-

Posts

2,899 -

Joined

-

Last visited

-

Days Won

32

Everything posted by Terry D EA

-

Client has a pay stub showing company paid contributions to his HSA. There is also a section that shows contributions to the same HSA that was made on his behalf from his net pay by his employer. Aren't those contributions deductible as an adjustment to income on the 1040?

-

rental property, special depreciation allowance

Terry D EA replied to cl2019's topic in General Chat

Check out Pub 527. Should answer your question. https://www.irs.gov/publications/p527 -

Thanks Lion, I really appreciate you posting this. I did copy both of them. While I do not practice law or financial advising, I will change that langue to reflect my business. Also, I will contact my E & O insurance to see if there is anything they would require. I hadn't thought of that until I saw you post.

-

The loaning member can claim a short term capital loss on form 8949 for the unpaid balance of the loan. This would also be classified as a bad business debt. Check out the link below for further help. https://www.irs.gov/taxtopics/tc453

-

Any expenses for the property that are incurred while the property is held by the trust are the trust's expenses. The only other expense I can think of would that you haven't mentioned is depreciation, insurance, utilities, mortgage interest (if any) and yes the repairs.

-

I am planning on hiring a very good friend of mine who is an excellent IT person to go over all of my office setup. I am running a server, a couple of desktop workstations, three method of backup with one being on line through Back Blaze. My question, should this person sign confidentiality documents? I plan on giving him all of the log in information to have in the event I kick the bucket so he can help my wife obtain the information to sell the business. Does anyone have a boiler plate of a confidentiality document they would be willing to share? Thanks

-

Edsel, I don't think Judy was looking for any banter in the conversation. I read this as she is offering advice for you to consider along with a word of caution for you to protect yourself. JMHO

-

Rental Property Converted to Personal Use - Sold

Terry D EA replied to Yardley CPA's topic in General Chat

I am in NC and yes on the NC return. Judy hit it right on the money and agree with both Judy and FDNY on adding the land component to basis. -

>>>>>The server gives 15% to the busser, 10% to the runner and 5% to the bartender. So in the year the server only made $39,000 but his W-2 shows $52,000. Also, the server already paid FICA on money that never received. Can I correct the W-2 and can the server get his FICA portion back?<<<<<< I think the key here is the server "Gives" to the busser, runner and bartender. By your OP, the server receives the tips, decided to spread the love around so therefore the FICA deduction would be correct. is there a requirement to share the tips? As Judy said, "is there tip pooling". "Is there proof the server gave the percentages". I would never change a W-2 form and that is an employer/employee issue and not yours.

-

I have searched for threads with this topic. I have entered the form various ways and have returned nothing. so, give me a title to find these threads.

-

The penalty applies to earnings and not the principal. He can take the principal at any time without penalty and tax.

-

I would suggest you get the trust document. This is always my first approach. While it looks like your just looking for what the trust date should be, there maybe some information in the trust document that could be very helpful when preparing the 1041. Also, do you know what type of trust this is? Check if the information below is helpful When a grantor – a living-trust creator – dies, the trust becomes irrevocable. An irrevocable trust is an independent taxpayer in the eyes of the IRS, required to file its own tax return. Responsibility for completing the paperwork falls to the trustee appointed by the grantor. If you're the trustee, you may be able to take almost a year to file. This is the link https://finance.zacks.com/tax-return-due-trust-person-dies-11236.html. I copied and pasted this cause I couldn't stand the liberty tax ads in my face. The tax return due date for a trust depends on the year-end for that trust, which is based on the grantor's death date. Trust Return Due Date As trustee, you have a lot of flexibility in when to submit the first tax return. The first step is to pick a closing date for the trust's tax year, known as the trust year-end. Suppose the grantor dies July 14. Some trusts must choose a calendar tax year ending Dec. 31. Other trusts can use a fiscal year with an ending date as far ahead as 11 months from the death. In this case, that would be June 14 of the following year. The instructions for Form 1041 explain which trusts have that option. Finding the Right Form Once you set the closing date, you have 3.5 months after that to turn in the return. If you pick Dec. 31, for instance, that gives you until April 15. The form to file is 1041, the income-tax return for trusts and estates. Whatever date you set for the end of the first tax year, that will be the date you use for future tax returns too, assuming the trust is set up to last a while. Revocable Trust Deadlines If the trust was revocable during the grantor's lifetime, you and his executor can submit one tax return instead of two. If you and the executor both agree, she can file a 1041 for the estate that includes the trust's income. You provide the trust's financials, but the executor deals with the IRS. To take this option, you have to file Form 8855 before the executor files the estate's first 1041. The decision is irreversible. When to Pay Estimated Tax Even if you postpone filing the 1041 until next year, estimated tax payments may be due a lot sooner. If you think the trust's going to owe $1,000 in income tax for the year, the trust may have to pay estimated tax. Estimated tax payments are due quarterly: in April, June, September and January of the following year, though the schedule obviously depends on when the grantor dies. The Form 1041 instructions spell out which trusts have to make estimated payments.

