-

Posts

3,394 -

Joined

-

Last visited

-

Days Won

315

Posts posted by RitaB

-

-

1 hour ago, JJStephens said:

Actually, come to think of it, I didn't fire her. I was going to but she passed away before I had the chance to. This one is getting pretty close to that threshold for me.

I knew there was somebody besides me with a backhoe and back 40.

-

1

1

-

7

7

-

-

On 4/7/2018 at 3:09 PM, Abby Normal said:

I hope Tom and Rita got a point for vulgarity in this thread.

It's not vulgarity if it's in the ACA Forum.

-

3

3

-

3

3

-

-

22 hours ago, jklcpa said:

Yes, it can be 0 and 100. So the kid is not part of the "tax family" and therefore the mom may choose to allocate all, some or none of each month's figures from the 1095-A. Because they are over the 400% FPV, they aren't an applicable taxpayer for the PTC (obviously) and will have the repayment, not capped. In that case, why not allocate 100% of all amounts to the kid?

Does checking the box on line 9 of the parents 8962 make your computer stop screaming?

I see from the Instructions for Form 8962 that 0% and 100% are allowed. TheTaxbook should not use the word “between” as that means greater than zero and less than 100. Or at least I think it did in the 90s when I was whacking Algebra students’ knuckles over things like that. I wish I could find an example of my situation; I would feel better. I realize loopholes are unfair by definition, but I feel like this is a terrible disservice to my other clients who projected their income accurately and thus did not qualify for APTC.

I’m not at work, but I’m sure I had the Box on Line 9 checked. On the other hand, and in the words of a great orator: Tax season has fried me good and proper.

If I can’t get ATX to create the e-file, I think it might be best to paper file parent's return. Does Drake allow the Form 8962 if Line 5 exceeds 400%?

-

On 4/14/2017 at 7:05 PM, Catherine said:

The Tax Book says: "The allocation percentage can be any amount between zero and 100% that is agreed upon by each taxpayer.

Inclusive? Can it be zero and 100? I have a mom and a kid sharing a policy. Kid not a dependent. Parents are over 400% of poverty level as early retirees. There is no IRA happening. And what about the program screaming at me to discard the 8962 for the parents since they are over 400% on line 5? Is the absence of 8962 gonna make my life [even more] miserable [because of this law] in a couple months when IRS sends letter to parents?

-

Once again, this thread saved my life. Love you guys. Kinda hate this client. He had zero business signing up for marketplace insurance.

-

2

2

-

-

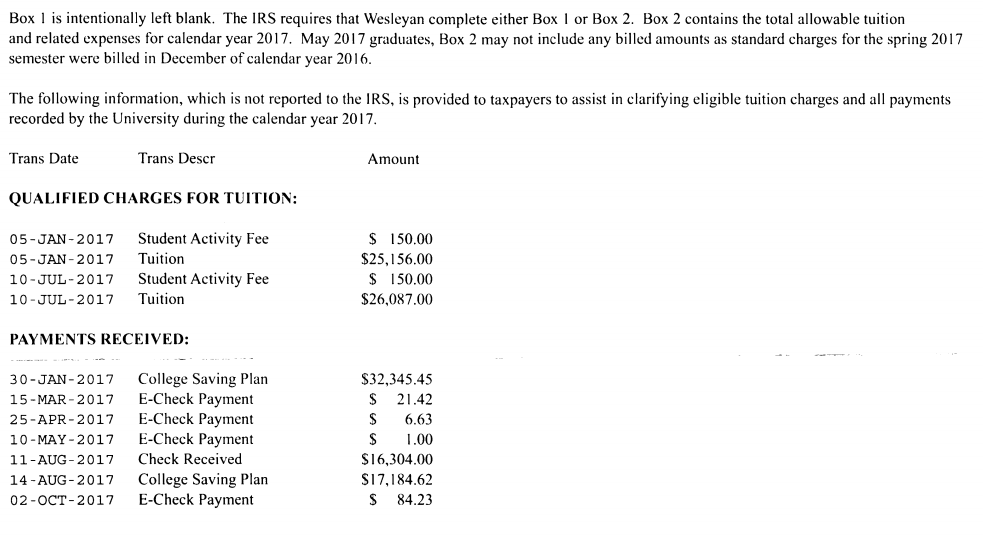

You know how you explain to clients the first year Junior went off to school that you need the Bursar's statement from college, and they remember to bring that every year forever and ever? Yeah, me neither.

-

6

6

-

2

2

-

-

8 minutes ago, Possi said:

Why you got to steal my JOY? Ain't nobody gonna steal MY joy! *wiggle wiggle*

Only 45.5 more work hours till the weekend!

