

-

Hahaha, yes, this reminded me of my client who came in with her stuff and told me that her husband said to make sure I knew that they wanted the dividends and capital gains distributions on her individual account to be tax deferred. Oh, is that what you want? Ok, good move, savvy investor. I see you're all over it now this fifth year you've had this account and the first year you've opened the envelope before giving it to me.

-

Oh, see, I would never fire someone on the spot. One guy in 25 years made me so mad that his nice letter was in the outgoing mail before he got home, but generally I put up with things for a while. Oh, yes, internally fuming at times, remembering always... I've sent maybe five "it's me, not you" letters overall. Wow, I need help.

-

I wish I could think a little more like you. Anybody who ignores my advice then blames me when what I said would happen happens is just not on my list of nice guys. I would remember this at the same time next year. Is this a woman thing?

-

They really can be jerks. This is the client who gets the nice letter from me: "It's me, not you (it's you). My business is going in a new direction (away from you). Best wishes for your continued success (aggravating the next poor soul to death)."

-

Yep. I was my one customer, too. My dad bought the bonds for me, and I tried, but my mileage wasn't great. I did have one that asked me about it this year. He always has a quick question at pickup. /s I was already dealing with his 529 and showing him he was better off having the kid claim the income in order to use AOTC. Two years we plowed this ground. I wanted to hug him so tightly.

-

You're very welcome. This is handled very similarly (in principal) to 529 withdrawals in that the earnings may be exempt to the extent the entire amount (basis and interest) is used for education expenses. Hey, keep posting. This is not FaceBook, or other forums, where there's always somebody ready to one-up you. We are family here.

-

You'll need to complete Form 8815, and this is a bit more complicated than they tell you on the news or at the bank. It's very common that not all the interest is tax exempt. Hopefully, these will help; the Instructions are with the form: https://www.treasurydirect.gov/forms/savpdp0051.pdf https://www.irs.gov/pub/irs-pdf/f8815.pdf

-

I enter the clergy expenses on Line 2 of Sch SE. Right click, and there's a worksheet where you can enter expenses with a description for each item. Enter them as negatives so you don't look stupid to the Preach. Not saying I messed that up on the first clergy return of the year or anything.

-

I am cleaning surfaces more, wiping the door handles, making sure I have paper towels rather than just a hand towel in the bathroom, and I have never in my life had my face to itch so much.

-

As Margaret said, yes, the HA is subject to SE tax. The pastor can exclude the lowest of these three for income tax purposes: 1) The designated amount 2) The actual housing expenses 3) The fair rental value of the furnished home plus the actual cost of utilities. These sites may be helpful: https://www.clergytaxnet.com/expenses-can-used-justify-housing-allowance-exclusion/ https://www.guidestone.org/LearningCenter/Ministry/MinistersTaxGuide.aspx

-

Yes, I enter selling fees on 3b of the worksheet. Print it. (I go over it with clients.) Then move the selling fees to a "cost" line to get the correct amount on 8949 and Sch D.

-

That worksheet didn't used to be all that useful to me years ago; I always had to tweak it a lot. Maybe it's better now. However, what I usually do is prepare the MFJ return. Then I duplicate it twice. I delete one spouse's information on one, and I delete the other spouse's information on the other. I also print all three and give to the taxpayers. This generally stops the self-appointed tax matters spouse who made 2,000 and paid in 11 bucks from asking again. True story. This really happened this year. It was worth the trouble. Some things are better than money.

-

No, it's not. I had sale of residence converted to a rental earlier in the season. I had converted the rental to personal use (they stopped renting, knew they were selling), and I have a feeling that might help you. I entered the whole kit and caboodle on the Sale of Personal Residence tab. In general, (any reporting of a sale of residence on that tab), I don't know why ATX won't account for sales commissions incurred on the sale, but will increase basis by sales commissions incurred on your purchase. (On the Sch D - they do show on the worksheet).

-

Is bonus income reported on a 1099 MISC, box 7 subject to SE tax?

RitaB replied to ETax847's topic in General Chat

It should have been treated as wages, but since it wasn't I'd put it on Sch C. Others will disagree. That's how we are. -

Thank you, I believe it's turning out to be much worse than we thought at daylight. A town 35 miles away lost at least 19. I was awakened at 2:30 by hail, and wondered if two baby calves would be ok. The entire herd came out of the woods at daylight. We are very fortunate and thankful.

- 4 replies

-

- 12

-

-

-

Hey, Everybody, we're all good. Lots of hail but the tornadoes missed us! Thanks for checking!

- 4 replies

-

- 16

-

-

-

That's what Jesus would do.