-

Posts

3,394 -

Joined

-

Last visited

-

Days Won

315

Everything posted by RitaB

-

I second what everybody is saying, plus I will add that the recipient ID number on all the ones I see are not my clients' SSNs. That always makes them feel better when I'm telling them, "No, I don't need to amend your return since you got this two days after filing..." (Every. Time. Grrrr.)

-

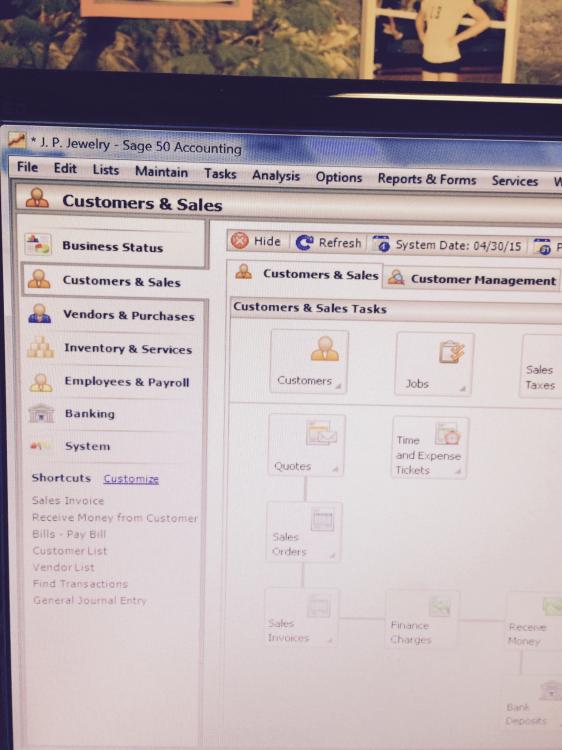

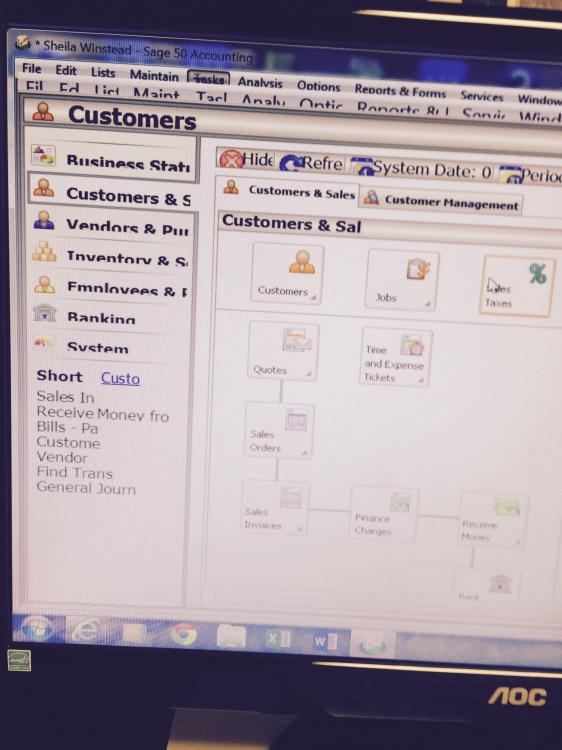

Another suggestion was make sure screen resolution was not too low. That was not my problem. I hear ya on the eyes thing. I look back at reports I did six years ago, and I can't even see them now. Who knew?? (Well, everybody, but I didn't believe them.) Thank God for 12 point font. OK, 14.

-

Sounds like a good way to handle it. Don't hold your breath, but I may have poked around and fixed the screen appearance problem. Was searching the Sage Knowledgebase, and yep, others have had the problem. One suggestion was make sure DPI is set to "smaller or 100%." Mine was on 125%. I changed it and have not had the wonky appearance issue. Yet. Now we wait... And hope every other program doesn't look screwy now.

-

So, Catherine, your clients are wanting RE to update with each Journal Entry, is that right? I think the reason the software doesn't do that is because dividends frequently get paid out at year end, and RE is a picture of how the company is managing profits. They don't really know till the end. You could tell them that, and if they believe you, they might let it go. But, you asked for a work around - I've had to make Excel reports when people didn't like the accounting software presentation. PapeJoe's suggestion also sounds good, but I gotta admit, I don't mess with the reports too much.

