DBerg

Members-

Posts

55 -

Joined

-

Last visited

Everything posted by DBerg

-

if you click the help icon in the toolbar () you will be taken to the help contents (I think it is the same thing that shows the release notes). Once this is open you can search for "shortcuts" and you should see all the Keyboard Shortcuts I did not see anything for Next form or Forward, but I could have missed it.

-

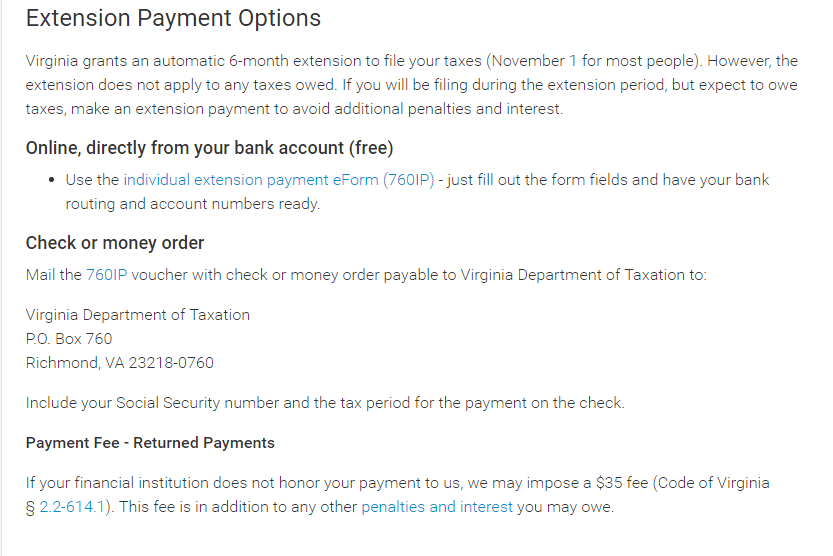

Looking at VA DOR site, they are okay with Check or money order payments. Normally states would say on the site if payment is over $XXX then they must be made online or e-filed. https://tax.virginia.gov/individual-income-tax-payment-options

-

Estimated payments automated after efiling?

DBerg replied to Margaret CPA in OH's topic in General Chat

@Margaret CPA in OH, you can check the state site and see if they allow estimated payments through their own portal, and the customer can setup the debit for the remaining quarters. -

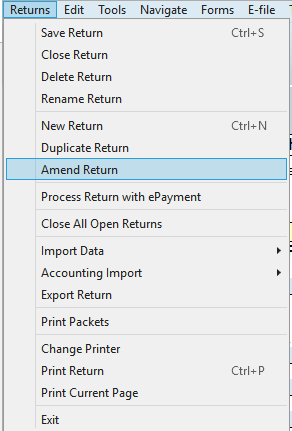

With the return that needs to be amended open, go to the Returns menu option and select Amend Return, it will then duplicate the return and put the word "(Amended)" in the name. You can now save this new return, and complete as you need to complete Here is the ATX knowledge base on this https://support.cch.com/sfs/solution/000050876

-

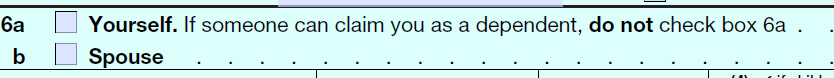

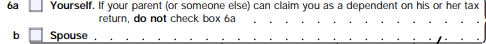

The wording seems to be a left over from the way the old versions of the 1040. Here is the 2017 version of what the 1040 PDF had Here is a 2000 version of what the 1040 PDF had So, look like ATX just kept the wording the IRS has been using despite, the IRS changing it this year on the form.

-

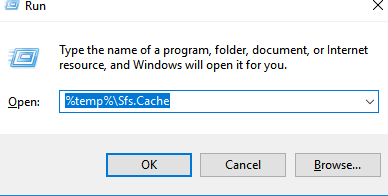

another way of getting to the temp folder is hit the windows key + R. This will open the RUN box and you can type in "%temp%\Sfs.Cache" (without the quotes) and then hit enter that should take your right there and you can then delete the 2018 folder.

-

if you are getting any of these, that generally means that you transmitted the state and federal return at the same time and the state linked return processed through the IRS system before the Federal return. STATE-901 - The IRS Submission ID referenced in the State Submission Manifest must be present in the e-File database. STATE-902 - The IRS Submission ID referenced in the State Submission Manifest must be in accepted status. STATE-007 - The IRS Submission ID referenced in the State Submission must be that of an IRS Return. Here is a KB article on this https://support.cch.com/sfs/solution/000046515/13206?q=WKArticleType__kav

-

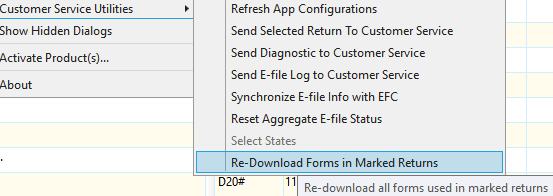

I know when I have issues opening a return I will try "Re-Download Forms in Marked Returns" first before restoring from backup Here is the KB on how to use it, hopefully this helps https://support.cch.com/sfs/solution/000046781/14202?q=WKArticleType__kav

-

Sorry, it is the VA Sch Income form not the VA 760-PY

-

Do you have Line 6 on the VA 760-PY, then "Sch of Inc, Part I, Sec A, Oth Inc Adj explanation", should be attached as a PDF. According to what I saw on the other board.