-

I think I would calculate the gain on the sale of the property when it changes hands and then show him what the fees are for the 1120S. This way he should be able to see the fees are well worth it. Especially, if he doesn't have the funds to pay the gain. If this is all the 1120S is used for, then the fee shouldn't be very much. No balance sheet, no M-2 or M-3 just 8825 and 4562.

-

I have been looking at this form for some time now and have been trying to figure out where the employee who is a new hire enters the desired withholding. It appears after running the withholding estimator from the IRS website, the amounts of withholding go on line 3 in the claiming dependents section. This is where the website pre=populates the form.However this amount is the total withholding of all jobs and is the annual figure. After reading Pub 15T it appears the employer has to use the appropriate table to calculate the withholding based on the information on the new form w-4. I need to know if my thinking is correct. I run payroll for a few companies and I want to be prepared for new hires. Also, when using the IRS estimator, the total withholding is based on numerous factors and returns the final amount as a total withholding for all jobs. So, as I see it, the employer needs to only look at their particular job and calculate the withholding plus any additional amount the employee indicates. I can see employees really getting this messed up. Also, I have clients that are asking about this form and felt really stupid this evening that I couldn't help them very much. They said their employer's accountant told the existing employees who were under 2019 w-4 and earlier they had to fill out the new form. That is not accurate and this accountant is showing zero federal withholdings based on what I don't know. Does anyone have a simplified explanation to get my head straight on this??? Medlin maybe??? I appreciate anything anyone can add to this.

-

Judy, I see what you are talking about so I stand corrected. Maybe this is something we can suggest to Drake for them to allow in the future.

-

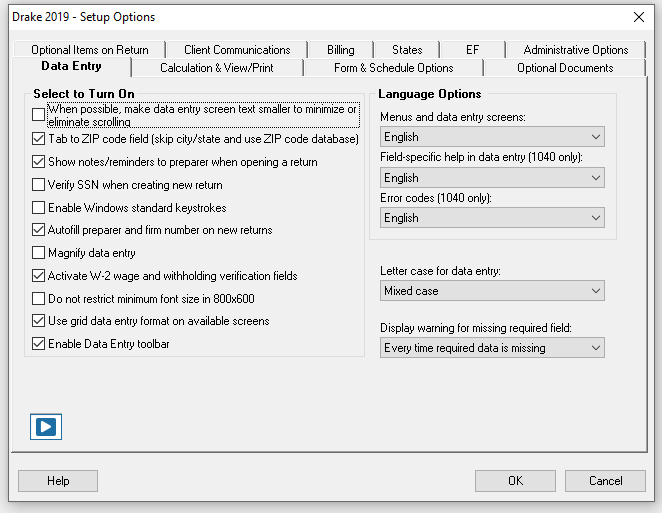

Catherine is correct. Here is a screen shot and hope this helps. Go to setup and options and click on data entry. Check the box by magnify data entry.

-

guaranteed payments and partner's adjusted basis

Terry D EA replied to cl2019's topic in General Chat

<<<<<for the use of capital>>>>> not the same thing as basis, outside basis or tax basis. <<<<<shouldn't we treat guaranteed payments as an increase in partner's basis if partner's basis calculation is "for other tax purposes", when "guaranteed payments are treated as a partner's distributive share of ordinary income".>>>>>>> NO, NO, NO A partner's capital account and outside basis are not the same. The partner's capital account measures the partner's equity investment in the partnership. The outside basis measures the adjusted basis of the partner's partnership interest. A partner who receives a guaranteed payment reports the amount as ordinary income on his or her tax return. ... Since guaranteed payments are not treated as distributions, there is no effect on the recipient partner's capital account or tax basis in the partnership interest. Just look at it this way, guaranteed payments are for services rendered so it is ordinary income. A distribution is a distribution of the partner's capital (investments from the partner for a percentage of the partnership interest). Distributions affect both outside basis and capital. See if the link below helps. https://www.taxact.com/support/22856/2019/partner-capital-account-vs-basis -

Sorry but I can't help you with ATX. However, in Drake, you enter the total qualified expenses, then enter the scholarship (drake is education assistance), then the balance would go to the credit. With the AOTC, you can only claim up to $2500.00. So in your case, 5950.00- 2223.00 = 3727.00. The AOTC should be 2500.00, part credit to reduce taxes and part refundable. 40% refundable up to 1000.00. The remaining 60% is to reduce tax liability to zero. A lot of times the client spends significantly more than what can be recouped from the credit. As in the past, I believe you can only take one of the credits. Either AOTC, LLLC, or tuition and fees but not two at the same time. If your client qualifies for the AOTC, then that will always return the best result.