-

I always thought that was the proper way to report - wait till the end of the year and close net income to retained earnings. I like looking at the net income on the May 2015 income statement and being able to point to that figure on the May 2015 balance sheet. And then saying, "And then at the end of the year, the net earnings for 2015 get sent to retained earnings. Where the cumulative net incomes for eternity get stored forever and ever. Amen." Sounds like QuickBooks and Peachtree do it the same way. As much as we pay for these, I'd hope they've got that right.

-

I am also a middle child. Suck it up, buttercup.

-

Yes, it has to have happened to someone. I was hoping someone here in order to avoid calling tech support. That's always a long process and the last thing I want to do. Always. The first thing I do is update. The middle thing I do is ask you guys.

-

Nah, 7 Pro. I have wondered if it's a Windows thing, but I don't recall any other program doing this ever.

-

Hey, I really did edit "to". Swear I did.

-

Ok, you may be giving us way to much credit...

-

It IS blue, and it's a lot of to write down, but I have my assignment, and will report back. Travel to a volcano? You say that like it's a BAD thing...

-

Ok. So, it's one of those things I just live with. Check. Here's another one: Sometimes I'm just minding my own business and everything just freezes up and there is a crash dump. What's that about? Don't ask me for specifics, I can't talk about it intelligently, I usually just cuss and hit "enter" when the option comes up to start Windows normally. It's disconcerting.

-

Yes, it goes away when I close and re-open. Don't have to kick it.

-

I don't remember how long this has been going on, but it drives me nuts. When I open Sage (Peachtree, why change the name? Peachtree was so lovely), everything on the screen appears fine. But, always, always, EVERY DAY, something happens and the screen appearance gets all screwy. Like the font size changed and the area holding the word did not. It's hard to explain, I'm attaching a screen shot. Top picture shows the screwy version. Bottom is normal. (That's my daughter posing during volleyball practice, never miss an opportunity to pose.) Anybody know what I can do about it?

-

You are correct. If net rental income is over $3,350 for 2014, no EIC.

-

Boy, do they ever! Hey, Margaret, I have paper 1099-Misc forms and 1096s and would be happy to mail them to you if you think that would be the solution. I kinda do. You can send me your mailing address in a personal message if you like. Will mail them out lickity split.

-

All I got is the boot recommendation. Sorry, my friend, I am still in the stone age filing paper 1099s. I just don't want to let it go.

-

Remember the boot incident I had about three weeks ago? That action would be appropriate for this. Pretty sure.

-

Well, then, she deserved to pay a stupid tax, so it all worked out. Seriously, though, I always enter 1099-Misc income on the line where IRS is going to look for it, and if the form is wrong, subtract it off with an explanation. Typically back of Sch C, page 2.

-

Yes, it probably would not be on a 1099-R if paid thru employer. I have never seen an incorrect 1099-R. /s

-

Another consideration - if taxpayer paid the premiums for the disability policy, it is not earned income. http://www.irs.gov/Credits-&-Deductions/Individuals/Earned-Income-Tax-Credit/Disability-and-Earned-Income-Tax-Credit

-

Eric - Where is the button to take us to the last unread post?

RitaB replied to BulldogTom's topic in General Chat

Yeah, and I bet there are people who didn't even know about the button at all. Like me. Hey, I love this hovering over a topic and getting the opening post. Two thumbs up. -

Oh, yeah, nothing aggravates me like a DIYer calling me for advice. Or messaging me on FaceBook. Or chasing me down at church. Nothing.

-

What I hate about payroll is when clients get QuickBooks and think they now understand payroll taxes. (Or any taxes, or bookkeeping, or anything, for that matter.) I am working on the 990 and awaiting the 2014 payroll reports from a non-profit that apparently thought my $85 per quarter to do reports after summarizing their payroll data was too much. I wonder when it will dawn on them that the QuickBooks updates will cost more than having correctly prepared reports.