-

Posts

5,160 -

Joined

-

Last visited

-

Days Won

319

Everything posted by Abby Normal

-

List as part of proceeds, or as part of basis?

Abby Normal replied to Catherine's topic in General Chat

On the 8949 it's a columns f and g adjustment code E for selling expenses, which reduces the gain as an addition to cost basis. -

Maybe they can find a computer museum that wants them... or just some nerds.

-

I would NEVER do a return without Sch L because it proves that the return is in balance.

-

I can't remember the brand of my first laser printer (Panasonic?) but it was around $700 and printed 4 pages per minute, but dot matrix printers were more like 4 minutes per page. I was still on DOS at that point so I liked that I could set the number of lines per page on the printer to 72, from the default of 60, since 72 lines was exactly 3 print screens at 24 lines per monitor, and it was nice to have long reports fit on fewer pages.

-

Might want to stock up on some printers now before the tariffs increase prices by 25-50%.

-

Iowa Public Employees Retirement System - EIN?

Abby Normal replied to jasdlm's topic in General Chat

I use Ecosia search. I think it's better than Google. https://www.ecosia.org/ -

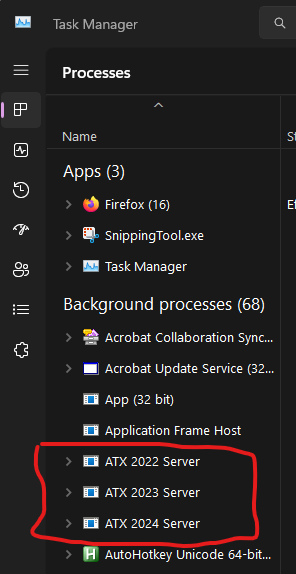

Bring up Windows Task Manager and end the ATX Servers tasks. You end them by right clicking on them and choosing End task, or by selecting them and pressing the Delete key (DEL). Knowing how to end or restart tasks is an essential ATX skill. To start Task Manager, you can use the menu and type 'task' or right click the taskbar and choose Task Manger or my preferred method, Ctrl+Shift+Esc.

-

Iowa Public Employees Retirement System - EIN?

Abby Normal replied to jasdlm's topic in General Chat

Search found this: https://www.hipaaspace.com/ein/ein_verification/426150870 -

ATX has carryovers for Sch D in the worksheets. Same for 8582 losses, foreign tax credit, contributions, PTP losses, etc. There's no one central place to see them all.

-

It doesn't have all the carryover info on it but it's better than nothing.

-

Not having a full and complete backup of all of your files is foolish. In addition to backing up the entire Wolters Kluwer folder, you should at least backup your documents and many other things in your Users folder, plus anywhere else you keep important files. It's important that you end the ATX servers, all of them that are running, before backup up the Wolters Kluwer folder. Occasionally, I turn off all the ATX servers and copy the entire Wolters Kluwer folder to My Documents and then it gets backed up with all my other documents. I name the folder Wolters Kluwer yy-mm-dd and keep the latest 3.

-

Back when DOB was required for efiling, in the 90s, the IRS had a birth date that was one day off from what the client said their birthday was. After it rejected I tried one day before and it went through. Perhaps this is why they IRS stopped verifying birth dates for efiling.

-

I love my Brother color laser HL-L3280CDW. It has a great envelope bypass and it was very reasonably priced, but it's monthly duty cycle is only 3,000, so it might not be good enough for printing a lot of pages.

-

education credit recapture - where is the input

Abby Normal replied to schirallicpa's topic in General Chat

Didn't even know such a thing existed. -

Basis = Beginning Basis (0) + net income (18,290) - distributions (?) +/- other adjustments (if any) = 18,290. Software is correct.

- 1 reply

-

- 3

-

-

The return is signed by the executor or personal representative, same as a single person's would be.

-

To say the least.

-

Last time I did a 1040X, a few years ago, there was no option for direct deposit or direct debit. Not sure what the reason is.

-

efiling Amended return with insufficient address information

Abby Normal replied to Mike T's topic in General Chat

Any address will work and zip codes are easy to look up. I doubt anything other than EIN and Name Control matter. Just pick a zip code in the state and make up an address. -

efiling Amended return with insufficient address information

Abby Normal replied to Mike T's topic in General Chat

Just file it with the 4 letter name and partial address. The IRS only verifies that the 4 digit name control matches the EIN, they don't check the address. -

I got a return from the big CPA firm in town and when they looked at the comparison, dividends were double the year before, and rather than double check their work, they circled the increase and wrote "Wow!" next to it. I quickly caught that they had entered a trust 1099-DIV on 1040 as well as the 1041, so, ta-da, dividends were doubled. I got to amend both the 1041 and the 1040, and got the new client a 10k refund. I used to work at that firm. years ago. The word of mouth referrals, or retelling of the story, is always good for my business.

-

For clarity, on the 2nd K1 you'll have an other increase or an other decrease to make it zero. So on the main K1, you'll need the opposite. If you have an other decrease on the 2nd K1, you'll need an equal other increase on the main K1. This represents the rental income.

-

No, I was referring to one K1 with both ordinary income and rent income. Those have to be entered as two separate K1s in ATX.

-

Piratization

-

When I have two K1s, I make the basis worksheet on the 2nd K1 work out to zero each year, and maintain the actual basis on the main K1.