-

3

3

-

3

3

-

-

-

My guy that came in yelling "Land Shark" paid his planners $28,000 last year. He would never whine about my fee. The first year he came here, he told me he worked on it himself for four days before he threw in the towel.

-

4

4

-

1

1

-

-

8 minutes ago, FDNY said:

If they don't sit down maybe they will leave sooner. We may be on to something. But I must say, this desk is working out really well...

The other thing that works before you get the standing desk is two or ten files in each chair. Hey, whatever it takes. There are advantages to being a paper freak, don't let the youngsters mislead you.

-

4

4

-

4

4

-

-

1 hour ago, TaxPreparer said:

Does anyone else have clients who complain about your measly fee (That should be higher) and you look at their investment paperwork and they have paid $51,000 to their investment company just this year!?

Nah, my one complainer guy's broker fees were only $9,057. He doesn't like my (finally up to) $350 fee. He's been struggling with my enormous fee for ten years now but manages to drop in five times a year to get advice. I have decided he will get the opportunity to find a better, less expensive alternative than me next year. That's right, I'm letting him live to regret trying that haggling ship on me. We don't do that here. If I think I'm paying too much, I smile politely, thank you, pay your fee, and don't come back nine more times. My #1 rule is everybody in this office is happy. My #2 rule is if everybody can't be happy, Rita will be happy.

-

9

9

-

1

1

-

-

You know clients who show up 45 minutes early to appointments? It's ok to kill those clients.

-

4

4

-

1

1

-

3

3

-

-

Ok, thank God. And Judy and Rich. Let's stop while I'm ahead. I've still not had a nap...

-

3

3

-

1

1

-

-

11 minutes ago, Richcpaman said:

I would go with his age calculation. I think somewhere, in the Social Security rules, they count the first day of the new year as the last day of the previous year.

If they send a letter, I would use his argument. He has reasonable basis.

Rich

Yes, I remember thinking that they call Jan 01 the last day of the prior year. He still missed the RMD though, right? Because 1/1/2017 would count as turning 70.5 in 2016.

-

Did client with DOB 7/1/1946 reach age 70.5 in 2016? He thinks he was 70.5 on 1/1/2017. I think he was 70.5 on 12/31/16, and he has missed his RMD. 7/1/2016 was the 183rd day of 2016 and there were 183 days left in the year.

If I'm right, should I just finish up this return and get it filed, have him take the RMD ASAP, and do the begging with Form 5329 as soon as I can get to it?

-

1 hour ago, ILLMAS said:

How do I report fellowship income/stipend for a whipper snapper that did not receive a W2/1099 or is not working towards a degree?

Thanks

Line 7 of Form 1040. Print SCH to the left. ATX will do it for you if you enter on Line 4 of the worksheet for Form 1040 Line 7.

-

2

2

-

-

16 minutes ago, Abby Normal said:

Dependency exemption

Thanks, I need a nap.

-

2

2

-

-

6 minutes ago, RitaB said:

I am taking this to mean the parents are deciding not to claim the kid and asking you to amend their return to remove him as a dependent. If so, I would explain to them that you can't just decide, his

dependencybelongs on one return or the other and explain the law. I would file the kid's extension request if he needs one, free gratis, because I'm all about customer service, even though I'm also all about doing things the right way, which is sometimes annoying to clients and bad for business, but it's hard to argue with me.Exemption may be the correct word. Y'all know what I'm getting at. Did kid provide over half his own support or not?

-

2

2

-

-

4 hours ago, TaxCPANY said:

Father just wrote that, after having claimed (college student) son as dependent on return filed last month, son now "will do his own . . . he likes to take responsibility." Hooray, ;-) . . .

But, I have NO time to amend returns before 17th. Should son be advised to file extension, or would late-filing penalty be averted merely by reference to the amended return down the road, or what else?I am taking this to mean the parents are deciding not to claim the kid and asking you to amend their return to remove him as a dependent. If so, I would explain to them that you can't just decide, his dependency belongs on one return or the other and explain the law. I would file the kid's extension request if he needs one, free gratis, because I'm all about customer service, even though I'm also all about doing things the right way, which is sometimes annoying to clients and bad for business, but it's hard to argue with me.

-

6

6

-

1

1

-

-

I sorta feel like I'm kickin tax season today. Woo hoo.

-

2

2

-

4

4

-

-

-

4

4

-

7

7

-

-

I have to use NMLS (Nationwide Licensing System) twice a year for one client and I am always astonished that I don't wind up on the six o'clock news. The WOAT.

TN sales tax site is trying to overtake them, however. Upgraded (yeah right) their system in MARCH 2017 (who does THAT?) and named it TNTAP. So cute.

-

3

3

-

-

-

Don't know whether to laugh or cry

in General Chat

Posted

We are nothing if not problem solvers.