-

Posts

5,166 -

Joined

-

Last visited

-

Days Won

320

Everything posted by Abby Normal

-

I sat through the IRS webinar on this and quickly decided I would continue to fax them, unless I was in a terrible hurry for it to be entered in the CAF system.

-

Once QuickBooks updates for the new year's forms, you can't go back and print prior years. More than once I've printed prior W2's to pdf and edited the year on every form. You might find an online service or software that will do the 2019 1099's.

-

I wish. I've submitted an enhancement request for a feature to collapse the icon ribbon and encourage everyone who doesn't use it much to do the same. That's precious screen space I'd like to have, but I doubt ATX has any interest in programming a 'hide' button for the ribbon, like most other software has. And this year it's even worse because they've added more crap I don't need or use and pushed the few icons I do use off the screen, when I'm not running ATX maximized.

-

You increase basis by enter an other addition on the K1 basis section (for entities) and the basis worksheet for 1040's. BUT you'll still need an M-1 adjustment for the nontaxable income.

-

This was a problem last year. I don't use ATX's payroll products but I think it had to do with not checking any boxes to say what you wanted printed.

-

I usually just efile and let ATX reject it (which happens quickly), then recreate the efile and it's fixed.

-

That's why we almost always use safe harbor amount for estimates. Then you can wait till 4/15 to pay any amount owed. And now you'll have to use the longer annualized income method to determine any underpayment penalty.

-

I'm encouraging direct deposit and direct debit for everyone. That's quite a hole the IRS has dig themselves out of!

-

You don't need special server software to run a server. We just have a modestly priced windows 10 computer in a closet that everyone accesses. You just share the drives/folders that contain the data.

-

But what is the coverage like? Are these plans nonprofit to keep the overhead down?

-

I do a lot of returns where the revocable trust's ein is on the forms, and I just report it on the 1040, and have never had a problem. But you're right. The instructions do say to file a blank 1041. Although, in practice, I doubt the IRS would really care.

-

The IRS usually cuts off online access to transcripts within a month of when a person dies. If I already have a POA for a client, I download everything I can as soon as I see the obit. You can file a 2848 as personal representative of the estate and attach the court document showing you as personal rep or executor, but you will still have to request paper copies be mailed. Obviously, now, that entire process could take quite awhile. Make sure you check the box on the 2848 to have copies of everything sent to you. You can fax in the 2848 along with the court doc's, but I'd also mail it with the 4506-T. Good luck!

-

We use the organizer as a checklist of what documents are needed. You must be using the basic organizer, which I haven't looked at in ages because it was not suitable for our purposes.

-

I've never had the type of trust that you describe, but if it's ignored for tax purposes, no 1041 is filed. If it's not ignored for tax purposes, the trust will pay taxes if the income is not distributed.

-

I think you mean 'revocable' trust, in which case the trust doesn't even file a tax return. https://www.thebalance.com/what-are-grantor-trusts-and-how-can-they-be-changed-3505545 But if it is an irrevocable trust and there are no distributions to the beneficiary, then the trust pays the tax at very high rates.

-

Since the company only paid 3500 net, add 3500 to box 1 wages only, not Social Security or Medicare. The 3500 is SEHI. The 1,500 should come out pretax so she doesn't lose out on the deduction.

-

Neither the W2 or 1099R pages have columns for last year's amounts. Are you using the basic or comprehensive organizer? I've only ever used the comprehensive one.

-

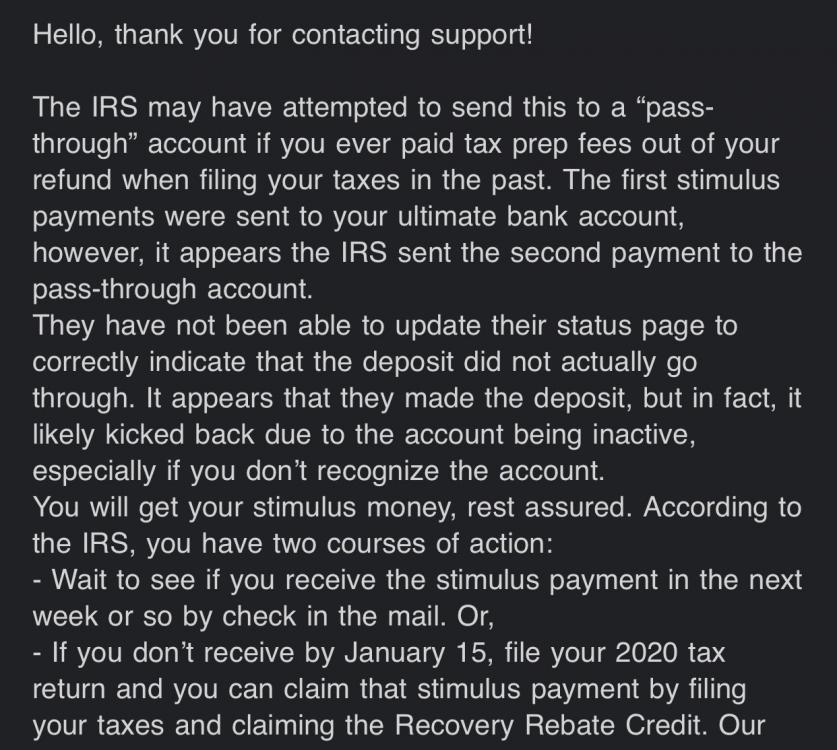

Got mine this morning, too. It showed as pending over the holiday weekend. If you don't get it now, you claim it on your 2020 return. That's why they're rushing to get it done by January 15th.

-

https://www.cnet.com/personal-finance/second-stimulus-check-irs-has-11-days-to-send-out-payments-when-will-yours-arrive/

-

People are getting the payments now but most will receive in 2021. Have not heard if the new round of payments will be part of 2020 or 2021 tax returns. It almost has to be 2021 because the Treasury will not have all the payments out before people start filing their taxes. Right?

-

After being a Quaker for awhile, I attended a regular church service and felt like I was at a musical play. I enjoyed it but did not find it spiritual at all. Guess I'm just a quiet man.

-

Hope everyone enjoyed their Christmas. I thought it was a great Christmas because we didn't have to spend hours in the car. We had a great zoom session with the kids and grandkids. Plus we had dusting of snow later in the day as we were watching the movie White Christmas! It was a very good a Christmas.

-

$300 x 12% = $36 in tax savings, which I'll take but it's just crumbs. $3,000 would be a lot more useful, obviously.

-

Isn't efiling the real better option?