-

Posts

5,164 -

Joined

-

Last visited

-

Days Won

320

Everything posted by Abby Normal

-

I agree it should be treated as an asset purchase because the transaction happened all at once. Just allocate the purchase price to the assets and start depreciation over.

-

Enter "INHERITED" in the acquisition date field and force long-term. I had one like this just recently, and no way was I going to track down all the charities for EINs and give them a K1, so I just gave K1s to the human beneficiaries, but in my case it was just to pass out capital losses.

-

Client received a letter from the IRS asking for proof of withholding.

Abby Normal replied to M7047's topic in General Chat

I was filing a late MD return with only an IRS transcript. MD asked for copies of the W2s, so to mock up a W2 to feed the bureaucracy, I had to call MD and ask THEM how much MD withholding there was on each W2. I think I just edited a PDF of the IRS transcript to add a line for MD withholding and MD processed the return. And, yes, that does sound like the basis for a Monty Python sketch. -

Possible Solution for ATX not rolling over Drivers License info

Abby Normal replied to Abby Normal's topic in General Chat

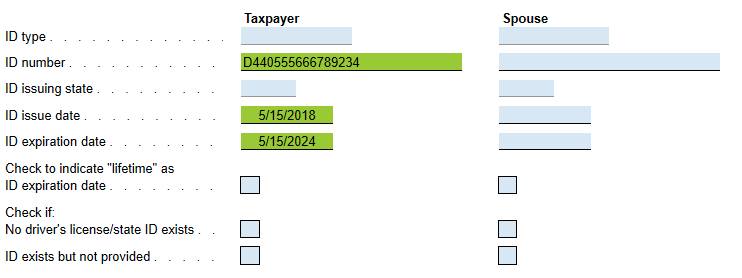

I was afraid that might happen with the dates. I've linked dates before and gotten rejects by agency. Try entering the dates manually but link just the license number. Thanks for testing it! -

You pick up where you left off, BUT if the FMV of the house is now less than the original cost, you must use the lower number as basis.

-

Precisely. I sometimes do calendar year on estates when it's going to be open for more than one year, but fiscal years usually work out better for most estates.

-

If there's a capital gain and it's not a final return, the estate will pay taxes on the gain.

-

Possible Solution for ATX not rolling over Drivers License info

Abby Normal replied to Abby Normal's topic in General Chat

I'm confident that a link will work there. I do something similar with MD, who require a taxpayer's physical address, which for us 95% of the time is the same as the mailing address already on the return. -

Possible Solution for ATX not rolling over Drivers License info

Abby Normal replied to Abby Normal's topic in General Chat

I'd say the links that I try to do work about 95% of the time, but then I have a lot of links. -

Possible Solution for ATX not rolling over Drivers License info

Abby Normal replied to Abby Normal's topic in General Chat

It's a huge system and none of us has seen every page of every form. -

Go to ATX's return query page and rehang it.

-

Possible Solution for ATX not rolling over Drivers License info

Abby Normal replied to Abby Normal's topic in General Chat

Plus this gets complained about every year, and I had recently suggested just keeping a note, so you could copy/paste the license number into ATX. Then last night, it just hit me. Enter it somewhere else in ATX that will rollover and link it. I was having a rough day where nothing went right, so I had a shower, drank a beer and it hit me. Besides linking fields in ATX is one of the best features and also one of the most underutilized features. I'd bet that the majority of users don't even know it's there. -

Possible Solution for ATX not rolling over Drivers License info

Abby Normal replied to Abby Normal's topic in General Chat

My mind works 24/7. I have some of my best ideas in the shower. I've considered billing clients for my shower time, when I come up with a solution for their problem. But seriously, this year, I'm only part time because I am done as of the 18th. Although I'm sure I'll get calls for at least a year from those wanting to pick my brain. -

