-

Posts

5,160 -

Joined

-

Last visited

-

Days Won

319

Everything posted by Abby Normal

-

Did you calculate partner basis? Did you check to box on the K1 input to calculate basis?

-

What I recommend doing is have a free checking account for all electronic payments, keeping the bare minimum that the bank requires in that account. Then just transfer money to that account to cover payments, and when a deposit is received, transfer it out to your normal account.

-

But they're not doing daily cleanings or providing other services like a hotel. I would go with sch E.

-

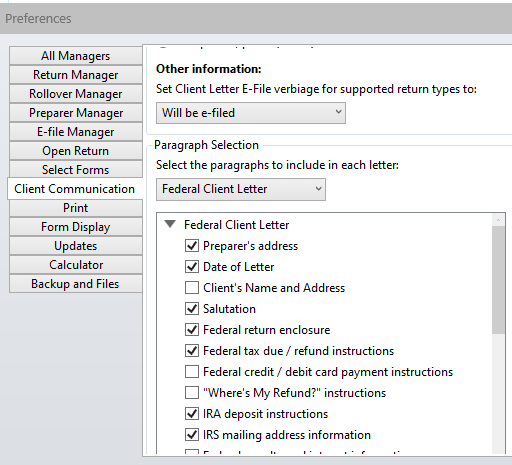

In preferences, client communication, there's a check box to turn that on or off. You can also turn it on or off inside each return while in the Federal Client Letter by selecting Letter Options at the top.

-

Page 1

-

It's the PTIN Directory you want to opt out of. Numerous sites download that data and make local lists of tax pros. I signed up to have Google search for and alert me about my personal info on the web, then give me the opportunity to have it removed. https://myactivity.google.com/results-about-you

-

Read it in a magazine article a few years ago. It made sense because most of the CP2000s I was seeing were for at least 1,000.

-

MD 502SU - code u - military retirement income subtraction

Abby Normal replied to MDCPA's topic in General Chat

There's a drop down on the 1099R where you can choose Military. -

In her defense, you were vague.

-

Same. It's just asking for trouble to do otherwise.

-

I've never amended for one of these corrected 1099s and I've never gotten any notices. I'm not certain that the IRS ever posts these corrected 1099s, and even if they did, they don't send out notices for smaller amounts. I heard they run the matching software later in the year, then sort the notices by amounts from high to low, and only send out as many CP2000s as they know they can process, starting with the highest amounts. And with what is happening now, there will be even fewer CP2000s going out.

-

The fumes from the highlighter made them high.

-

If you set your default ATX printer to PDF, you can save scanning it. As for why, ATX has always had weird printing issues.

-

Here's the link for those who need it: https://support.cch.com/oss/sfs/kb/solution/000283148 The downloads are near the top, hidden in a drop down box.

-

Re-install ATX as a Server previously installed as Stand-Alone

Abby Normal replied to BKG's topic in General Chat

I've never done that but it should be fine. Your data is stored in the same place for both installs. I'm assuming you're talking about the same computer? -

Except it's not printing in the print manager. Perhaps a print preview in print manager will make it print.

-

ATX has a service you can pay for to restore efiled returns if you've lost you database and don't have any backups. ATX backs up a return every time you close it, so if you backed up those backups you can restore them.

-

Did you try print page? You do that while on the page you want printed. The trick is to change your default printer to PDF. While in Return Manager, go to Returns menu and choose Change Printer.

-

I always preferred instrumental music during crunch time. Mike Oldfield and Two Siberians were my go to.

-

1099-R with charitable direct contribution INCLUDED - now what?

Abby Normal replied to Catherine's topic in General Chat

Why not 59 1/2? -

The beauty of ATX is that you can type up any letter you want and insert variables to make it say what you want. Then roll that letter over to next year.

-

1099-R with charitable direct contribution INCLUDED - now what?

Abby Normal replied to Catherine's topic in General Chat

I wish the IRS had made the QCD a subtraction on the Sch A so it was clearer what was going on. Also, adding a box to the 1099R for QCDs would help. -

Just use Other country or Various. I forget which one it is on the 1099-DIV.

-

That's because your PDF viewer (e.g., Adobe) options are set to open bookmarks by default. Change that setting.

-

The taxpayer had no cash outlay, other than a cleaning, which should be deductible, and they lost no asset value, so there's no economic basis for a deduction.