-

Posts

4,172 -

Joined

-

Last visited

-

Days Won

62

Everything posted by Margaret CPA in OH

-

Grrrr ATX is not approved for NC this year!

Margaret CPA in OH replied to Margaret CPA in OH's topic in General Chat

I posted that too quickly just responding to what NC DOR rep told me. I kept pursuing the KB which referenced something from TaxWise in 2015 but decided to look further into it. Although the field for standard deduction had 8750 in it, I didn't check the box at the top of the page to take the standard deduction - of 8750 - which populated that field. Then went through. Why the hoops? Tech support said something couldn't be fixed about it. At least it's done and I got to vent a bit although needlessly. -

What a revoltin' development this is! I just got a rejection for a guy leaving for 6 months for England and now he has to paper file. I've efiled his returns to NC for several years. Why wouldn't a client (me) be notified that suddenly this super software is not approved for at least this state? I wonder how many other states have not approved ATX. Grrr....

-

My insurance is through AICPA, brought to me by Aon, underwritten by CNA (whatever all that means). It's the AICPA CPA Value Plan. I really only do taxes now with minimal bookkeeping for certain tax clients and no other assurance work. As my gross income is pathetically low, my fees are too. Hey, as long as the profit pays for my dive trips

-

I did get it this year for $190. Network protection limits of liability $100,000; Deductible per claim $1000; Extortion $15,000; Deductible per claim $1000; Privacy event expense $100,000; no deductible. As with all insurance, I sincerely hope to never have to use it.

-

Bring some to Rita's in June!

-

Hah! Got it! Recalling that the 2441 fields were blue (can fill in) I just typed in child's information. If taken as dependent, that fills in automatically. How grateful that I can still learn something new!

-

Hmmm, client says they split exactly 50-50 but in any event, she is considered the custodial parent. She has relinquished claiming the dependency exemption for 2017 as they alternate claiming the child. But QF references Notice 2006-86 that the 'custodial parent's release of an exemption to the noncustodial parent only applies for claiming a dependency exemption credit and child tax credit for the child.' It has a little chart (love those little charts!) showing that release of exemption for the custodial parent still qualifies that parent to claim child as qualifying child for dependent care. I just don't know how to make that happen in ATX. I thought by indicating HOH and putting child's name there, that would work but it didn't. No easy answers for me today!

-

New client has child care expenses, splits custody down the middle, so claimed, and alternates taking dependent exemption. So this year she does not claim dependent and my QF handbook shows she can still claim child care expense but not child tax credit. However, I can't figure out how to have ATX Max allow child care expense with no child. I have child listed with HOH but doesn't show up as Qualifying Person for care. What am I missing? New to me, most of my clients are older with no children at home.

-

Yes, I was thinking there should be a 1099-R, too, but there isn't except, except one from a Life Ins Co with a code 4D. However, none of the figures anywhere even remotely resemble the ones I posted. Plus there is tax withheld. Well, on my list - a long one - of missing info. Sigh...

-

Client included in papers from Lincoln Financial Group a 4th quarter annuity statement. It shows Contributions $33,124.75, Total Withdrawals $10,000, YTD Withdrawals $10,000, Cost Basis $4,998.58, Gain/Loss $9600.76. The next line says Your Tax Information YTD Taxable Amount $10,000, TYD Non-Taxable $0, Fed and state no taxes withheld. I've never seen such a thing. The only other annuity withdrawals I've seen have been reported on a 1099R form. I believe client's father died so may be relevant. For cost basis and gain/loss, well, I can't figure out how that was derived. If the basis was $4998.58, I can't make my calculator come up with a gain of $9600.76. Ideas?

-

Who Will Be Our Next Tax Star - week of 3/3 - 3/9/18

Margaret CPA in OH replied to jklcpa's topic in General Chat

Great response! Indeed, as you opined elsewhere, priorities are important and putting up with boorish behavior is not a job requirement. NON-VOTING POST -

Oh, my - so much loss. My heart goes out to you. Yes, rethinking priorities is also on my mind. BHoffman, be sure to take care of yourself.

-

We'll have lots of good hugs in June....

