-

Posts

5,164 -

Joined

-

Last visited

-

Days Won

320

Everything posted by Abby Normal

-

Call the MD efiling unit at 410-260-7753 or email them at [email protected] And no, that's not a typo. There is no 'e'. They had already used [email protected] for something else, and this was the poor decision someone made, instead of doing efilehelp@...

- 1 reply

-

- 1

-

-

I once missed some US govt interest on a nonconforming 1099-INT because it was list in the bottom half of the page and I just glanced right over it, after entering in the box 1 interest.

-

You should always look at every page of a lengthy 1099. Sometimes the amounts in the detail are higher than the 1099 amounts for things like bond premium amortization, and sometimes there's a missing basis for a stock sold. Or they might provide a US Gov % for each fund and if that amount is material, you need to know the dividends for just that fund.

-

Usually, if it's not a state specific muni bond fund, the % for the resident state will be too small to matter, in most cases, especially since most state tax rates are low.

-

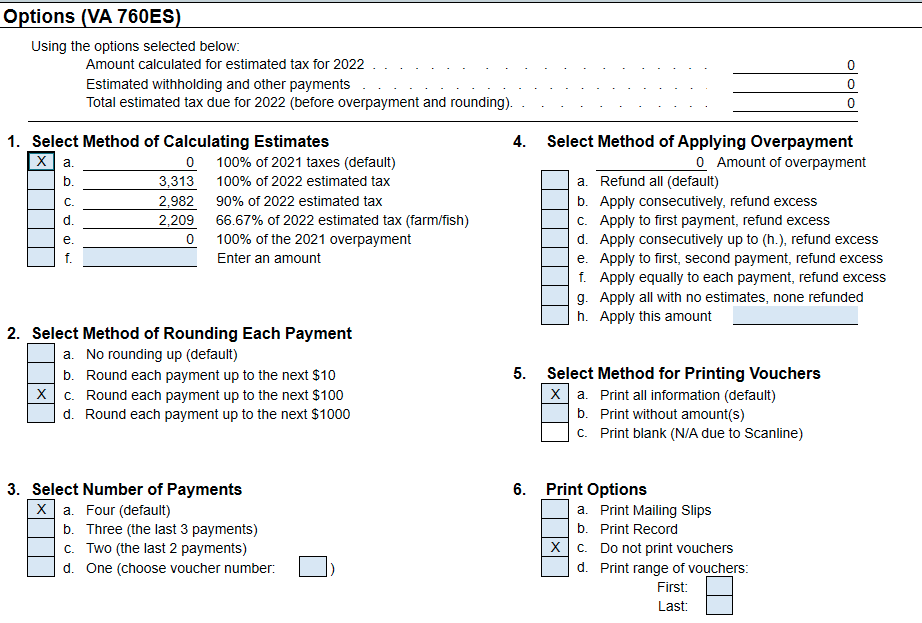

You're right. VA is behind the times (or ATX is) in allowing direct debit for estimated payments. You can probably set them up on a VA website. https://www.business.tax.virginia.gov/tax-eforms/760es.php#

-

There's no earnings test for qualifying child, and a student who attends one semester of school, is still a qualifying child, but then it comes down to the 'half of support' test. https://www.irs.gov/publications/p501#en_US_2021_publink1000220887 And, yes, if AOTC has only been claimed for 3 years, it can be claimed one more time.

-

unreimbursed partnership expense for limited partner

Abby Normal replied to tax1111's topic in General Chat

No, what cbslee said is what I meant. I worded my comment clumsily. An inactive limited partner could have some expenses for promoting the business, schmoozing customers, but not actively participating in the management or operations of the business. -

I hate when a client sends me just page 1 of a 17 or 50 page brokerage 1099, because they think that's all I need. I tell them that their tax return is like a puzzle and if they don't give me all of the pieces I won't be able to complete the puzzle.

-

unreimbursed partnership expense for limited partner

Abby Normal replied to tax1111's topic in General Chat

If the partnership agreement says partners can be reimbursed for out of pocket expenditures, then yes. -

Most states accept the federal extension and I've yet to find a state with late FILING penalty. States seem to just have late PAYING penalties and interest. If you must file the state extension, just show no balance due.

-

The Payment tab is where you choose direct debit, but you also need the Bank Info form added in ATX.

-

Called an elder client yesterday who had a battle with cancer, chemo and radiation, and she told me that sendinc.com would not let her send me the documents I needed, but she couldn't tell me what the problem was. I think her brain is fried, which is completely understandable. Also, she was trying to use an ipad and an ancient computer. Sometimes, you just don't have the hardware it takes.

-

You need to do a journal entry for the deposit based on the closing documents to record all of the associated costs. Depending on the entity and the timing of the withdrawal, you may have issues with debt financed distributions. https://www.thetaxadviser.com/issues/2007/nov/interestdeductionondebtfinanceddistributions.html

-

Color me confused.

-

-

I get best results from articles on https://www.thetaxadviser.com/. I print a lot of those article to PDF for future reference. Very practical examples with clear explanations.

-

I've never noticed that here on the east coast. Must be a certain IRS location that does that.

-

If it's not his Social Security number then it's not his K1. It could however be in the name of a revocable trust and therefore would go on his 1040.

-

There will not be an IRS letter since 1041 (and 1065) do not have absolute filing requirements like 1120S or 1120 do, only conditional filing requirements.

-

It can't be done. Call support. It will likely have to be elevated since this is a fairly rare situation. You may have to not do this through fixed assets and just make all of the entries manually. Use a disposition method in fixed assets that doesn't calc any gains.

-

There are some field you just should not modify, and this sounds like one of those fields. Did you mark the Sch E 'complete disposition'?

-

Nah, the IRS knows that trusts and estates often don't file returns. I wouldn't file.

-

Assets removed from an S corp are essentially treated as if sold for FMV. https://www.thetaxadviser.com/issues/2011/apr/casestudy-apr2011.html

-

From the link: Tax considerations An IRA is an exempt entity separate from the beneficial owner of the IRA and can be subject to taxation on its own. UBTI is subject to taxation in all varieties of retirement accounts, such as IRAs, retirement plans like Keoghs, and health savings accounts (HSA). When total positive UBTI across all applicable investments held in a retirement account equals $1,000 or more, then Form 990-T must be filed. Sounds like fun, right? Tell client to get rid of these investments in an IRA because they're not good for IRAs.

-

Yes, use adjustment code B for basis adjustment for the cumulative adjustments to basis in the K1 notes. And use code O for the 4797 portion of the gain, then put the gain on the 4797 part II. There's a dropdown box to choose the K1 that it comes from. The B adjustment is a minus and the O adjustment is a plus, so just net the two into one adjustment amount with the code BO (because these investments stink!) And mark the K1 final and complete disposition of a PTP. This will release all of the suspended losses for that K1.