-

Posts

5,164 -

Joined

-

Last visited

-

Days Won

320

Everything posted by Abby Normal

-

It couldn't be easier to efile fed and state payroll forms right in QB with Accountants Enhanced Payroll, but QB is switching up their products and not selling new licenses for it. Current owners will be able to keep renewing.

-

Maryland is finally getting its program up and running. Not sure if it's the same company as the others. http://www.marylandsaves.org/

-

I'd ignore that letter. Most likely a glitch.

-

This is all a prelude to forced efiling of all forms. And really, it's about time. Computers have been part of everyday life since the 80s, or almost 40 years. It's long past time to modernize the entire system.

-

And I'm sure that private company will never sell our personal data, right?

-

These are almost 100% efiled by the banks and brokerage houses.

-

QB has always only supported the last 3 years for payroll.

-

MD calculates to the penny if there are any changes to the return. Drives me nuts.

-

S-corp partner died last year. How to allocate.

Abby Normal replied to Max W's topic in General Chat

Community property?! I'm tagging out, because I have zero community property experience (thankfully). -

S-corp partner died last year. How to allocate.

Abby Normal replied to Max W's topic in General Chat

You should probably just use the built in proration by dates of ownership for the deceased shareholder, but the question is, does his ownership pass to the estate or to the widow? You could also allocate by running a P&L through the date of death and just put those amounts on the K1 for the deceased, but it might not be worth the effort. I recently had some older clients request their K1s be titled as 'Tenants by the Entireties' with their spouses (MD law), so they get one K1 with both names on them. They had the same last name so I added "& Spouse Name" to the first name field and "TBE" after the last name. -

You misunderstood what I was trying to say. I didn't mean to make penalties higher. Penalty calculations would remain the same, but if a penalty is less than $20 then no penalty will be assessed. The IRS does this already, even with CP2000 notices. They run the program, sort the notices from high to low for the amount of the notice, then only send out the top ones in a quantity that they know they can handle, and all of the smaller just get skipped.

-

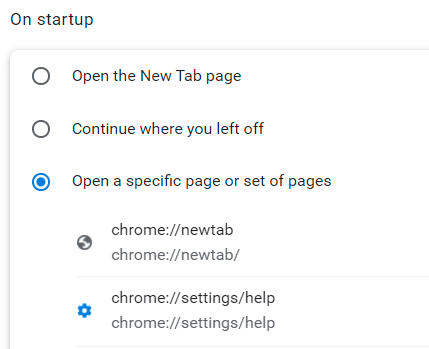

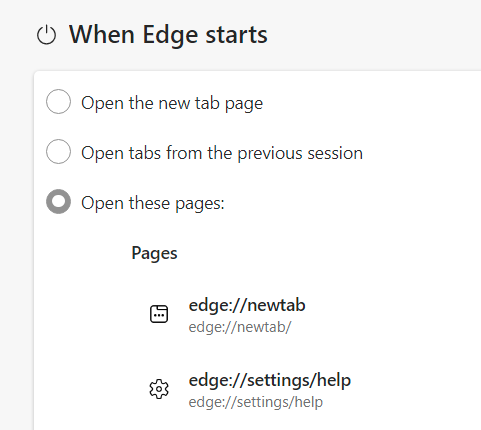

I have 2 tabs set to open whenever I start Chrome. The first tab is just New Tab, but the 2nd tab is chrome://settings/help which makes Chrome check for updates. The update failed so many times from within Chrome that I have the install file on my desktop just to update Chrome, but recently it seems to be working on from within Chrome. Same goes for Edge.

-

Write to an Illinois rep and explain to them that the state probably spent $5-10 just to collect $1.40, and suggest they instate a minimum of $15-20 for any penalties or interest.

-

I just overrode the Extenison box on PA40 to yes, and oddly, it becomes a dropdown list when you do that, but it works.

-

The real question is why is anyone using the paper form when the online system is so much easier, better and faster? You get the EIN and download the letter in minutes.

-

The Info sheets are new and there were bound to be bugs. Just keep reporting to ATX.

-

It's been shrinking since the 90s. A bunch couldn't make the jump from DOS to Windows. Others kept getting bought up and the product was eliminated, so they were really just buying the customers. That happened to me twice, at least.

-

No, 1250 gains have a 25% max tax rate, which means for people in brackets less than 25%, the gains are taxed at their ordinary income rates, not capital gains rates of 0%, 15% or 20%. I think we're getting mired in the wording and missing the practical.

-

reject due to dependent- wht to do about the state

Abby Normal replied to Hahn1040's topic in General Chat

Disconnect the state from the Mef system and just efile the state. This might not be available for all states, but it works for MD. -

ATX really needs a checkbox to create a new submission ID. It would solve the problem of having the wrong year in the submission ID, plus be the best way to fix duplicate IDs.

-

Where it's taxed at ordinary income rates, which is is same concept as depreciation recapture.

-

Depreciation on real estate results in sec 1250 gain and we all know there's a line for that on Sch D, so it's part of the tax calculation. AND the 25% is a rate cap, that only applies if you're in a tax bracket higher than 25%.

-

ATX does not "automatically" make the estimated tax payments direct debit. You have to check a box on the payment page. Ours is marked 'paper check' by default, because we almost never set up estimated to be debited.

-

Yes, but it sounds like both states and the feds are moving to direct deposit/direct debit only. And I approve.