-

I agree with your position. Yes, get a statement from the bursar's office. Yes, review the scholarship terms and then you will make a decision that you will finally be comfortable with. You have been given very good advice here that is thorough.

-

First let me say that I am sorry for your loss. Loosing a parent is tough. Estate laws differ from state to state so I may be off a bit here. Obviously you know the investments and cash in the bank is all part of your father's estate. The interest & earnings that accrued after his passing are part of his estate. Any uncollected earnings prior to his death are income in respect of a decedent and would be reportable on form 1041 if it was not included in his final 1040. I found the link below and don't know if it will help you or not when making decisions regarding your father's estate. Also, I see you are in NY so I am assuming your father may have been a resident of NY as well. https://bhlawpllc.com/wp-content/uploads/2015/08/NYS-Executors-Guide.pdf

- 1 reply

-

- 3

-

-

Well, I stand corrected. Form 8917 is available on the IRS site for 2019 and shows a revision date of January 2020. Accept my apologies. Form 8917 (Rev. 1-2020) Page 2 General Instructions Section references are to the Internal Revenue Code unless otherwise noted. What’s New Deduction extended. The tuition and fees deduction is extended for qualified tuition and fees paid in calendar years 2018, 2019, and 2020. Don’t claim the deduction for expenses paid after 2020 unless the credit is extended again. Use Form 8917 (Rev. January 2020) and these instructions for years after 2017, unless a newer revision is issued indicating it is succeeding this revision. Apparently the author of the site I posted is not up to date. The article is dated Jan 23, 2020 so don't pay any attention to that.

-

Let me chime in here again. I know some of us don't like clicking on links. But the link I have posted shows the tuition and fees had expired and has not been extended. It was not part of the extender credits extended on Dec. 20. Please correct me if I'm missed something here but I don't want to see a bunch of folks get burned on this when talking with clients. If the tuition and fees deduction has been extended, please give me a resource. https://www.efile.com/new-tax-breaks-cuts-changing-extended-expired-laws/

-

I'm going to respectfully disagree with some of the responses. First, any funds received from a scholarship that exceed the qualified expenses is taxable income plain and simple. You said the student received $6400.00, $4200.00 is for tuition, then $2200.00 is taxable income. You may need to know exactly what the scholarship was for. Room and board are not qualified education expenses. FYI- The tuition and fees deduction is not available for TY 2019. so you can't use that anyway. Also, if there is proof the remaining funds were spent on qualified expenses, then the excess spent on those fees is not taxable. If a balance still remains, then it is taxable income. I would not do this. If the dad is claiming the daughter as a dependent (she has to be under 24) then he can take any tax credit he qualifies for. The only portion of the scholarship that would go into the dad's income is the amount NOT spent on qualified educations expenses. I would suggest contacting the bursar's office of the college and obtaining a print out of ALL of the fees charged for the academic year. This is your only proof of exactly what was charged and paid as well as where the payment came from. The only way I would take what the client is telling me is if they produced receipts. I have had two or three client's returns questioned by the IRS for additional information to substantiate the credit claimed so be careful and CYA. I require every client who will be claiming or think they will be claiming the education credits to bring a printout from the bursar's office. This bothers me a bit. While it seems legit, I still question it. First, doing so could trigger a balance due for the student. Yes, the parents would get the full AOTC. Remember that is limited to $2500.00. Would the benefit outweigh the tax? Also, would mom and dad be willing to help the daughter with her tax burden, if there is one, because they benefited from claiming the credit. Only good way is if the daughter does not have any taxable income as it has been said, the standard deduction very well may wipe out any tax due. Agree, no election but as with all of these credits, document and be sure to do your due diligence. Again, CYA!!! Also for the AOC, pay attention to the parents AGI to be sure they still qualify. In my opinion the $400.00 per month paid for room and board is just plain gone. One way for parents to lessen the pain a bit is to make deposits into a 529 plan where the interest is tax free as along as the funds are used for educational purposes.

-

I have filed several 1099MISC using the IRS fire system. It takes three days at a minimum for the IRS to accept or reject the file. In Drake the file is created for you, I run the test, it passes every time without fail. After three days I received a notice from the fire system, that all is good. It then takes about 10 days for the IRS to release and finalize the file. So, with ATX you may not receive a confirmation of or an ACK until the file is release. As it was stated earlier, contact their tech support to see when the send out the acks for 1099 filing.