-

I have a second fake ERO with the EFIN 111111 and I put that in and then I change it back to my normal efin. I use the "Insert Preparer/ERO on Return" to this

-

I saw on the official board there was an update for the OH forms. But that was on the 2/14-2/15. So, hopefully you got the form update and that resolved your issue.

-

@WITAXLADY I created a sample WI return and attached the PDF for the WI Sch OS Other State Tax Return an Rent certificate or Property tax. I created e-file and I see they do show up on the E-filed Forms Tab on the WI EF Info. I even attached an 'Other' pdf and gave it a description and it also showed up on that same tab. And if you want to print this you can right click any where in the white area and select 'Print Current Pag' As you can see the descriptions do get cut off a bit, but at least it is something

-

We have a Brother all in one printer and after a few windows updates. The some PC's did not see the printer as default and other would "send" the file to the printer queue and it would sit there. I finally downloaded the Brother software (which has the print drivers and some other things for the scanning and such) and have not had an issue with printing again (knock on wood). So, I would suggest see if your printer has specific software or print drivers. Because the default ones that windows puts out are good but something along the way causes them to stop working.

-

Not sure if anyone else saw this, but thought it would be interesting with all the other changes coming. https://www.foxbusiness.com/politics/new-1040-tax-form-will-be-the-size-of-a-postcard https://www.wsj.com/articles/smaller-irs-1040-tax-form-will-be-postcard-size-mnuchin-says-1529527839

-

Have you tried entering None, on the NE K-1 Input for the Nebraska ID Number? I know that most of the time this does not work, but it might be worth a shot

-

The submission ID, that is how states should be able to find the return in their system (like the old DCN's) You can check the e-file manager for the number

-

Black Bart, I have gotten these in the past and I found that if I open the return and from the e-file menu and select display rejection errors, that I get to see the messages. I have written ATX about this to see if they can add new menu option do display messages.

-

Not sure if you knew this or not but ATX has a preference to use ALL CAPS for data entry. I saw someone else mention it either here or on the other boards. This way you don't have the CAPS lock on, you just type in ATX and you get uppercase and then you have normal typing everywhere else (so, you don't have the issues with passwords and caps lock) In preferences, on the Open return button(tab) , it is the first checkbox there. "Use ALL CAPS for data entry"

-

just make sure you put it in as PO BOX, I have found that P.O. BOX can cause issues with some states. when creating the e-file.

-

Since I did not see a Form 1100V in the ATX program I went to the DOR site and found a list of business forms, there is no 1100 V listed here either. http://revenue.delaware.gov/services/bt_number.shtml At the bottom of the DE 1100 page 2, on the state site, it has this (http://revenue.delaware.gov/services/current_bt/TY15_1100e.pdf) "MAKE CHECK PAYABLE AND MAIL TO: Delaware Division of Revenue, P.O. Box 2044, Wilmington, DE 19899-2044" Normally the state would put "Mail Voucher xxx and check to " or say see instructions for payment information. Sorry could not be of more help.

-

Yeah, had this same problem, the TIME Interval was set to 5 minutes or something. What I did here was in the Calendar view, I selected week, then right clicked on the time numbers on the left hand side, and set it to 30 min.

-

Mike have you tried going to File>Option. and then on the General tab, in the Personalize your copy of Microsoft Office, change the Office theme to Dark Gray and office background to No background I tried some of the thing suggested in here http://www.howto-outlook.com/howto/outlook2013whiteandbright.htm

-

Have you looked into the Winbooks? http://www.microcenter.com/product/437498/TW100_101_Tablet_-_Black I have this model and been using it since Dec I use a bluetooth keyboard and mouse combination (like the logitech Mk320) with it. Works out to be a cheap laptop

-

I noticed this(for other states), called the IRS and waited on hold for what seemed like an entire day. Turns out this is just a processing issue, when we send the files up to the ATX system , they are all just batched and sent to the IRS and then the IRS processes them (putting the state reutrns in the state return mailbox) So, if the state return (that is sent linked) is processed before the IRS return, you will get this error. Hopefully, i said this right, the rep I had gave a bunch of jargon i did not get. So, i just started using the Held feature in ATX, it will put the state return in a status of held, so I can e-file my federal and then once I get the federal accepted ack, I can just send off the state. Since doing this I have not gotten the error again.

- 1 reply

-

- 2

-