-

Posts

3,394 -

Joined

-

Last visited

-

Days Won

315

Everything posted by RitaB

-

I actually do not think you are in the minority here.

-

Yeah, I changed my opinion about the Employee status when I saw that she came and went as she pleased. Sounds like a subcontractor. But I am Letting. It. Go. Now.

-

What are you trying to say??

-

Yes, I thought of that line 22 fix, but it's not really truthful, even if basis exceeds distribution, since line 19 SHOULD be zero. But I'll be honest, I am tempted. There is no chance of a code correction, as that's what Code T is for - account custodians with new accounts. Too bad it's an option, and they don't have to find out when the taxpayer contributed. Oh well, that's why we are heroes.

-

Hahahaha, thank you, and Vanna has nothing on you. If you can't get a zero, I'm in good company.

-

So I have a qualified ROTH distribution that broker doesn't know is qualified and used Code T. Ok, fair enough. ATX sends amount to Line 19 of Form 8606. OK, fair enough, again, as I am apparently the only person on earth who knows it's qualified. My client sure didn't. I had to dig thru records. So, I can override and make line 19 blank. How can I get an actual zero to print there? I'm thinking IRS will think I ignored the issue if line 19 is blank, but there were no nonqualified distributions, and I want a zero there.

-

Crying. I also see it like ILLMAS. SIL is escaping SE tax on the amount she paid for this work. I don't think IRS really wants us all looking for hobby office grunts and shifting our income to them. Even if they hug us.

-

I am not as good a friend as you. I would report this on Sch C as it was compensation for work. If she had worked at McDonalds for two weeks (or two hours), never to return to the food industry, SS and MC tax would have been withheld and paid in starting at the first clock in, and no tax pro would give a second thought as to regular and continuous. Yeah, she was really an employee, but just because that was done incorrectly, it doesn't mean you have to break your neck to help her escape the tax liability somebody should have paid. She can rat out sister-in-law I suppose, or ask sister in law to pay half her SE tax, but you have other fish to fry.

- 33 replies

-

- 12

-

-

Well, this gentleman is delightful and neat as a pin. I guess you can't judge a book by the cover of the other book they referenced.

-

I'm gonna have to agree with that one. Ok, I always agree with you three. Yesterday one showed up with sale of four rentals, ok, five, but whoops, we'll have to look up the paperwork on that one... haha... And all the rental expenses for all the rentals on that spreadsheet with all the personal household expenses. You know the one. Whoops, you're going home and fixing that.

-

Pacun, I'm not losing him over the ACA. I've had this family for three years. Parents retired early, and grown @$$ kid won't hit a lick at a snake. They want special treatment because they CHOOSE to loaf. Hello? Get jobs, People! They are entitled little moochers who call me about everything, and complaining about a very reasonable fee was the last straw. I'm not losing them; they're losing me. I'm not helping him get out of that SRP. I am that hard headed. I sure am.

-

Well that was torture, but character building. If I did the worksheets correctly, and I actually printed them and did them by hand, he could have gotten a plan for 202.35 and the subsidy he qualified for would have been 236.63. So, his required contribution amount is zero. So, yes, it was affordable. But I could also be wrong... Raise your hand if your health has declined because of stress associated with the Affordable Care Act.

-

I have been figuring the SRP, business as usual, but have two that TOLD ME they wanted to wait and see. Ok, great. Now I have another person with the SRP and very upset about it. He didn't know he'd get a penalty and didn't know to try to get a subsidy, even though he's 38 and lives with mom and dad who DO get the subsidy. They're retired and he's underemployed. Exactly who we like to subsidize. /s He also got EIC. I gave you that background because I'm pretty fed up with how this has all panned out. Plus, he bitched about my $125 fee. My question is, do I have an obligation to tell him he can ignore Line 61? I won't do the return that way for him, but should I tell him?

