-

Posts

6,673 -

Joined

-

Last visited

-

Days Won

166

Everything posted by Jack from Ohio

-

Tax Court: Cost Of Ralph Lauren Salesman's Polo Wardrobe

Jack from Ohio replied to grmy2h's topic in General Chat

Seriously? -

Your taxpayer will need to go to the Marketplace online, or call them to get the 1095-A that is in her name and SS#. She or someone else established an account and purchased insurance through the marketplace. Despite what the parents did or say, there is an account in the daughter's name and SS#. I have had 3-4 like this this season. In each case, there was an account and a 1095-A to use on the return.

-

That is definitely a question of law in your state. The persons involved need to consult an attorney experienced in probate issues for your State.

-

My favorite laughing moment is when clients come in with three years that need completed. Without fail, these are the words: "I just have not had time...." Then, when I file the extension for 15, do a quick scan to see if they should send in a payment before the due date, and put their whole stack at the back of the queue, they get irate. "I will not have time to do your old returns until I have completed all 2015 returns" is my response. "I just do not have the time to fix your extreme procrastination situation." I do this, no matter when these kind of clients come in.

-

$160-$190. I always meet with new clients face to face for the first time. After that, I push for drop off their information. If I give a discount, I ALWAYS show the full boat price then show the discount I have decided on. This prevents: "Your price was much less last year" complaint. I also still show a separate line charge for ACA. I want to keep my clients fully aware that I did not choose to be the enforcer of Congress' insurance regulations.

-

Several of the chains would have charged that much. No surprise there.

-

I may have received it, but it reeks of phishing in so many obvious ways that I simply deleted it. I never even open such blatant phishing e-mail.

-

Ahhhh yes!! The salesman tax professional...

-

Catherine is absolutely correct. Tell the attorney to stick to law and leave taxes alone.

-

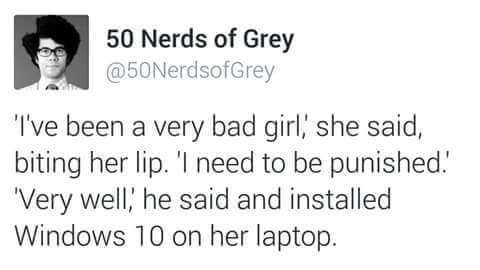

Windows 10 screwed up all of my ATX!

Jack from Ohio replied to NECPA in NEBRASKA's topic in General Chat

-

Windows 10 screwed up all of my ATX!

Jack from Ohio replied to NECPA in NEBRASKA's topic in General Chat

I have a source. Send me a PM. -

Windows 10 screwed up all of my ATX!

Jack from Ohio replied to NECPA in NEBRASKA's topic in General Chat

This was predicted as much as 6 months ago. Now do you understand why I refuse to take on WIN 10? Computer shops all over the country are backlogged with computers to undo this upgrade. Microsoft added it to the list of "important Updates." If you have your system set to automatically update, you have been HAD!! Use the tool that Catherine gave the link to. -

Then claim as expense, any un-depreciated portion of the old roof.

-

Then dive head first into all the issues from all your previous clients. Take each situation, review the returns, develop what needs to be amended, prepare the amended returns and rectify the issues. Do this for every prior client that complains to you. This is what your posts and responses indicate that you want to do. You post conflicting information, but your true feelings about what you want to do shine through very brightly. Either get ALL IN, or ALL OUT. This is good business thinking 101. I challenge you to provide one single piece of evidence to refute my observation as previously stated. <<<< On 04/19/2016 at 4:53 PM, Jack from Ohio said: Either let it go, or buy it back. You may as well own it again, you have never left it.>>>

-

You continue to solidify the fact that my observations are spot on.

-

NT: Starting the post-season right - NOT.

Jack from Ohio replied to Catherine's topic in General Chat

Cash from an ATM. Just sayin... -

It is called the "Tattle-Tale" form.

-

I stick by my previous post. Your reply verifies my observations.

-

NT: Starting the post-season right - NOT.

Jack from Ohio replied to Catherine's topic in General Chat

Simple foolproof method to prevent anyone from opening fraudulent accounts in your name, even with your information. Institute a credit freeze on your account at all three credit bureaus. Foolproof. -

NT: Starting the post-season right - NOT.

Jack from Ohio replied to Catherine's topic in General Chat

No info, no card. Hence the reason Gail is correct. -

Either let it go, or buy it back. You may as well own it again, you have never left it.