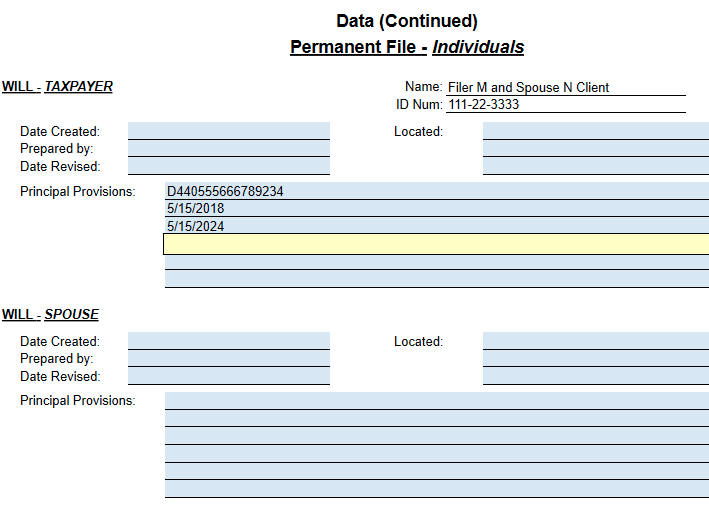

Add the Permanent File form and on the Data 2 tab, enter the license number, issue date and expiration date on 3 separate lines. Then link those lines to the Main Info form. This will need to be tested to see if causes any efile rejections, but the Permanent File form will rollover and the links will be there.

-

the letter doesn't seem to update for amended returns

Abby Normal replied to schirallicpa's topic in General Chat

In 2020 or 2021? If you edit the letter, just add the variable "amended/ -blank-" and save for future returns. State letters have a similar variable. -

Really? 1116 has to be added now as pdf?

Abby Normal replied to Margaret CPA in OH's topic in General Chat

We desperately need a tax law that indexes EVERY amount in the tax code to inflation. I swear the $25 business gift limit has been that way since the 1960s or earlier. -

Really? 1116 has to be added now as pdf?

Abby Normal replied to Margaret CPA in OH's topic in General Chat

Yes. This has always been the case. When foreign tax is below the $300 single, $600 joint limits that allow you to not include the 1116, you were still supposed to complete the 1116 to do the calculations, but you could check the box to not send the form to the IRS. I think most of us just skipped the 1116 most of the time, to save time. -

I spent way too much time re-creating "expired" efiles.

Abby Normal replied to schirallicpa's topic in General Chat

I don't understand this process. If you change anything in the return, you have to save it, and saving cancels any existing efiles. -

I spent way too much time re-creating "expired" efiles.

Abby Normal replied to schirallicpa's topic in General Chat

We make the preparer create the efile as the final step to make sure it can be created. Also, the 'included efile forms' page doesn't populate until you create the efile, and I use that to determine which forms I'm required to print for the client. We use the efile manager to see which 8879s we're waiting on. If you try to use return manager to see this, it will be muddled up with all the in progress returns, which is a lot less useful. And, if recreating the efile causes changes in a return, we can alert other preparers that forms have changed and to be aware. But, to each his own! -

How often is "sometimes?"

-

I spent way too much time re-creating "expired" efiles.

Abby Normal replied to schirallicpa's topic in General Chat

We went through this last year and, especially as some state forms were updated, some returns changed, so I had to open the PDF of the return to locate the differences. So far this year, no returns have changed, so fingers crossed. But, yes it does add hours to the process. ATX needs to give us an automated way to recreate efiles, and if neither the federal or state balances due/refunds have changed, then a lot of time will be saved. I'd like to be able to mark all the returns in the Efile Center that have expired and batch create new efiles. -

I haven't heard anything, but I remember when eservices went more secure about 5-10 years ago. The nice thing is I haven't had to change my eservices password in years. Used to have to change it once a year, I think.

-

Can't win with PY residency OH and KY

Abby Normal replied to Margaret CPA in OH's topic in General Chat

There were bound to be hiccups, but it should be a better way, once they work it out. Please open a case so ATX can have a look. -

To me it sounds like they realized they made a bad choice trying to create a new authentication scheme, when the login.gov site was working for other government agencies. This is why I always sign up early for any new site. I like to be 'grandfathered' in on these things. I've had an irs.gov personal account for so long, I don't even need a login.gov account.