-

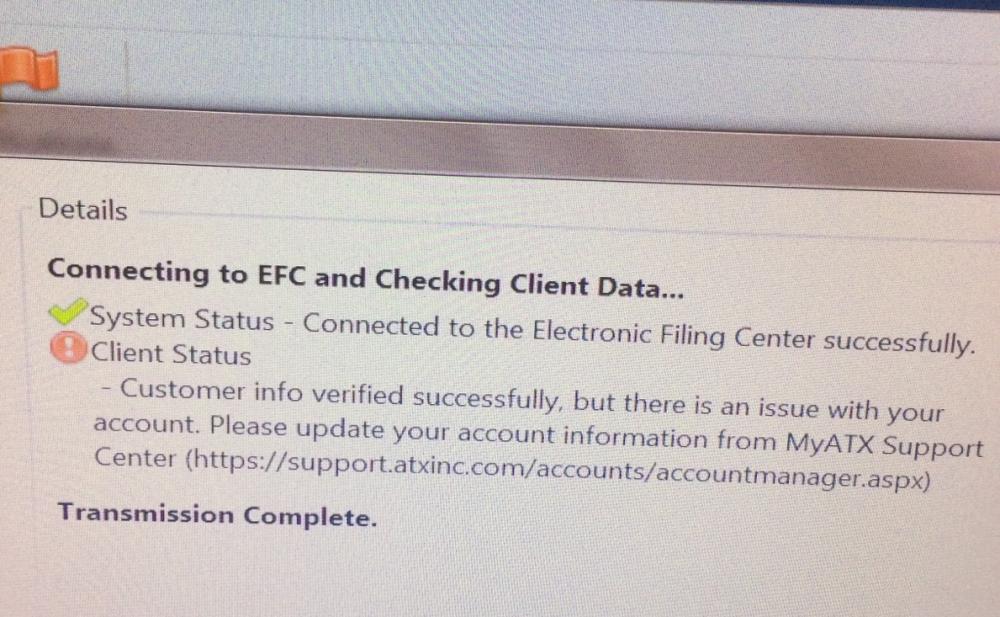

No, I reenlisted in the fall 2016 and the deal was pay $xx down and we'll bill the remaining $xxxx in February 2017. Somewhere down the line, I had a fraudulent charge on my credit card, and got a new account number. I neglected to tell ATX about this, so really it's my fault. But sending me to update my phone numbers was really not the best way to handle that one, I think. Anyhow, you could never offend me, Tom, what is wrong with you?

-

I'm just over here trying to decide whether to call new client or not. He's called twice and dropped the name of my most PITA client. Yay. I'm wondering if this is a PITA added referral.

-

PM me your address and I will mail you one and a W-3c

-

Hahahaha, it's my fault for not thinking about my credit card number changing, so I might get hugged back. It's still cracking me up how I was wondering, "Why the hell do they need my fax number so badly that they just cut me right off? Seriously? Over a fax number?" LOL.

-

I told the person who emailed me and advised me to go to MyATX and pay my bill that it would be good to put "Go to MyATX and pay your bill" on that error message or shoot us an email instead of sending us to update phone and address and fax number. I updated the crap outta that stuff though. They can find me, I'm certain. LOL.

-

Hahaha they were kidding about updating on that screen. Seems there is a problem with my credit card info. Hahaha. Ha. Ha. Carry on.

-

Well, I followed the directions here and updated where it said to update and I've emailed ATX. I would rather take a beating than call support. Any support, not just ATX. Last time I did I think it was when the software changed to "spaceship up in here". I told "James" (not his real name) that while some appreciate bells and whistles I really don't all that much. Taxes are not sexy, James, trust me on this..." And he started laughing and we had a light moment. I miss him. Any words of wisdom from my water cooler buddies?

-

The guy who had his unemployed, degree holding wife drop off an accordion file on Oct 10 paid about twice as much for the bookkeeping. They returned from vacation on Oct 17. I feel pretty good about it.

-

I took a chance...

-

This looks like as good a place as any - could it BE any more cumbersome to enter assets in ATX? It's a space ship up in here. And it's as if you can see one star in this whole universe at a time. The scrolling. The trying to widen the place you want to see. The fighting with the date. Come back here, why do you want to jump to the day, let me enter a month, for the love of God...