-

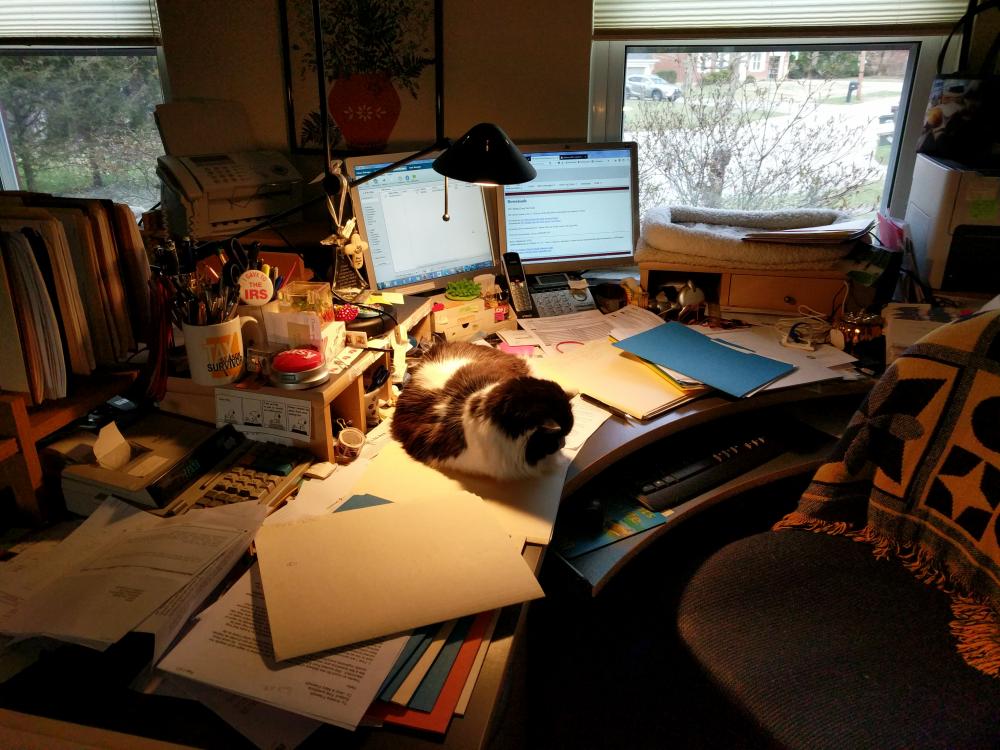

My very messy desk along with the primary cat (as in my avatar photo), calculator on the left (I trained myself to use the left hand so I wouldn't have to put down my pencil), little rolodex on the righ (shhh, all my logins and passwords).

-

Not to mention overloaded brains long 'bout now... It's a village here and we look out for each other, no worries!

-

RE taxes on jointly owned property

Margaret CPA in OH replied to Margaret CPA in OH's topic in General Chat

EITC has no place at all in this scenario. Both are retired and financially stable. I was just asking about proper assignment of real estate taxes paid. Thanks for all this input but I think we've come to a resolution, easier than I thought. Back to the really hard issues now - they always appear later in the season when we are crunched for time and brain power, right? -

RE taxes on jointly owned property

Margaret CPA in OH replied to Margaret CPA in OH's topic in General Chat

I just knew I should have written county auditor. Haste makes waste and a bit of humor here. -

Cursed blue triangle popups

Margaret CPA in OH replied to Margaret CPA in OH's topic in General Chat

I just discovered that I unchecked "Show popup tooltips..." NOT "Display Tax Research..." I happened to be on the phone with tech support about RITA 37 and a malfunction still and asked about the blue triangles. She directed me to the right place. Happy camper here -

Cursed blue triangle popups

Margaret CPA in OH replied to Margaret CPA in OH's topic in General Chat

Yes, I did. And I can't go back and redo because it is grayed out. I could only 'reinstate' what I thought I deleted to redelete. But that didn't work either. I've been using this program since 1997 so am sort of familiar with how things work although don't know everything - and there is always some new thing. Like now on Sch. A for Tax preparation fee, you can't just put in the number. There is a whole new link to billing. Yes, I can put in the number at the top but it is one more click I don't need. Rant over.... -

RE taxes on jointly owned property

Margaret CPA in OH replied to Margaret CPA in OH's topic in General Chat

Pacun, there is no 1098, no mortgage. I was asking about the real estate taxes paid directly to the auditor from a joint checking account. I split it. -

I'm not entirely sure about this situation. Unmarried couple have jointly owned condo and joint checking account. They file single but the one with little income wants the one with beau coup income to take entire re tax deduction. Fair? Proper? Legal? I can be persuaded either way (might have been a good debater, able to take either side ).

-

I deselected in Preferences Show popup tooltips in all managers and dialogs. I foolishly imagined that it might remain in those returns already rolled over but stop (please, God) in future rollovers. No such luck. I've checked and triple checked to be sure that it is deselected and STILL they appear. Suggestions - before I lose my remaining mind? Thanks!

-

Could it be the school address that is missing? I know there is a worksheet for lots of school related information such as EIN and address, I believe. Been a while for me, though.

-

Exemption from SS and MC is not required but is an option for ministers. They must meet 6 requirements and file timely Form 4361. It is quite possible this minister either does not qualify and/or failed to timely file the exemption certificate which certifies "I am conscientiously opposed to, or becausse of my religious principles I am opposed to, the acceptance ...of any public insurance..."

-

JB, me, too. And I wonder about future years. How long will we be required to change the password every 90 days? With the 3 year sol, we sometimes go back to prior years to amend or even prepare original returns. Frankly, I have my passwords on my desktop so I don't forget. It's just me here, home office, all alone...