-

Posts

2,899 -

Joined

-

Last visited

-

Days Won

32

Everything posted by Terry D EA

-

Yeah I know and I have never had an IRS agent refuse to fax a transcript. Guess it is all in who you talk to. I wonder if my existing fax number can be ported over to a new fax. Hmmm.

-

IRA, SEP, & Simple Plans are NOT a business operating expense. Correct me if I'm wrong, but I thought SE Health Ins, SEP and simple plans were deducted on the 1040 and not the C. These items are not used to calculate the QBI.

-

I'm curious what type of fax system, preferably online is everyone using? I have been using RingCentral for a number of years and the price keeps going up. Just got a notice they are upgrading me again which will not cost $152.00 per year. Has to be something more reasonable out there. No, I don't have a land line. Suggestions please.

-

Federal Pension Question - Washington DC Police

Terry D EA replied to gfizer's topic in General Chat

Going out on a limb here. How and why would his pension be Federal Government if he worked for the City of Washington in the District of Columbia? I think it would be a local or State Government pension. I am an NC State employee (teacher) and I don't see the difference here. To be a Federal Government pension, your client would have to have worked for the Federal Government in some capacity. It will be interesting to see what others say. -

I really think you have to go with Catherine' suggestion. Get the trust document it very well may help you understand what to do.

-

Form 8868 is for tax exempt entities. You stated there are form 1041's. I would be extremely careful here the IRS likes to penalize heavily for wrong form filings, late filings and using the wrong extension form. So, be sure the extension form you are using is for the right form to be filed. Google the 8868 and bring look at the form. The form shows which forms to use the 8868 for.

-

I wonder if the congressmen's proposal includes extending the time to pay? By the OP statement it would seem that is the direction they were looking for.

-

Follow Lion EA's guidance. Get the statements from the college. I've had two situations within the last two years of the IRS questioning the amounts on the 8863. I have noticed this year the colleges are now putting amounts in Box 1 of the 1098-T. I have also notice those amounts are not entirely accurate either. I make copies (digital) of everything and put them in the client's file just in case my client's get a letter.

-

The requirement of probate could be per State. After death, usually the decedent's will is admitted to probate so the court can oversee the administration of the will. However, if there are no assets, the probate court will run the statute for claims against the estate to be presented and the estate will be closed at that time. In your case, the executrix has the authority to sign the tax return and at the time of death the executrix has full authority. The executrix should still receive letters of authority granting him/her the right act on behalf of the decedent. That covers your client on the Federal side. Just follow your State's requirements and all should be well.

-

The form your looking for may very well be a POA. However, if the estate rep has letters of authority from the probate court, then those should suffice to sign the return. You will probably have to submit a copy of the letters or POA with the return. I had to do this very thing to sign the return for my mother who is now incompetent in a skilled nursing facility. Yes, the 1310 is used to claim a refund if any.

-

Haven't heard that but it sure would be interesting to see how it plays out.

-

Let me throw my 2 cents worth in. While SaraEA very well maybe correct, I think it is always best to obtain the trust document (instrument) prior to filing any type of trust. The trust document will tell you the details you need to properly file the trust return as well as the taxation of the earnings and to whom it applies.

-

Your last line of all assets held jointly is what is throwing this off. The OP said the CC was in the decedent's name only. That being said, I agree with SaraEA. However, I don't see how a beneficiary is liable for the tax. Especially if the estate is closed. In my opinion, this is still a debt to the estate. The OP doesn't give any amounts so we don't know which way this should be handled. Estate closed? Is or was there an estate? A lot of unknowns here.

-

Below is a different twist in this situation. I would check further into the changes for 2018 to be sure this is filed correctly. Yes, unearned income (including scholarships) is subject to the Kiddie Tax. For 2018, Kiddie Tax rules change and will be taxed at Trust rates. However, for some mysterious reason the Standard Deduction treats scholarships as 'earned' income. In other words, the student will get the $12,000 Standard Deduction, and only the income above that would be subject to Kiddie Tax.

-

Catherine that was great! LOL!!!

-

It would seem to me in this scenario, the CC should have filed a claim against the deceased's estate which that statute would have run out by now. The spouse filing single is her only option at this time and the 1099C is not included as it is not hers nor under her SS# as you stated. If the deceased's final return was filed for 2017. then the CC is out of luck. I am assuming the final return was filed as a MFJ return and if the debt was forgiven in 2018, too bad for the credit card company.

-

Sorry you're having all these problems. OLTPRO would have to pay me substantially to use their program. I jumped ship from OneDesk/OLTPro a while back to Drake and I have had zero problems for three years. The only thing I ever call Drake support is a result of my learning something new. Best of Luck to you.

-

Did the 39,049 include the business income that generated the SE tax? SE tax has no bearing on determining eligibility for EIC.

-

I wonder if he meant per-too-tee. Like in its her ass if she doesn't. Hmmm

-

<<<<<< Being solvent or insolvent on April 19, 2018 has no bearing on the future 1099-C.>>>>>> Why not? It may not have any bearing on the date the 1099C was issued but it will have bearing as to whether insolvency existed the date the debt was forgiven. The date the debt was forgiven should be on the 1099C. The paragraph below is from IRS topic 431 Canceled debt. Lion is correct as to how to handle the rental sale but you will deal with the 1099C when and if your client receives it. I agree with Tom, do the insolvency prior to the sale and keep that to prove insolvency if needed. The original return will have to be amended to reflect the cancelation of the debt in the year the debt was cancelled and to report the insolvency. After a debt is canceled, the creditor may send you a Form 1099-C.pdf, Cancellation of Debt, showing the amount of cancellation of debt and the date of cancellation, among other things. If you received a Form 1099-C showing incorrect information, contact the creditor to make corrections. For example, if the creditor is continuing to try to collect the debt after sending you a Form 1099-C, the creditor may not have canceled the debt and, as a result, you may not have income from a canceled debt. You should verify with the creditor your specific situation. Your responsibility to report the taxable amount of canceled debt as income on your tax return for the year when the cancellation occurs doesn't change whether or not you receive a correct Form 1099-C.

-

Only thing I see is prepare the return from the Hud1 which should show all of the terms of the sale. If the clients get a 1099C, then amend. Client's like this drive me crazy. Explain to them upfront what the possibilities are, maybe make notes to give them to CYA.

-

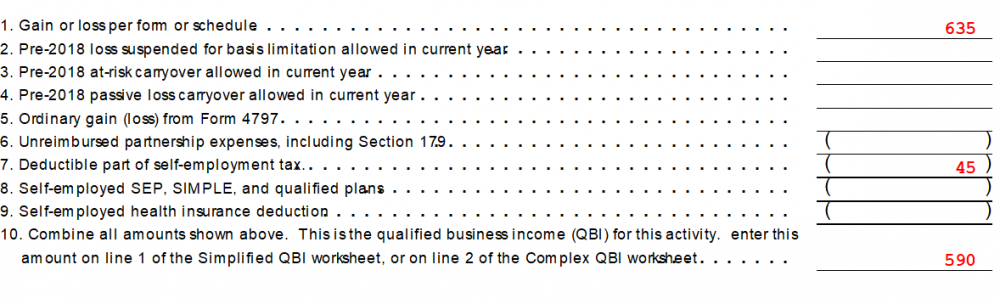

My take is contributions to an IRA reduce gross income from wages and not from business related activities. The income from any pass thru entities is used to calculated QBI on the 1040 as the starting point. The plans on line 7, 8 & 9 of the worksheet I posted are all items relating to self-employment or from a pass thru. The business income from the partnership is entered on line 6 of the 1040, the IRA contributions are an adjustment to that income. Remember the QBI is a below the line adjustment that is entered after the standard or itemized deduction. The QBI is calculated as I said earlier by deducting the items on the worksheet and then the 20% is deducted from the lesser of taxable income or QBI. Better stated, the IRA is a personal contribution not related to business activities which is why it is not included in the QBI calculation. Again, I think we are all way overthinking this process thus leading to additional confusion. I'm not pointing at anyone and am including myself as well. GGRNY made a statement about simple IRA's. They are part of line 8 of the worksheet because they have some connection to the business activity. I hope I have helped here and not added any more confusion.

-

A snip of the worksheet from Drake is attached. This is for a client that has a Sch C business. Line items 6 thru 9 show the deductible items from QBI. I don't see anything here regarding IRA's. So, I agree with PaulH if the commercial software is not deducting IRA deductions then I won't be adjusting them either. Why Drake does provide overriding capability, they do not provide a line with the words other deductions to enter anything. I think we all are way over thinking this at times and are our own world worst enemies. Trust me I'm including myself in the group as this QBI stuff has made me crazy.

-

I don't know but I'll bet there are difference in opinions here. Personally, I would wait until the client has their refund and then file the amended return. If by chance the two returns happen to get processed it very well may screw things up. To me, this is the same thing as putting two tax returns in one envelope. That will definitely sink the ship.

-

Sorry but I don't use ATX any more so I can't be of any help there. $33.00 is a difference I would look into as it appears something is definitely not right. The old ATX use to allow you to bunny hop from the cell to the associated forms for the value. Again, not sure if it is the same today.